GM to all of you nutcases. It’s Crypto Nutshell #597 sleepin’ easy… 😴🥜

We're the crypto newsletter that's more unforgettable than a night in Vegas you really shouldn’t remember... 🎰🍾

What we’ve cooked up for you today…

⛈ Inflation cools again

🙅♂️ Cycle is over…

💪 Barely flinching

💰 And more…

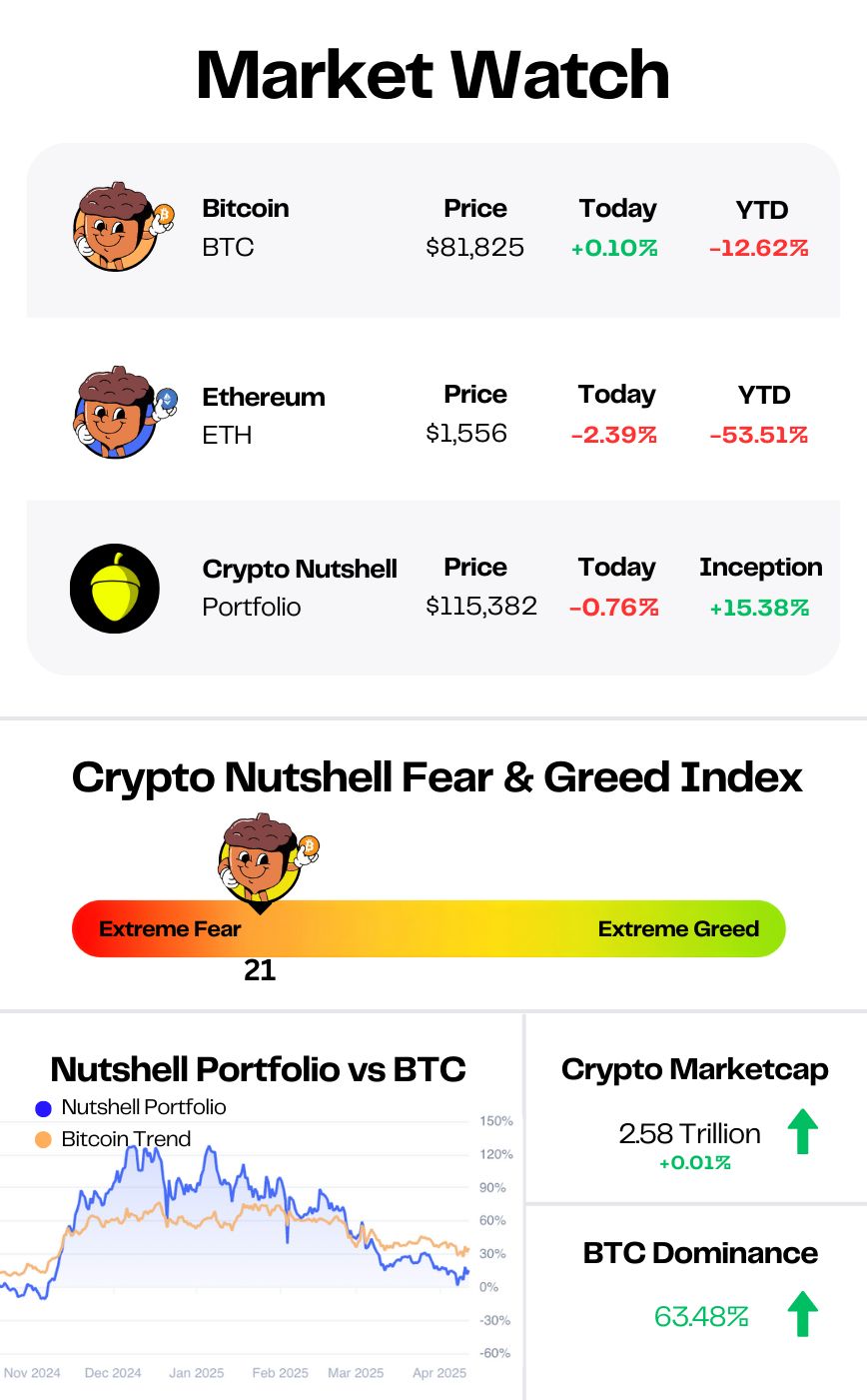

Prices as at 5:30am ET

INFLATION COOLS AGAIN 😎

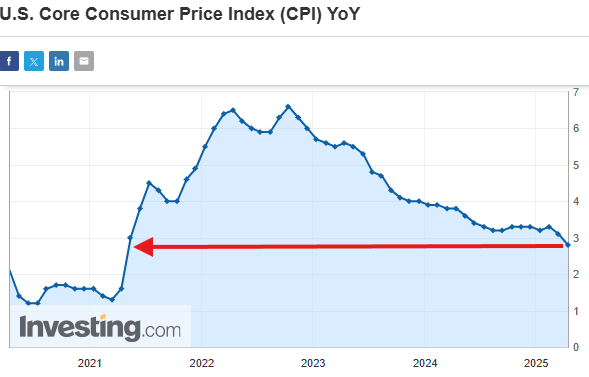

BREAKING: U.S. CPI Declined in March; Core Rate Rose Just 0.1%.

U.S. inflation just cooled for the second month in a row…

March CPI came in softer than expected - headline inflation rose just 2.4% year-over-year, with core CPI (excluding food and energy) up only 2.8%.

That’s the lowest core inflation print we’ve seen in 4 years!

Normally, this would be rocket fuel for risk assets.

But this isn’t a normal market anymore...

Despite the good news, stocks opened deep in the red. 📉

The S&P 500 fell 3.5%. The Nasdaq dropped 4.2%.

Bitcoin fell below $79,000 after the news, but has since recovered the $80,000 level.

Crypto as a whole shed $100 billion in market cap overnight.

So why the weakness? 🤔

Simple:

After yesterday’s 90-day tariff pause, the markets are waking up to a harsh reality.

The trade war is still very much alive.

Right now, we still have:

10% baseline tariffs on all countries globally

25% tariffs on automobile imports to the US

25% tariffs on steel and aluminium imports

25% tariffs on imports from Canada and Mexico

145% total tariffs on imports from China

Even with yesterday’s relief bounce, uncertainty is sky-high.

But it wasn’t all bad news…

Odds of a rate cut at the next FOMC meeting on May 7th have jumped from 20.4% to 37.7% following today’s data.

That’s a big move.

Lower inflation + slowing growth estimates + trade war pressure = rising chance of Fed intervention.

For now, Bitcoin is proving somewhat resilient - holding well above Monday’s low of $74,700.

But risk assets are searching for direction.

Markets NEED clarity.

Until then… choppy waters ahead.

Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

THE 4-YEAR CYCLE IS FINISHED 🙅♂️

Matt Hougan just flipped one of crypto’s most sacred ideas on its head:

“The 4-year cycle is over. But not in a bearish way - in a bullish one.”

Matt is the Chief Investment Officer at Bitwise, one of the biggest names in institutional crypto investing.

In his latest interview, he broke down why the 4-year crypto cycle is finished.

According to Matt, this bull market didn’t start with the halving. It started the day Grayscale won its lawsuit in March 2023.

“That’s when institutional capital started flowing in.”

Then? A second major spark:

“Trump’s re-election. A second “cycle-starting” catalyst.”

Matt believes we basically reset the clock in November 2024.

Which means:

We’re not in year 3 of the usual cycle...

We’re in month 5 of something totally new.

“This isn’t the end of a cycle - it’s the beginning of a US-driven, crypto golden age.”

Matt sees a full regime shift underway:

From hostility in Washington to full-blown tailwinds

From war on crypto to strategic Bitcoin reserves

From silence to legislation at the top of the priority list

“We’re not facing a slight shift. It’s a roller coaster drop into a brand new era.”

Don’t let the bad start to 2025 fool you.

This isn’t the end of a cycle - it’s the start of something bigger. 🌊

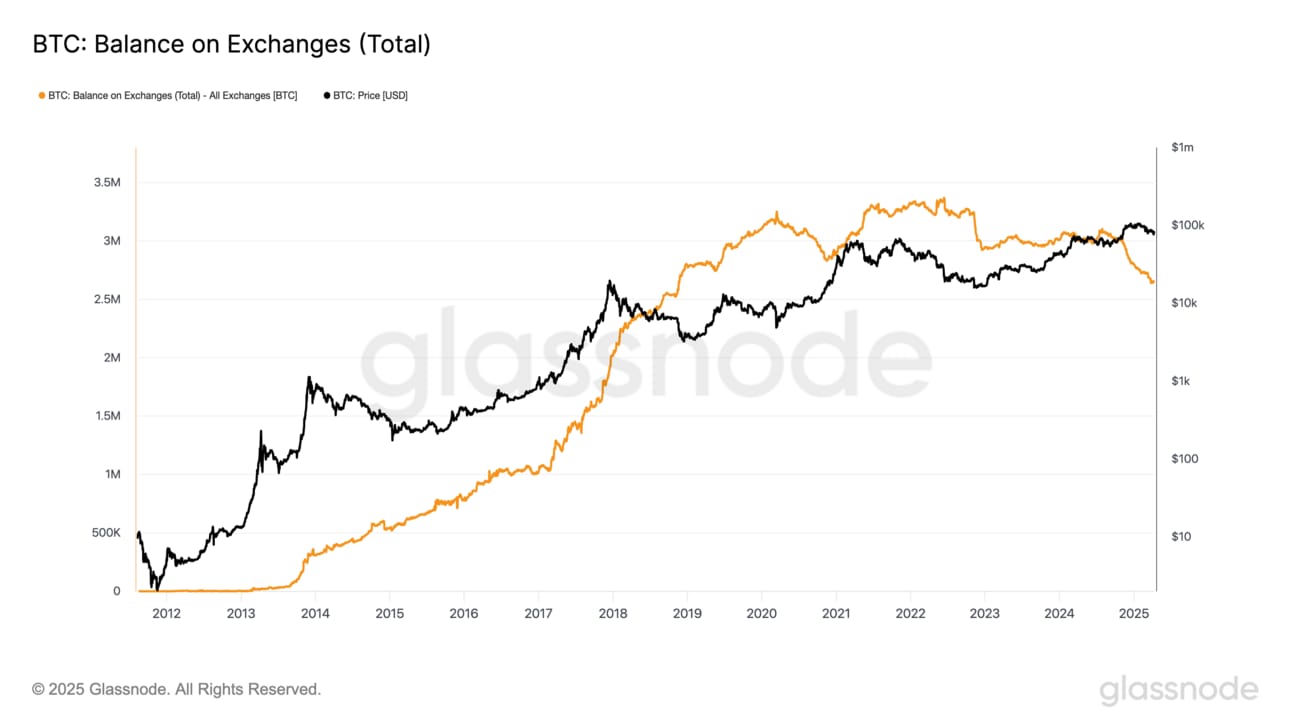

BARELY FLINCHING 💪

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Currently, just 2,652,858 BTC is sitting on exchanges.

That’s only 13.37% of Bitcoin’s total circulating supply.

In other words, there’s not a lot of BTC left for sale…

Over the past two weeks, we have seen a small increase of 10,348 BTC (~$824 million at today’s prices) move back onto exchanges.

But zoom out...

Year-to-date, exchange reserves have fallen by 143,592 BTC.

That’s an incredible stat - especially when you consider the wild price swings we’ve seen over the past few weeks.

The takeaway?

Investors aren’t flinching. 💪

Despite volatility, exchange reserves are still trending lower.

Supply is tightening.

And history tells us - that’s exactly how major Bitcoin rallies start.

CRACKING CRYPTO 🥜

Paul Atkins confirmed to Chair SEC as Gary Gensler's long-term replacement. The decision, supported entirely by Senate Republicans, initiates a departure from the enforcement-led regulatory approach under former Chair Gary Gensler.

North Carolina lawmaker introduces Digital Asset Freedom Act. North Carolina joins the growing list of US states attempting to pass comprehensive digital asset bills as a hedge against inflation.

President Trump Signs Resolution Erasing IRS Crypto Rule Targeting DeFi. The successful reversal of the Internal Revenue Service rule marks the first time the industry got a significant pro-crypto effort through Congress.

Silk Road creator Ross Ulbricht to make first public appearance at Bitcoin conference. In January, President Donald Trump signed an executive order issuing a full and unconditional pardon to Ulbricht.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which blockchain is most commonly associated with the rise of Decentralized Finance (DeFi) applications?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Ethereum 🥳

Ethereum’s smart contract functionality unlocked the entire DeFi movement.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.