Today’s edition is brought to you by Coinbase - the easiest way to purchase crypto.

GM to all of you nutcases. It’s Crypto Nutshell #648 packin’ it up… 📦🥜

We're the crypto newsletter that's more wild than a multiverse where every decision splits reality into chaos... 🌌🌀

What we’ve cooked up for you today…

🏦 Uncertainty

✈ Is the cycle over?

💪 Still holding

💰 And more…

Prices as at 3:55am ET

UNCERTAINTY 🏦

BREAKING: Bitcoin Rebounds as Markets Price in 'Short-Lived' Iran Conflict

Well… that escalated quickly.

The U.S. and Israel launched coordinated airstrikes on three Iranian nuclear facilities.

Within hours, more than $1 billion in crypto positions were wiped out, and Bitcoin plunged below $100,000 for the first time in 45 days.

Altcoins bled even harder.

AI tokens and small caps fell up to 20%, while Ethereum alone saw nearly $300 million in long liquidations.

Iran responded with missiles, drone strikes, and a familiar but serious threat - closing the Strait of Hormuz, one of the most critical chokepoints for global oil supply.

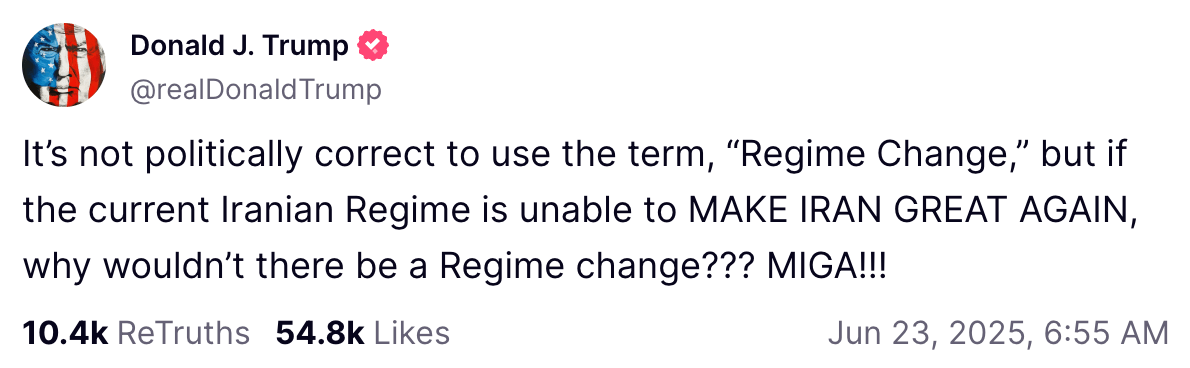

And Trump?

He called the operation “very successful” and hinted at backing regime change - a message that sent geopolitical risk soaring.

But by Sunday night… the panic somewhat faded.

Bitcoin bounced back above $100,000.

Oil barely moved. Gold cooled off. Equities held steady.

And Iran’s foreign minister reopened diplomatic backchannels in Moscow.

According to Pav Hundal of Swyftx:

“We saw a lot of twitch trading after the US attacked Iranian nuclear targets… But if tensions soften, confidence will return and prices should grind higher…. Nobody, including Trump, knows what happens next… That uncertainty is what traders hate most.”

The Bottom Line:

Markets hate uncertainty.

But smart investors know how this usually plays out.

Wars don’t strengthen fiat. They weaken it.

Wars don’t hurt Bitcoin. They highlight its value.

Selling Bitcoin during a geopolitical crisis is like selling your life jacket when you see dark clouds forming.

The storm isn’t over.

But the case for sound money has never been clearer.

BUYING CRYPTO MADE SIMPLE 🤑

Buying crypto can be easy.

Knowing which exchange to trust? That’s where it gets complicated.

That’s why over 100 million users have started their journey with Coinbase - the most recognised crypto exchange in the U.S.

Here’s what makes Coinbase stand out:

A beginner-friendly platform with a clean interface, helpful tips, and easy access to 250+ cryptocurrencies 💰

Coinbase Advanced for pro-level trading tools - no separate account needed 📈

Staking made simple: earn rewards on ETH, SOL, ADA, and more, all without leaving the app 🥩

You’ll also get access to learning rewards (yes, free crypto), recurring buys, and a sleek mobile app - all backed by a publicly traded company with transparent financials and industry-leading security.

Whether you’re stacking Bitcoin weekly or diving into deep altcoin research…

IS THE CYCLE OVER? ✈️

Bitcoin just dropped to ~$101,500.

Panic is in the air.

Tensions are flaring.

And some are already calling a cycle top.

But Raoul Pal says otherwise.

Today, he shared an updated chart of Global M2 vs the price of Bitcoin:

What are we looking at?

▪️ The black line = global M2 money supply

▪️ The pink line = Bitcoin (lagged 12 weeks behind M2)

And the takeaway?

Bitcoin’s not crashing. It’s tracking.

The latest dip feels scary - but zoom out, and it fits the pattern perfectly.

Raoul’s words:

“Nothing seems unusual here... It's the overall contextualization that matters the most.”

Why this chart matters:

▪️ Every time global liquidity rises (M2), Bitcoin follows.

▪️ The correlation isn’t exact - but the directionality is.

▪️ If the M2 lead holds… Bitcoin is still pointing toward $160K+.

So no - the cycle’s not over.

Not even close.

Corrections are normal.

Altcoins bleed harder.

The macro tide is still rising.

Final note:

The real top comes when liquidity shrinks.

That’s not happening yet.

Stay focused. Stay patient.

The chart says we’re not done. 📈

STILL HOLDING 💪

Time for a check-in on the Long/Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): Coins held for less than 155 days

🔵 Long-Term Holders (LTHs): Coins held for more than 155 days

🟥 Short-Term Holder Cost Basis: All coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: All coins purchased in this price range are LTHs

This metric is powerful because it shows exactly what price range long and short term holders bought their Bitcoin at. 🔍

The key cutoff date right now is January 18, 2025, when Bitcoin was trading near $104,300.

Any BTC bought before that is classified as long-term (LTH).

Anything bought after is short-term (STH).

And the gap between them is growing fast…

LTHs currently hold 14,696,708 BTC, or 73.91% of the circulating supply.

STHs hold just 2,262,130 BTC, or 11.38%.

In the past 90 days, 665,512 BTC has migrated into long-term hands.

That’s a clear sign of rising conviction. (Despite the shaky price action)

Historically, this kind of shift leads to one outcome:

Supply shrinks, sell pressure fades, and upside explodes.

Bottom line:

The strongest holders are locking in, and they’re not moving. 💪

CRACKING CRYPTO 🥜

Bloomberg analysts revise altcoin ETF approval odds to '90% or higher' as SEC requests amended filings. Bloomberg analysts expect SEC to approve broad range of crypto ETFs following constructive talks and increased optimism.

North Korean Hackers Are Using Python-Based Malware to Infiltrate Top Crypto Firms. A DPRK-linked group is using fake job sites and Python malware to infiltrate Windows systems of blockchain professionals.

Texas governor signs bill adding Bitcoin to official reserves. Texas Governor Greg Abbott signs SB21, launching a publicly funded Bitcoin reserve to hedge inflation and boost the state's financial resilience.

Spot Ethereum ETFs log largest outflows in one month as ETH price tumbles below $2,400. Meanwhile, spot Bitcoin ETFs set a total net cumulative inflow record for the fifth straight day on Friday, though the inflow level was comparatively low.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

In a decentralized exchange like Uniswap, what do liquidity providers (LPs) earn in return for supplying tokens?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Trading fees from swaps 🥳

Liquidity providers earn a cut of the trading fees generated by swaps in the pool — it's passive income, DeFi style. 💧💸

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.