GM to all of you nutcases. It’s Crypto Nutshell #750 feelin’ at peace… 🧘♂️🥜

We're the crypto newsletter that's more daring than a thief pulling off an impossible heist under the neon lights of Vegas... 🎰🎭

What we’ve cooked up for you today…

🏦 Regulatory clarity

🧠 Coinbase: The cycle isn’t over

📉 Two in a row

💰 And more…

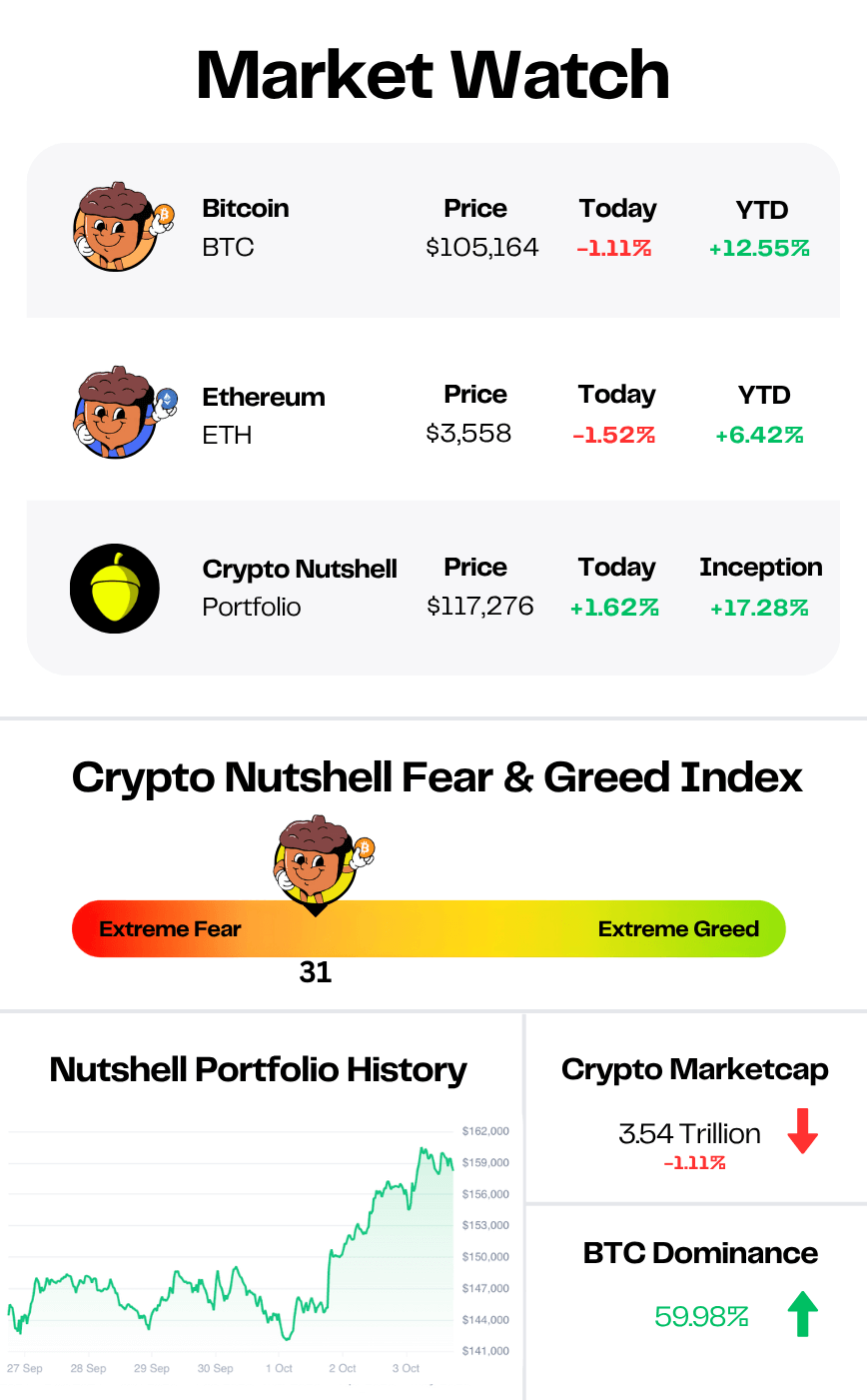

Prices as at 2:30am ET

REGULATORY CLARITY 🏦

BREAKING: Senate Ag Releases Long-Awaited Version of Crypto Market Structure Legislation

After years of debate, Washington is finally moving toward clear crypto regulation.

On Monday, the Senate Agriculture Committee released its long-awaited draft bill.

This is the first concrete step toward defining how the CFTC and SEC will share oversight of the crypto market.

The 155-page draft gives the CFTC new authority over spot digital commodities like Bitcoin while directing the agency to coordinate with the SEC on joint rulemaking.

It builds on the House’s Clarity Act and aims to close the regulatory gaps that have left the industry in limbo.

Senator John Boozman said:

“The CFTC is the right agency to regulate spot digital commodity trading, and it is essential to establish clear rules for the emerging crypto market while also protecting consumers.”

But the bill isn’t finished yet…

Dozens of sections remain in brackets, signalling unresolved issues, including:

How to fund the CFTC

How to treat DeFi protocols

And how to address potential conflicts of interest tied to President Trump’s crypto ventures

Still, the industry sees progress.

Crypto Council for Innovation CEO Ji Hun Kim called it:

"Meaningful positive progress… Momentum continues to build for clear, risk-based rules that promote innovation, protect consumers, and strengthen U.S. competitiveness."

If this makes it through, it will set up the first unified crypto framework vote in U.S. history, potentially in early 2026.

The path ahead won’t be smooth - with Democrats divided over Trump’s involvement and DeFi language still up in the air - but the direction is clear:

Regulatory clarity for the crypto industry is coming. ⏳

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

COINBASE: THE CYCLE ISN’T OVER 🧠

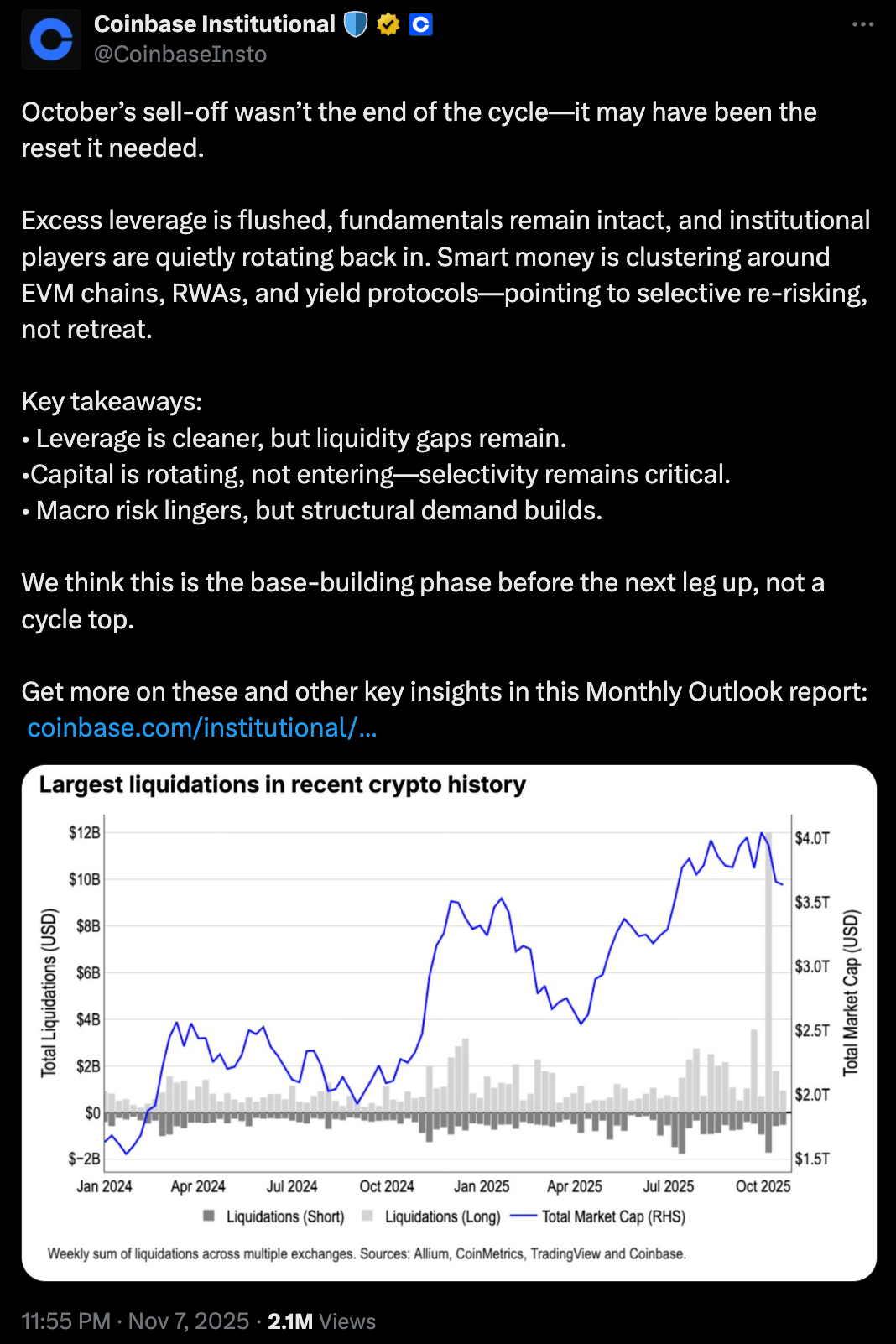

Coinbase Institutional just dropped its October outlook - and their message is clear:

October wasn’t the top. It was the reset.

This cycle isn’t over.

Here’s a summary of what the report said:

In a nutshell: Leverage got flushed, liquidity’s still thin, but the fundamentals? Still rock solid.

Their analysts say institutional capital is quietly rotating back in - not running for the exit.

Key takeaways:

• The market’s been flushed of excess leverage - but money flow is still tight 💧

• Smart money isn’t leaving crypto, it’s just moving between sectors 🔄

• The economy’s still uncertain, but long-term demand keeps growing 📈

In Coinbase’s words:

“We think this is the base-building phase before the next leg up — not a cycle top.”

Translation?

The biggest institutional desk in crypto just confirmed what we’ve been saying for weeks:

This isn’t the end of the bull run - it’s the reload phase. ⚙️

TWO IN A ROW 📉

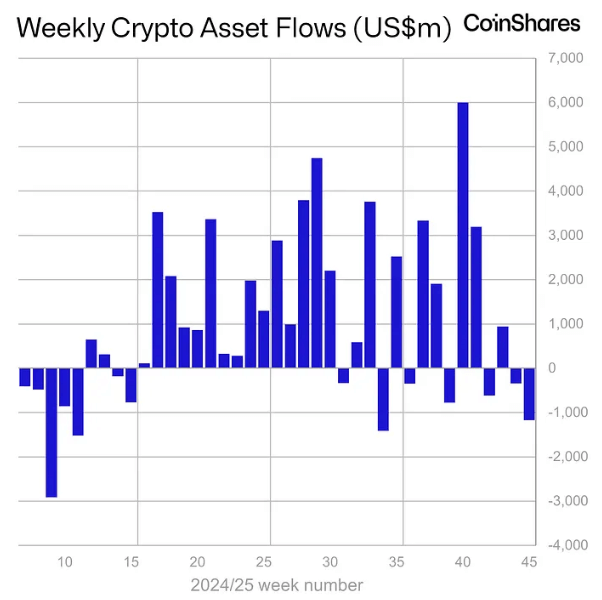

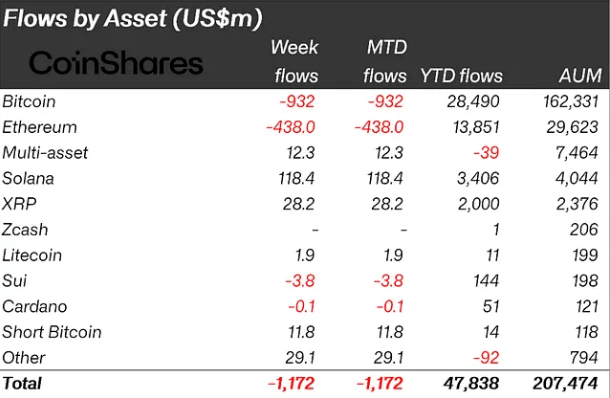

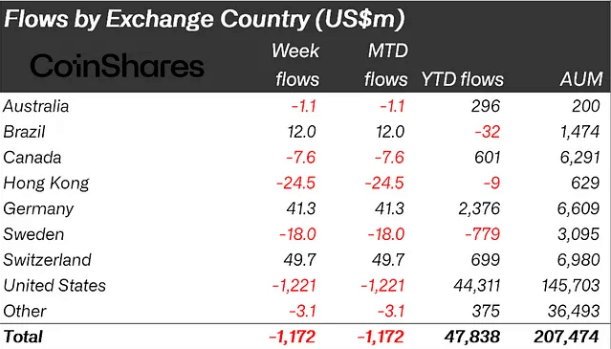

Digital asset funds saw a second week of outflows totalling $1.17 billion last week.

Let’s break it down.

As usual, Bitcoin was the primary focus, experiencing outflows of $932 million.

Ethereum also saw substantial outflows totalling $438 million.

Whilst Solana and XRP held strong with inflows of $118.4 million and $12.3 million respectively.

From a regional perspective, the U.S. led with outflows of $1.22 billion.

Switzerland, Germany, and Brazil saw inflows of $49.7 million, $41.3 million, and $12.0 million respectively.

Negative sentiment lingered last week as fears over the government shutdown and a fading December rate cut kept markets uneasy.

On Thursday, hope briefly returned after reports suggested progress toward reopening the government.

But the relief was short lived…

By Friday, optimism faded and outflows came rushing back.

CRACKING CRYPTO 🥜

BTC targets CME gap at $104,000 as shutdown end buoys risk. Bitcoin's CME gap from $104,000 to $110,000 shows how weekend price action still shapes Bitcoin’s weekly tone.

Strategy adds $50M in Bitcoin holdings to crypto stockpile. With the price of Bitcoin still over $100,000 after threatening to dip on Friday, Strategy announced another significant purchase of $50 million in crypto.

Ethereum Treasury News: BitMine (BMNR) Keeps Buying Ether (ETH). The crypto treasury firm now owns 2.9% of the ETH supply and holds nearly $398 million in cash for more purchases.

Coinbase launches public token sales platform with US access, Monad as the first issuer. The Monad public token sale on Coinbase is scheduled for Nov. 17–22 ahead of the Monad mainnet launch on Nov. 24.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which Layer 2 solution uses zero-knowledge proofs to validate transactions off-chain?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: zkSync 🥳

zkSync leverages zero-knowledge proofs to batch transactions efficiently and securely. 🧠

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.