GM to all of you nutcases. It’s Crypto Nutshell #708 makin’ magic… 🧙♂️🥜

We're the crypto newsletter that's more hilarious than two slackers traveling through time to ace their history report... 🕰️🎸

What we’ve cooked up for you today…

🏦 Memecoin ETF season

🚀 $180k by the end of the year?

📉 Historic low

💰 And more…

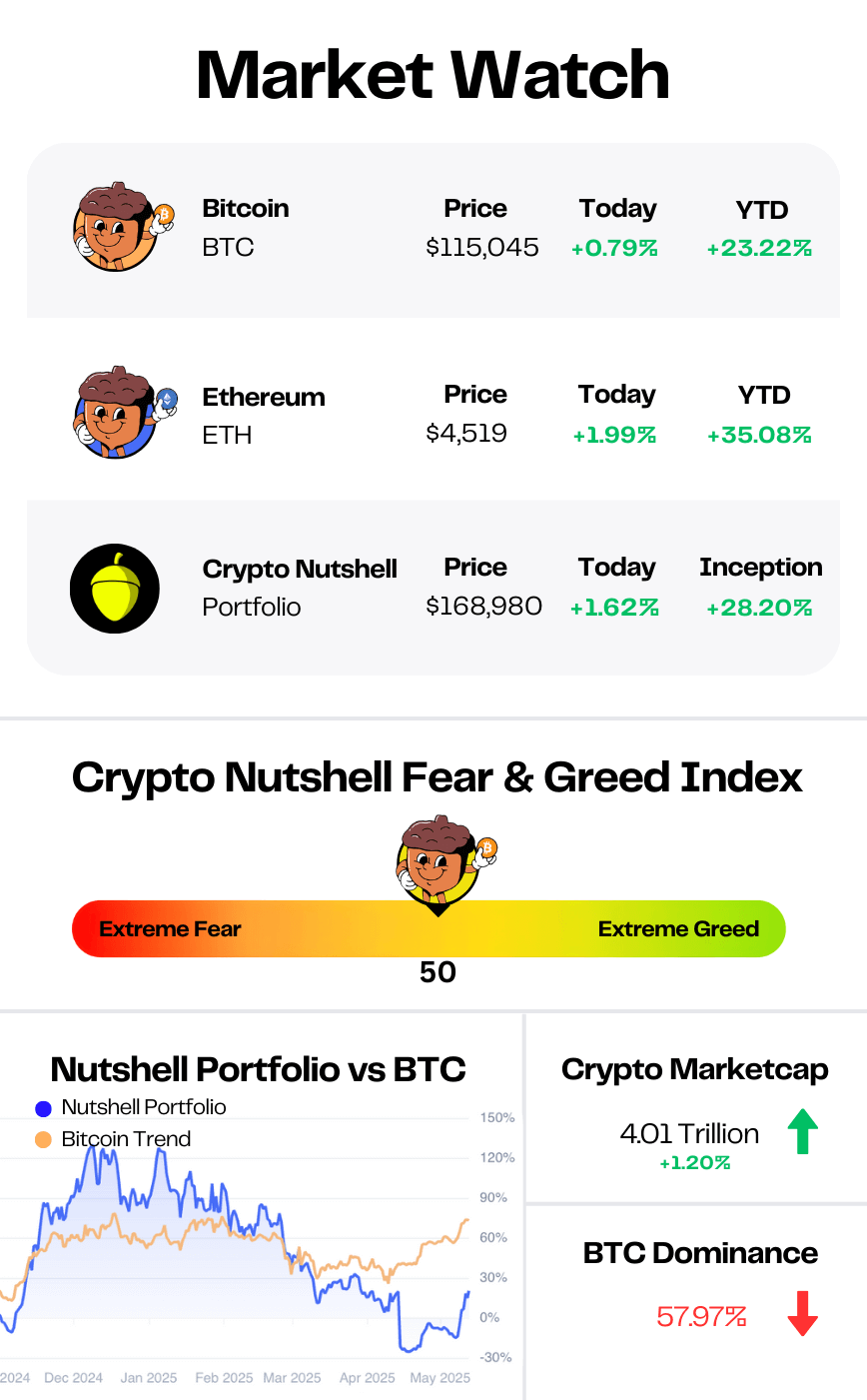

Prices as at 4:20am ET

MEMECOIN ETF SEASON 🏦

BREAKING: Dogecoin Rises 20% as Treasury Firm Amasses DOGE, ETF Nears Launch

Dogecoin has been unstoppable this week - and this time, it’s not retail hype doing the heavy lifting.

Institutions are moving in.

DOGE has surged 20% over the past seven days, outpacing Bitcoin and Ethereum, as two catalysts collided:

CleanCore Solutions, the first publicly traded Dogecoin treasury, scooped up more than 500 million DOGE (≈$125M) in just three days.

Rex-Osprey’s Dogecoin ETF (DOJE) is set to debut in the U.S., marking the first time a memecoin gets its own regulated Wall Street wrapper.

CleanCore’s ambitions are massive:

“Our vision is to establish Dogecoin as a premier reserve asset while supporting its broader utility across payments, tokenization, staking-like products, and global remittances.”

The company plans to acquire up to 1 billion DOGE within 30 days - and longer-term, as much as 5% of the entire circulating supply.

But the ETF side is stirring debate.

Bloomberg analyst Eric Balchunas summed it up bluntly:

“Pretty sure this is first-ever U.S. ETF to hold something that has no utility on purpose.”

Unlike Bitcoin’s spot ETFs, DOJE comes via the 1940 Act, meaning it’ll mix spot DOGE with derivatives to meet diversification rules.

That has skeptics rolling their eyes:

“These ETFs are charging off-the-charts fees when you could simply create a Coinbase account in five minutes.”

But others argue it marks a cultural shift:

“If DOGE is first, it’s less about technical roadmaps and more about acknowledging that communities themselves can push assets into regulated structures.”

Whether you call it legitimacy or lunacy, the facts are clear: DOGE just crossed into a new era.

Institutions are hoarding supply, Wall Street is opening the door, and a coin that started as a joke now has the same infrastructure as Bitcoin and Ethereum. 🐕

Join 400,000+ executives and professionals who trust The AI Report for daily, practical AI updates.

Built for business—not engineers—this newsletter delivers expert prompts, real-world use cases, and decision-ready insights.

No hype. No jargon. Just results.

$180K BITCOIN BY END OF YEAR? 🚀

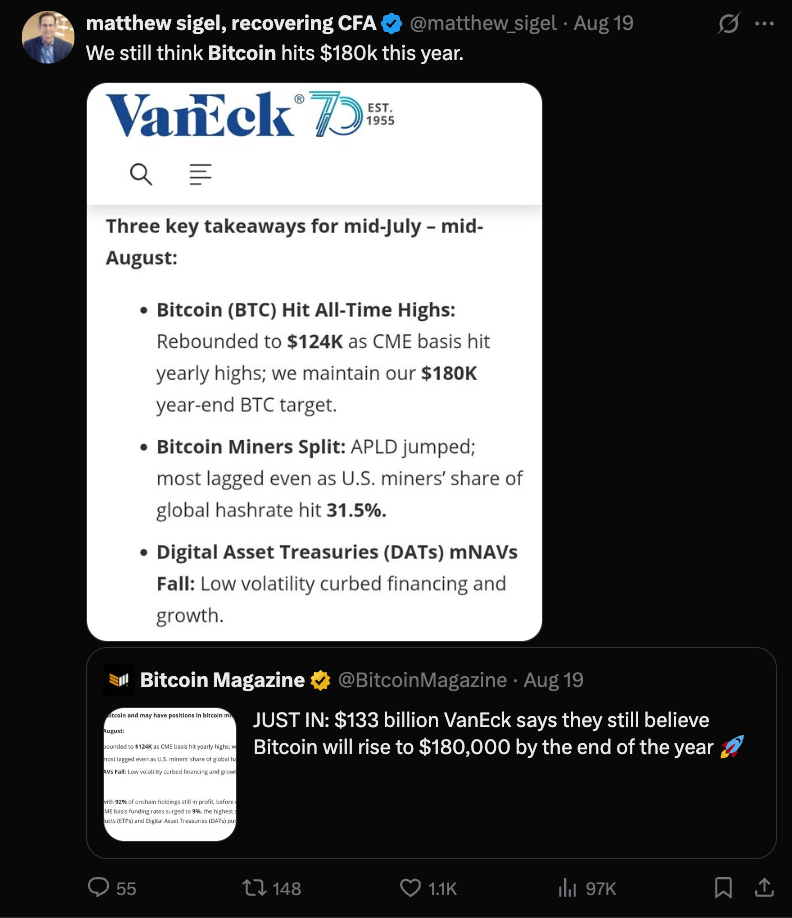

This week, VanEck - one of the largest asset managers on Wall Street and a major Bitcoin ETF issuer - doubled down on their end-of-year Bitcoin price target.

In a tweet, Matthew Sigel (Head of Digital Assets Research at VanEck) laid it all out.

If he’s right?

The end of 2025 is going to be very, very fun. 👀

That’s the latest out from VanEck’s head of digital asset research, Matthew Sigel.

Here’s what Sigel tweeted:

And he backed it up with their latest investor note:

Why This Prediction Matters

VanEck isn’t a small fish.

This is a legacy financial giant managing $100B+ in assets, running one of the biggest spot Bitcoin ETFs in the U.S.

Their conviction matters - because it reflects how institutional money is thinking about Bitcoin right now.

The Numbers

Recently Bitcoin hit $124K, a new all-time high.

VanEck is holding their call: $180K before year-end 2025.

That implies another ~45%+ upside in the next 4 months.

When firms like VanEck plant a flag this bold - and put their reputation behind it - you’d be crazy to ignore it.

Institutions aren’t just buying Bitcoin… they’re openly telling us where they think it’s going.

Don’t fade the $180K target. 🎆

HISTORIC LOW 📉

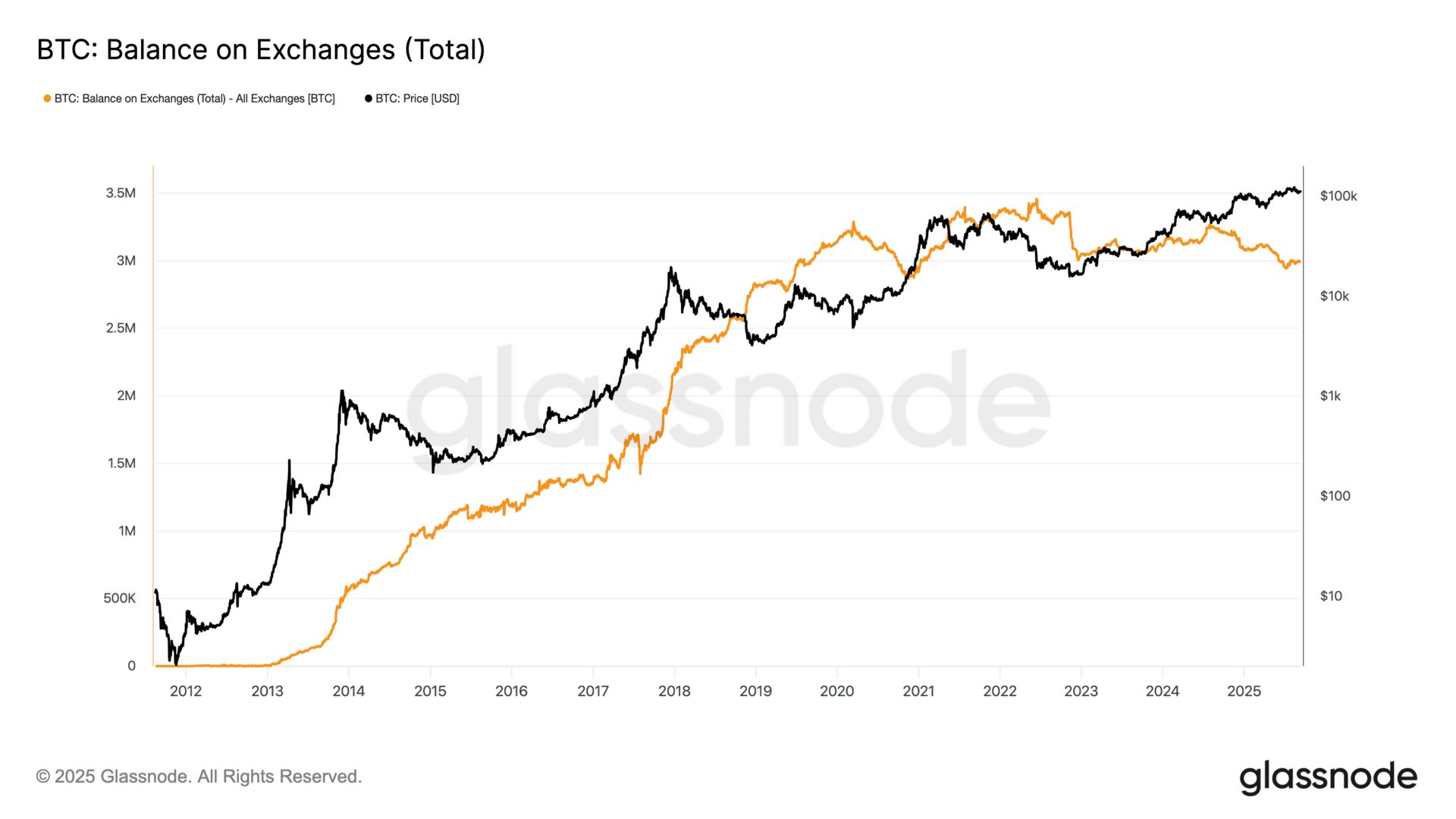

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Only 2,985,592 BTC remain on exchanges - just 14.99% of the total supply.

Since January, another 93,452 BTC (≈$10.78B) has been pulled off exchanges.

You’d have to go back to 2021 - when Bitcoin traded around $40K - to find balances this low.

But this isn’t retail piling in late. This is institutions, treasuries, and smart money quietly draining supply and locking it away.

And history leaves no doubt: when exchange liquidity dries up, price doesn’t drift sideways.

It rips higher. 🚀

CRACKING CRYPTO 🥜

Dormant Bitcoin whale last active at $12 per BTC awakens sending funds to Kraken. Bitcoin whale's move signals potential market impact as inactive wallets awaken to capitalize on soaring prices.

Coinbase: Crypto Bull Market Still Has Legs. A mix of strong liquidity, a benign macro backdrop and supportive regulatory signals could keep the crypto market rally alive in the fourth quarter, the report said.

BlackRock weighs ETF tokenization as JPMorgan flags industry shift. BlackRock is weighing tokenized ETFs after its Bitcoin fund success, joining Wall Street’s push to bring real-world assets onto blockchain rails.

CleanCore Solutions buys more DOGE as first Dogecoin ETF draws near. Earlier this week, CleanCore kicked off its Dogecoin treasury with an initial 285.4 million DOGE purchase.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 2040 🥳

Over 99% of Bitcoin will be mined by 2040, but the very last fraction won’t be mined until 2140. ⏳

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.