GM to all of you nutcases. It’s Crypto Nutshell #706 keepin’ it balanced… ⚖️🥜

We're the crypto newsletter that's more intense than racing chariots through an ancient Roman arena... 🐴🏛️

What we’ve cooked up for you today…

🏦 Another one

🐳 Ethereum whales are circling

📈 This chart only goes up

💰 And more…

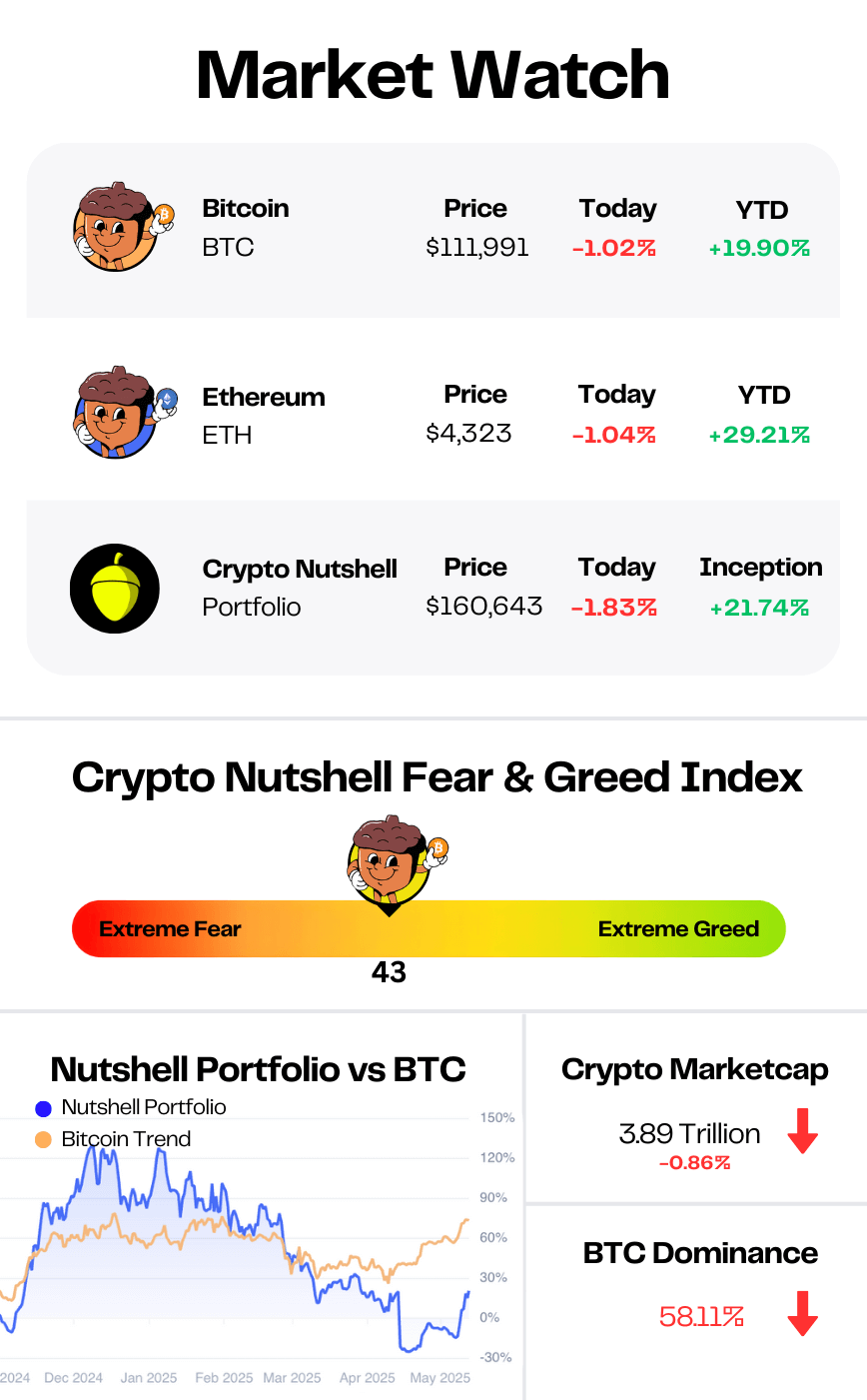

Prices as at 3:30am ET

ANOTHER ONE 🏦

BREAKING: QMMM Stock Skyrockets Nearly 1,750% on Bitcoin, Ethereum, Solana Treasury Plan

Another day… another corporate treasury…

A little-known Hong Kong digital advertising firm just went parabolic after announcing it’s going all-in on crypto.

Shares of QMMM Holdings exploded as much as 1,750% today after the Nasdaq-listed company revealed plans for a $100 million digital assets treasury focusing on Bitcoin, Ethereum, and Solana.

At one point, the stock spiked above $200 before cooling back toward $150 - still a meteoric leap from single digits just days ago.

This chart is ridiculous…

And the treasury is just the start.

QMMM says it’s also building:

A decentralized data marketplace

Pairing AI with blockchain to deliver analytics

DAO treasury tools

Metaverse integrations

And smart contract security.

CEO Bun Kwai framed the pivot as a bet on accelerating global adoption:

“The global adoption of digital assets and blockchain technology is accelerating at an unprecedented pace… QMMM’s entry into this space reflects our commitment to technological innovation and our vision to bridge the digital economy with real-world applications.”

But skeptics point out the math doesn’t add up.

SEC filings show QMMM ended last year with less than $500K in cash and a $1.6M net loss.

How it plans to fund a $100M treasury remains a mystery.

Even so, the mania is clear.

Corporate digital asset treasuries now hold ~$120B in crypto - and QMMM isn’t alone.

Just a day earlier, Eightco stock ripped 3,000% after announcing a $250M World token treasury.

The takeaway: Wall Street no longer needs a Tesla or MicroStrategy to spark fireworks.

Any public company hinting at a Bitcoin, ETH, or Solana treasury is enough to send stocks vertical.

And if this keeps spreading, the corporate adoption wave in this cycle won’t just be bigger. It’ll be wilder. 🚀

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

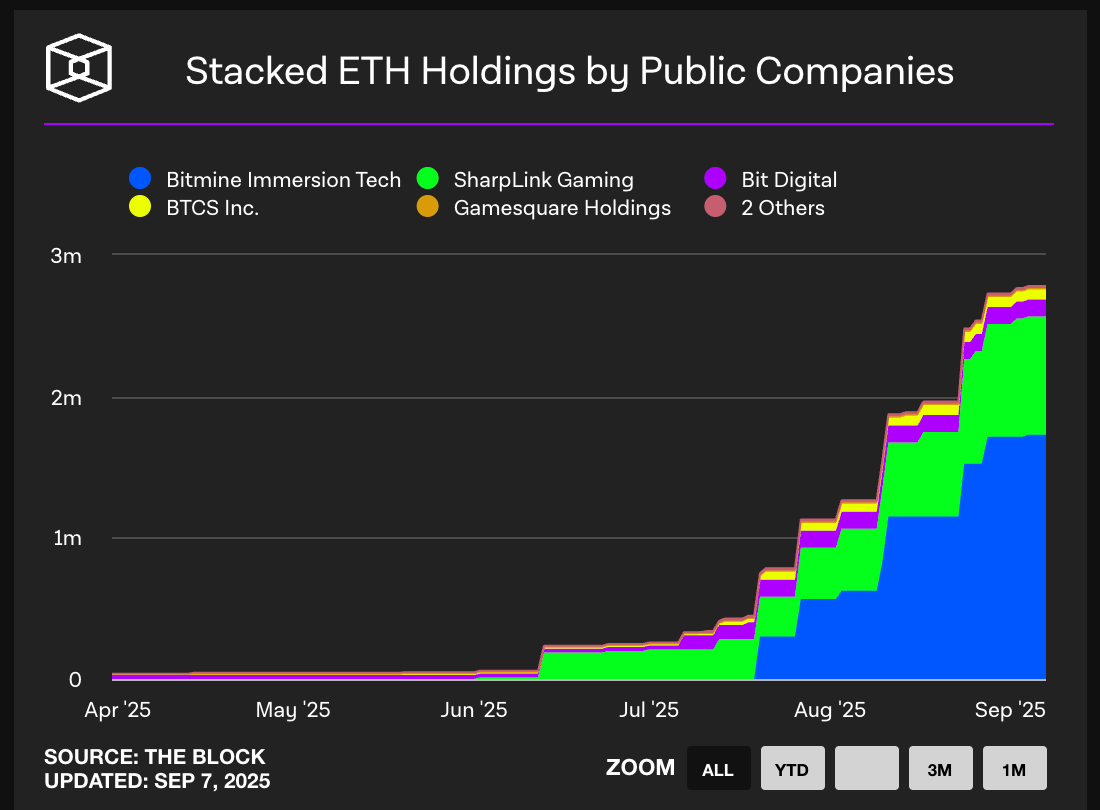

ETHEREUM WHALES ARE CIRCLING 🐳

In just the past week, the biggest Ethereum treasury players have gone on an absolute buying spree:

As Anthony Sassano - OG Ethereum voice and founder of The Daily Gwei - points out, this is not a trend you want to bet against.

Here’s the public company buying he flagged in a recent post:

ETHZilla - $100M ETH into EtherFi

The Ether Machine - added +150,000 ETH

BitMine - added +74,284 ETH

SharpLink - added +39,526 ETH

Yunfeng Financial (co-founded by Jack Ma)- added +10,000 ETH

That’s hundreds of thousands of ETH quietly scooped up by whales with deep, patient capital.

Ethereum holdings by public companies

Don’t bet against the whales.

Ethereum’s supply shock is building. 🐳

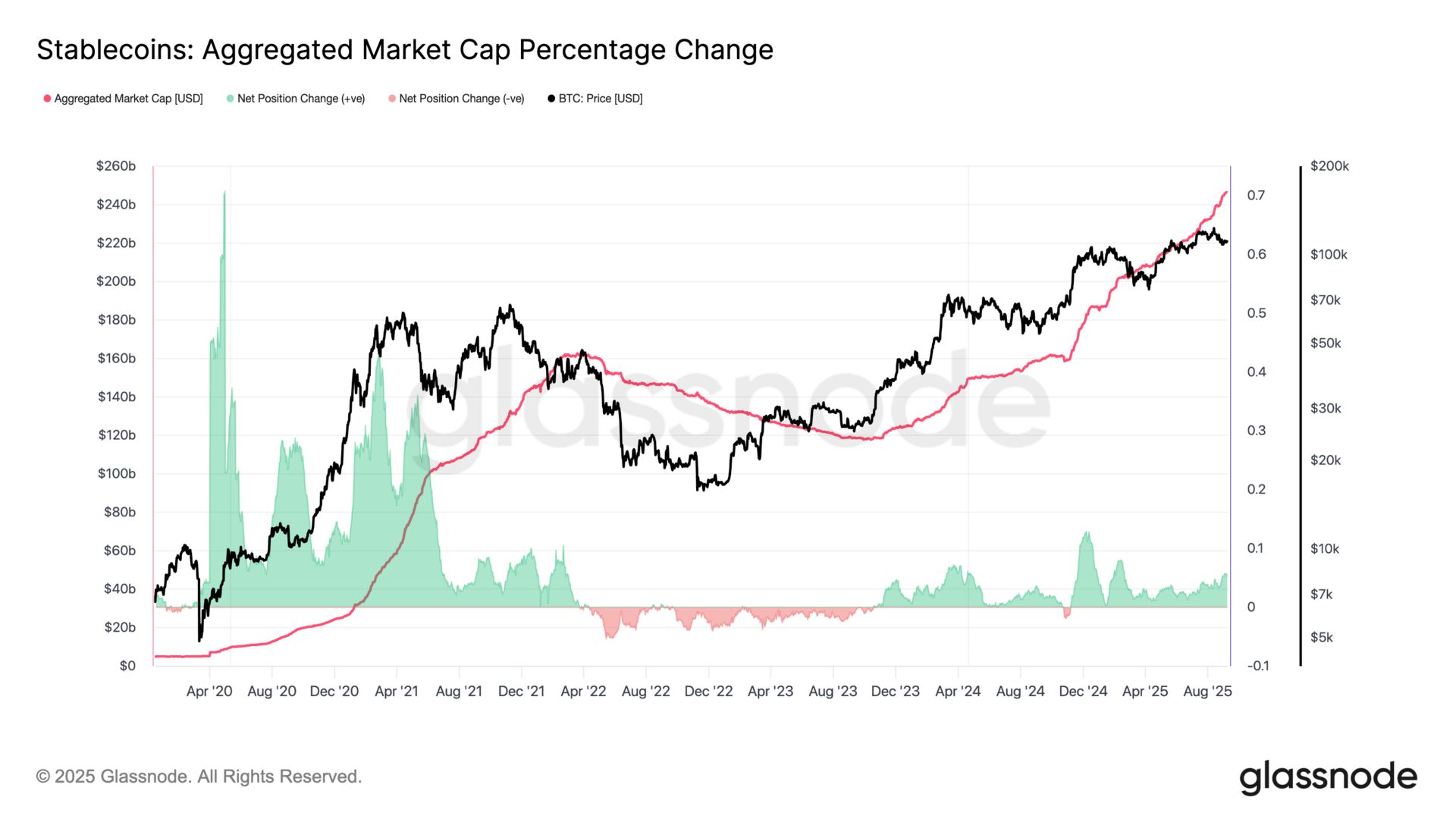

THIS CHART ONLY GOES UP 📈

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

Two weeks ago, the stablecoin supply sat at $240.40B.

Today? $246.34B.

That’s a $5.94B surge in just 14 days - and of course a brand-new all-time high. 🚀

Since January 1st, supply has exploded by $61.30B. 🤯

Let that sink in…

Why does this matter? Because stablecoins aren’t just digital dollars. They’re dry powder.

Fresh capital. Sitting on-chain. Locked. Loaded. Ready to fire.

And the pattern couldn’t be clearer: stablecoin supply doesn’t trail rallies… it ignites them.

They’re not the aftermath of a bull run. They’re the spark that lights it. 🔥

CRACKING CRYPTO 🥜

SEC pushes back decisions on Bitwise, Grayscale crypto ETFs to November. The SEC has extended its review of the Bitwise Dogecoin ETF and Grayscale Hedera ETF until Nov. 12, leaving all altcoin spot ETF approvals in limbo.

First Dogecoin ETF to launch on Sept 11, Bloomberg analyst says. The first-ever DOGE ETF marks the beginning of the memecoin ETF era, according to Bloomberg’s Eric Balchunas.

HUT, BITF, CIFR, RIOT, IREN Among BTC Miner Big Gainers. The big gains for players like Bitfarms, Hut 8 and Cipher Mining came despite lame price action for bitcoin.

Nasdaq-listed QMMM surges 800% on crypto treasury plan targeting Bitcoin, Ethereum, and Solana. Along with building a decentralized data marketplace, QMMM plans a crypto treasury expected to reach an initial scale of $100 million.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

One of the biggest criticisms of Solana is its occasional network halts. What usually causes these outages?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Spam or bot-driven transaction overload 🥳

Heavy spam and bot-driven loads have caused Solana to halt multiple times in its early years. ⚡🛑

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.