GM to all 22,138 of you. Crypto Nutshell #160 scamperin’ through. 🐿️ 🥜

We’re the crypto newsletter that's more thrilling than a love story set on a sinking ship... 🚢 💔

What we’ve cooked up for you today…

⚽️ Ronaldo gets siuuuu’d?

👨🚀 How high will Ethereum go in 2024?

📈 Stablecoins are surging

💰 And more…

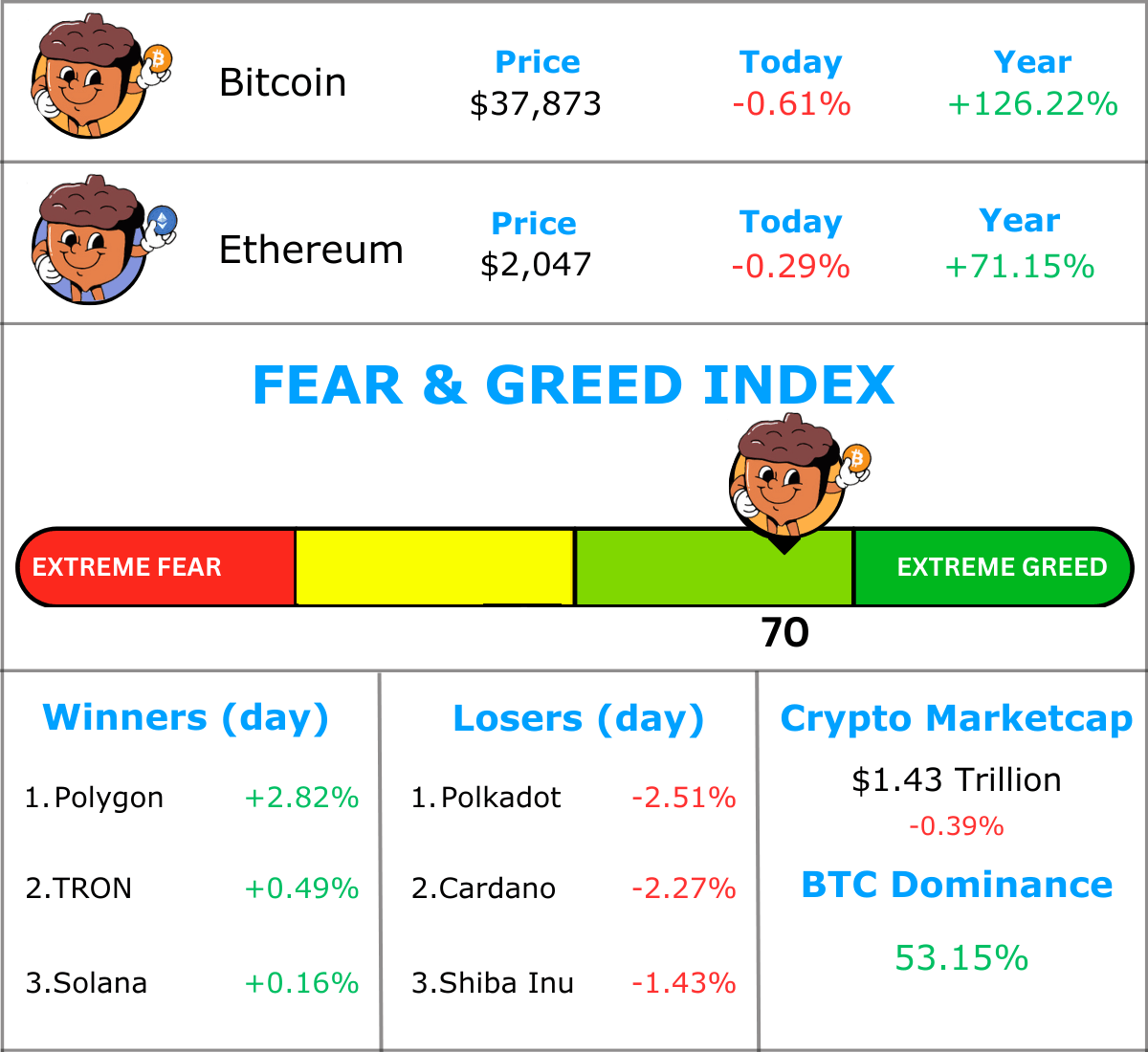

MARKET WATCH ⚖️

Prices as at 7:30am ET

Only the top 20 coins measured by market cap feature in this section

RONALDO GETS SIUUUU’D? ⚽️

Breaking: Cristiano Ronaldo sued for promoting Binance, unregistered securities

The Binance saga continues. (sort of)

One of footballs biggest stars, Cristiano Ronaldo, has become the subject of a class-action lawsuit. The suit is seeking $1 billion in damages for promoting NFTs on Binance.

This has come just days after Binance was asked to pay US authorities $4.3 billion in settlements.

The filing states that Ronaldo:

“Promoted, assisted in, and/or actively participated in the offer and sale of unregistered securities in coordination with Binance.“

Back in 2022, Ronaldo entered into a multiyear partnership with Binance. Ronaldo began to promote a series of his own NFTs exclusively on Binance.

The suit claims that users who signed up for the NFTs were more likely to use Binance for other purposes. These other purposes include investing in unregistered securities. (where have we heard that before?)

“Ronaldo’s promotions solicited or assisted Binance in soliciting investments in unregistered securities by encouraging his millions of followers, fans, and supporters to invest with the Binance platform.“

The suit also claims that Ronaldo should have known “about Binance selling unregistered crypto securities” as he has “investment experience and vast resources to obtain outside advisers”.

But don’t forget, the SEC’s case against Binance is still underway. It’s yet to be determined exactly which cryptocurrencies count as securities.

So this lawsuit is definitely an odd one…

For the full article click here.

TOGETHER WITH VINOVEST 🍷

What do Thomas Jefferson, LeBron James, and the British royal family have in common? They all invest in wine and whiskey.

And with good reason. According to Knight Frank, wine and whiskey have been two of the best-performing alternative assets of the last decade.

There’s just one catch. For hundreds of years, you needed serious cash and connections just for a seat at the table. Plus you had to build fancy cellars and attend exclusive auctions while sporting an encyclopedic knowledge of wine and whiskey. Not happening - right?

Vinovest is changing that. With its easy-to-use platform, you can build a world-class portfolio of wine and whiskey in no time. Our portfolio managers work with you to find the right assets for your unique goals and horizons.

Here’s how Vinovest makes that possible:

- Analysis of 1+ billion data points to find advantageous opportunities

- World-class storage across Europe, Asia, and North America

- Guaranteed authentication and comprehensive insurance

Wine and whiskey are your answer to high yield, low risk investing and there’s nothing (not even LeBron) can do to stop you. Get started with 3 months free with this exclusive link.

2024 ETHEREUM PRICE PREDICTION 👨🚀

This week, we’ve been speaking a lot on Ethereum.

It’s fundamentals & supply dynamics have never been better.

Raoul Pal called its long-term chart one of the most bullish he’s ever seen.

We have the spot Ethereum ETFs to look forward to.

Which all begs the question…

How high will Ethereum go in 2024? 🤔

That’s exactly what crypto expert, Guy Turner, answered in his latest interview.

You may recognise Guy Turner as the host of Youtube’s largest Crypto channel - Coin Bureau. Guy has been making educational Crypto content for 5+ years.

In terms of crypto and it’s cycles? Guy has seen it all.

How high does he think Ethereum will go?

Here’s what he said:

“In terms of price… top of next cycle? I’d be targeting around $5,000 minimum. But I think it could get as high as maybe $8,000.”

Why does he think Ethereum will get that high?

Guy pointed to two reasons:

Ethereum's ecosystem is massive, with ever increasing applications & use cases 📈

Thanks to the Merge & Ethereum’s burn mechanism, the more Ethereum is used, the more Ethereum is burnt 🔥

The equation is simple:

Decreasing supply + increasing demand = higher ETH prices

In terms of 2024:

“2024 is going to be big. There is so much good news on the horizon.”

Guy added that his predictions weren’t moonshots, but his actual realistic outlook.

With a prediction of between 150% - 300% gains over the next year, I think we’d all be happy with that. 👨🚀

STABLECOINS ARE SURGING 📈

Today we’ll be taking a look at the stablecoin market.

Stablecoin’s play an important part in the wider crypto market. They are often used on centralized & decentralized exchanges to purchase other digital assets.

By taking a look at the change in the stablecoin market cap, we can gauge the general demand of digital assets.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: risk-off environments and net capital outflows from digital assets 🐻

You see that tiny little green triangle forming there?

Recently there’s been a 3% expansion in the 30-day aggregate stablecoin supply.

Although this is not a huge increase, it is a notable shift in sentiment.

Since April 2022, the stablecoin supply was constantly decreasing. 📉

BUT, November marked the first full month of positive inflows in over a year.

On-chain liquidity is returning to the digital asset space. But we still have a long way to go until we’re back to 2021 bull market levels… (checkout the size of those green peaks)

Top 5 stablecoins by market cap (Tether continues to dominate the market):

USDT: $89.29 billion

USDC: $24.43 billion

DAI: $5.35 billion

TUSD: $2.96 billion

BUSD: $1.69 billion

Bottom line: This is definitely one chart to keep an eye on. 👀

Capital flowing back into the stablecoin supply is a clear signal of an early bull-market and represents a clear shift in market sentiment. 🐂

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

PROFIT+

Everyone wants to be successful. But most people sacrifice the wrong things for money. There’s a better way. Profit+ shares actionable ideas and examples on how you can reach financial freedom whil...

Sponsored

Alex & Books Newsletter

Join 50,000+ subscribers and get the best 5-minute book summaries every week + my list of 100 life-changing books.

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

CAN YOU CRACK THIS NUT? ✍️

Did you catch yesterday’s newsletter?

Approximately how many Bitcoin’s are currently in the hands of long-term holders?

A) 14.957 million

B) 2.294 million

C) 21 million

D) 12.873 million

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) 14.957 million 🥳

It almost sounds like a made up stat but 14,956,934 Bitcoin’s really are in the hands of long-term holders right now.

GET IN FRONT OF 22,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.