GM to all 12,421 of you. Crypto Nutshell comin’ in hot. 🥜🔥

We’re the crypto newsletter that's more exhilarating than deciphering the mysteries of a secretive island... 🏝️🗺️

Today, we’ll be going over:

🧑⚖️ Gensler testifies

👾 Pressure mounting for spot ETFs

🤔 What’s going on with Ethereum

💰 And more…

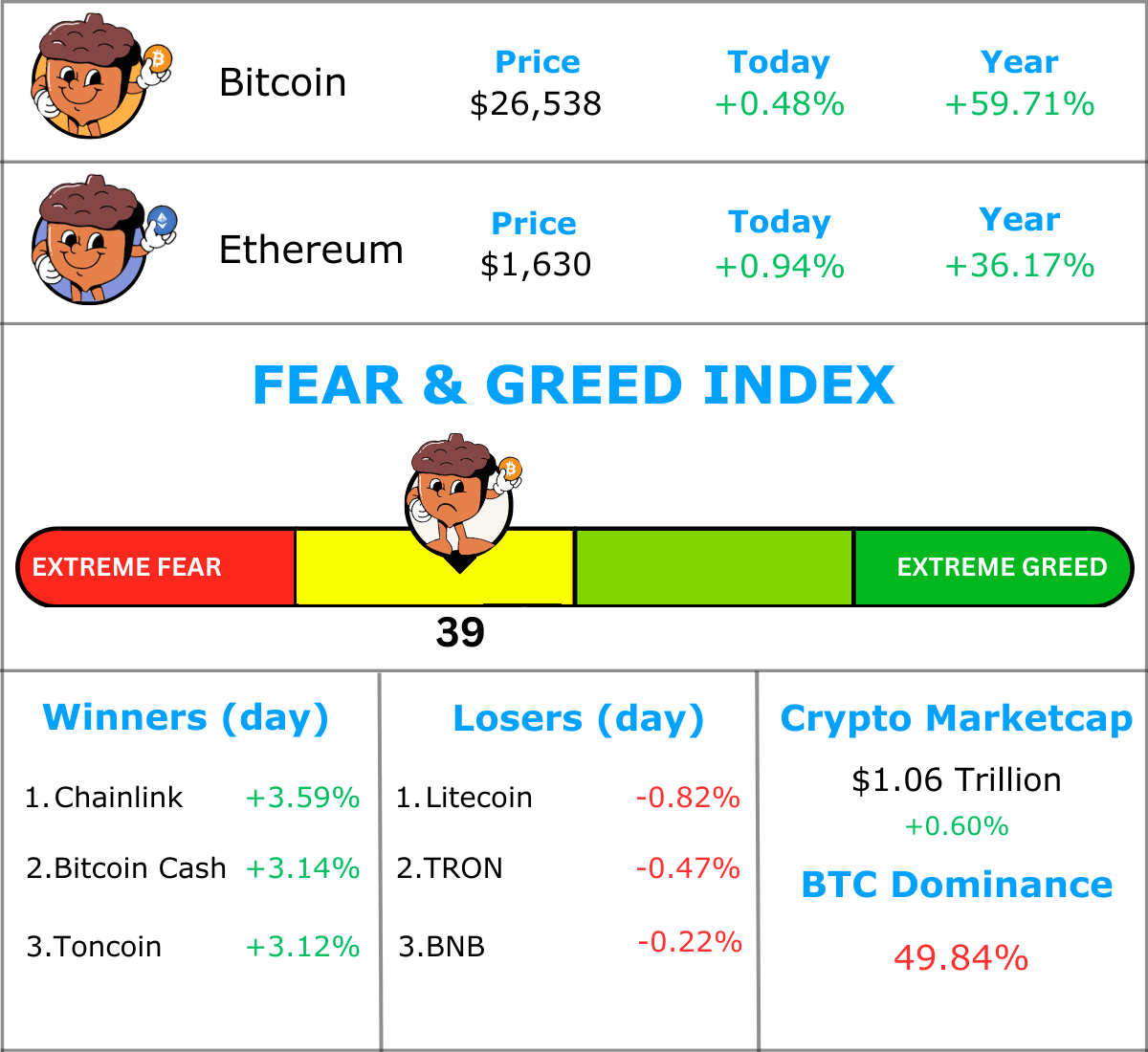

MARKET WATCH ⚖️

Prices as at 7:05am ET

Only the top 20 coins measured by market cap feature in this section

GARY GENSLER GETS GRILLED 🔥

JUST IN: Pro-Crypto Lawmakers Blast SEC chair Gary Gensler for 'Loyalty' to Big Banks

Gary Gensler has just testified at a Congressional hearing and it was heated…

Lawmakers cooked Gensler over allegations of suppressing innovation in order to protect established banks. 😡

Rep. Tom Emmer blasted Gensler for creating regulatory uncertainty that’s only benefited big businesses in the crypto industry over start-ups (not everyone has the legal budgets of Coinbase or Binance to fight against the SEC).

“Despite your years of rhetoric, I’m convinced you are not an impartial regulator… Instead, it’s clear that you are working to consolidate your own power even though it means crushing opportunities for everyday Americans, and frankly the financial future of this country… A common theme throughout your career has been your relentless loyalty to the largest financial institutions at the clear expense of innovation, competition, and everyday Americans,”

Gensler maintains that his actions are intended to protect the everyday American from fraud and manipulation…

BUT Emmer counters with an interesting point. 😎

Last year Gary Gensler made comments regarding traditional bank executives complaining of customers moving money into crypto. Emmer alleges that Gensler’s actions are not to protect the everyday American but rather to protect traditional banking from losing power.

Anyway, here’s some “highlights” from the hearing.

Last but not least. A reminder that those who oppose Bitcoin have no idea what they are talking about…

TOGETHER WITH THE PHENOM UPDATE ♟️

One reason we love crypto? The returns.

It’s not uncommon to see 10x, 50x or even 100x returns in a bull market.

As much as we love Bitcoin & Ethereum, unfortunately they’re most likely not going to pull a 100x next bull run. They’ve gotten too big.

The next 100x gem is probably going to come from a coin you’ve never heard of.

The problem? There are literally thousands upon thousands of coins.

That’s why we read The Phenom Update.

They share the best kept secrets on the latest DeFi & crypto trends. 🤫

The best part?

Just like us, they’re completely free.

Slam that beautiful subscribe button and it’ll automatically add you to their list.

If you’re not a fan, you can always unsub. Nothin’ to lose. 🎉

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

PRESSURE MOUNTING FOR SPOT ETF 🌬️

The pressure to approve a spot Bitcoin ETF is building. 🌡

Eric Balchunas is the senior ETF analyst at Bloomberg. When it comes to ETF’s, he’s THE MAN.

This week he revealed a letter sent by a group of both Democrat and Republican lawmakers to Gary Gensler. The letter was pleading with Gensler to approve a spot Bitcoin ETF.

Here’s some highlights of the 2 page letter:

“We write to ensure the Securities and Exchange Commission (SEC) does not continue to discriminate against spot bitcoin exchange traded products.”

Also…

“A regulated spot Bitcoin ETP would provide increased protection for investors by making access to bitcoin safer and more transparent.”

Why is this letter significant? 2 reasons:

This letter was sent on September 26. With key decision dates coming up in just 3 weeks, this adds pressure to the SEC.

The letter was sent by both democrat AND republican law makers. Bitcoin has now become a bipartisan issue. It’s clear Bitcoin has government support outside of the SEC. 🤝

With poor ol’ Gensler losing lawsuits left & right and now receiving letters pleading for an approval… it's not a good look.

Just a reminder, earlier this month Balchunas put odds of approval by the end of 2023 at 75%.

He also estimates an ETF will bring a fresh $150 billion worth of new capital to Bitcoin.

Bottom line: Pressure is mounting. A spot Bitcoin ETF is closer than ever before with a good chance of approval in mid October. 😎

WHAT’S GOING ON WITH ETHEREUM? 😳

Ethereum has turned inflationary. 😱

But wasn’t the Merge supposed to make Ethereum deflationary?

Well yes, it did (check the chart below) but in the last 30 days, we’ve seen decreased network activity and reduced transaction fees, which has actually resulted in the supply of Ethereum growing.

Ethereum is only deflationary when there’s sufficient network activity.

The way this works is that transaction base fees are “burned”, meaning they are permanently removed from the circulating supply.

Since August 31, the supply of Ethereum has increased by 41,936 ETH.

Taking a look at the average transaction fees below you’ll notice that it’s been on a downward trajectory.

Transaction fees just hit an 8-month low of $2.55. 🤯

With fees continuing to decline and network activity dropping, the rate of new ETH being created is outpacing the rate of ETH being burned and that’s how ETH has flipped back into an inflationary state.

However, it’s not all doom and gloom for Ether.

The total value staked can often be thought of as the confidence that long-term holders have in the cryptocurrency. The more confident they are, the more they will stake.

And guess what? 🤷♂️

The total value staked continues to break all time highs.

Currently there is 29,564,981 ETH staked 😲

Ethereum’s supply situation may not be as bullish as it was just a month ago, but HODLers are still convinced the future will be bright. 🌞

CRACKING CRYPTO 🥜

WHAT WE’RE READING? ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

CAN YOU CRACK THIS NUT? ✍️

When was Ethereum’s “Shanghai” upgrade implemented?

A) September 2022

B) January 2023

C) April 2023

D) December 2022

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) April 2023 🥳

The Shanghai fork was implemented in April 2023 and allowed validators to withdraw ETH that had been previously staked. For more checkout this article.

GET IN FRONT OF 12,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.