Today’s edition is brought to you by TLDR Newsletter - catch up on the latest tech, startup, and coding stories.

GM to all 63,460 of you. Crypto Nutshell #294 countin’ the days... ✂️ 🥜

We’re the crypto newsletter that's more exhilarating than a team of elite soldiers battling against terrorists in a high-rise skyscraper... 🏢 🔫

What we’ve cooked up for you today…

🤨 What just happened?

💸 All roads lead to inflation

📈 Stablecoin’s are on the rise

💰 And more…

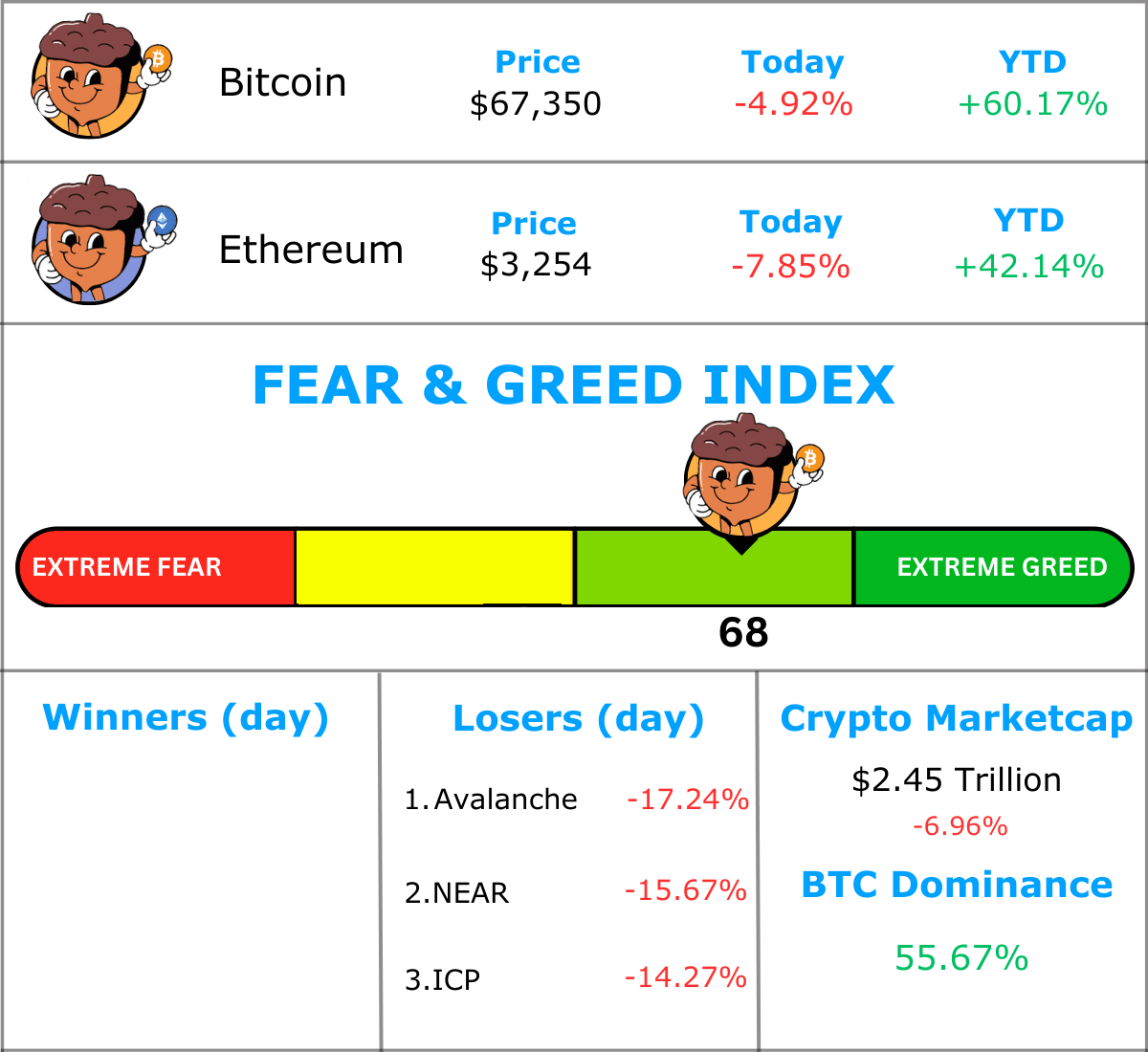

MARKET WATCH ⚖️

Prices as at 3:35am ET

Only the top 20 coins measured by market cap feature in this section

WHAT JUST HAPPENED? 🤨

BREAKING: Bitcoin Plunges to $66K, Altcoins Tumble 10-15% on ugly day for risk assets

Friday was a terrible day for cryptocurrencies.

Friday afternoon saw Bitcoin plunge below $66,000 after hovering around $70,000 over the last couple of days.

At the time of writing, Bitcoin has bounced back to ~$67,500, down more than -5.1% in the last 24 hours.

Ethereum felt the pressure even more than Bitcoin, falling -8.25% in the last 24 hours down to ~$3,200.

Smaller cryptos suffered even heavier losses. With Cardano, Avalanche, Bitcoin Cash & Polkadot all plummeting 15-20%.

The only positive here (for Bitcoin holders) is Bitcoin dominance just hit its highest level since 2021.

So why’d this happen?

The exact reason isn’t clear, but some are attributing this crash to:

Higher than expected inflation numbers in the US

Rising fears of escalating conflict in the middle east

SEC issuing a Wells notice to Uniswap

There just hasn’t been a lot of good news for crypto this week.

Drawdowns like these also typically trigger market liquidations.

According to CoinGlass, ~$850 million in leveraged positions were liquidated with the majority being long positions. (meaning investors were expecting price rises)

The worst of it appears to be over for now, with prices stabilising across the board.

Remember, during a bull market, price drawdowns like these aren’t out of the ordinary (in fact this one was quite small…)

Keep in mind - only 6 days until the halving… ✂️

Tik Tok…

TOGETHER WITH TLDR NEWSLETTER 🤖

Love Hacker News but don’t have the time to read it every day? Try TLDR’s free daily newsletter.

TLDR covers the best tech, startup, and coding stories in a quick email that takes 5 minutes to read.

No politics, sports, or weather (we promise).

Subscribe for free now and you'll get their next newsletter tomorrow morning.

ALL ROADS LEAD TO INFLATION 💸

U.S debt is out of control.

And the government has no choice but to print more dollars…

That’s the latest out from Steven Lubka.

Steven Lubka is the managing director of Swan Bitcoin, a Bitcoin only exchange.

Speaking with CNBC, Steven explained current market conditions.

Over the last 20 - 30 years, typically:

Rates go down = stocks go up 🤑

Rates go up = stocks go down 😢

That’s the common perception. But recently, things have been a little different…

Steven explains:

“Markets are operating a little differently. We’ve had very high rates relative to the last decade and the stock market has been on a tear for the last year.”

Why is that? 🤷♀️

It’s simple.

US debt is out of control. (It’s growing by $1 trillion every 100 days)

When rates go up, interest payments on that debt also go up.

In response, dollars are being printed (out of thin air) to pay holders of treasury bonds.

Steven explains rising interest rates is actually another form of money printing (inflationary force).

The US Fed finds itself in a hard place:

Raising interest rates = inflationary

Lowering interest rates = inflationary

Inflation is inevitable…

“Either path the fed takes is going to result in more dollars being issued into financial markets which improves liquidity and drives up asset prices.”

With this in mind, if all assets are increasing due to increased liquidity…

You may as well back the asset that benefits the most.

And that’s crypto. 🏆

STABLECOIN’S ARE ON THE RISE 📈

Today we’ll be taking another look at the stablecoin market.

Stablecoin’s play an important role in the wider crypto market. They are often used on centralized and decentralized exchanges to purchase other digital assets.

By taking a look at the stablecoin market, we can gauge the demand for digital assets.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

When we checked in on this metric two weeks ago, the stablecoin market cap was ~$143 billion.

Today the aggregate stablecoin market cap is ~$145 billion. 📈

Week by week the stablecoin market cap continues to grow.

In fact, it’s only $17 billion short of reaching it’s all-time high.

And since October 2023, this metric has only been increasing.

Let’s also take a quick look at the stablecoin supply dominance:

🟩 USDT: 73.81%

🟦 USDC: 22.11%

🟪 DAI: 3.68%

USDT absolutely dominates the stablecoin market, with 73.81% dominance.

And it’s not even close…

(something drastic would have to happen for USDT to lose it’s market share)

There’s a simple takeaway from this data.

Liquidity is pouring back into the crypto industry.

Which also means demand is continuing to up.

Growth in stablecoin supply is a clear bullish signal.

Onwards & upwards. 🐂

CRACKING CRYPTO 🥜

Bitcoin and Ethereum ETFs could launch in Hong Kong before halving. Bloomberg is reporting that both Bitcoin and Ethereum ETFs are expected to be approved as early as Monday.

Bitcoin falls to new lows as stock markets correct — Did something break? Poor performance from the stock market and concerns about the Federal Reserve’s monetary policy result in a sharp correction in Bitcoin price.

BlackRock bitcoin fund accounts for 20% of the firm’s Q1 ETF net inflows. BlackRock reported during a Friday earnings call that IBIT has seen net inflows on every trading day since its Jan. 11 launch.

Coinbase Seeks to Take Core Question in U.S. SEC Case to Higher Court. The crypto exchange is trying to appeal part of a judge's recent denial of its motion to dismiss.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the maximum amount of Ethereum that can ever exist?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Infinite 🥳

Ethereum has no maximum supply limit, which means that theoretically, an unlimited number of Ether can be created.

GET IN FRONT OF 63,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.