GM. Crypto Nutshell dropping in hot! 🫶 🥜

The crypto newsletter that won't deceive you like a secret agent with a license to kill... 🕶️🔫

Today, we’ll discuss:

Another HUGE financial Institution joins the scene 🤑

Why a global economic collapse is coming 📉

Bitcoin emissions myth debunked 💪

And more…

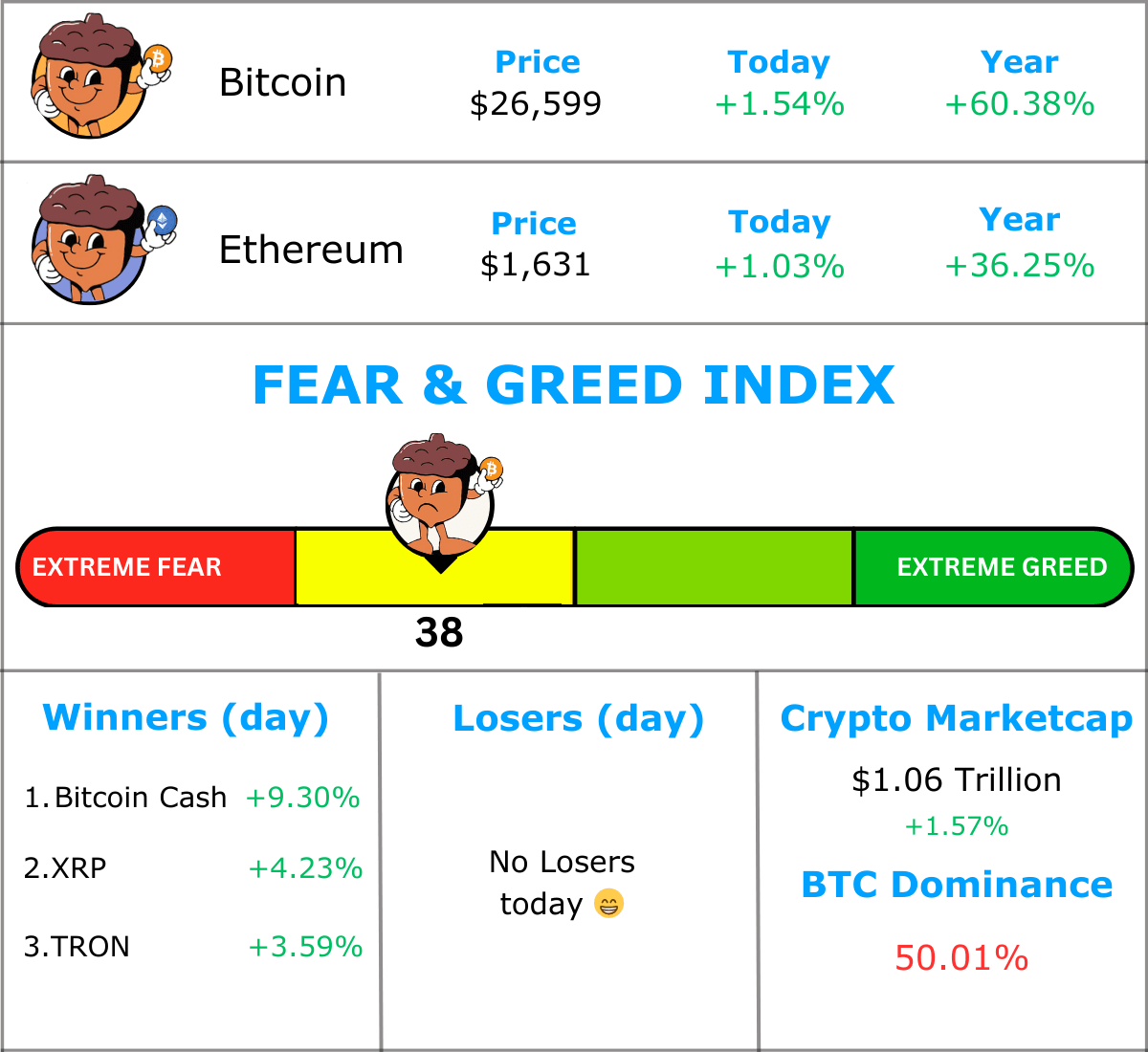

MARKET WATCH ⚖️

Prices as at 1:55am ET

Only the top 20 coins measured by market cap feature in this section

ANOTHER INSTITUTIONS ADOPTS CRYPTO🤑

JUST IN: €1.34 trillion asset manager Deutsche Bank to offer Bitcoin & crypto custody services.

BIG NEWS. Germany’s largest bank has just announced that they will integrate Taurus’s digital asset custody and tokenisation services for it’s clients.

This isn’t the first time Deutsche bank has showed it’s ambition to join the crypto space. They recently applied for a crypto custodial services licence in Germany and participated in Project DAMA in Singapore.

It’s clear Deutsche Bank believes crypto is the future and is preparing accordingly.

Deutsche Bank’s global head of securities services, Paul Maley had this to say 👀

“As the digital asset space is expected to encompass trillions of dollars of assets, it’s bound to be seen as one of the priorities for investors and corporations alike. As such, custodians must start adapting to support their clients.”

Top financial institutions continue to join the crypto scene. BlackRock, Fidelity, Franklin Templeton and now Deutsche Bank. Who will be next? 🤷

GLOBAL ECONOMIC COLLAPSE 📉

Max Keiser, believes we are on the brink of an economic collapse that has been brewing steadily for years now. 😱

Max Keiser is truly an OG of the Bitcoin community. Once a financial analyst and reporter, Max first bought into Bitcoin in 2011. His first purchases were made when Bitcoin was just $1.

In his latest interview, he warns that we may be a few short months away from witnessing a financial disaster play out globally.

One thing is a fact: Every fiat currency over the course of human history has eventually inflated away and collapsed into nothing.

We are witnessing this play out in real time in places like Argentina & Lebanon.

Argentina Pesos Shocking Inflation Numbers

Soaring inflation rates are commonplace around the world and it’s eroding away at people’s quality of life. 😔

Keiser doesn’t think there’s a solution to the problem. The U.S has printed too much money and has too much debt to reign in inflation.

But he does believe there’s an orange life raft...

Bitcoin. 🛟

P.S. This is what Keiser thinks about the current Bitcoin price and if he would buy at these levels:

“The current price is an excellent entry point. With unconfiscatable, uncensorable property, that's portable and obviously is going to do better than any fiat money out there… it's superior to gold in my opinion. Where are the prices going right now? I look at the strength of the network. That's at all-time highs. So for me bitcoin's at an all-time high today. The price? It's a lagging indicator.”

BITCOIN MINING EMISSIONS DEBUNKED 💪

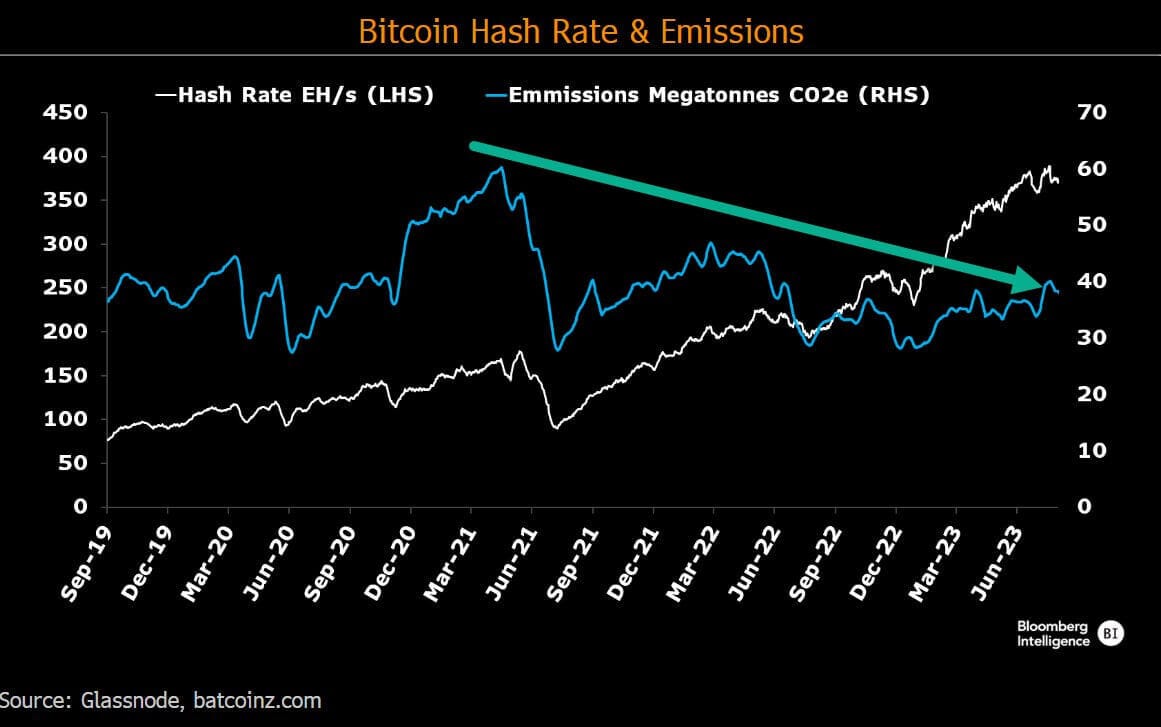

A common argument against Bitcoin is that the heavy energy use in mining makes its carbon footprint unsustainable. But Bloomberg analyst James Coutts has the data to show that this is completely wrong.

Bitcoin’s hash rate can be thought of as the overall computational power in the Bitcoin Network. When this metric increases, it means that the number of miners is increasing or computer processing power is becoming more efficient. 📈

Some facts:

Since 2019 the Hash Rate has quadrupled and 🔵 carbon emissions have only increased by 6.9%

Since China’s mining ban in 2021 emissions have declined by 37.5%, peaking at 60.9 Megatonnes of carbon dioxide

The concern about Bitcoin’s carbon footprint has been EXTREMELY overstated. Hash Rate is increasing but emissions are barely changing.

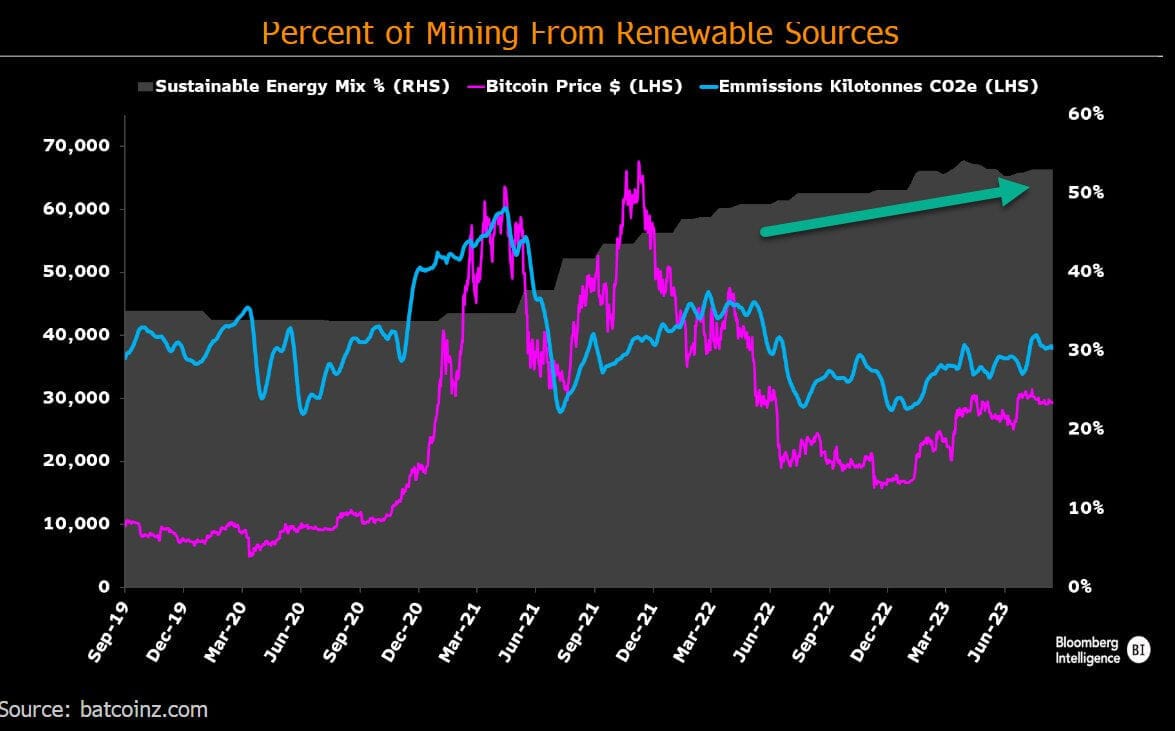

Since China’s mining ban in 2021, the use of renewable energy sources (grey) has increased to over 50% whilst the total emissions has continued to decrease.

Another interesting point that James Coutts raises is that Bitcoin mining doesn’t actually emit anything. 🤯

Miners don’t emit, they consume purchased electricity just like an EV does. The emissions come from the power grid themselves. Could Bitcoin mining be the ultimate driver for a push towards renewable energy adoption? 🤔

Isn’t it interesting that this false narrative has been spun up to single out Bitcoin miners as unsustainable?

Remember when Elon Musk said Tesla would resume Bitcoin payments when mining is ~50% sustainable…

CRACKING CRYPTO 🥜

CAN YOU CRACK THIS NUT? ✍️

What year did the Ethereum “merge” take place?

A) 2020

B) 2022

C) 2023

D) 2021

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) 2022 🥳

That’s right! The Merge was executed on September 15, 2022. This transitioned Ethereum from a proof-of-work consensus mechanism to a proof-of-stake consensus mechanism. If you’re not sure what this means checkout this article for a rundown.

GET IN FRONT OF 10,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.