GM to all 64,612 of you. Crypto Nutshell #307 bringin’ the milk... 🐮 🥜

We’re the crypto newsletter that’s more captivating than a group of adventurers embarking on a journey through a post-apocalyptic wasteland... 🏜️🔥

What we’ve cooked up for you today…

🦊 Metamask sues the SEC

⛏️ Bitcoin Gold Rush

📉 Exchange balances declining

💰 And more…

MARKET WATCH ⚖️

Prices as at 7:05am ET

Only the top 20 coins measured by market cap feature in this section

METAMASK SUES THE SEC 🦊

BREAKING: Consensys sues SEC, seeks court declaration that Ethereum is not a security

On April 10, the SEC issued a Wells notice (potential legal action) to Consensys, the company behind the Metamask wallet.

The SEC accused Consensys of operating as an unregistered broker-dealer (where have we heard that before?)

Well Consensys didn’t like this one bit…

Now they’ve clapped back with a lawsuit of their own against the SEC.

Consensys wants the court to declare that Ethereum is not a security.

(This would also mean that the SEC is overstepping it’s authority)

In a statement published to Twitter, Consensys said:

“The goal behind this is to ensure that Ethereum remains a vibrant and indispensable blockchain platform and to preserve access for the countless developers, market participants, and institutions who have a stake in the world’s second largest blockchain.”

Paul Grewal, Chief Legal Officer at Coinbase, commented on the situation:

In the lawsuit, Consensys has raised 3 key arguments:

The SEC only has jurisdiction over securities - they’ve previously agreed ETH is not a security

The SEC wrongly classifies non-financial platforms as financial applications - The SEC has no authority to regulate the internet, the same applies to applications built on Ethereum

Metamask is not a securities broker

One of the biggest question marks in crypto right now is whether or not the SEC classifies ETH as a security.

This decision has a HUGE impact on the approval/denial of spot Ethereum ETFs. (which also means a huge impact on Ethereum’s price)

It’s fantastic to see a crypto company take action and fight back - all they want is regulatory clarity.

(again, why is this such a big ask?)

We’ll keep you updated on future developments in this story.

TOGETHER WITH INCOGNI 🕵️

Odds are, you've received a suspicious phone call, text, or email asking for money in a roundabout way.

If you have a trained eye, you may be able to spot the scammer, but their tricks are becoming more and more sophisticated.

Every day, data brokers profit from selling your sensitive info.

Think: SSN, DOB, home addresses, health information and contact details

That's where Incogni comes in.

Incogni scrubs your personal data from the web, confronting the world’s data brokers on your behalf.

With Incogni, you’ll worry way less about:

Identity theft

Health insurers raising your rates based on info from data brokers

Robo and spam calls

Scammers taking out loans in your name

Exclusive discount for CryptoNutshell readers: Use code "cryptonutshell" at checkout to get 55% off the annual plan.

BITCOIN GOLD RUSH ⛏️

If it’s not going to zero, it’s going to 1 million.

Bitcoin’s gold rush era has only just begun.

That’s the latest out from Michael Saylor.

In his latest interview, Saylor was asked the following question:

MicroStrategy was the first company to move forward with Bitcoin. When will another public company follow your strategy?

Here’s what Saylor had to say:

“It’s hard for anyone else to look at this. Because 18 months ago, Bitcoin was $16,000 and everyone thought the crypto economy was going to zero… January when the SEC approved the spot ETF, the mainstream consensus in the world shifted to Bitcoin is an asset, it’s not going away.”

Saylor then followed up with:

“If it’s not going to zero, it’s going to $1 million.”

The ETFs have literally changed the game.

In fact, Saylor believes the approval of the ETFs kicked us into a gold rush era.

For the first time ever, Bitcoin is recognised as an institutional grade asset.

Over the next 10 years, we’ll see increased levels of awareness and adoption.

“That [ETF approval] kicked us into this Bitcoin gold rush era. For the next 10 years, every quarter there will be more enthusiasm, more adoption, more awareness. But it’s still year 1 of Bitcoin as an institutional asset.”

Back to the question of when will the next public company adopt a Bitcoin strategy…

Saylor thinks we will start to see it happen during this gold rush period.

The thing with large corporations is BIG decisions like these take time.

Especially considering the collapse of FTX and other bankruptcies are still fresh in everyones minds.

But it WILL happen… eventually…

Which public company do you think will be next to adopt a Bitcoin strategy?

Let us know in the “How did we do?” poll at the bottom of this newsletter. 👇

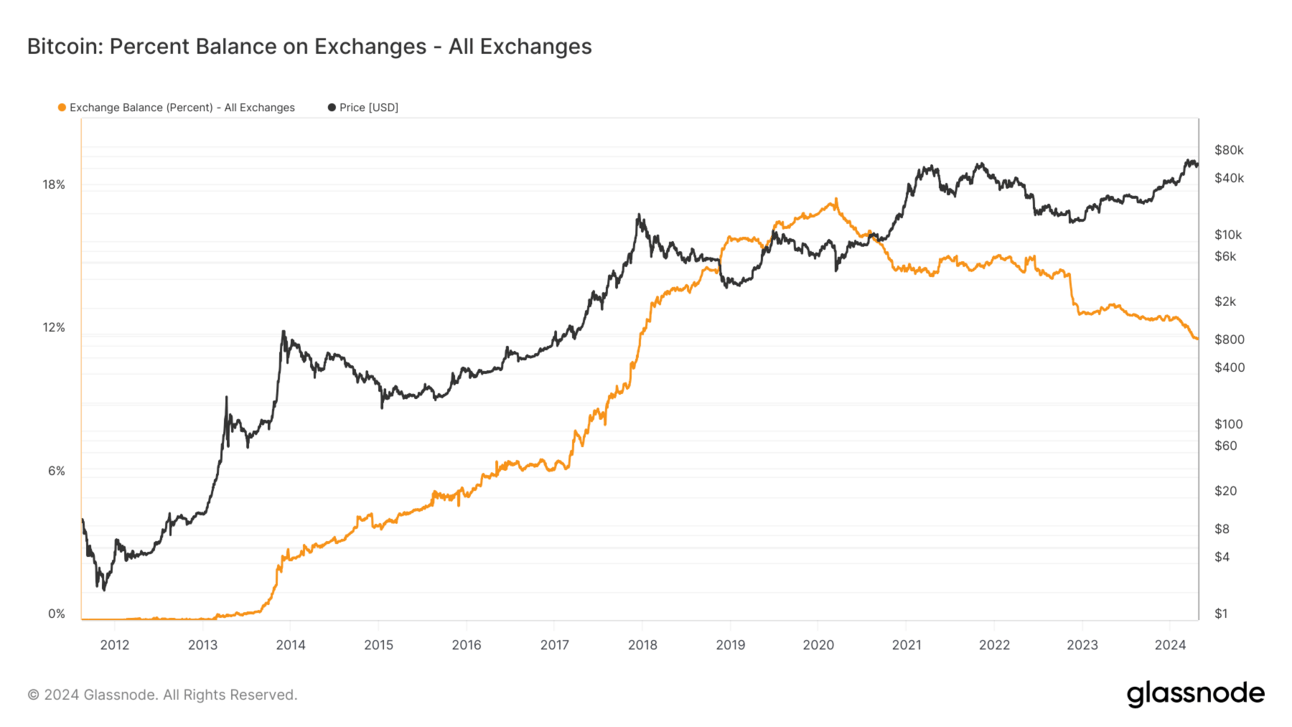

EXCHANGE BALANCES DECLINING 📉

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Currently there is only 2,322,755 Bitcoin available for sale on exchanges.

That’s ~11.80% of the entire circulating supply.

Two weeks ago exchange balances were 2,324,866 BTC.

That’s a decrease of 2,111 BTC across all exchanges.

(~$136 million at todays prices)

Decreasing exchange balances is one of the key reasons that many believe this bull run is different.

There’s barely any Bitcoin currently available for sale.

That’s a recipe for rocket fuel. 🚀

CRACKING CRYPTO 🥜

Morgan Stanley considers allowing brokers to recommend Bitcoin ETFs to clients. Wall Street giant Morgan Stanley is considering empowering its brokers to endorse Bitcoin ETFs for their clients.

FBI warning against crypto money transmitters ‘appears’ to be aimed at mixers. The FBI has issued a “broad” warning, urging American citizens against using unregistered crypto Money Service Businesses.

Stripe Brings Back Crypto Payments Via USDC Stablecoin. The payments firm stopped taking crypto payments in 2018 due to bitcoin’s high volatility.

SEC seeks to regulate ETH as a security, Consensys alleges in lawsuit. Consensys, the company behind MetaMask, filed a lawsuit against the Securities and Exchange Commission in a Texas court on Thursday.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

When was the first Bitcoin Halving event?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) November 2012 🥳

The first bitcoin halving happened on Nov. 28, 2012

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.