GM to all 14,850 of you. Crypto Nutshell #121 shootin’ thru. 🌠🥜

We’re the crypto newsletter that won't disappear like people in a small town plagued by supernatural occurrences... 🌌👻

Today, we’ll be going over:

☀️ Crypto spring is here - what does that mean?

🌊 The Bitcoin ETF is not priced in

💰 Short term holders back in profit

🤑 And more…

MARKET WATCH ⚖️

Prices as at 5:45am ET

Only the top 20 coins measured by market cap feature in this section

CRYPTO SPRING IS HERE ☀️

BREAKING: Morgan Stanley believes crypto winter is over and the bull run is here

Investment banking giant Morgan Stanley has just released a report on why they believe crypto winter is over. 👀

The report notes that following:

“Historically, most of bitcoin’s gains come directly after a ‘halving’ event that occurs every four years.”

Now this isn’t really ground-breaking news. We’ve been talking about the upcoming halving and it’s potential impact quite a lot.

The BIG thing here is more and more traditional financial institutions are talking about Bitcoin. A clear sign of increasing demand.

However, they do outline an interesting way of thinking about the four year cycle:

Summer: starts with the halving event and ends once the price hits it’s prior peak 🌞

Fall: the time between Bitcoin reaching it’s previous high and achieving a new one. Categorised by increased media attention and maximum FOMO 🍂

Winter: the time between the new peak and the next bottom. HODLers cash in and new investors are scared off by falling prices ❄️

Spring: leading up to the halving, Bitcoin’s price recovers from the cycle low. However investor interest is still low 🌱

Morgan Stanley believes we have moved past crypto winter and are now in crypto spring. The reasons why:

Time since the last peak: Cycle lows typically occur 12-14 months after the peak

Magnitude of drawdown: Previous bottoms were ~83% off their respective highs

Miner Capitulation: During bottoms many miners shut down their operations, which decreases difficulty. Decreasing difficulty is a sign that the bottom is in

Bitcoin price-to-thermocap multiple: “Thermocap” is a measure of the money invested in Bitcoin from the beginning. A lower price-to-thermocap multiple signals the bottom is in

Exchange problems: Crypto exchanges collapsing are a signal that the bottom is in

Price action: A 50% increase from Bitcoin’s low is a sign that we have recovered from the bottom

With all the above points being true - it’s safe to say we have moved out of crypto winter and are now in crypto spring. 🌼

How long until crypto summer? 171 days - the amount of days left until the April 2024 Bitcoin halving. ☀️

TOGETHER WITH NIFTY NEST 🦉

Crypto is like the new frontier of investing. 🪐

There’s so much to cover - Bitcoin, Ethereum, Alt-coins, NFT’s…

We’ve got you covered on Bitcoin, Ethereum & all the top Alt-coins. But you’ll rarely hear us cover much about the NFT world.

The problem? NFT’s see some of the most insane returns in the crypto space.

That’s why we read Nifty Nest.

Think of it like the Crypto Nutshell, but for NFT’s. They share the latest trends & news in the NFT space.

The best part?

Just like us, they’re completely free.

Smash that subscribe button and it’ll automatically add you to their list. Future you will thank you. ❤️

THE BITCOIN ETF IS NOT PRICED IN 🌊

At this point, everyone and their dog knows that the Bitcoin ETF is coming.

According to ETF analysts James Seyffart & Eric Balchunas, approval odds stand at 90% by January 10th 2024.

Which must mean… the ETF is priced in… right?

Absolutely not.

At least according to hedge fund CEO & founder - Mark Yusko.

Here’s his logic:

There’s $30 trillion of assets prohibited from investing in Bitcoin. This is due to risk, regulatory & custodial issues.

Once a BlackRock ETF is approved - all these risk, regulatory & custodial issues are resolved. It opens the floodgates for the $30 trillion.

Yusko estimates that of the $30 trillion, a 1% allocation would be prudent.

A 1% allocation of $30 trillion in assets? That’s $300 billion.

$300 billion of capital coming for a $500 billion dollar asset?

That’s not priced in. 🌊

“A prudent allocation would be a 1% position… so that's $300 billion. $300 billion on a $500 billion asset? That ain't priced in. I'm on the record - that is not priced in.”

SHORT TERM HOLDERS PROFITABLE 🤑

On average, short and long term holders are now in profit. 🥳

Profit and loss is a major driver behind any market.

If your coins go into profit, you’re more likely to hold them longer. But eventually you will sell when the amount of profit becomes significant.

There’s also only so much losses investors can take. When drawdowns become significant, panic selling becomes more likely. This means only the ultra price resistant HODLers survive deep bear markets.

This is why taking a look at the cost basis of investors is super useful.

The more the spot price deviates above or below the cost basis, the more likely we see investors taking profits / panic selling.

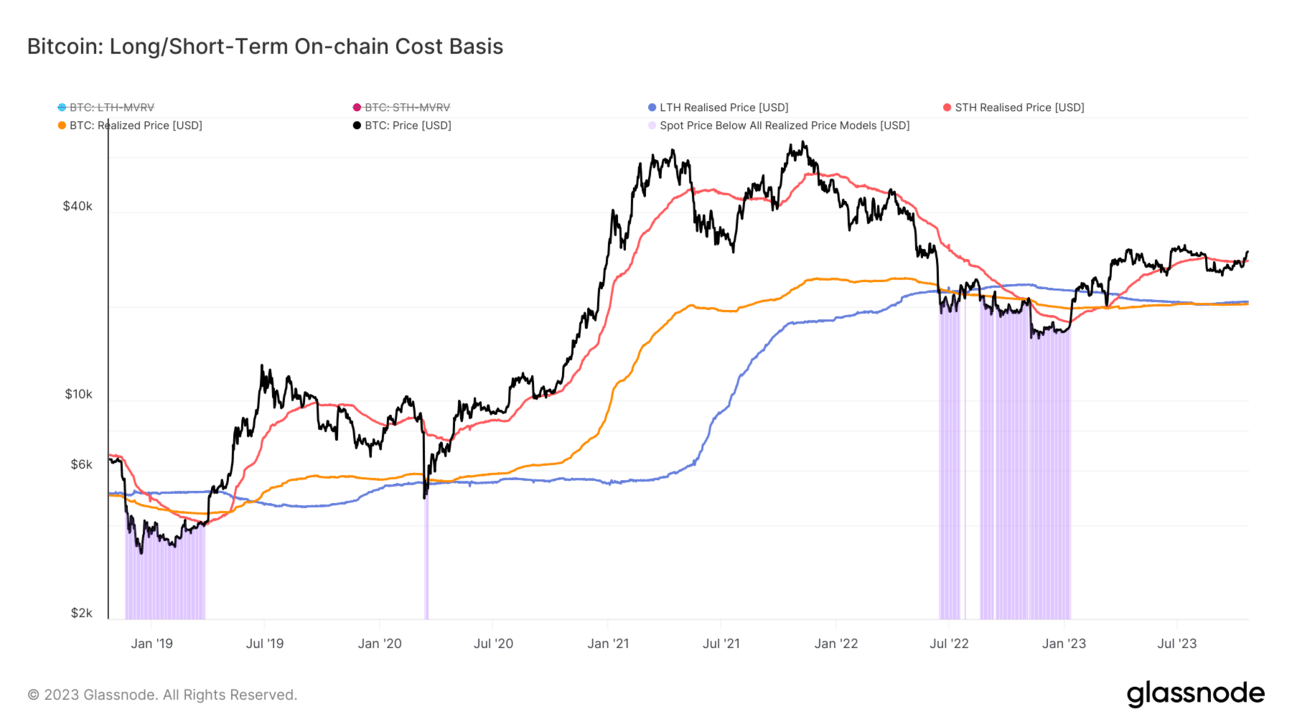

Here’s a quick rundown on this chart:

🟠 The Realized Price: average purchase price for the entire supply, currently at $20,366

🔴 Short-Term Holder Realized Price: average purchase price for coins last moved less than 155 days ago, currently at $28,026

🔵 Long-Term Holder Realized Price: average purchase price for coins held longer than 155 days, currently at $20,722

🟪 Periods where the spot price is below all cost basis models: occurs in deep bear markets (dark times when this happens)

The $28,000 price level is an extremely important one (STH cost basis).

With Bitcoin currently trading above $30,000, we’ve broken through the STH cost basis. This represents a shift in market sentiment (everyone’s happier when they’re in profit).

This is a pretty big deal…

With this recent price action, the average STH is now sitting on an unrealized profit. This gives them more incentive to HODL for future p

rice rallies (and potentially convert to long-term holders).

Bottom line: With Bitcoin shooting back above the short term holder cost basis, it encourages short-term holders to hold their coins for longer.

This is a great set-up leading into ETF approval & the Bitcoin halving. It bodes well for short-term price action. 🚀

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

Sponsored

The Intrinsic Value Newsletter

The weekly newsletter devoted to breaking down business and estimating their intrinsic value, in just a few minutes to read — Join 35,562 readers

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

CAN YOU CRACK THIS NUT? ✍️

Who wrote Ethereum’s whitepaper?

A) Satoshi Nakamoto

B) Vitalik Buterin

C) Gavin Wood

D) Charles Hoskinson

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) Vitalik Buterin 🥳

The whitepaper paper was originally published in 2014 by Vitalik Buterin, the founder of Ethereum, before the project's launch in 2015

GET IN FRONT OF 14,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.