GM to all 10,362 of you. Crypto Nutshell comin’ in hot! 🔥 🥜

We’re the crypto newsletter that won't vanish like half the population after the snap of a cosmic titan's fingers... 🌌🧤

Today, we’ll be going over:

How many L’s can the SEC take? 😂

The #1 asset over the last decade? 🤑

Do you hold more than 1 Bitcoin? 🤔

And more…

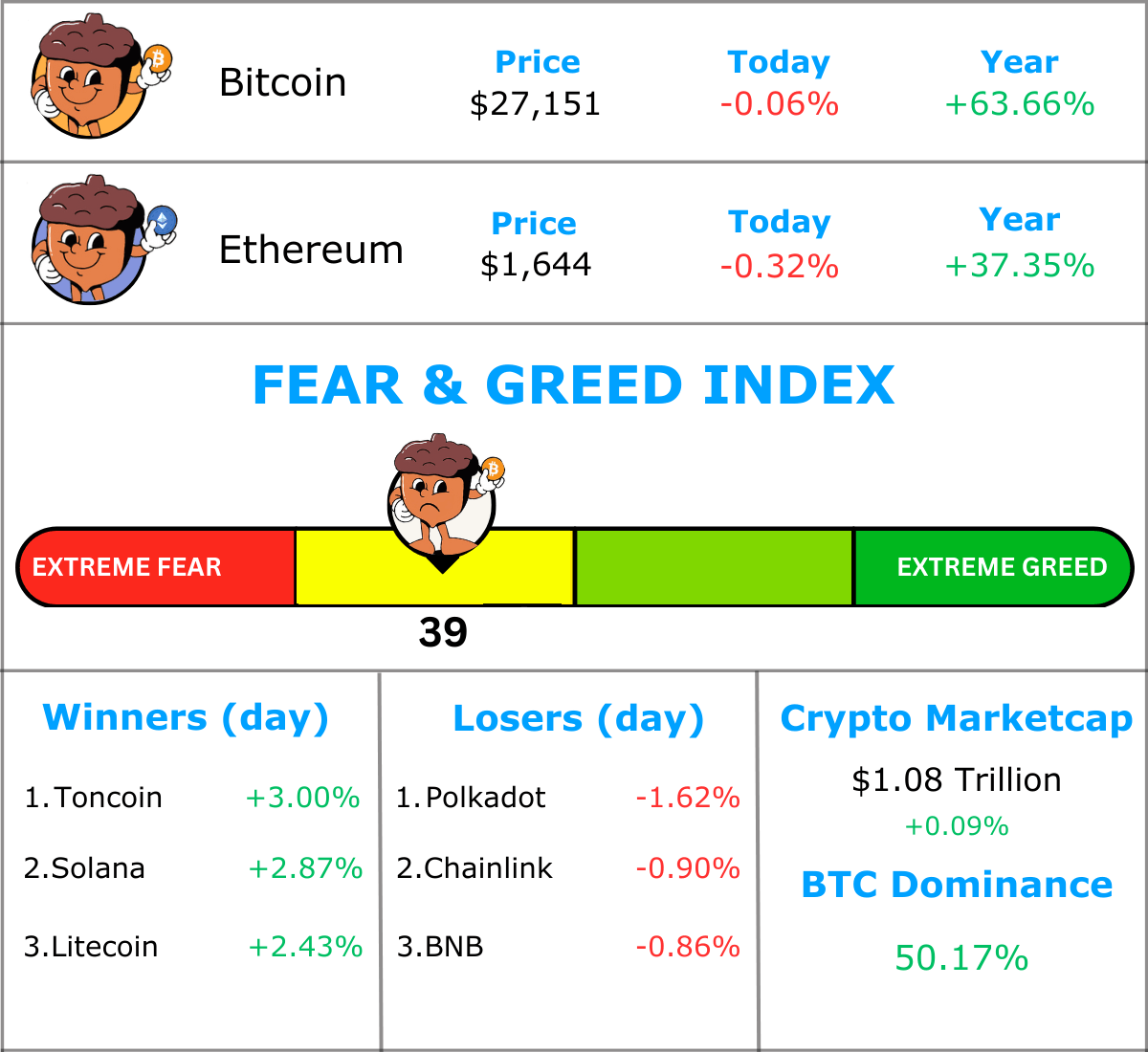

MARKET WATCH ⚖️

Prices as at 7:15am ET

Only the top 20 coins measured by market cap feature in this section

THE SEC TAKES ANOTHER L 😂

JUST IN: Judge Declines SEC’s Request to Inspect Binance US

How many L’s can the SEC take?

Back again with the SEC vs Crypto. This time a U.S judge has denied to pass an order that would allow the SEC to inspect Binance US documents. 📃

This all started in Q2 2023 when the SEC called out Binance for supposedly running an unlicensed securities exchange. The SEC is asking Binance to prove that assets from U.S based customers are staying in the U.S.

This is what the judge had to say:

“I’m not going to order from the bench right now that they produce or not produce things. Let’s continue to try to work this out. I just want to keep things moving.”

And this is what Binance had to say:

The SEC still has no evidence to support its unsubstantiated allegations that imply investor assets have been somehow diverted. All the evidence in this matter—including documents, declarations, and sworn deposition testimony—supports BAM’s [Binance U.S] position that it has custody and control of its digital assets.

At the end of the day this is only a minor setback for the SEC. We’ll keep you updated on any major updates. 😎

For the full article click here

TOGETHER WITH THE BRRR 🖨️

Let’s be real.

A.I is f*cking confusing.

Artificial Intelligence is the fastest adopted technology the world has ever seen. Even faster than crypto.

It’s almost impossible to keep up with.

That’s why we read The BRRR.

The BRRR breaks down the latest happenings in both A.I and crypto markets so that you can literally print money. 😉

The best part? Just like us, they’re completely free.

Subscribe now by hitting that big beautiful subscribe button below, you’ve got nuttin’ to lose. 🥜

Sponsored

The BRRR

We help you print money. Join the 10,000+ investors staying ahead of the AI and crypto markets.

THE #1 ASSET OVER THE NEXT DECADE?💰

Lyn Alden is a seriously brilliant economist who definitely doesn’t get enough recognition.

For those not familiar with her, she’s an investment strategist & financial analyst.

She’s well known for her expertise in macro-economics and equity analysis.

The asset that she’s most interested in over the next 10 years?

Bitcoin.

In her latest interview, she broke down her reasons why:

It’s the most superior form of money humanity has come up with

It’s proved itself as the #1 asset over the last decade

There’s so much intellectual capital building on Bitcoin

“I think ultimately, it solves a lot of problems with money.”

She also noted that there’s a huge amount of capital sitting on the sidelines waiting to enter Bitcoin. 💰

A spot Bitcoin ETF is the first step towards getting the tsunami of money in. 🌊

Bottom line: It’s not just Bitcoiners & crypto enthusiasts that are bullish long-term on BTC. Serious economists and financial analysts are paying attention. 🧐

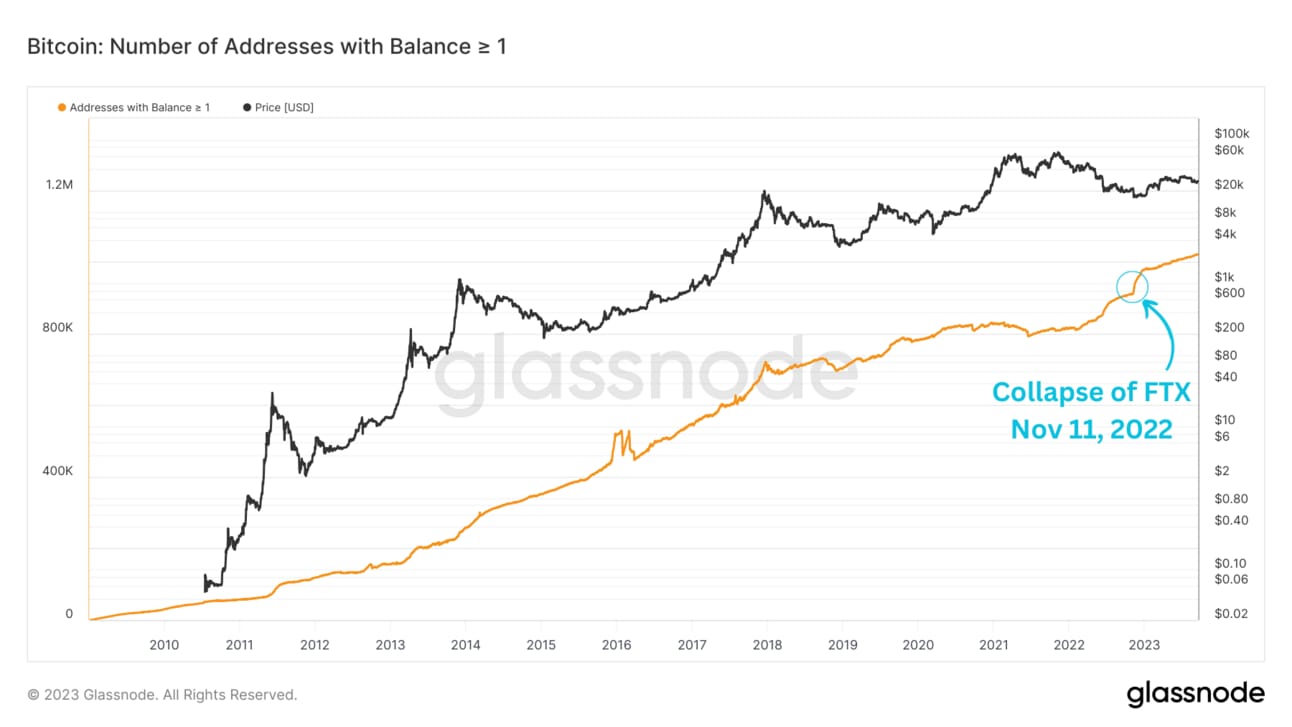

DO YOU HOLD MORE THAN 1 BTC? 💰

The number of wallets holding one or more Bitcoin has just reached a new all time high. 🎉

If you’re one of the 1,021,168 “wholecoiners“ out there CONGRATULATIONS.

If you aren’t quite there yet, don’t sweat it. It’s not the end of the world. If you own any amount of Bitcoin, you’re on the right track. 😃

Also it’s important to keep in mind that this doesn’t mean there are 1,021,168 people out there who have more than one Bitcoin. This stat includes people who have multiple wallets, institutional holdings and exchange balances as these are difficult to filter out.

This metric has been constantly trending upwards throughout Bitcoin’s history but you’ll notice that it really started accelerating at the cycle low (Nov & Dec 2022).

This spike in growth also lines up with the collapse of FTX. 🤔

Clearly investors jumped at the opportunity to accumulate cheap Bitcoin, which if you don’t remember was trading as low as ~$15,700.

So if you purchased during this time you would have almost doubled your money by now. Not bad eh?

Bottom line: Bitcoin adoption continues to increase as more and more wallets accumulate. Another not so obvious benefit we can take from this metric is the increased decentralisation of Bitcoin.

The more Bitcoin spread around the population the better. Meaning that whales have less and less influence on the price as Bitcoin matures. 🐳

CRACKING CRYPTO 🥜

WHAT WE’RE READING? ✍️

Want to get even smarter in Finance? Check this out.

p.s. completely FREE

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

CAN YOU CRACK THIS NUT? ✍️

This one should be easy, It’s at the top of every newsletter.

Approximately, how much is Bitcoin up YTD?

A) ~53%

B) ~62%

C) ~46%

D) ~74%

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) ~62% 🥳

So far it’s been a great year for Bitcoin, we’re looking forward to what’s to come.

GET IN FRONT OF 10,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.