GM to all of you nutcases. It’s Crypto Nutshell #673 goin’ dark… 🌑🥜

We're the crypto newsletter that's more intense than a cop infiltrating a criminal empire—only to find the criminals have done the same... 👮♂️🎭

What we’ve cooked up for you today…

🏦 Another treasury?

🚨 Ethereum demand shock

💪 HODLing

💰 And more…

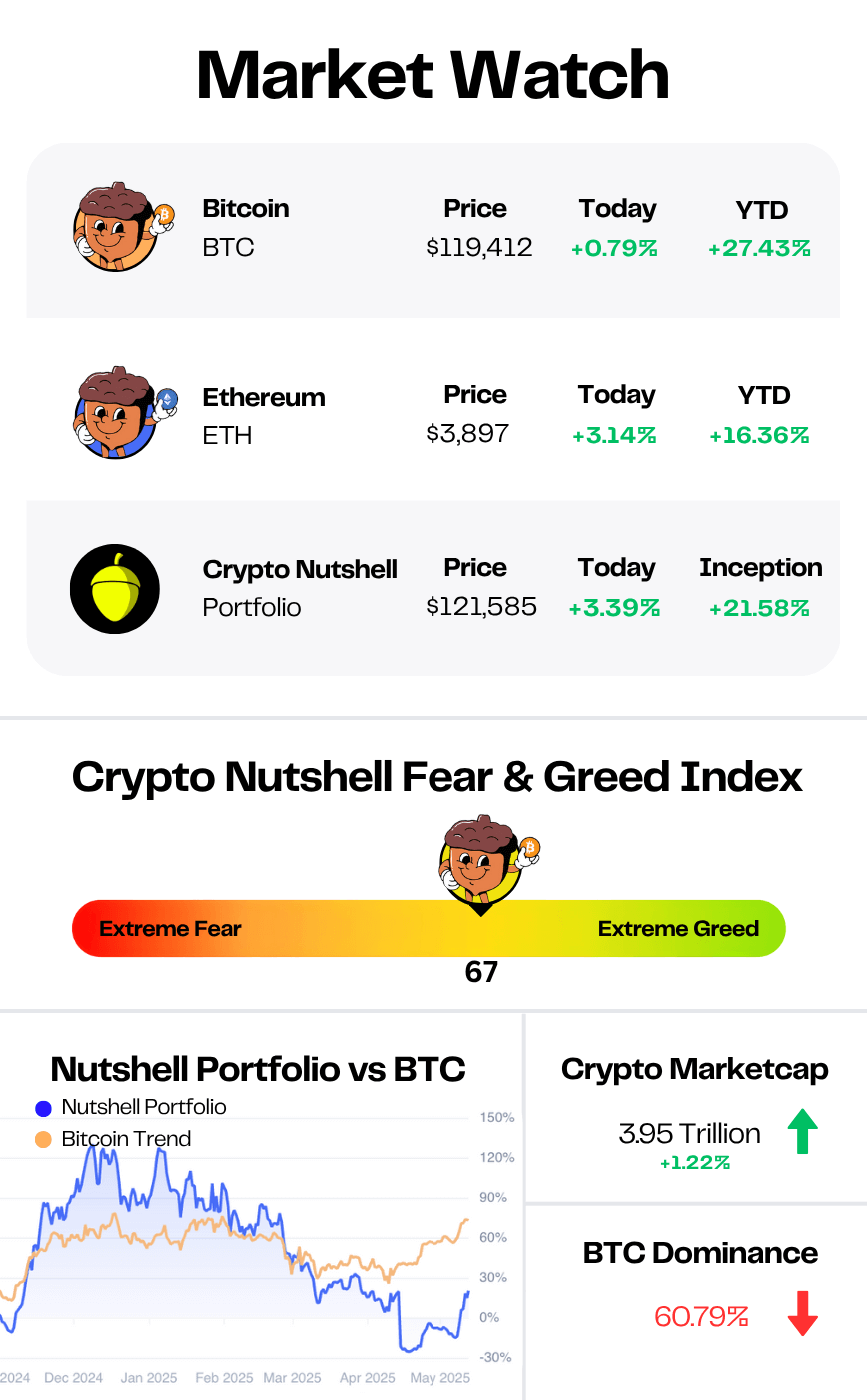

Prices as at 3:30am ET

ANOTHER TREASURY? 🏦

BREAKING: Drug Company Will Buy Up to $700 Million in BNB After Coin Hits All-Time High

Another day, another crypto treasury.

But this one?

It came out of nowhere.

Windtree Therapeutics, a Nasdaq-listed biotech firm, just committed up to $700 million to buy Binance Coin (BNB) - a bold pivot into crypto that no one saw coming.

They’ve teamed up with Kraken for custody and are now aiming to become one of the largest corporate holders of the fifth-biggest digital asset in the world.

Here’s what CEO, Jed Latkin, had to say:

"We are excited to incorporate these new facilities to enable our future BNB acquisitions as part of our BNB treasury strategy… Pending stockholder approval, the opportunity to secure additional funds for purchasing more BNB cryptocurrency is essential to our strategy."

This move comes as BNB continues to outperform.

It’s up 30.6% in the past month, hitting a new all-time high of $851 today.

The rally is being fueled by more than just price action - it’s being driven by narrative.

And Windtree’s $700M equity raise is throwing rocket fuel on that fire.

But this isn’t just about Windtree and BNB…

It’s part of a much bigger wave - a corporate altcoin treasury movement that’s rapidly gaining momentum.

Some of the most notable being:

Strategy (formerly MicroStrategy) and its massive Bitcoin bet

SharpLink Gaming which recently added Ethereum to its balance sheet

Nano Labs and Classover diving into BNB and Solana respectively

The Takeaway?

Windtree’s move isn’t a one-off.

It’s the latest sign that altcoins are going corporate - and that balance sheets are becoming battlegrounds for narrative, momentum, and market positioning.

With $520 million now backing BNB?

This is just the beginning. 🧨

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

ETHEREUM DEMAND SHOCK 🚨

Matt Hougan (Bitwise CIO) just explained why Ethereum’s price is ripping - and why this is only the beginning.

Let’s break it down 👇

1. Demand For Ethereum Just Exploded 💥

Until May, demand for ETH was flat.

The ETF’s had only bought 660k ETH total - this matched new supply.

That’s why Ethereum traded sideways.

Then in mid-May, it flipped.

Now institutions are buying a whopping 32x more ETH than is being issued.

2. Treasury Trend Is Accelerating 🏛️

Companies like Bitmine and SharpLink are now buying ETH for their corporate treasuries.

These “ETH treasury stocks” are trading at a premium - which attracts even more demand from investors & institutions.

3. Bitcoin Set the Playbook 📘

Bitcoin's pump this year?

It came from ETFs and treasuries buying 5x more BTC than the network issued.

Hougan says the exact same pattern is now unfolding for ETH —

Just a few months behind.

4. The Numbers Are Insane 🤯

Hougan projects $20 billion of Ethereum demand over the next 12 months.

That’s 5.33 million ETH at current prices…

Versus only 0.80 million ETH expected to be produced.

That’s a 7:1 demand-to-supply imbalance.

Bottom line:

This is the Bitcoin run all over again.

ETH was just next in line.

And institutions are finally showing up.

Simply put, there’s just not enough Ethereum to go around…

Brace for impact. 🧠📈

HODLING 🤯

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

As always, we’re focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 16.91% (up from 17.49%)

1y - 2y: 11.31% (up from 11.21%)

2y - 3y: 7.73% (down from 7.80%)

3y - 4y: 6.55% (up from 6.32%)

4y - 5y: 8.70% (unchanged)

5y - 10y: 14.58% (down from 14.63%)

>10y: 8.88% (unchanged)

TL;DR: 74.66% of all Bitcoin hasn’t moved in over six months. 🔒

What stands out?

The 6–12 month band declined, meaning some previously short-term holders took profits — totally normal after an all-time high.

But… the 1–2 year and 3–4 year cohorts are growing, showing that conviction continues to age upward into stronger hands.

The small dips in the 2–3 year and 5–10 year bands likely reflect modest selling — but nothing that suggests widespread exit.

Long-term holders are STILL holding strong.

And Bitcoin’s liquid supply continues to tighten even in the face of all-time highs.

Conviction? Still rock solid. 💪

CRACKING CRYPTO 🥜

Winklevoss accuses JPMorgan of retaliation over criticizing 'bankster' war on open banking. Tyler Winklevoss claimed the bank told Gemini that his earlier tweet had prompted a pause in re‑onboarding.

Bitcoin ‘up year’ is 2026, and the four-year cycle is dead. Bitwise Invest CIO Matt Hougan said in an X post on Friday that the Bitcoin four-year cycle “is dead” and Bitcoin will see an “up year” in 2026.

Analysts See Ripple Hitting $4, Solana $250 as ETF Buzz Builds. XRP’s ETF exposure is currently limited to futures, but analysts say any progress toward a spot product could drive a second wave of inflows

BlackRock executive joins Joe Lubin's Ethereum treasury company SharpLink as co-CEO. Chalom previously served as a managing director as head of strategic ecosystem partnerships at BlackRock, “where he led the firm’s strategy across the digital assets.”

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What consensus mechanism does Solana primarily use?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Proof of History combined with Proof of Stake 🥳

Solana uses a unique combo of Proof of History (PoH) to timestamp events and Proof of Stake (PoS) for validation - enabling blazing-fast block times. 🕒⚡

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.