GM to all of you nutcases. It’s Crypto Nutshell #668 heatin’ up… 🔥🥜

We're the crypto newsletter that's more emotional than a lonely boy befriending a misunderstood iron giant... 🤝🛠️

What we’ve cooked up for you today…

🏦 Schwab wants in

🔓 Ethereum Will Hit New All-Time Highs

🤯 Long-term holders

💰 And more…

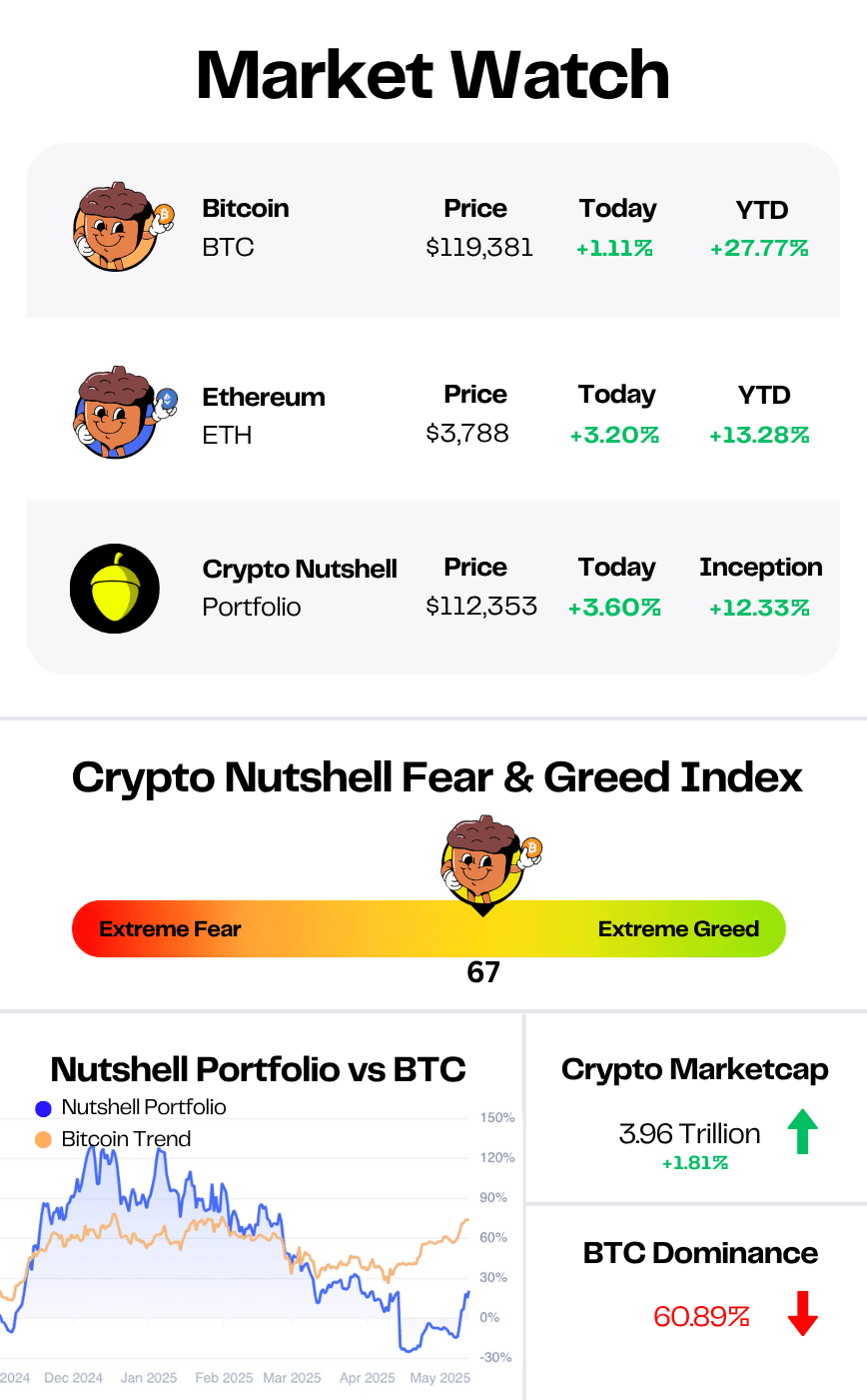

Prices as at 4:00am ET

SCHWAB WANTS IN 🏦

BREAKING: Charles Schwab CEO Says Crypto Trading Is Coming Soon, Will Compete With Coinbase for Retail

The gate is opening - and Charles Schwab is stepping through. (Charles Schwab is the third largest asset manager in the world with ~$10 trillion in AUM)

On Friday, CEO Rick Wurster confirmed that the firm will “sometime soon” launch spot Bitcoin and Ethereum trading - marking Schwab’s most aggressive crypto move yet.

“Our clients want their crypto to sit alongside their stocks, bonds and cash - not off to the side on a different app.”

And that’s exactly what Schwab plans to offer.

Direct BTC and ETH custody

Seamless integration with existing portfolios

A full-on platform to compete with Coinbase

“If they’re buying crypto at Coinbase, we’d love to see them bring it back to Schwab… We will absolutely compete.”

Schwab’s not early to crypto…

But they’re definitely not late.

Their clients already hold over 20% of all U.S. crypto ETPs — and with $10 trillion under management, Schwab is positioned to consolidate the next wave of adoption.

And they’re not stopping there.

Wurster also revealed Schwab is exploring a Schwab-branded stablecoin, telling analysts:

“Stablecoins are likely to play a role in transacting on blockchains and that’s something we do want to offer.”

All of this comes just as President Trump signs the GENIUS Act into law - the first federal stablecoin framework - finally giving TradFi the green light to go full crypto.

With the regulatory walls falling and brokerages piling in, a new phase of adoption is here:

Not banks vs. crypto.

Not TradFi vs. DeFi.

Just money - finally meeting the future. 🚀

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

ETHEREUM WILL HIT NEW ALL-TIME HIGHS 🔓

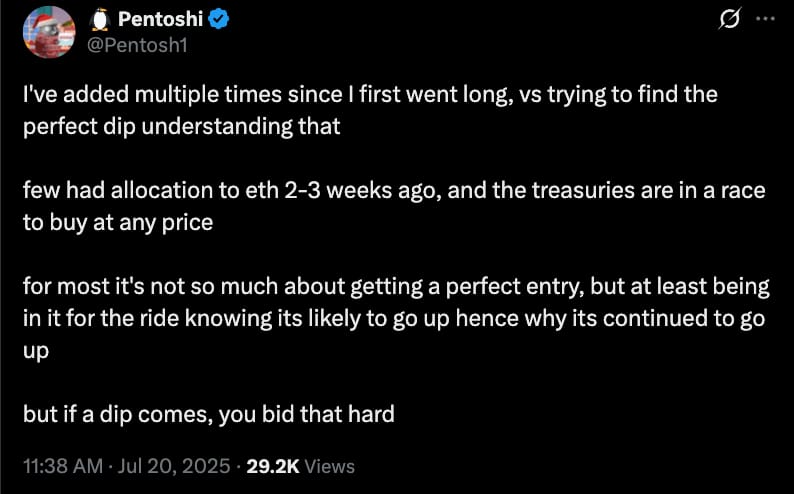

Pentoshi - our favourite chart whisperer - just made his boldest Ethereum call yet:

“$ETH is going to hit a new ATH this year”

If you don’t know him yet, Pentoshi is a pseudonymous macro + technical analyst who’s nailed major moves since the 2020 bull run.

He doesn’t post fluff - just high conviction predictions backed by data.

The wild part? He’s almost always right.

And right now? He’s backing Ethereum - big time.

Why He’s Confident:

• He’s been adding to his position - not waiting for the “perfect” dip 🧠

• Treasury buyers are racing in - bidding at any price 💸

• Most people didn’t have ETH exposure a month ago - and are now panic-buying 📈

“But if a dip comes, you bid that hard"

Forget waiting for a perfect dip. Just don’t miss the move.

Ethereum is waking up.

And according to Pentoshi?

A new all-time high isn’t a matter of if…

It’s a matter of when. ⏳

LONG-TERM HOLDERS 🤯

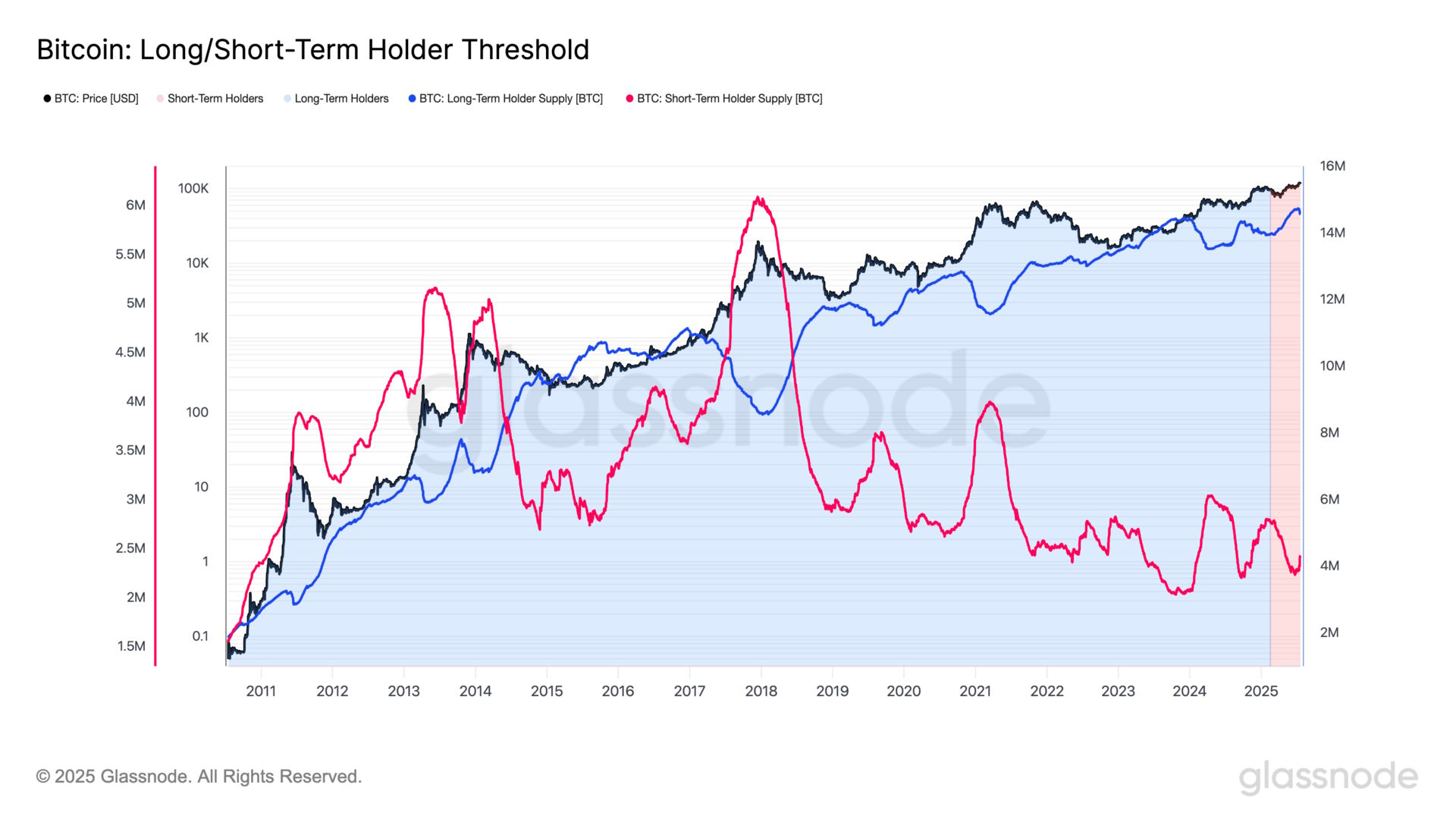

Time for a check-in on the Long/Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): Coins held for less than 155 days

🔵 Long-Term Holders (LTHs): Coins held for more than 155 days

🟥 Short-Term Holder Cost Basis: All coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: All coins purchased in this price range are LTHs

This metric is powerful because it shows exactly what price range long and short term holders bought their Bitcoin at. 🔍

The key cutoff date is now February 16, 2025 - when Bitcoin hovered near $96K.

BTC bought before that is classified as long-term (LTH).

Anything after? Short-term (STH).

Here’s what the data shows:

Long-term holders now control 14.56M BTC - that’s 73.2% of the circulating supply.

Short-term holders? Just 2.43M BTC, or 12.2%.

Over the past 90 days, more than 350,000 BTC has migrated into long-term hands.

But last week?

Roughly 154,181 BTC was moved out of long-term wallets - a sign of expected profit-taking after Bitcoin hit a new all-time high.

Here’s the twist:

That outflow is already starting to reverse.

Which means that the long-term supply is growing again.

Bottom line?

Conviction remains strong.

Long-term holders are still in control.

CRACKING CRYPTO 🥜

UK government eyes £5 billion seized Bitcoin sale to manage fiscal shortfall. The UK government is considering selling billions in seized Bitcoin to fill budget gaps, but risks missing out on greater profits.

Joseph Lubin on ETH Rivalry With Tom Lee — ‘We Will Both Compete, Hard’. Bitmine Immersion Technologies and SharpLink Gaming now hold more ETH than the Ethereum Foundation, leading a growing wave of public companies adopting Ethereum treasury strategies.

Saylor signals Bitcoin buy as Strategy's stash climbs to over $71B. Strategy co-founder Michael Saylor hinted that the company would buy more Bitcoin, by posting the Bitcoin chart on social media.

Jack Dorsey's Bitcoin-centric Block Inc to join S&P 500 this week. Block's Bitkey unit is a simple self-custody wallet built for bitcoin, while Proto is a suite of bitcoin mining products and services.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Who is credited as the original creator and primary visionary behind Ethereum?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Vitalik Buterin 🥳

Vitalik Buterin proposed Ethereum in late 2013 after writing for Bitcoin Magazine and realizing Bitcoin needed programmable smart contracts. The rest is Web3 history. 🧠🚀

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.