Today’s edition is brought to you by Topper

Topper makes off-ramping effortless, fast, and accessible. Get started now and convert your crypto to cash, fee-free!

GM to all 84,827 of you. Crypto Nutshell #528 gearin’ up… ⚙️🥜

We're the crypto newsletter that's more daring than stealing a priceless artifact while dodging traps in ancient ruins... 🏺🌟

What we’ve cooked up for you today…

🏦 What just happened?

🤨 We’ve seen this crash before…

📉 It’s all down

💰 And more…

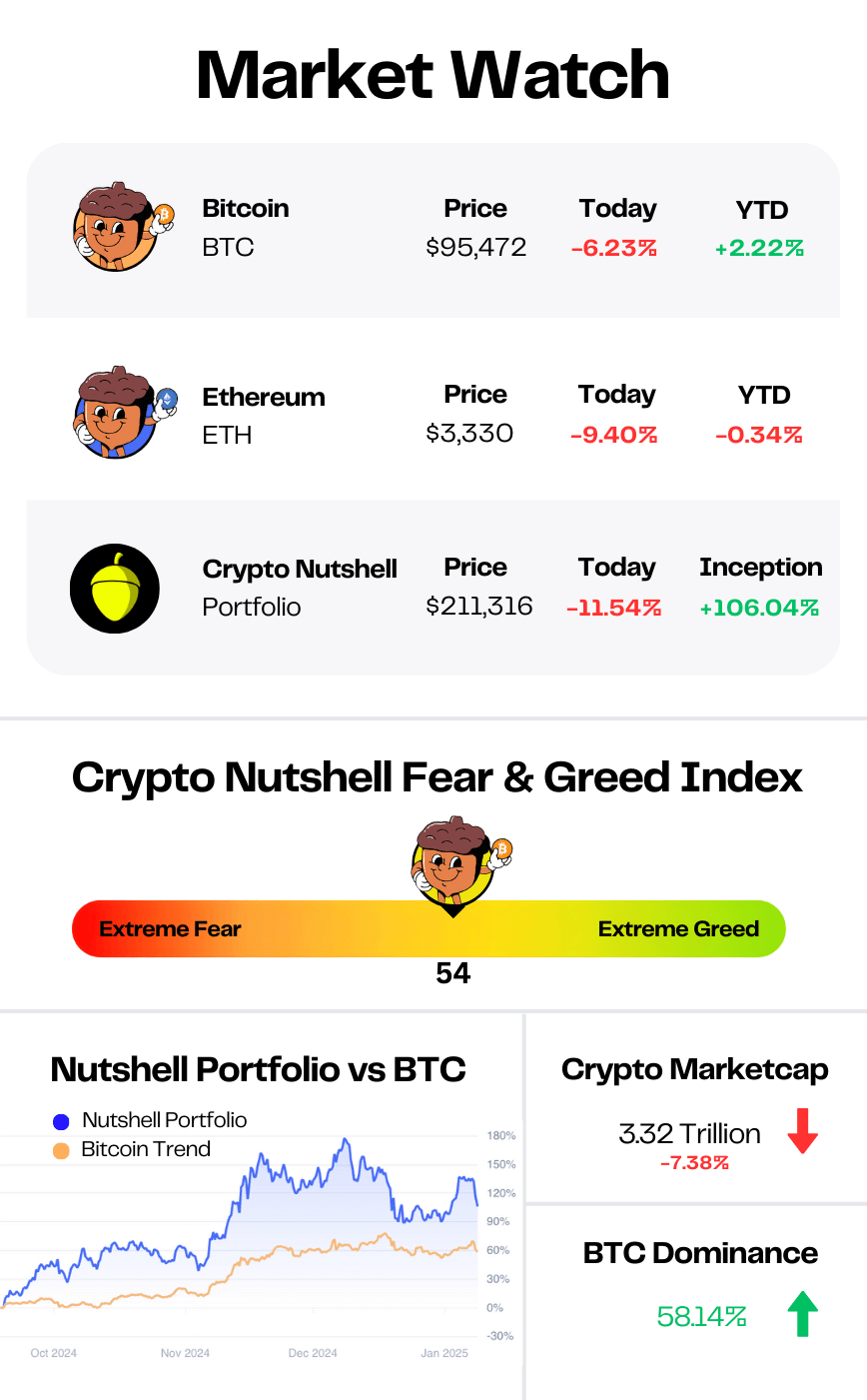

Prices as at 2:30am ET

WHAT JUST HAPPENED? 🏦

BREAKING: Bitcoin Dips Below $98K as Strong U.S. Economic Data Leads to $300M of Crypto Liquidations

That was short lived…

Yesterday Bitcoin briefly surpassed $100,000 before tumbling all the way back down to $96,000.

But what caused the crash this time?

Well surprisingly it was the release of stronger than expected US economic data.

The Bureau of Labor Statistics’ job openings for November unexpectedly rose to 8.1 million.

This in an improvement from the previous months 7.8 million and easily tops analysts estimates of a decline to 7.7 million.

(More job openings = more demand for labor = stronger economy)

Basically everything is down

Released at the same time was the ISM Services Purchasing Managers Index.

The ISM is a monthly gauge of economic activity.

And like the job openings data, the ISM came in at 54.1 overshooting expectations of 53.3.

This also marks an increase compared to Novembers 52.1, indicating that economic conditions are improving.

Both of these data sets sound positive right?

After all, isn’t a strong economy a good thing?

So why did crypto and stocks crash after the release of this data?

Well here’s the thing…

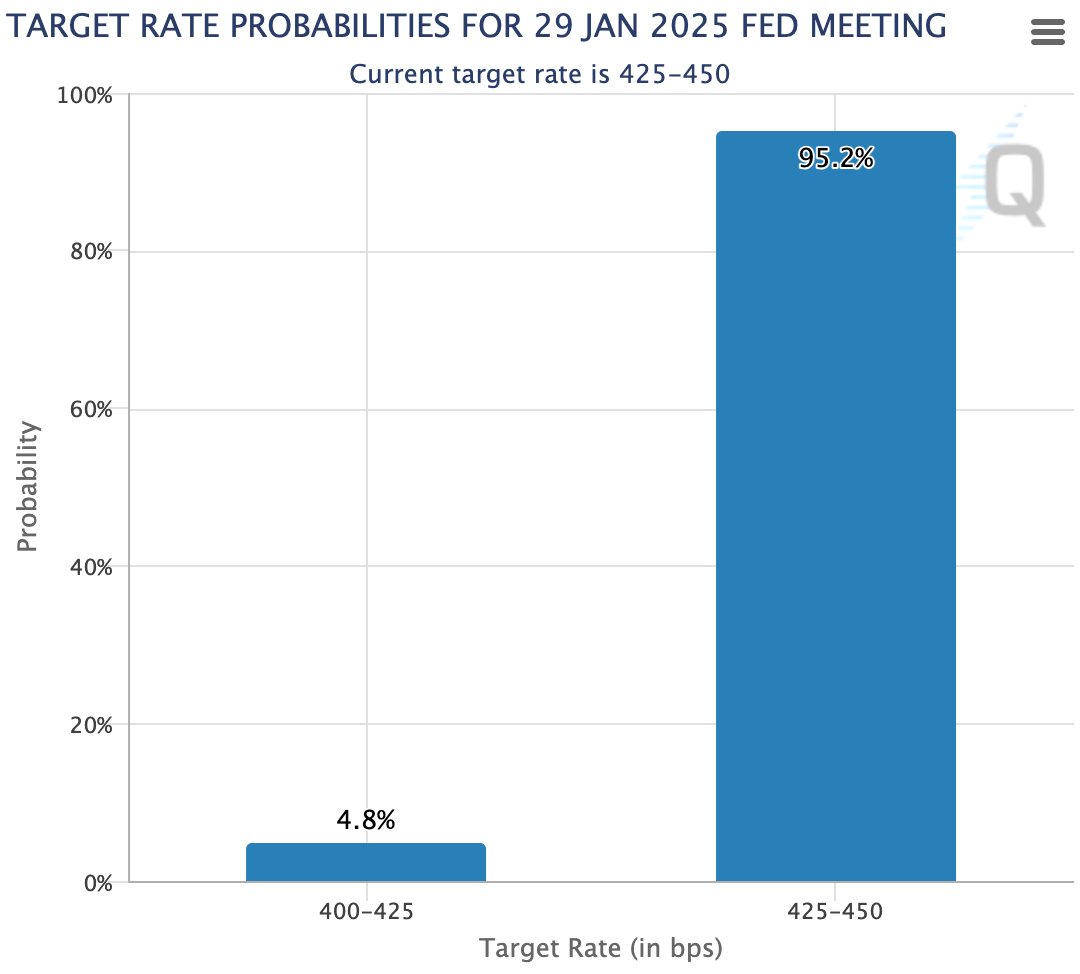

This strong data has analysts further rolling back their expectations of rate cuts in 2025.

Quick note: Lower interest rates make traditional investments like bonds less attractive, pushing investors towards higher-risk, higher-reward assets like Bitcoin. Increased liquidity from lower rates also fuels investment in cryptocurrencies.

According to CME Fedwatch, theres a 4.8% chance that we see a rate cut in January.

There’s also now a 37% chance of a March rate cut, down from ~50% just one week ago.

Looking out even further, the odds of a rate cut in May are also now well below 50%.

But…

Incoming President Donald Trump just mentioned that “Interest rates are far too high”.

It’s important to keep in mind that while Trump can influence the conversation around interest rates, the actual setting of rates is done solely by the Federal Reserve.

And the Federal Reserve operates independently from the government.

Right now the markets find themselves in an odd place…

Will the Fed cut or keep rates the same at their upcoming January 29th meeting?

Remember: Markets hate uncertainty

Off-Ramping Crypto Doesn’t Have to Be Hard 🤑

Converting crypto to fiat can be frustrating—limited asset support, high fees, and long delays. That’s why Topper’s new Off-Ramp is a game-changer.

With Topper Off-Ramp, you can:

✅ Withdraw over 200+ assets: From Bitcoin and Ethereum to emerging tokens, access one of the largest supported asset libraries in the crypto space, giving you the freedom to manage your portfolio your way.

✅ Access your funds instantly: Say goodbye to waiting days for withdrawals. Topper ensures your funds reach your debit card almost immediately, making your crypto as liquid as cash.

✅ Enjoy global coverage: With Visa and Mastercard debit card support in the U.S.and Europe—and Visa Original Credit Transactions worldwide—off-ramp securely, no matter where you are.

Take control of your digital assets today with Topper’s Off-Ramp and experience a faster, smarter way to convert crypto to cash.

WE’VE SEEN THIS CRASH BEFORE 📉

Today’s crypto market crash may seem scary.

But don’t panic.

We’ve see this before.

That’s the latest message out from Raoul Pal.

In his livestream 12 days ago, Raoul predicted a Bitcoin correction would occur in early January.

Why?

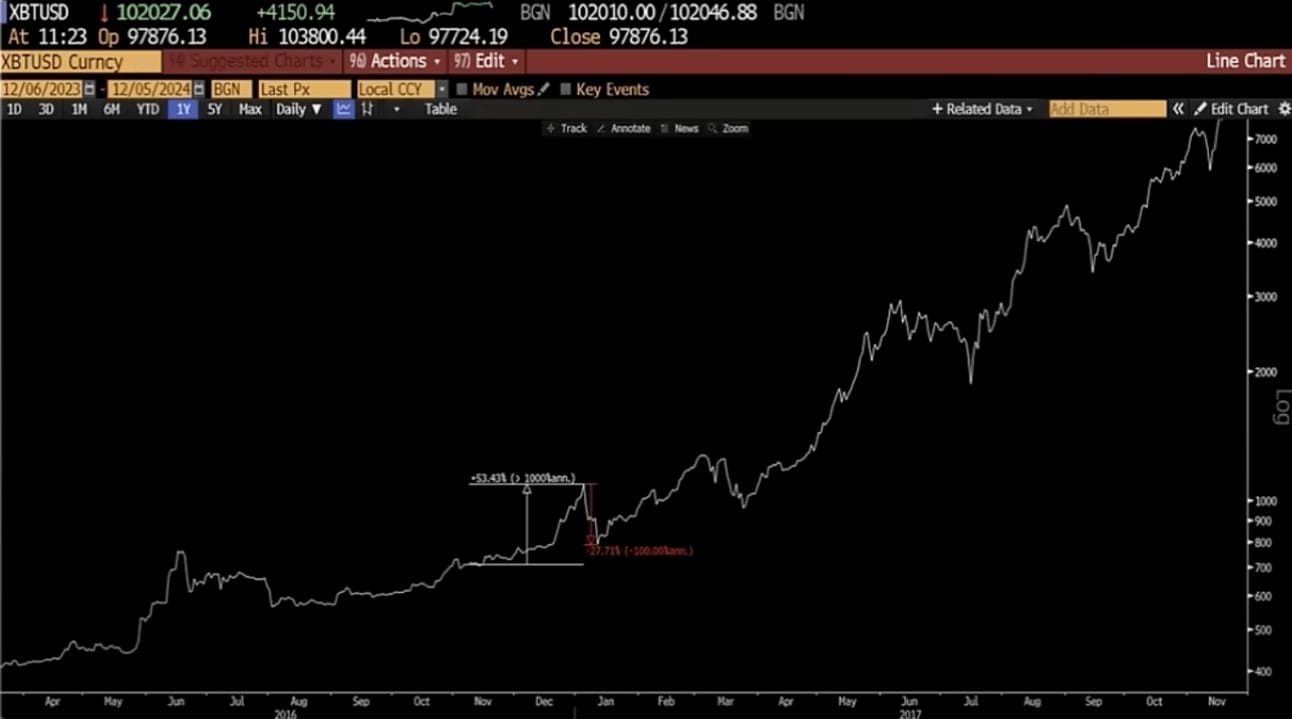

It’s exactly what happened last time Trump was elected, in 2016:

“We had exactly the same thing last time Trump was elected: the dollar was strong, rates went up, liquidity contracted, and the market had a big rally, which included Bitcoin. Then, in January, because of the lag, we saw a sharp 27% correction in Bitcoin.”

Bitcoin fell 27% in January after Trump’s 2016 election

However, what came next is the important part:

Bitcoin ripped upward.

“Then it ripped higher, ripped higher. So much, in fact, that it went up 23x.”

To Raoul, this correction is nothing to fear:

“I’m not expecting that because this is a much earlier cycle. However, what we’re saying is that the correction is nothing to fear. It’s simply a marker, signalling the transition from phase one of the Banana Zone to phase two of the Banana Zone.”

Bitcoin was never going to go up in a straight line.

In a few weeks, today’s price dip will feel like a tiny, meaningless bump. 🌅

IT’S ALL DOWN 📉

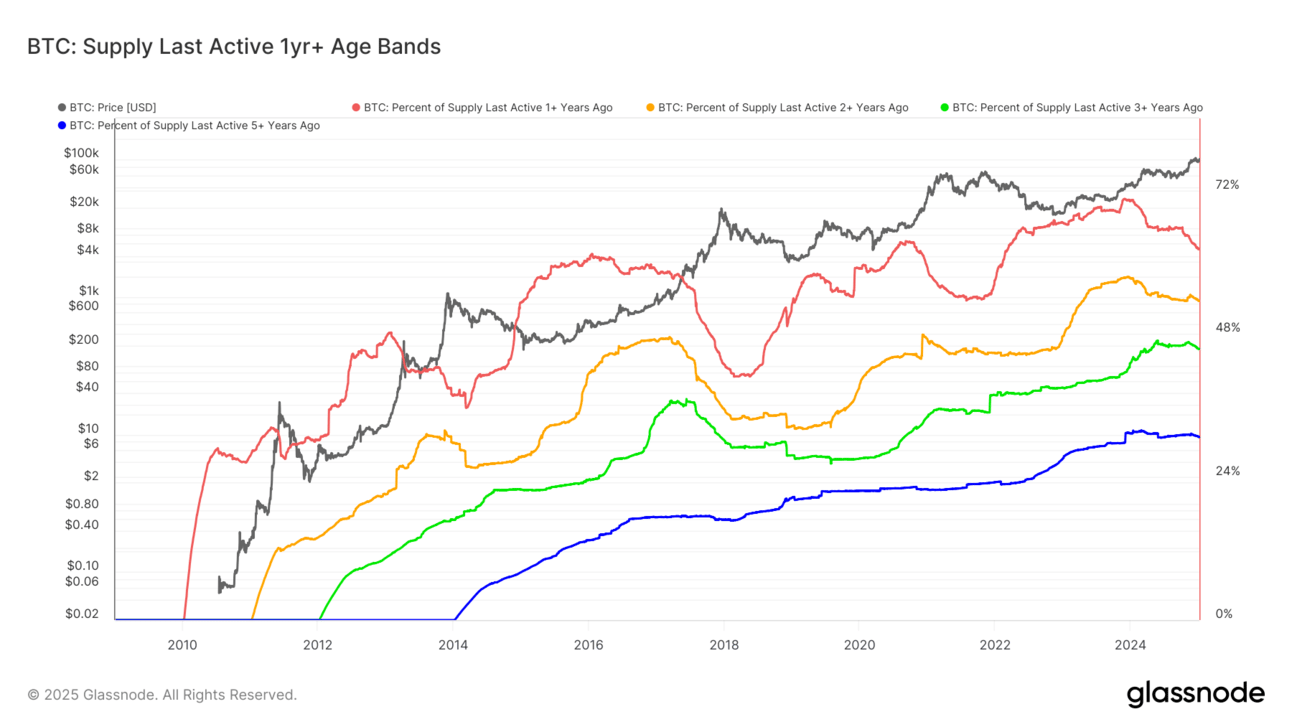

Time for a check in on one of our favourite charts.

The supply last active 1+ years ago metric is super simple to understand and extremely useful.

It categorises coins based on how long it’s been since they last moved on-chain. (As a percentage of the circulating supply)

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

Here’s the breakdown for each cohort (compared to what it was 2 weeks ago):

🔴 Supply last active 1+ years ago: 62.18% (down from 62.27%)

🟠 Supply last active 2+ years ago: 53.45% (down from 53.66%)

🟢 Supply last active 3+ years ago: 45.40% (down from 45.55%)

🔵 Supply last active 5+ years ago: 30.66% (down from 30.82%)

Again, all four cohorts experienced minor declines over the last two weeks.

Which means, long-term holders are still selling off some of their coins.

But…

We discovered that the majority of this sell-off is coming from the youngest long term holders. (Those who have held Bitcoin for between 6 and 12 months)

And with Bitcoin briefly crossing over $100,000 yesterday, this isn’t anything out of the ordinary.

($100,000 represents a huuuge psychological level where investors are likely to lock in profits)

True long-term holders are still holding out for higher and higher prices…

CRACKING CRYPTO 🥜

MicroStrategy's Bitcoin strategy yielded $14 billion in shareholder value in 2024. MicroStrategy's Bitcoin bet yields $14 billion, boosts shareholder value throughout 2024, according to Michael Saylor.

Hyperliquid must draw developers or risk unraveling — VanEck. The layer-1 chain needs more than a successful perpetuals exchange to justify the HYPE token’s lofty valuation, according to the asset manager.

Correlation Between Bitcoin and U.S. Stocks Reemerges: Van Straten. The renewed correlation poses a short-term risk for bitcoin prices, according to an analyst.

Czech National Bank weighs bitcoin purchases for potential reserve asset diversification. Czech National Bank Governor Aleš Michl is considering buying bitcoin to diversify the bank’s reserves.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Twice weekly Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) IBIT 🥳

BlackRock’s Bitcoin ETF traded under the ticker $IBIT

GET IN FRONT OF 85,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.