Today’s edition is brought to you by Crypto Nutshell Pro.

If you’re interested in altcoin coverage, buy recommendations & want to know what’s in the Crypto Nutshell Portfolio, click here to join now!

PS: Only 5 new spots open…

GM to all of you nutcases. It’s Crypto Nutshell #726 sittin’ by… 🪑🥜

We're the crypto newsletter that's more intense than a getaway driver caught in a heist gone completely off the rails... 🚗🔫

What we’ve cooked up for you today…

🥊 Bitcoin vs gold

☀️ Don’t count out Solana

📈 All-time high alert

💰 And more…

Crypto Nutshell Pro Doors Are Open ✅

As you know, each day this week we are opening Crypto Nutshell Pro to 5 new members, each day.

All 5 spots in the first 2 days were taken in under 10 minutes.

Why do we cap members so tightly?

Simple: if everyone knows the best alpha, no one knows.

Capping spots makes sure the members inside get the most value possible.

Today, 5 more slots are open.

By signing up, here’s what you’ll get:

Exactly what we hold - A look into exactly what we’re holding in our portfolio

Altcoin Coverage - Detailed analysis on altcoins

Bull / Sell indicators - know exactly when we believe it’s a good time to enter and exit positions

After this week, doors will be closed indefinitely.

If we do open the group up again, it will be at higher prices.

Click below to secure 1 of the 5 spots.

But, be fast:

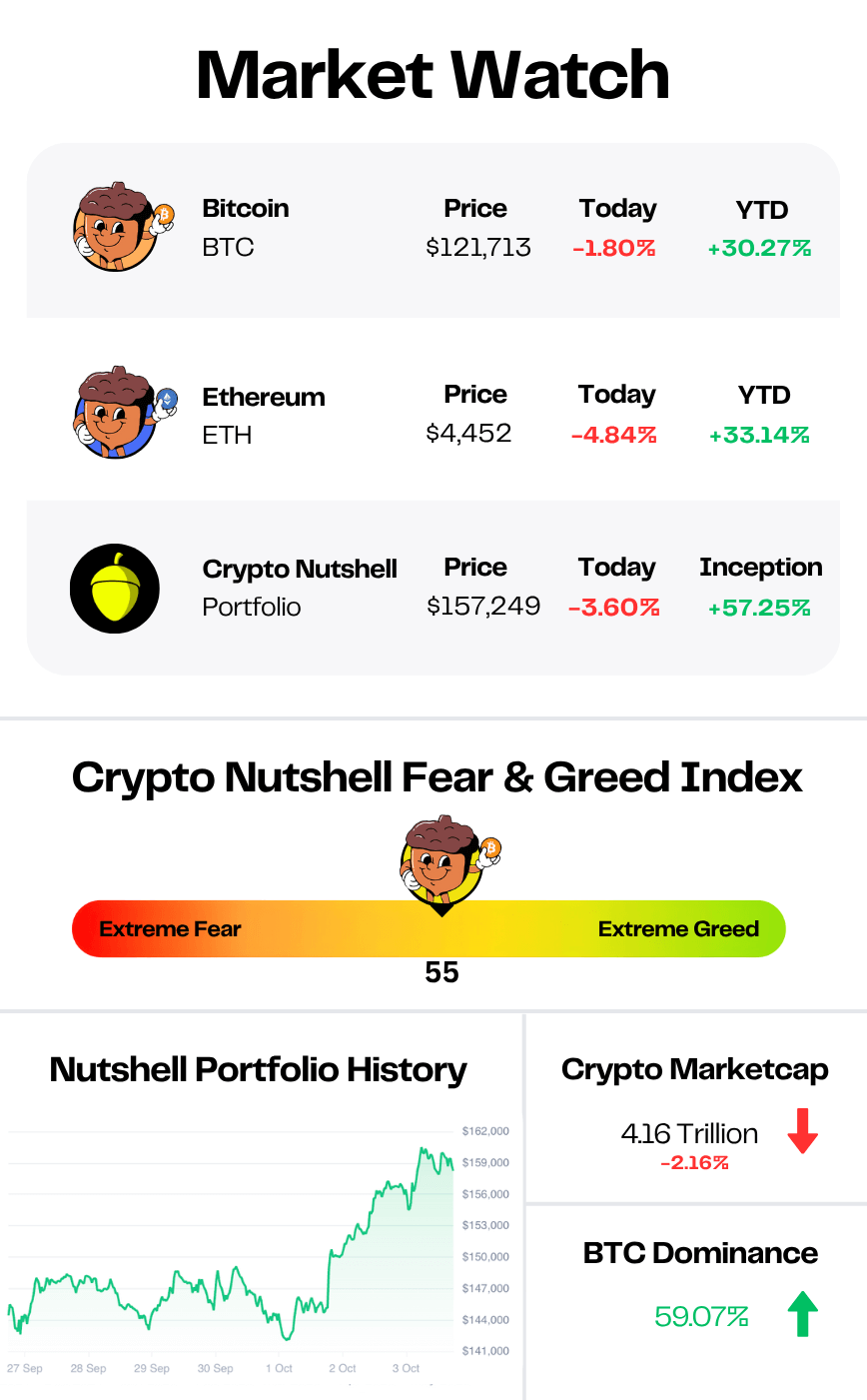

Prices as at 3:15am ET

BITCOIN VS GOLD 🥊

BREAKING: VanEck Sees Bitcoin Reaching Half of Gold’s Market Value - But When?

VanEck just dropped one of the boldest forecasts of the year - and it’s not about this cycle.

It’s about Bitcoin’s endgame.

According to Matthew Sigel, VanEck’s head of digital assets research, Bitcoin could one day capture half of gold’s $26 trillion market cap - implying a $644,000 price per BTC.

“At today’s record gold price, that implies an equivalent value of $644,000 per Bitcoin.”

The timing couldn’t be better.

For the first time in history, Bitcoin and gold are leading global markets together - both breaking records as faith in fiat fades fast.

Gold’s up 48% year-to-date, Bitcoin’s up 30%, and both are being driven by the same force: investors fleeing paper money for hard assets.

As Ecoinometrics noted, the pattern’s been clear for two years - a steady rotation into Bitcoin and gold as U.S. debt climbs and fiscal dominance takes hold.

Sigel believes the next big catalyst arrives after the 2028 halving, when Bitcoin’s new supply gets cut in half again:

“Younger investors, especially in emerging markets, increasingly view Bitcoin as a superior store of value to gold.”

And he’s not alone.

Dave Weisberger, CEO of CoinRoutes, says the real fireworks haven’t even started yet:

“Bitcoin’s real bull market hasn’t even started yet. When it does, you’ll know it from the disbelief that echoes around this platform.”

Meanwhile, David Marcus, former PayPal president, went even further - saying if Bitcoin were priced like gold, it would already trade north of $1.3 million per coin.

VanEck’s thesis ties it all together:

Institutional adoption is accelerating.

Fiat credibility is eroding.

And the next generation is choosing digital over physical.

Bitcoin sits around $124K today - still miles from $644K.

But remember: gold had centuries.

Bitcoin’s only had 17 years. 🚀

DON’T COUNT OUT SOLANA ☀️

That’s the latest reminder from Hunter Horsley - CEO of Bitwise, one of the largest and most respected institutional crypto firms on the planet.

Hunter isn’t just another market commentator.

Bitwise manages billions, runs the leading crypto ETFs, and has become a key bridge between Wall Street and digital assets.

When he speaks, institutions listen.

This week, Hunter tweeted just two words:

It’s most definitely something

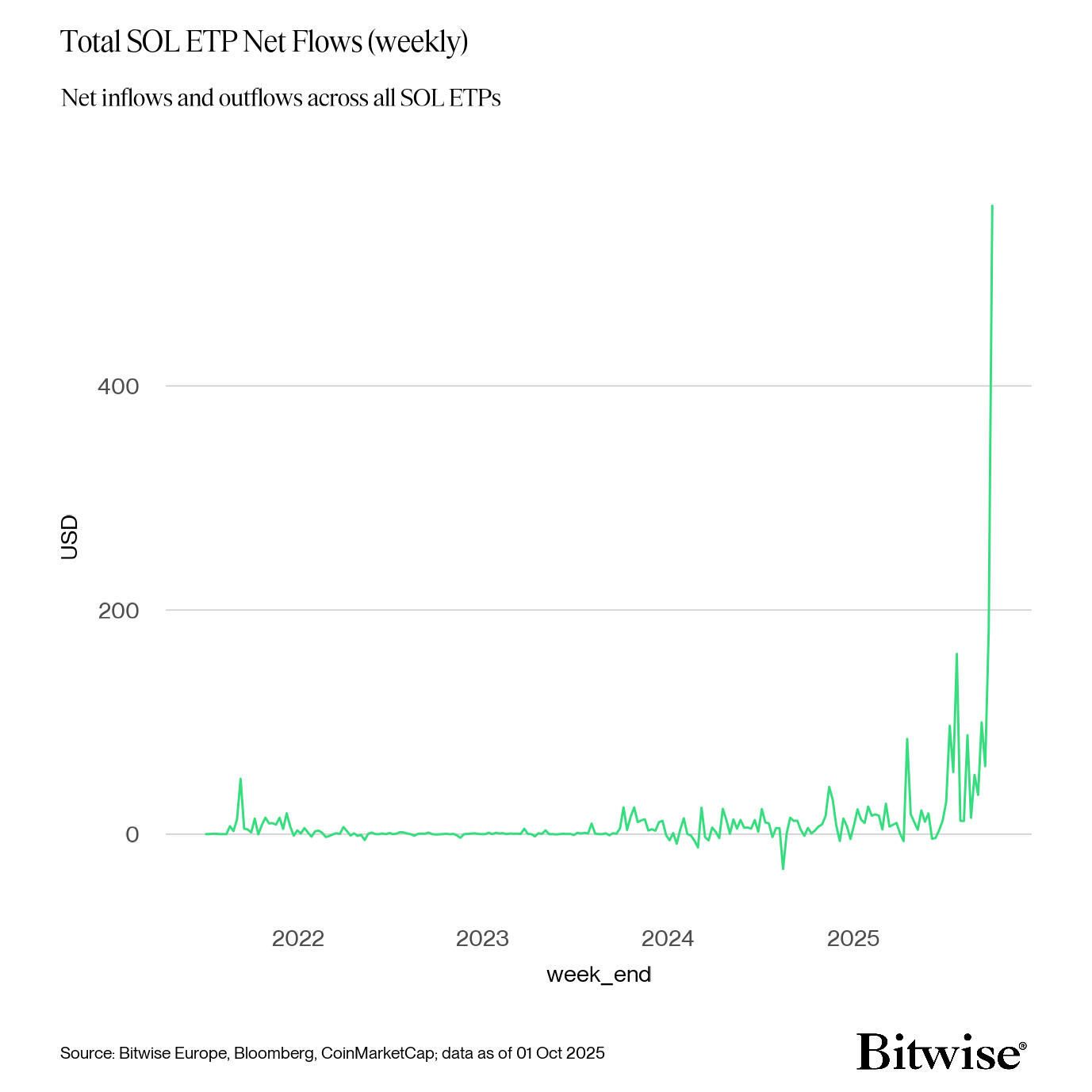

He was retweeting Bitwise’s latest chart - showing Solana Exchange Traded Product inflows going absolutely vertical:

It’s easy to get caught up in Bitcoin and Ethereum right now - and for good reason.

ETF flows are surging, and treasury accumulation is accelerating.

But don’t forget about Solana.

It may just be the dark horse of Q4. 🐴

Institutional capital is clearly waking up to it. Flows are exploding.

And history shows these quiet rotations often turn into massive moves.

All the attention might be on Bitcoin and Ethereum...

But Solana’s starting to whisper its comeback. 🌅

ALL-TIME HIGH ALERT 📈

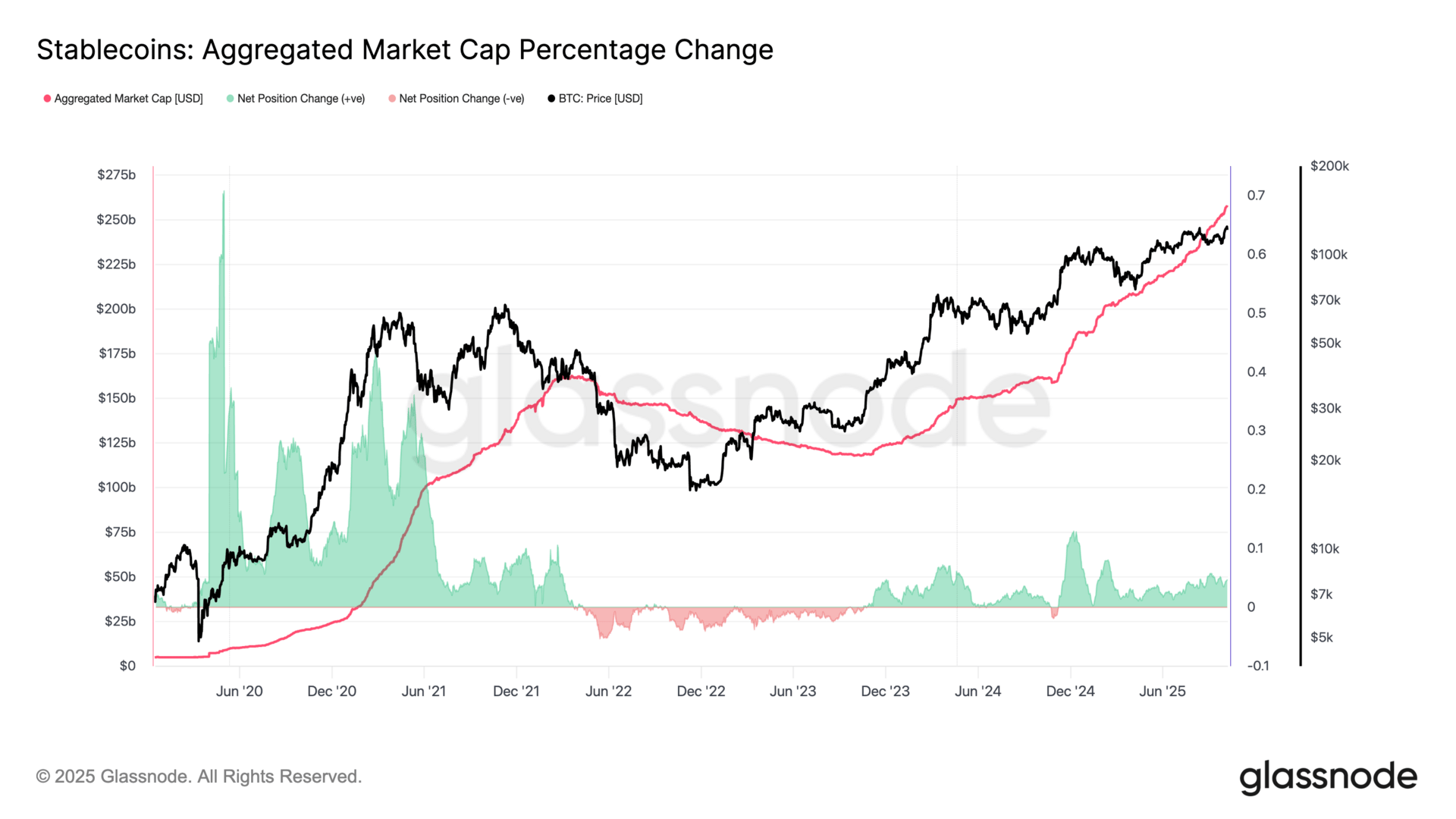

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

Two weeks ago, the total stablecoin supply sat at $251.42 billion.

Today? $258.11 billion.

That’s a $6.69 billion surge in just 14 days - and yet another record high. 🚀

Since January 1st, supply has grown by $73.07 billion, marking one of the fastest expansions in crypto history.

Why does this matter? Because stablecoins aren’t just digital dollars - they’re dry powder.

Billions in sidelined capital, already on-chain, waiting for deployment.

Stablecoin supply doesn’t chase bull markets… it ignites them. 🔥

CRACKING CRYPTO 🥜

Bulls exit exchanges at record levels. Bitcoin God candle squeeze incoming? Institutional adoption through ETFs shifts Bitcoin's liquidity landscape from self-custody to regulated custodial products.

SEC Aiming to Formalize 'Innovation Exemption' by End of Year, Chair Atkins Says. While the government shutdown is slowing the SEC's work, Atkins said he still intends to initiate formal rulemaking by the end of 2025 or beginning of 2026.

Litecoin, HBAR and more crypto ETFs ‘at the goal line’ as shutdown sits in the backdrop, analysts say. A new filing for an ETF tracking HBAR has revealed key details that analysts say signal it's inching closer to receiving the SEC's sign-off.

‘Hundreds of simulations’ pin Bitcoin at 50% odds of $140K this month. Economist Timothy Peterson says Bitcoin has a 50% chance of reaching $140,000 in October, based on simulations drawing on years of market data.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the main purpose of liquidity pools in decentralized exchanges like Uniswap?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: To provide assets for automated trading 🥳

Liquidity pools enable automated swaps without traditional order books — the backbone of DeFi trading. 💧

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.