Today’s edition is brought to you by Gemini

Get $25 in bitcoin when you trade $100.

GM to all of you nutcases. It’s Crypto Nutshell #659 lightin’ the fuse… 🧨🥜

We're the crypto newsletter that's more epic than gods clashing with titans in a battle for Olympus... ⚡🗡️

What we’ve cooked up for you today…

🏦 The accumulation game

🚀 Nowhere near the top

🔥 Twelve

💰 And more…

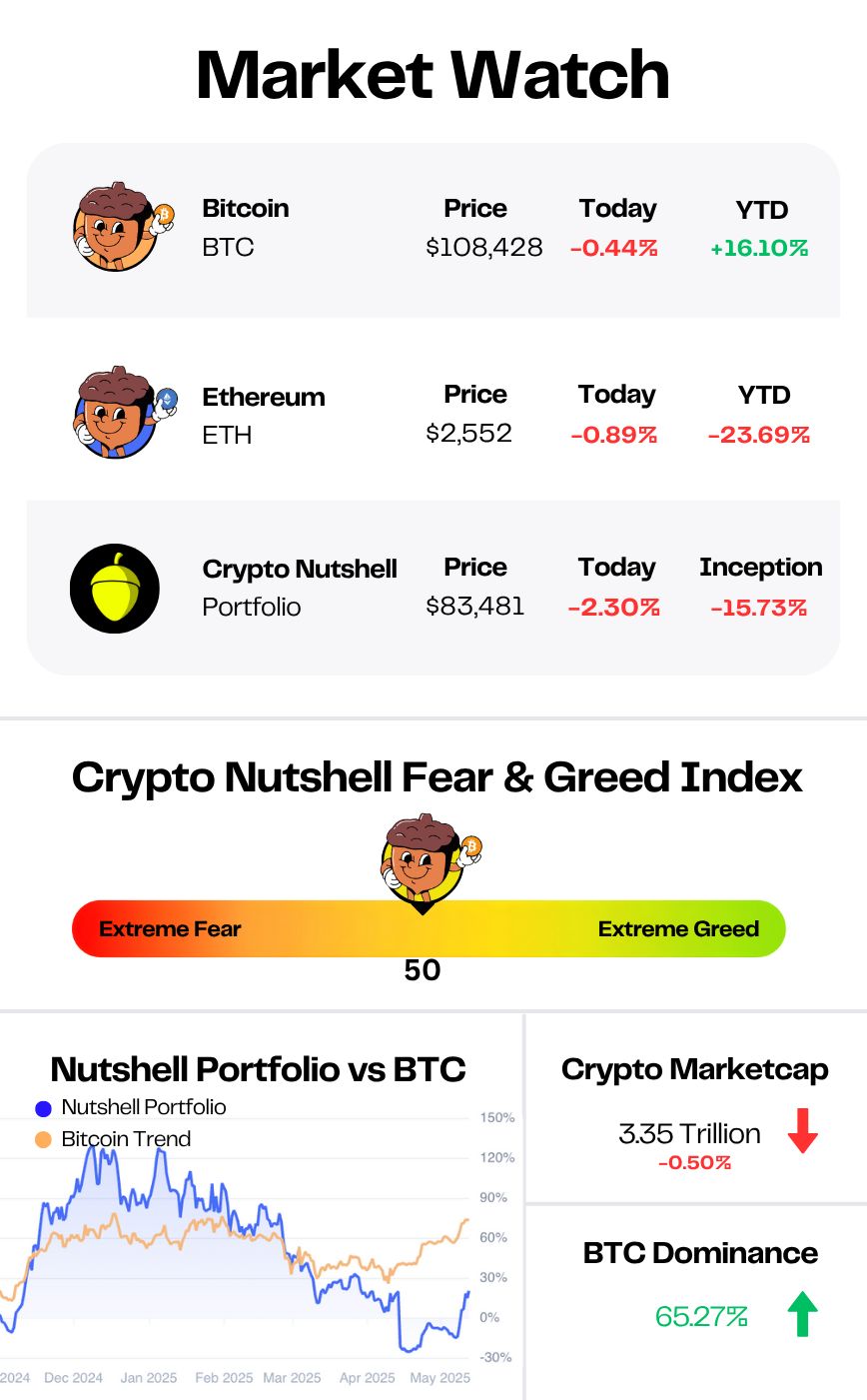

Prices as at 4:30am ET

THE ACCUMULATION GAME 🏦

BREAKING: Strategy pauses bitcoin buying spree for first time in 3 months

After three straight months of relentless buying, Strategy finally took a breather.

No new Bitcoin added this week…

Saylor posted the following to X earlier in the week:

But while the king of corporate Bitcoin hit pause, a new contender just went full send…

Bit Digital has officially flipped.

Dumping its entire BTC stash, the Nasdaq-listed firm splashed $173 million into Ethereum - acquiring over 100,000 ETH and instantly becoming the second-largest public ETH holder behind Coinbase.

CEO Sam Tabar didn’t hold back:

“We believe Ethereum will rewrite the entire financial system. We are starting with exposure to over 100K ETH for now, but we intend to aggressively add more so we become the preeminent ETH holding company in the world.”

The market loved it.

BTBT shares ripped higher, sending its market cap back above $1 billion.

And this isn’t a one-off.

BitMine Immersion and SharpLink have made similar pivots, betting big on Ethereum’s staking yield, tokenization boom, and future role as financial infrastructure.

A pattern is emerging…

While Bitcoin purists cling to scarcity and simplicity - Ethereum’s camp is playing the long game: programmable money, real-world assets, institutional staking.

Even as Strategy sat out, Metaplanet swooped in with a $239M BTC buy, and Semler added another $20M - pushing total corporate BTC holdings past 852,000 coins.

Still…

The narrative is shifting.

And Ethereum just raised its flag.

THE EASIEST WAY TO BUY CRYPTO 🤑

With all the ways to buy crypto today, making your first purchase isn’t the hard part.

Knowing where to keep it? That’s where things get tricky.

That’s why more and more traders are turning to Gemini - one of the most trusted names in the game.

Here’s what makes Gemini stand out 👇

A clean, beginner-friendly interface that makes buying your first crypto feel effortless

An advanced “ActiveTrader” platform for pros with real-time data, charting tools, and low fees

Over 80 assets to choose from - including Bitcoin, Ethereum, stablecoins, and various altcoins

Simple staking that lets you earn up to 4.98% APY just by holding your crypto

You’ll also get tools like price alerts, recurring buys, and a mobile app that mirrors the full desktop experience - perfect for tracking your portfolio on the go.

Whether you're starting with $100 or scaling up a strategy, Gemini has your back.

As a bonus for Crypto Nutshell readers, Gemini is offering $25 in Bitcoin when you trade $100!

👉 Check it out at gemini.com (Promo code: CryptoNutshell)

NOWHERE NEAR THE TOP 🚀

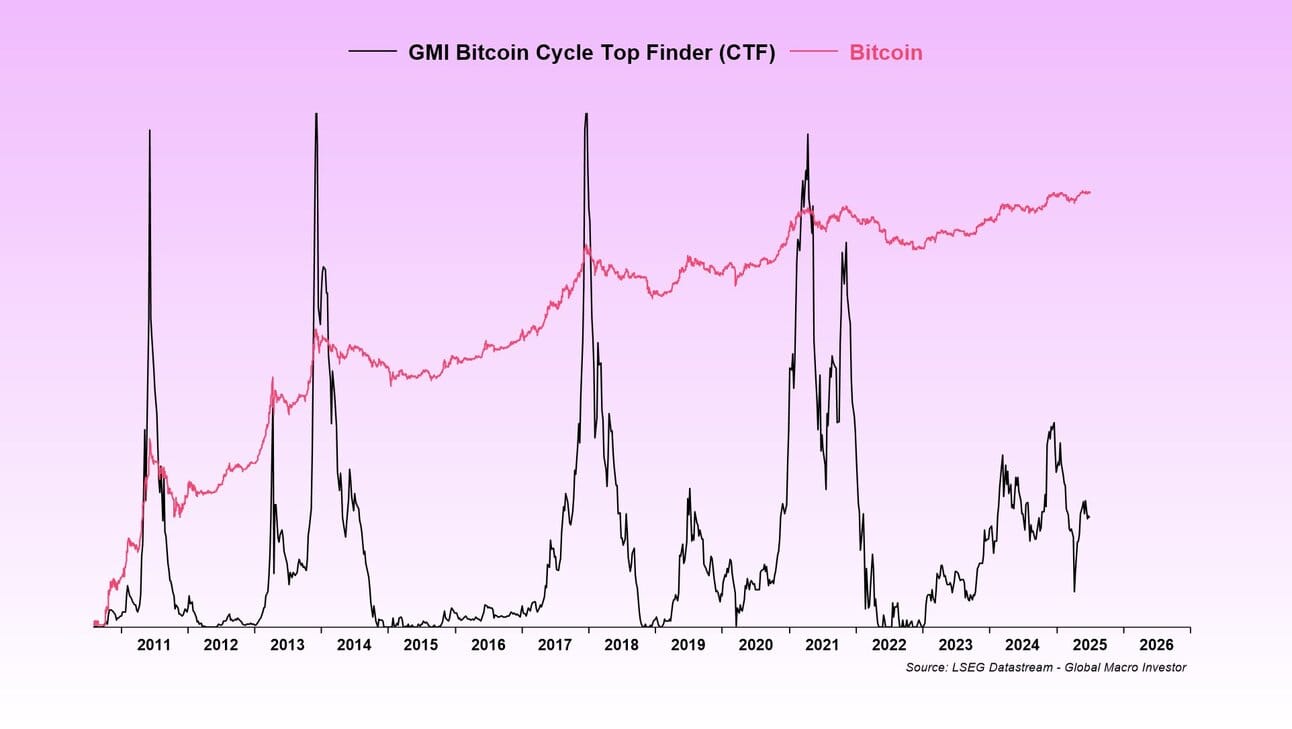

Julien Bittel just dropped a new signal…

And it’s crystal clear:

We’re nowhere near the top.

If you know his work with Raoul Pal at Global Macro Investor, you know they don’t guess.

They model.

Their latest chart?

The GMI Bitcoin Cycle Top Finder

It’s nailed every cycle top - 2011, 2014, 2018, 2021.

Each peak corresponded almost perfectly with Bitcoin’s blow-off tops.

But right now?

It’s nowhere close.

According to Julien, this cycle still has legs - and the biggest move is still ahead.

We agree.

Not financial advice.

But when the guys who built The Everything Code say we’re not done…

You might want to listen. 🚀

TWELVE 🔥

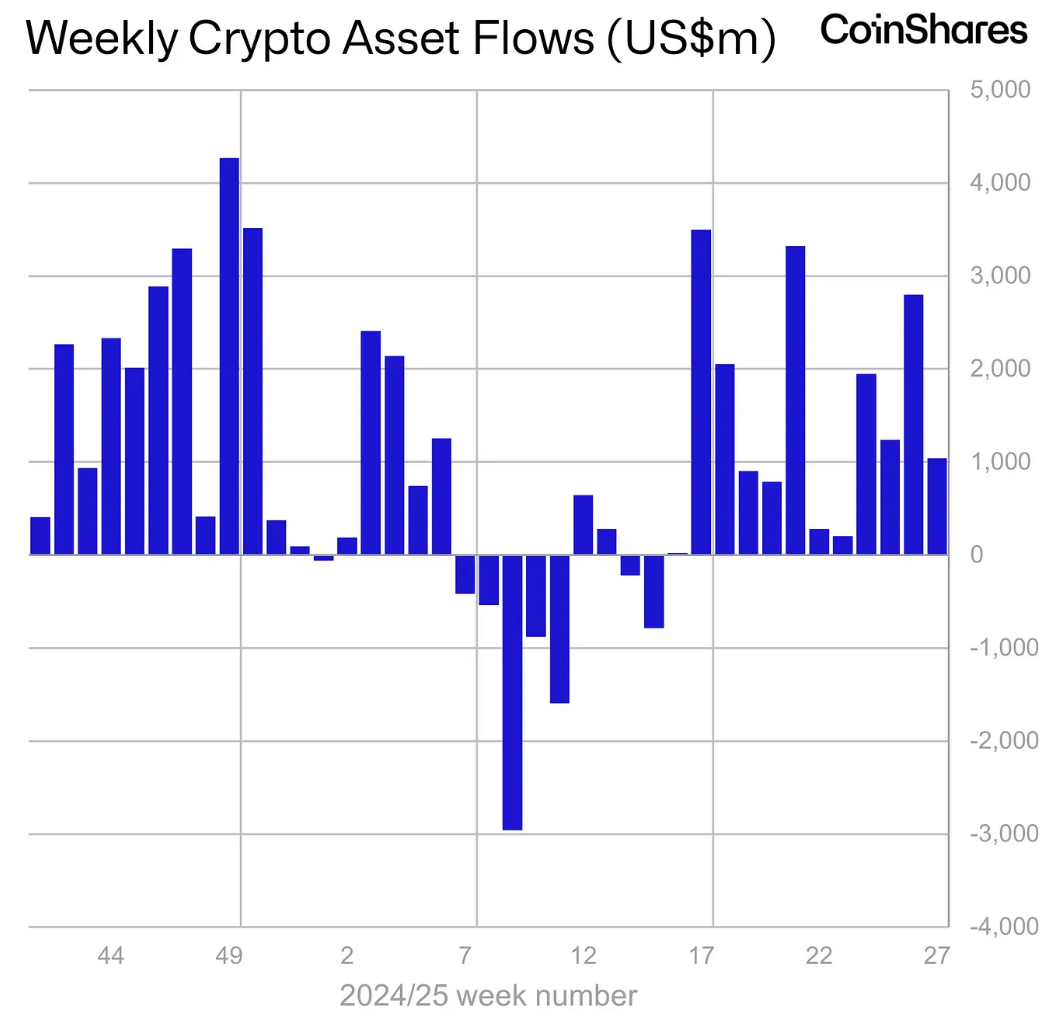

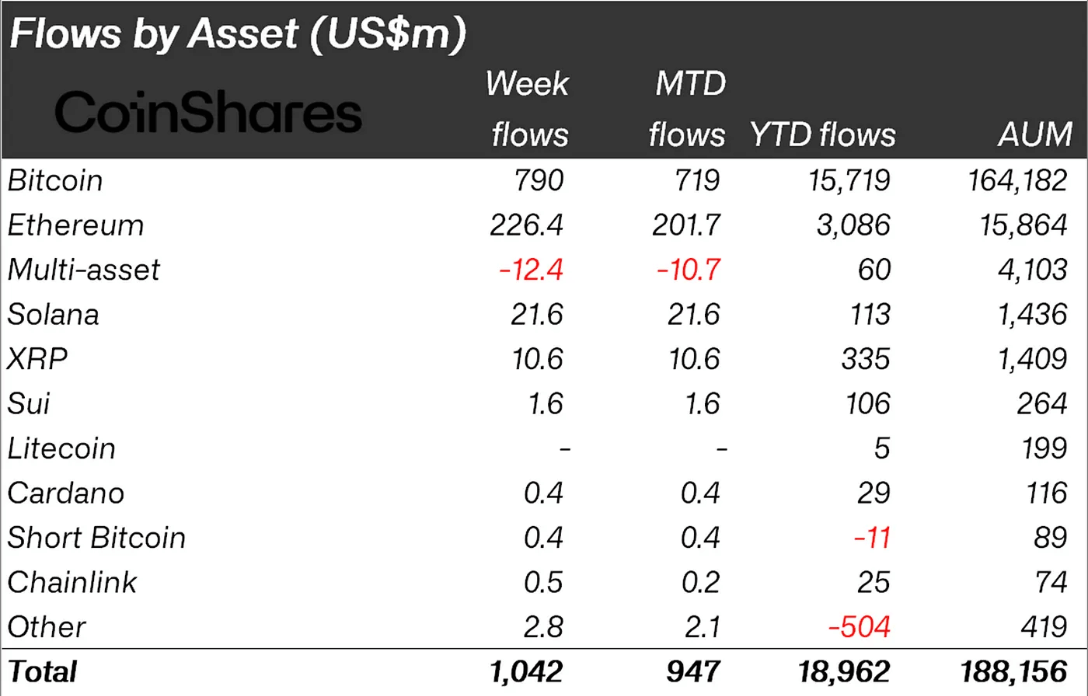

For the twelfth week in a row, digital asset funds saw net inflows of $1.04 billion.

That brings the year-to-date total to nearly $19 billion.

And thanks to strong price action across the board, total assets under management just hit a new all-time high of $188 billion.

Let’s break it down.

As always Bitcoin led the charge, pulling in $790 million in inflows.

Ethereum followed with $226.4 million.

While Solana and XRP continued their inflow streaks with flows of $21.6 million and $10.6 million respectively.

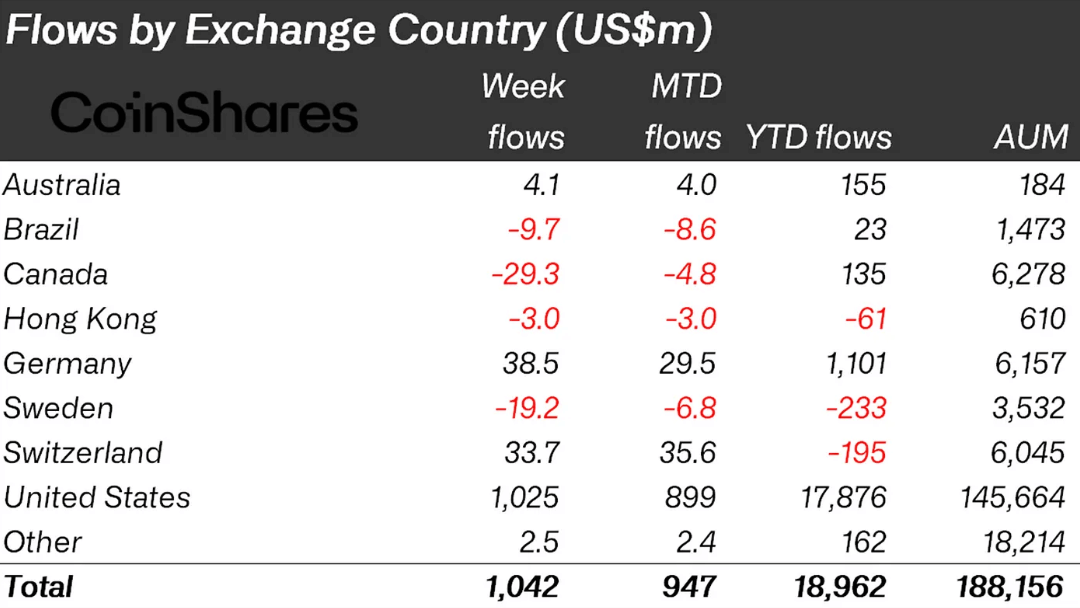

Regionally, the United States dominated with $1.03 billion in inflows.

Germany contributed $38.5 million, Switzerland added $33.7 million, and Australia brought in $4.1 million.

In contrast, Canada, Sweden, and Brazil each saw outflows of $29.3 million, $19.2 million, and $9.7 million respectively.

And here’s the kicker - this all happened during a week when U.S. markets were closed for the 4th of July holiday.

The message?

Even with a day off, the flows didn’t stop.

Institutional demand is still alive. Capital is still moving in. And the conviction behind this market keeps building.

CRACKING CRYPTO 🥜

Jack Dorsey launches Bitchat, a Bluetooth-based messaging platform. Bitchat operates fully over Bluetooth, ensuring private, internet-free communication with resilience against outages.

Court ends Coin Center-US Treasury appeal over Tornado Cash. Following a joint filing with Coin Center and the US Treasury, the US Court of Appeals for the 11th Circuit granted a motion to vacate a lower court ruling.

SEC Sets July Deadline for Solana (SOL) ETF Refilings, Clearing Path for Pre-October Approval. The first final deadline for a spot Solana exchange-traded fund is October 10, but the SEC is under pressure to keep the approval process moving smoothly, sources say.

Solana-based memecoin generator Pump.fun plans to list its upcoming PUMP token on July 12. The Pump.fun team will apparently offer 150 billion PUMP tokens priced at $0.04 worth of USDT with a 1 trillion max supply.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the main use of a governance token in a DeFi protocol?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Voting on protocol changes 🥳

Governance tokens give holders the power to vote on proposals, upgrades, treasury use, and protocol decisions — putting decentralization into action. 🗳️🧠

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.