GM to all 23,879 of you. Crypto Nutshell #165 sneakin’ in. 🥷 🥜

We’re the crypto newsletter that's less chaotic than surviving a weekend with an eccentric family during a wedding... 💍🏰

What we’ve cooked up for you today…

😮 Bitcoin ETF updates

⚡️ Ethereum Supply Shock Incoming

🔥 The streak continues

💰 And more…

MARKET WATCH ⚖️

Prices as at 3:50am ET

Only the top 20 coins measured by market cap feature in this section

BITCOIN ETF UPDATES 😮

Breaking: BlackRock, Bitwise file updated spot Bitcoin ETF applications with the SEC

Asset management giant BlackRock filed an amended S-1 filing with the SEC. Bitwise also filed an amended S-1 filing today.

Things are definitely heating up in the race for the Bitcoin ETF. 🏎️

When asked what these filings meant, ETF analyst James Seyffart had this to say:

“It just means that the wheel is still turning. Both the SEC and these issuers are working hard to iron things out. These filings are likely the result of many conversations and a lot of man hours on/between both sides.”

These filings have been updated to address matters raised in recent discussions between the SEC and ETF applicants.

Bloomberg ETF analyst, Eric Balchunas, predicted that we would see some updated filings this week. 🔮

So expect more to come…

As a reminder, the Bitcoin ETF final deadline is only 36 days away…

They’re so close. 😎

TOGETHER WITH THE EDGE 🤖

Crypto was the fastest adopted technology the world had ever seen… until Artificial Intelligence came along.

Which makes keeping up with A.I … complicated. 😕

Between learning the newest tools and knowing the latest news, Artificial Intelligence can feel overwhelming.

But it doesn’t have to. That’s where THE EDGE steps in.

Makes keeping up with the latest AI breakthroughs dead simple ✅

Helps you stay on top of the latest AI Tools with real life use cases 🔨

Delivered straight to your inbox every single day in a 3 min read 📨

The best part? They’re also completely FREE just like us.

Subscribe now by five star frog splashing that big subscribe button below, there’s really nuttin’ to lose. 🥜

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

ETHEREUM SUPPLY SHOCK INCOMING ⚡️

Crypto is the most forward-looking asset class in markets.

To maximise returns, you shouldn’t be looking at what’s happening right now.

You should be looking at what’s going to happen in the future. 🔮

That’s the latest message out from macroeconomic expert, Raoul Pal.

What is happening right now?

2 catalysts are taking up the majority of mainstream attention in crypto.

These are:

Spot Bitcoin ETF (36 days away)

Bitcoin Halving (133 days away)

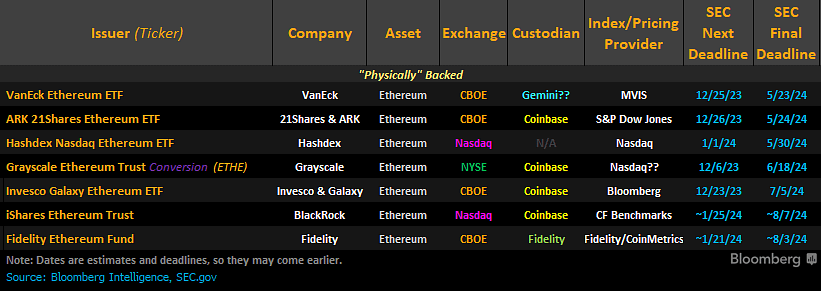

But looking into the future, we have 7 spot Ethereum ETFs to look forward to:

Their final deadlines sit between late May, 2024 to early August, 2024.

Raoul points out that an epic supply shock is coming for Ethereum:

He’s not wrong, either.

The amount of Ethereum locked away for staking has never been higher:

What’s more?

The rate of Ethereum staked over time is not slowing down, but increasing.

Additionally, interest is returning to crypto. This means the amount of Ethereum being burnt is increasing too:

So here’s the situation:

Records amount of Ethereum being burnt 🔥

Records amount of Ethereum being locked for staking 🔒

7 financial juggernauts fighting over a spot ETF, including BlackRock, Fidelity & Grayscale 🥊

A perfect storm.

We like Bitcoin & Ethereum equally, and hold a ~50/50 split to both.

But if we had to bet which one outperforms in 2024?

We’d pick Ethereum.

But we want to hear from Crypto Nutshell readers. Which digital asset do you hold more of?

What do you hold more of?

THE STREAK CONTINUES 🔥

For the tenth week in a row, digital asset investments saw net inflows.

The total weekly inflows were $176 million, down from $346 million the week prior.

This brings total inflows over the 10-week stretch to $1.76 billion. The best stretch since October 2021, the same month Bitcoin futures ETFs launched.

If you’re not sure what we’re talking about here, checkout this short article.

As expected, Bitcoin continued to dominate weekly inflows.

With $132.8 million coming in for the week. This brings the total YTD Bitcoin inflows to $1.683 billion.

Ethereum had another positive week, with $30.8 million in inflows.

For the first time this year, Ethereum’s YTD flows are now positive at $10 million. (isn’t that crazy?)

Now let's break these net flows down by country.

Once again Canada, Germany and the United States were the most active. They had net inflows totalling $79m, $56.9m and $53.5m respectively.

Why are Canadian inflows so much more than everyone else’s?

Simple.

As it stands, Canada is currently home to the largest spot Bitcoin ETF.

The Purpose Bitcoin ETF has been growing in popularity over the year with net inflows of $339.29 million YTD. 📈

Institutional money & interest is pouring back into the space.

If this data is anything to go by (it is), imagine how big the launch of the Bitcoin ETFs will be. 😎

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

The Intrinsic Value Newsletter

The weekly newsletter devoted to breaking down business and estimating their intrinsic value, in just a few minutes to read — Join 35,562 readers

Sponsored

Fast Food Club

The Official Fast Food Club. Get access to the world's largest group for fast food secrets, news, tips, menu hacks, and secret recipes. Once you subscribe you'll become a member.

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

CAN YOU CRACK THIS NUT? ✍️

How good’s your memory?

What is the current balance of Bitcoin on exchanges?

A) 2.32 million

B) 3.23 million

C) 2.45 million

D) 1.69 million

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) 2.32 million 🥳

Currently only 2,319,888 Bitcoin remain on exchanges.

Checkout the full breakdown here.

GET IN FRONT OF 23,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.