GM to all of you nutcases. It’s Crypto Nutshell #679 spreadin’ knowledge… 🧠🥜

We're the crypto newsletter that's more magical than a boy taming dragons and becoming a legend... 🐉🔥

What we’ve cooked up for you today…

🏦 They’ve taken over

🏁 The end of the beginning

😲 The streak is over

💰 And more…

Prices as at 3:00am ET

THEY’VE TAKEN OVER 🏦

BREAKING: BitMine’s Ethereum holdings surge to 833,000 ETH worth $2.9 billion, largest among public firms

Just 35 days…

That’s all it took for BitMine to shake up the crypto treasury rankings - and Wall Street is watching closely.

The Bitcoin miner–turned–Ethereum powerhouse has now stacked 833,137 ETH (worth over $3 billion), making it the largest public holder of Ethereum in the world.

It now ranks #3 globally across all crypto treasuries - behind only Strategy (formerly MicroStrategy) and Marathon Digital, both Bitcoin-heavyweights.

What’s more impressive?

They started from zero just five weeks ago

Averaged $1.6B in daily stock volume last week - ranking just behind Uber

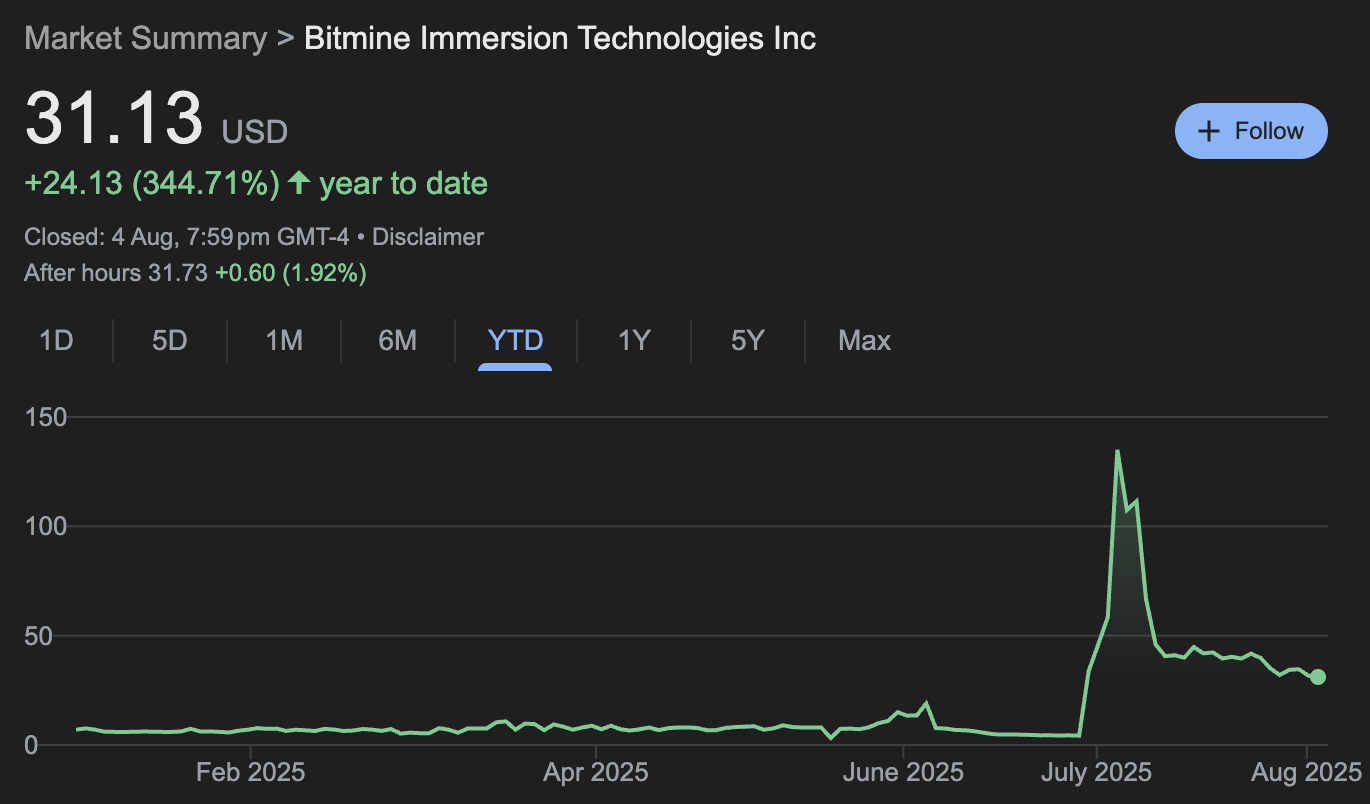

Saw a 300%+ rally in their share price since the ETH pivot

Attracted heavyweight investors like ARK Invest, Peter Thiel, and Bill Miller III

This isn’t just another treasury move.

Chairman Tom Lee says BitMine is chasing the “alchemy of 5%” - aiming to eventually hold 5% of Ethereum’s supply.

“BitMine moved with lightning speed in its pursuit of the ‘alchemy of 5%’ of ETH growing our ETH holdings to over 833,000 from zero 35 days ago. We have separated ourselves among crypto treasury peers by both the velocity of raising crypto NAV per share and by the high liquidity of our stock.”

And they’re not done.

Staking is next - turning ETH into a yield-generating asset and adding cash flow to their balance sheet.

Does this strategy sound familiar?

It’s the same playbook MicroStrategy used to become a $72B Bitcoin proxy.

Now, Ethereum might be getting its own Saylor moment.

And BitMine is leading the charge. 🚀

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

THE END OF THE BEGINNING 🏁

Bitwise CEO Hunter Horsley just sounded the alarm:

July 2025 was the end of the beginning - the real crypto era starts now.

“July 2025 was the end of the beginning for crypto. A new chapter is starting now— crypto will start to show up everywhere as a mainstream asset class and technology over the next 12-24 months.”

Here’s why Hunter says the real crypto era starts now:

3 massive initiatives have just been launched or greenlit by the U.S. government:

The Genius Act is live - kickstarting the use of stablecoins across fintech, banking, and e-commerce 🧠

The Clarity Act is coming - aiming to give crypto assets clear legal rules for the first time ever 🔎

The SEC just launched “Project Crypto” - an aggressive plan to move U.S. financial markets on-chain 🏛️

This is exactly what is needed to take crypto to the next level.

It’s happening - and it’s going to unlock a tsunami of crypto adoption.

In the words of the new SEC Chairman:

“We won’t sit by while innovation happens overseas. We’re making America the crypto capital of the world.”

Hunter thinks the writing is on the wall:

• Every major bank, payments company & fintech will start using crypto rails

• Stablecoins will flood into apps and balance sheets

• Ethereum becomes essential infrastructure

This is the adoption wave. And it’s how prices go vertical.

Hunter’s been calling this for months.

Now it’s here. 📈

THE STREAK IS OVER 😲

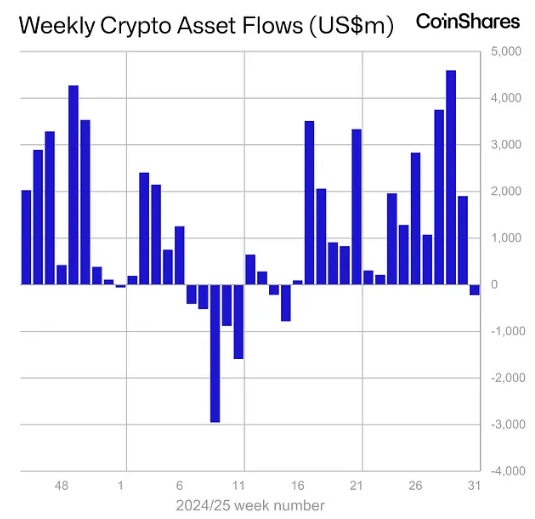

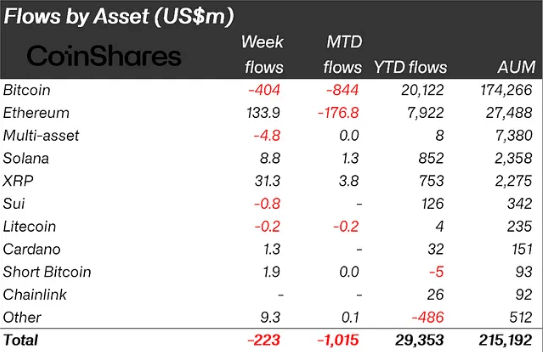

After 15 straight weeks of inflows, digital asset funds finally saw some red - with $223 million in outflows last week.

But with $12.2 billion pouring into crypto funds over the past month alone, CoinShares says a little profit-taking was bound to happen.

Let’s break it down.

Bitcoin took the biggest hit, with $404 million in outflows — the majority of last week’s losses.

Still, year-to-date inflows remain strong at just over $20 billion.

Meanwhile, Ethereum extended its winning streak to 15 weeks, attracting $133.9 million in new capital.

XRP and Solana followed with strong performances, seeing inflows of $313.3M and $8.8M respectively.

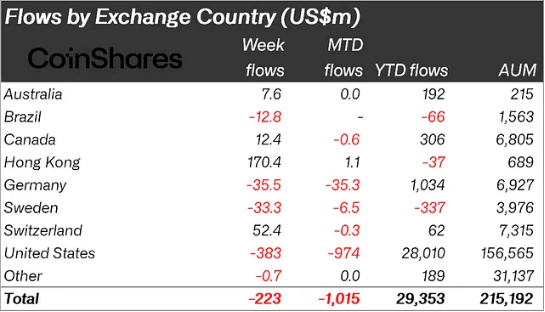

Regionally, the U.S. led the outflows, with $383 million.

Germany, Sweden, and Brazil followed with outflows of $35.5m, $33, and $12.8m.3m respectively.

Whilst Hong Kong, Switzerland and Canada experienced inflows of $170.4m, $52.4m and $12.4m.

The week actually started strong with $833 million in inflows.

But that momentum reversed sharply in the second half, likely triggered by the hawkish tone from the latest FOMC meeting.

By Friday, the mood had flipped — and investors went full risk-off, yanking out over $1 billion in a single day.

After a monster month of inflows, this is more of a healthy breather than a trend shift - especially with Ethereum and XRP still drawing fresh capital.

CRACKING CRYPTO 🥜

BitMine buys 833k ETH in 35 days to leapfrog SharpLink, stunning Wall St with $1.6B trading volume. BitMine's bold ETH strategy catches investor eyes as its stock, BMNR, leaps in trading volumes and market activity.

BTC Prices Still on Track For $140K This Year, But 2026 Will Be Painful, Elliot Wave Expert Says. Elliott wave expert suggests a potential BTC peak at around $140K followed by a bear market in 2026.

Grayscale adds Wall Street veterans as founder Barry Silbert returns to chair. Grayscale expands its leadership with hires from Goldman, Bridgewater, and Citadel, while founder Barry Silbert returns as chairman to guide ETF strategy.

Peter Thiel-backed crypto platform Bullish files IPO, aims to raise up to $629 million. The company aims to sell 20.3 million shares at a price between $28.00 and $31.00, according to a preliminary prospectus.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What happens during a Bitcoin halving event?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: The block reward for miners is cut in half 🥳

Every ~4 years, the Bitcoin block reward is reduced by 50% — slowing the issuance of new BTC and reinforcing its scarcity. It's a major event in every market cycle. 📆🪙

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.