GM to all of you nutcases. It’s Crypto Nutshell #684 surfin’ the wave… 🍲🥜

We're the crypto newsletter that's more hilarious than a clueless news anchor trying to survive the chaos of live TV... 📺😂

What we’ve cooked up for you today…

🏦 This is getting out of hand

🌊 Ethereum tidal wave

📈 And we’re back

💰 And more…

Prices as at 5:30am ET

THIS IS GETTING OUT OF HAND 🏦

BREAKING: Largest Ethereum treasury firm BitMine adds 317,000 ETH to push holdings worth nearly $4.9 billion

The Ethereum treasury game is going parabolic.

BitMine Immersion - already the world’s biggest ETH hoarder - just blew past the 1 million ETH milestone.

It now holds 1.15M ETH worth nearly $4.9B.

That’s 317,000 ETH added in a single week. 🤯

A buying binge that cements its lead and keeps it on track for a wild target: 5% of all ETH in existence - about $25B at today’s prices.

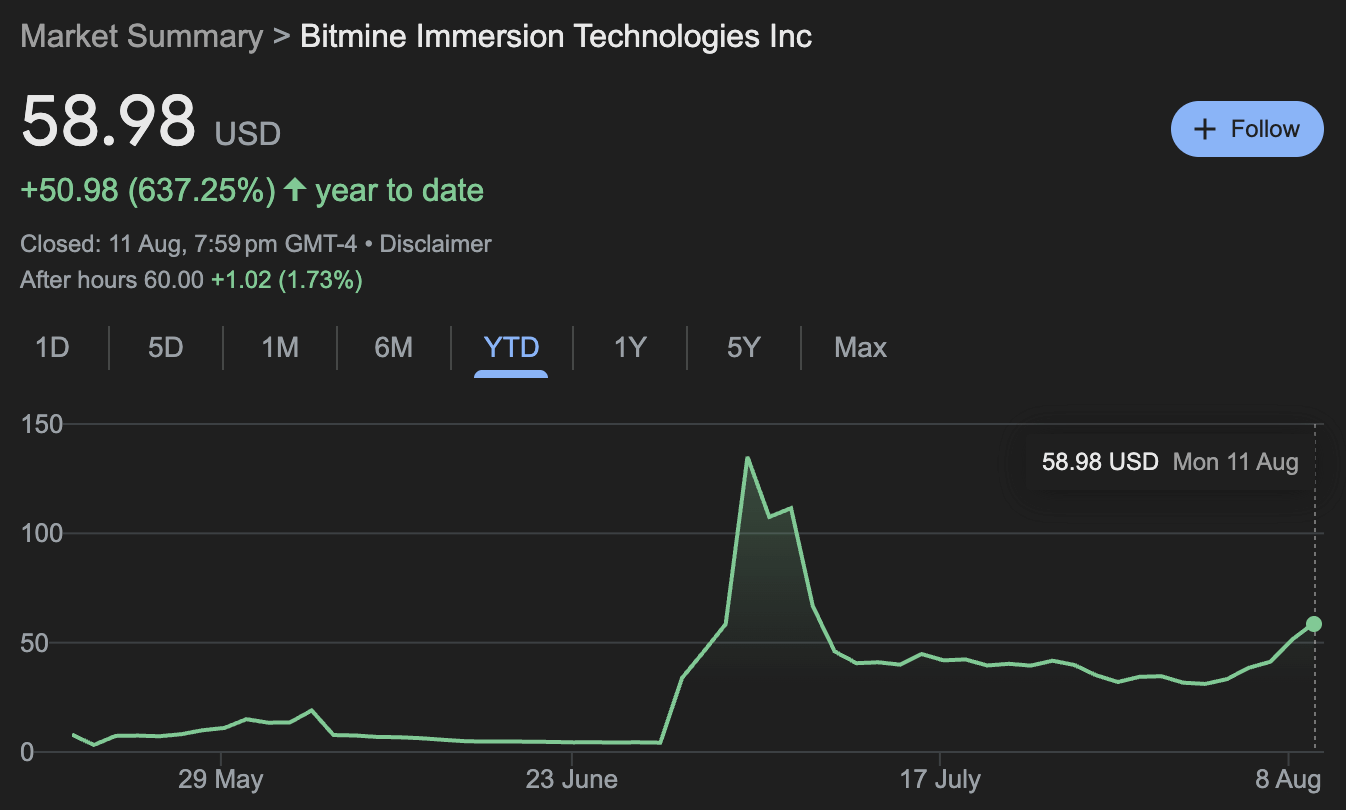

And the market’s taking notice.

BitMine’s stock (BMNR) is now one of the 25 most-traded U.S. companies, moving $2.2B a day in volume. Shares are up 637% year-to-date.

And BitMine’s not alone.

SharpLink Gaming (SBET) just pulled in $400M to boost its stash past $3B.

That’s on top of $900M raised last week. It now holds 598,800 ETH - worth over $2.5B - and is chasing its own 1% supply goal.

Add in players like Bit Digital, and publicly traded ETH treasuries now control several billion dollars worth of ETH.

Standard Chartered says that could soon hit 10% of all ETH in circulation.

The Top Ethereum Holders

The Bottom line:

The “Ethereum MicroStrategy” era is here.

Corporate treasuries are stacking billions, supply is tightening, and if this pace continues… $4,200 is likely just the warm-up. 🔥

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

ETHEREUM TIDAL WAVE 🌊

In case that didn’t get you excited for the near future of Ethereum, let’s get you even more fired up.

An institutional tidal wave is coming for ETH. 100% certainty.

The latest prediction from our favourite chart analyst, Pentoshi?

We’re only 13% from Ethereum all-time highs.

As soon as it breaks that? It’s game on.

Billions are coming. 🌊

If you’re new here, Pentoshi is a pseudonymous macro + technical analyst who’s nailed major market moves since the 2020 bull run.

He doesn’t post speculation, just high-conviction calls backed by data.

And the wild part? He’s usually right.

Here’s what he tweeted today:

He then followed up:

Sharplink is the second-largest Ethereum treasury company, right behind Tom Lee’s.

They already own 600,000 ETH… and they just announced they’ve locked in funding to buy at least $600M more this week.

SharpLink announcement

Ryan from Bankless summed up the current Ethereum situation perfectly:

“You can buy ETH below ATH before this tidal wave hits, but not for long and you have to decide.”

A tidal wave of institutional money is coming.

Not “maybe” - they’re literally telling us.

Just like when they were telling us when the Bitcoin ETFs were approved - and BTC was only around $20,000…

Tomorrow we’re dropping a full YouTube breakdown on how ETH could realistically hit $30,000+.

That’s not a prediction from us, but straight from Tom Lee himself.

Get ready.

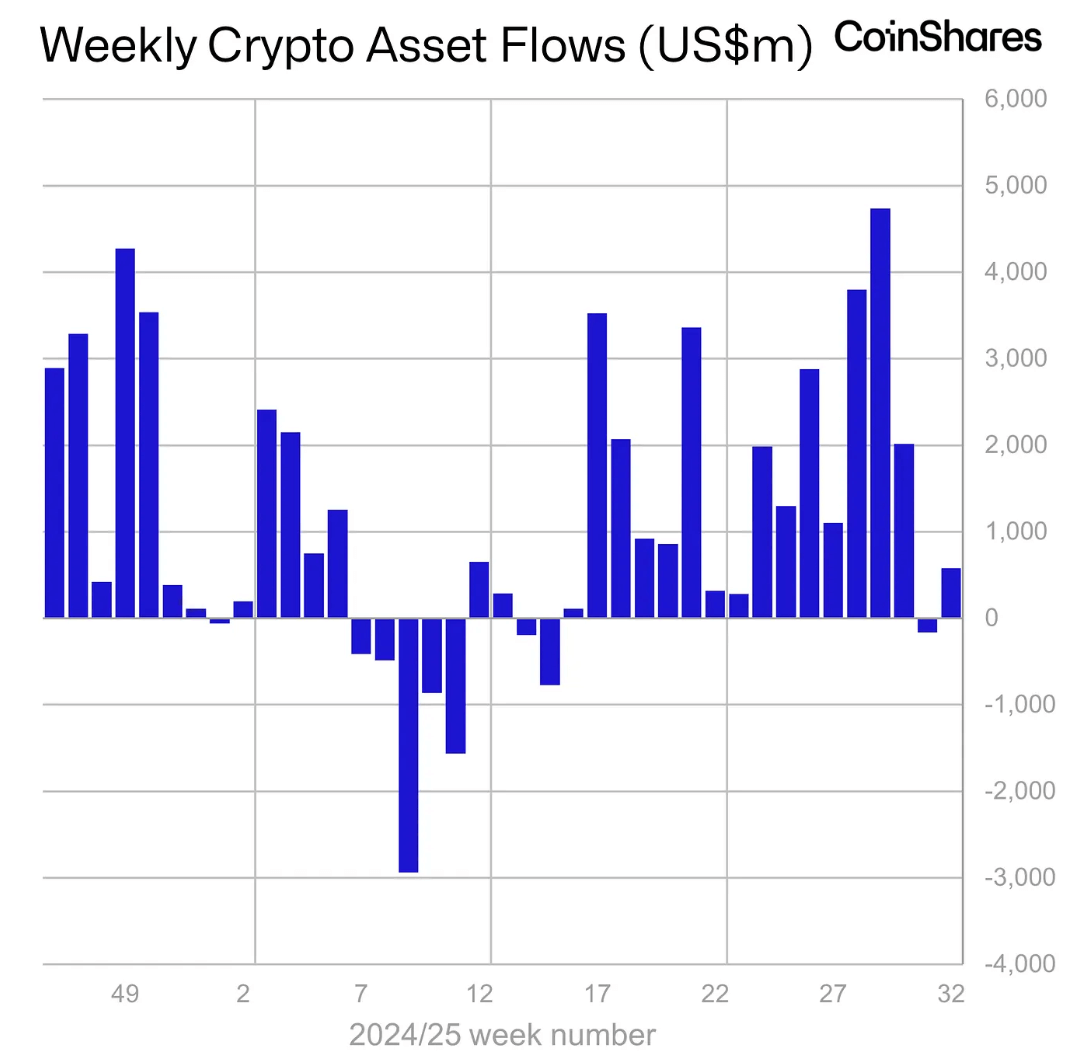

AND WE’RE BACK 📈

Inflows are back…

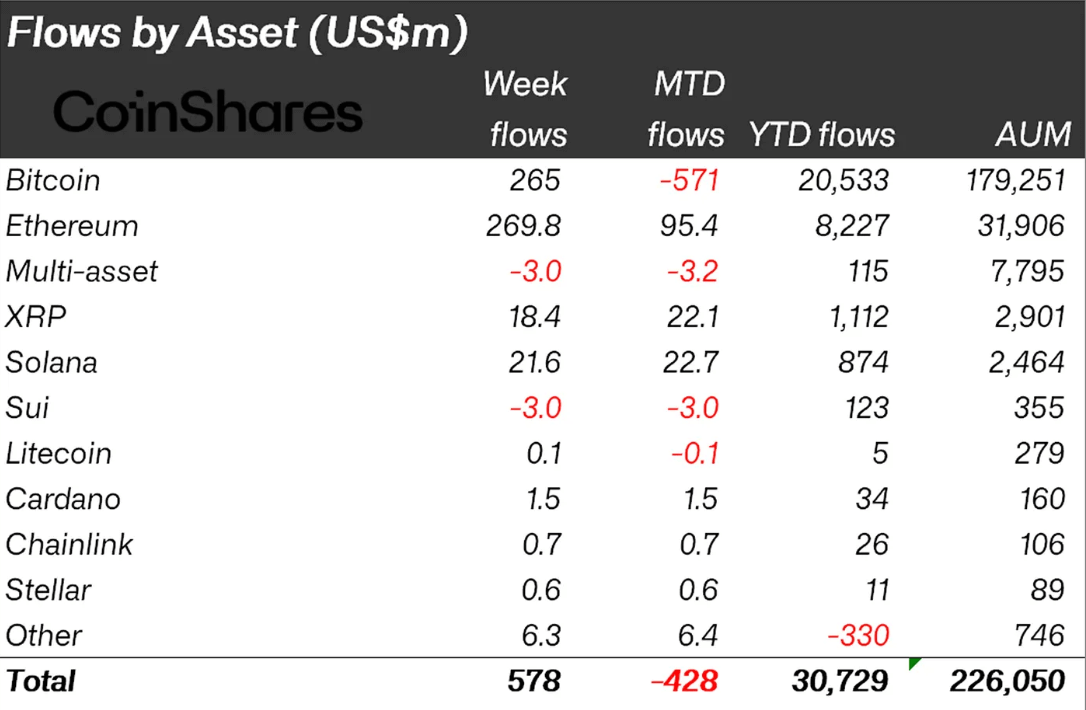

Digital asset funds snapped back into positive territory last week, pulling in $578 million.

Let’s break it down.

Ethereum led the charge with $269.8M in inflows - the biggest of any asset.

That pushed its year-to-date total to a record $8.23B, while recent price gains sent ETH’s total AUM to an all-time high of $32.6B.

Bitcoin also bounced back after two straight weeks of outflows, pulling in $260M.

Solana and XRP followed with $21.6M and $18.4M respectively.

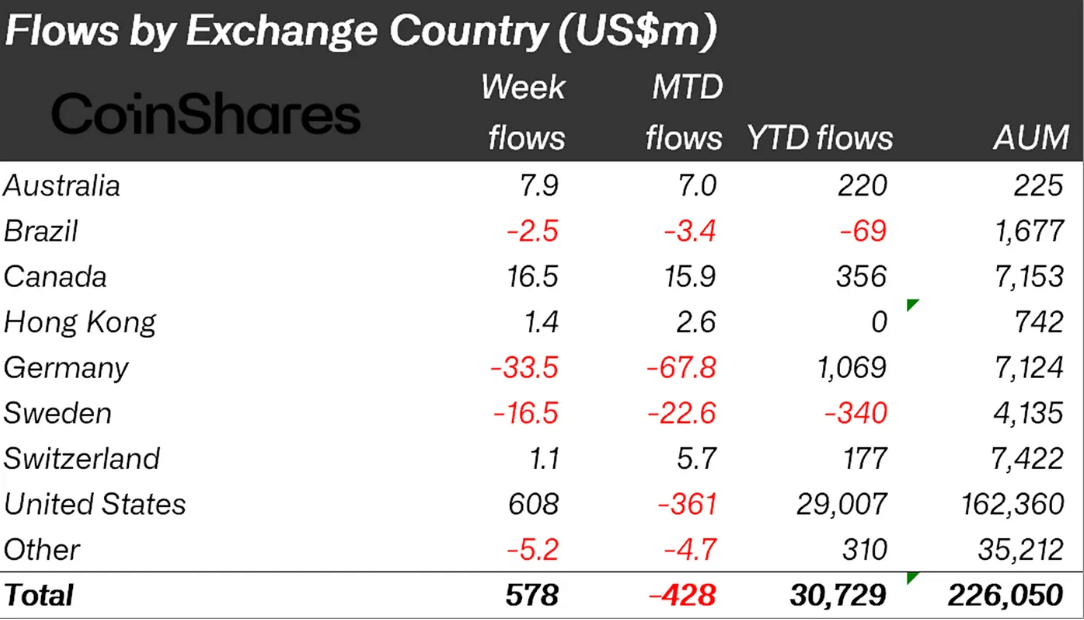

Regionally, the U.S. dominated with $608M in inflows.

Canada, Australia, and Hong Kong followed with inflows of $16.5m, $7.9m, and $1.4m respectively.

Whilst Germany, Sweden and Brazil experienced outflows of $33.5m, $16.5m and $2.5m respectively.

The week actually started ugly - with $1B in outflows, likely tied to weak U.S. payroll figures.

But momentum flipped hard midweek.

Inflows surged to $1.57B in the back half - a move CoinShares links to the U.S. government’s announcement allowing digital assets in 401(k) retirement plans.

From red to record-breaking - all in a matter of days. 🚀

CRACKING CRYPTO 🥜

Strategy celebrates 5 years of Bitcoin success with $18M BTC purchase. Michael Saylor's Strategy pioneering Bitcoin strategy has delivered a 100% annual return rate since inception.

BitMine (BMNR) Up 10% as ETH Holdings Near $5B. The company aims to acquire 5% of all ether supply, worth around $25 billion at current prices.

Bitcoin’s corporate boom raises ‘Fort Knox’ nationalization concerns. Bitcoin’s growing centralized stockpiles among US institutions are presenting Fort Knox-like nationalization concerns, according to crypto analyst Willy Woo.

Terraform co-founder Do Kwon may plead guilty Tuesday morning in US fraud case. Terraforn Labs co-founder Do Kwon plans to plead guilty years after U.S. prosecutors charged him with fraud and money laundering.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 97% 🥳

Due to Bitcoin’s halving schedule, about 97% of the total 21 million BTC will be mined by 2030 — but the last fraction won’t be mined until around the year 2140. ⛏️⏳

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

Have you seen our new YouTube video?

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.