GM to all of you nutcases. It’s Crypto Nutshell #787 poppin’ bottles… 🍾🥜

We’re the crypto newsletter that’s more twisted than a perfect plan unraveling the moment it’s put into action… 🧠💥 ♟️🧠

What we’ve cooked up for you today…

🏦 How crypto changed in 2025

🔮 3 final predictions

💎 Holding the line

💰 And more…

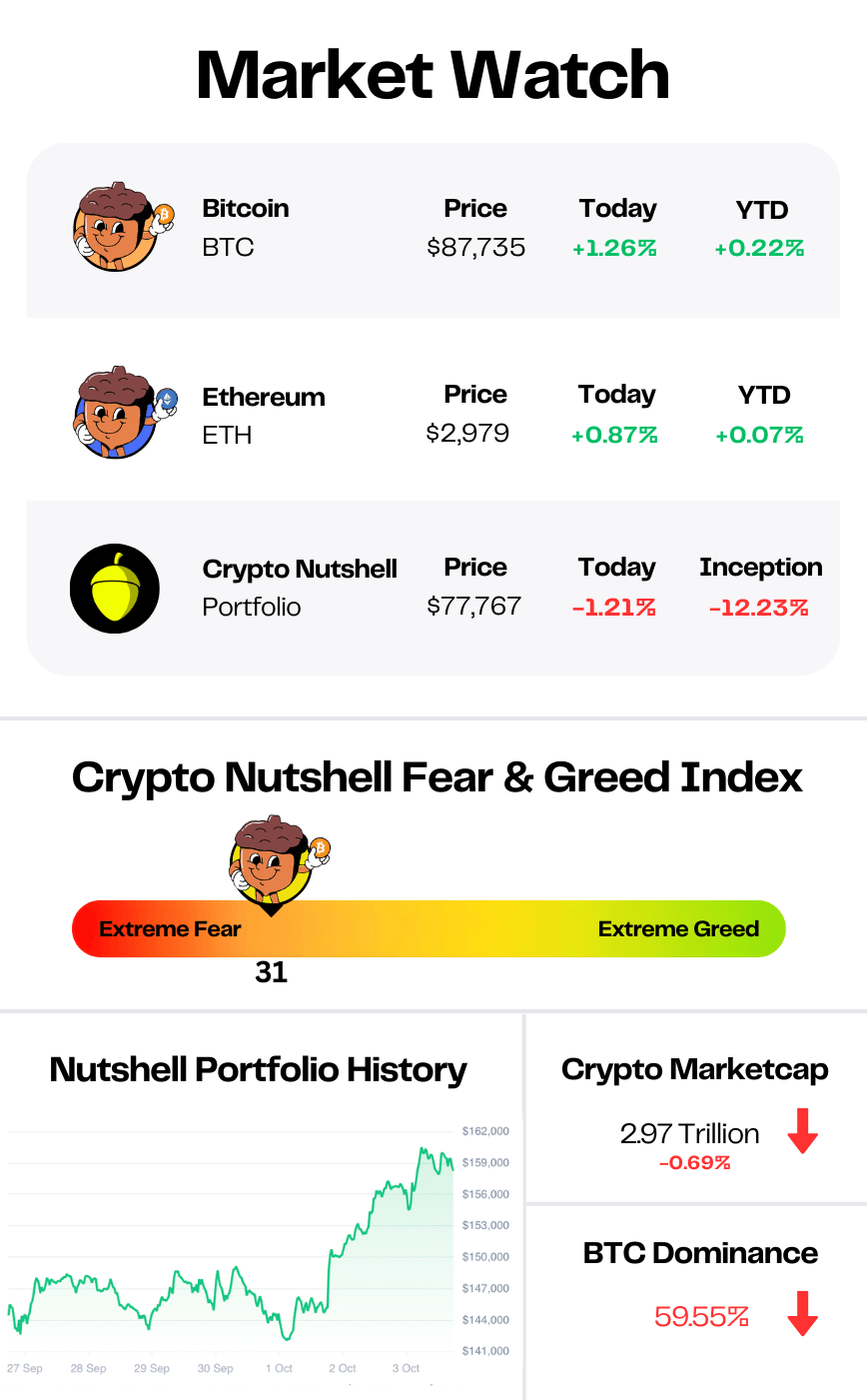

Prices as at 5:10am ET

HOW CRYPTO CHANGED IN 2025 🏦

BREAKING: The year in data: 5 charts that show how crypto changed in 2025

2025 failed to live up to the four-year cycle expectations…

Bitcoin hit new all-time highs.

But most alts never came close to their prior peaks. And the year ended negative…

Here's how crypto changed in 2025, in five charts.

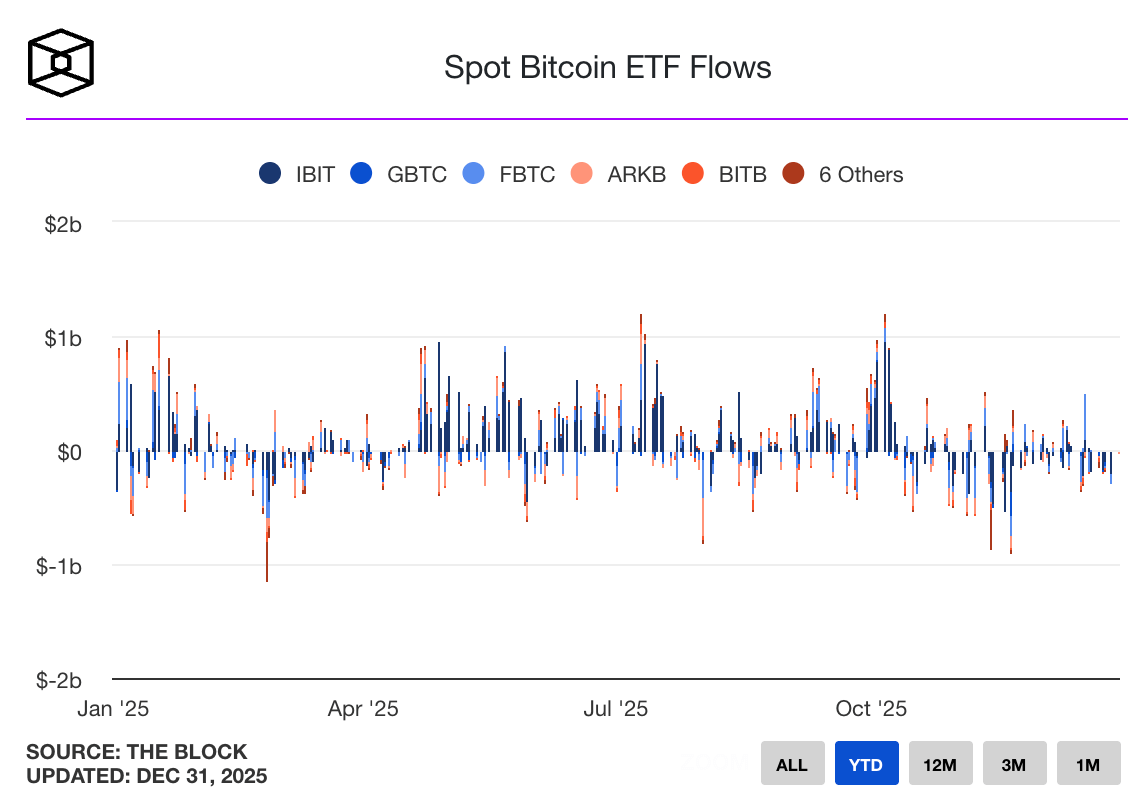

Spot crypto ETFs: slower, but still massive

Bitcoin ETFs pulled in $21.8 billion in net inflows - down from $35.4 billion in 2024.

BlackRock's IBIT dominated with $24.9 billion alone, offset by outflows from other funds. IBIT now holds $66 billion AUM with over 70% market share by volume.

Ethereum ETFs generated $9.8 billion in net inflows, up from $2.7 billion in 2024.

September brought a breakthrough: the SEC approved accelerated listing standards for crypto ETFs. Spot ETFs for Solana, Litecoin, XRP, Dogecoin, HBAR, and Chainlink followed.

XRP ETFs lead the new cohort with $1.2 billion in inflows since November 13.

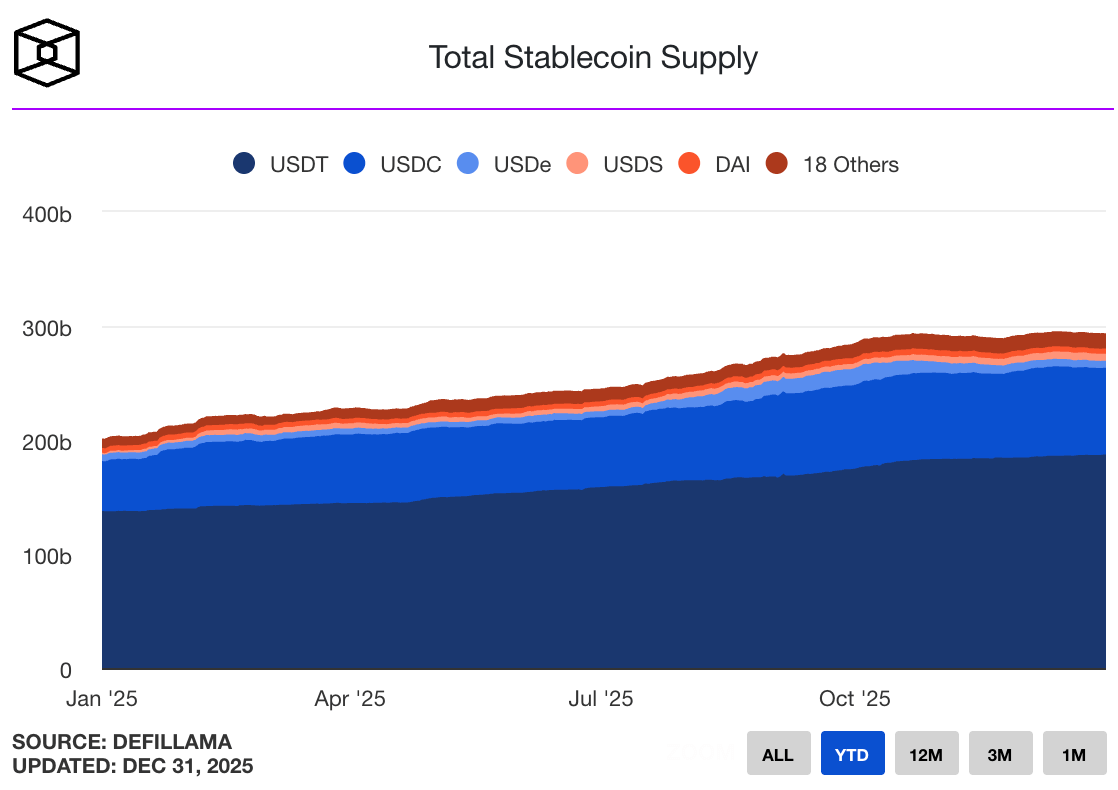

Stablecoins hit $300 billion

Stablecoin supply surged to nearly $300 billion as payments firms, GENIUS Act clarity, and new infrastructure pushed the asset class mainstream.

Tether maintained dominance with $187 billion (64% market share). Circle's USDC holds $76 billion (26%). Ethena's USDe has $6.3 billion (2.2%).

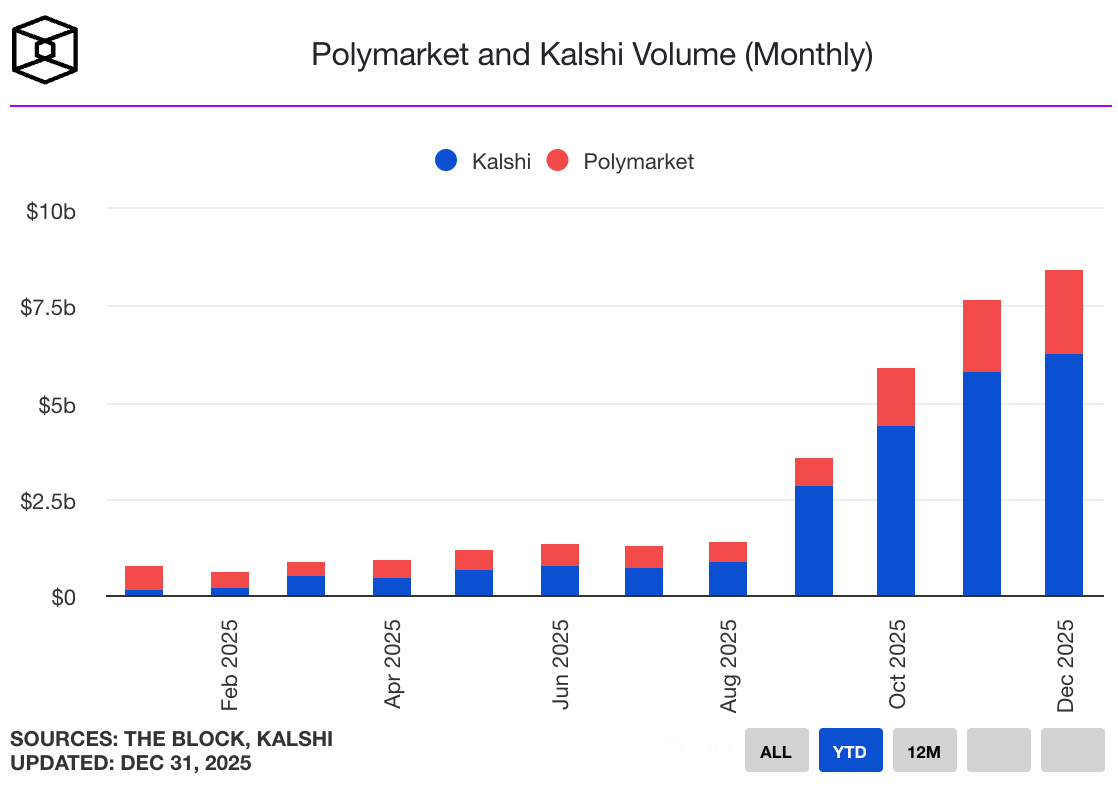

Prediction markets went mainstream

Kalshi and Polymarket broke volume records.

Kalshi hit $6.3 billion in December trading volume versus Polymarket's $2.2 billion, flipping dominance after winning court approval for political contracts.

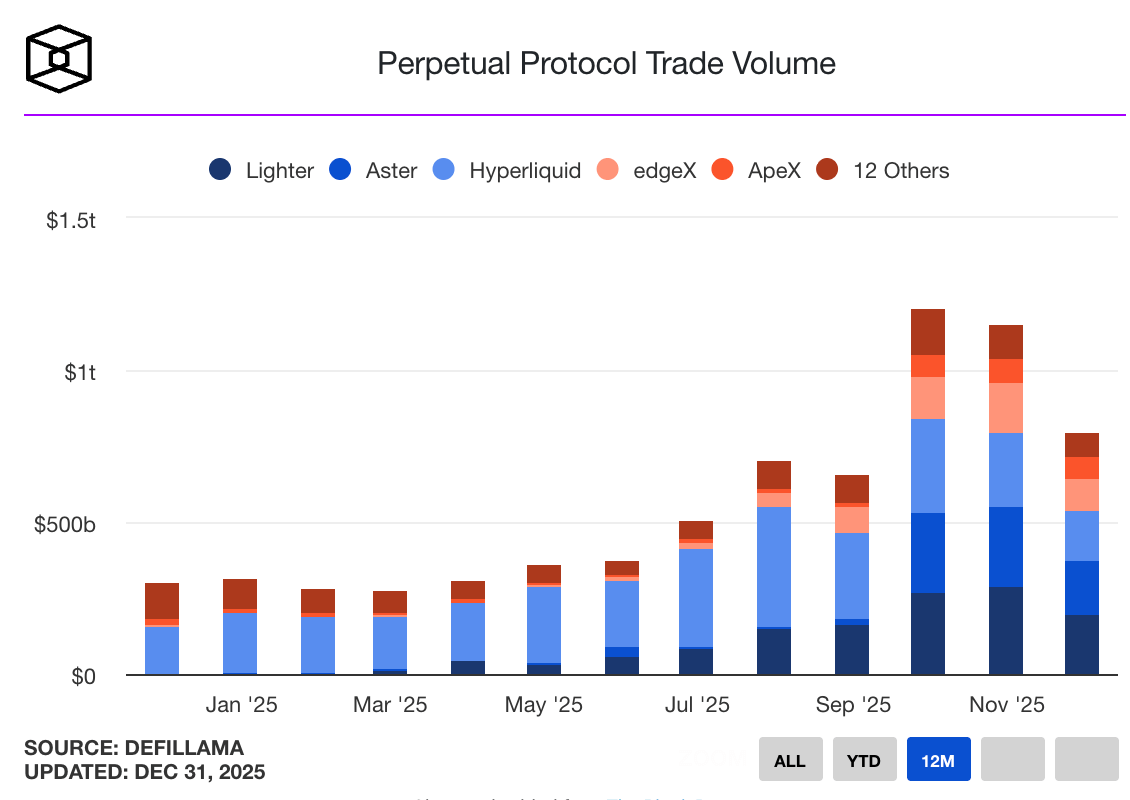

Perp DEX resurgence

Hyperliquid reignited onchain derivatives, pushing the sector to record volumes.

Perpetual protocol monthly volume topped $1 trillion for the first time in October.

Hyperliquid commanded $308.5 billion of that total. Lighter followed with $272.5 billion. Aster hit $259.9 billion before DefiLlama flagged wash-trading and delisted its data.

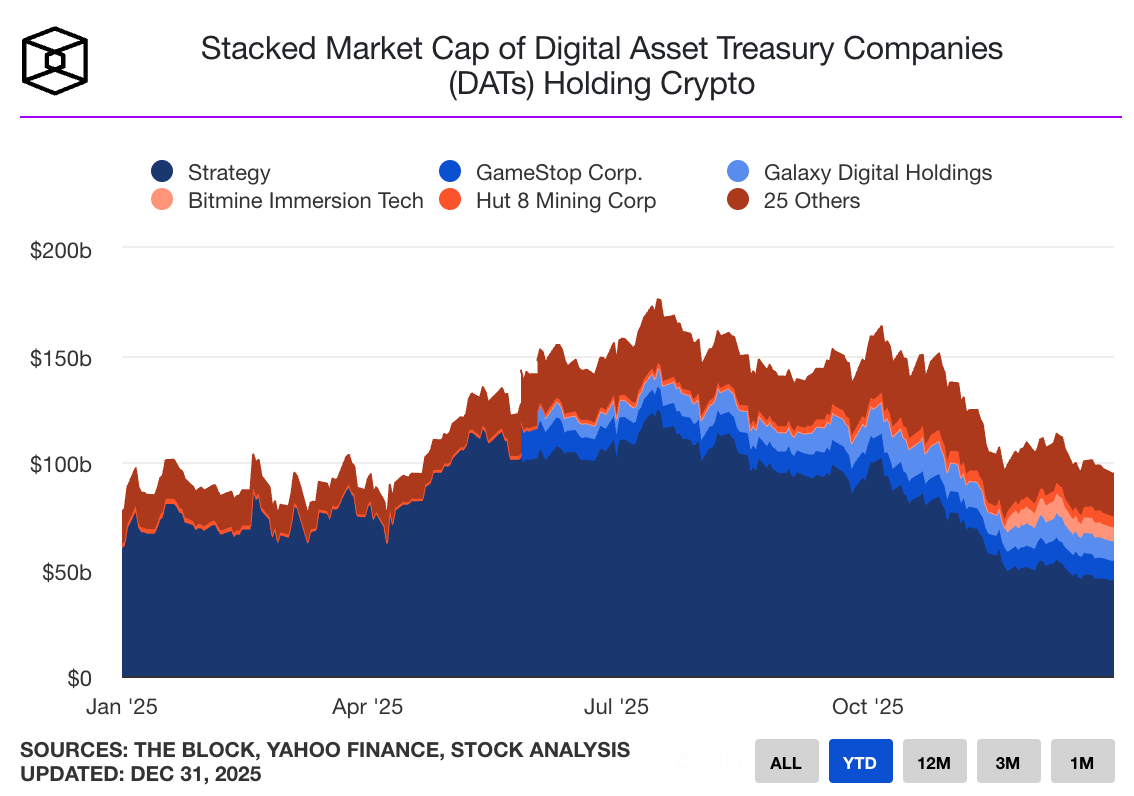

DAT boom and bust

Strategy topped 672,000 BTC - over 3% of total supply.

But the DAT craze fizzled fast.

Strategy's stock fell 66% from its peak. Its modified NAV dropped below 1 - worth less than the Bitcoin it holds.

BitMine (Ethereum) dropped 79.5%.

Total DAT market caps plunged 46% from $176 billion to $94 billion.

The takeaway

2025 brought institutional infrastructure and regulatory clarity.

But unfortunately not the alt season four-year cycle bulls expected.

ETFs expanded. Stablecoins hit new highs. Prediction markets and perp DEXs went mainstream.

Yet treasury stocks collapsed. Alts underperformed. Bitcoin ended well off its highs.

Let’s hope 2026 delivers. 🚀

Pelosi Made 178% While Your 401(k) Crashed

Nancy Pelosi: Up 178% on TEM options

Marjorie Taylor Greene: Up 134% on PLTR

Cleo Fields: Up 138% on IREN

Meanwhile, retail investors got crushed on CNBC's "expert" picks.

The uncomfortable truth: Politicians don't just make laws. They make fortunes.

AltIndex reports every single Congress filing without fail and updates their data constantly.

Then their AI factors those Congress trades into the AI stock ratings on the AltIndex app.

We’ve partnered with AltIndex to get our readers free access to their app for a limited time.

Congress filed 7,810 new stock buys this year as of July.

Don’t miss out on direct access to their playbooks!

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

3 FINAL PREDICTIONS 🔮

If you’ve been reading us this year, you already know Tom Lee has been making a lot of predictions on Bitcoin & Ethereum.

Well, in a final interview with CNBC to wrap up the year, he put his 2026 expectations on the table.

Tom Lee

Here’s the 3 predictions he’s calling for next year:

$7k-$9k Ethereum in early 2026

$200k Bitcoin in 2026

$20k ETH over the longer term

Importantly, Lee was careful with the framing:

“I don’t want to overuse the word supercycle...”

But realistically, Tom Lee is calling for a supercycle.

As we’ve pointed out previously, Tom Lee has been putting his money where his mouth is.

Through his Ethereum treasury company BitMine, Lee has put real dollars behind his predictions. By year-end, BitMine is will be holding ~4.02 million ETH, worth just under $12 billion at current prices.

That matters.

Tom Lee isn’t making these calls for attention.

He’s backing them with billions of dollars - and his own reputation. 🎰

HOLDING THE LINE 💎

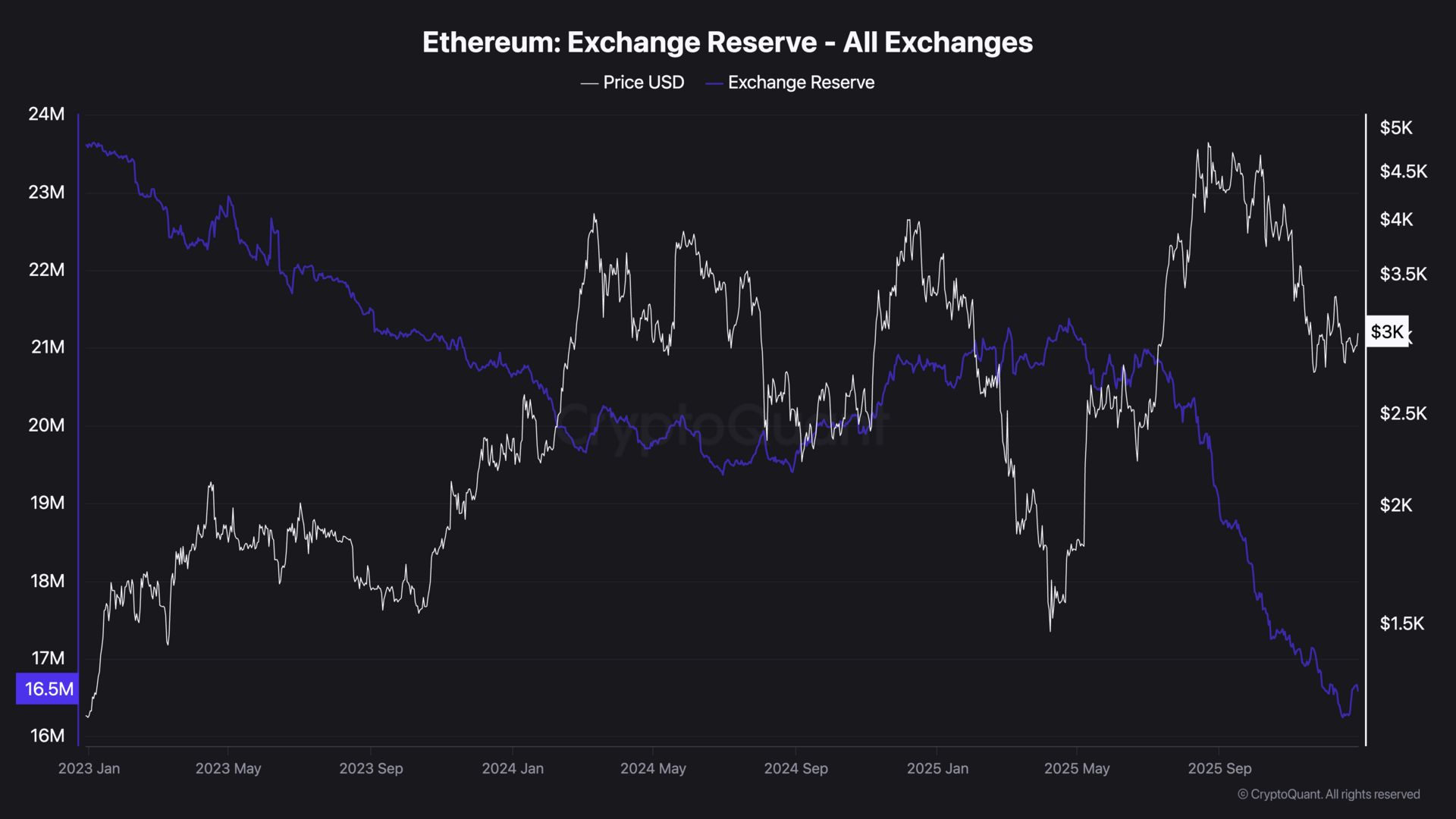

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Only 16.59 million ETH are left on exchanges.

That's just 13.74% of the entire supply. And since January, another 4.17 million ETH has been pulled off exchanges.

Read that again...

This is what a supply squeeze looks like before the market wakes up.

ETH has sold off alongside the rest of crypto. Fear's still running the show.

And yet... exchange balances still aren't climbing.

That tells you everything.

This isn't panic.

It's veteran holders holding the line whilst the long-term supply base keeps tightening. 💎

CRACKING CRYPTO 🥜

The 10 biggest crypto losers of 2025 (and what went wrong). 2025 was supposed to be crypto's maturation year, with regulatory clarity, institutional adoption, and infrastructure built to last.

Bitcoin Will Extend Decline in 2026, While Payment Infra Improves. The price of Bitcoin will continue to decline in 2026, but the infrastructure enabling BTC payments will continue to develop in the new year.

Trump Media plans new token distribution for shareholders in partnership with Crypto.com. The Truth Social parent said it will issue a new digital token on Crypto.com’s Cronos blockchain.

From Pectra to Fusaka: How Ethereum's protocol changed in 2025. Ethereum spent 2025 overhauling leadership, expanding a privacy roadmap, and starting its bi-annual hard-fork cycle with Pectra and Fusaka.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 17 hours 🥳

Solana's longest outage lasted 17 hours in September 2021, caused by a bot spam attack that overwhelmed the network with 400,000 transactions per second.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.