Today’s edition is brought to you by TLDR Newsletter - catch up on the latest tech, startup, and coding stories.

GM to all 62,081 of you. Crypto Nutshell #286 givin’ the sauce. 🥫 🥜

We’re the crypto newsletter that's as exhilarating as a group of survivors battling against hordes of zombies in a post-apocalyptic world... 🧟♂️🌎

What we’ve cooked up for you today…

🤯 Here come the wirehouses

🤑 It’s so simple

🐂 Bull market HODLer dynamics

💰 And more…

MARKET WATCH ⚖️

Prices as at 5:30am ET

Only the top 20 coins measured by market cap feature in this section

HERE COME THE WIREHOUSES 🏦

BREAKING: Morgan Stanley, UBS on the verge of approving Bitcoin ETF exposure

We’ve got some BIG news for you today.

Arch Public co-founder Andrew Parish has revealed that UBS is opening up the Bitcoin ETFs to all of their clients… next week…

(Andrew is a reputable source when it comes to Bitcoin ETF news)

UBS manages $3.5 trillion in global wealth.

Currently they only offer the Bitcoin ETFs to clients with >$10 million invested on their platform.

Well it turns out Morgan Stanley didn’t like this:

Now, after hearing this news, Andrew believes Morgan Stanley will be the first to implement full platform approval.

FYI, Morgan Stanley have $1.5 trillion in assets under management.

That’s a tonne of money coming for Bitcoin…

ETF analyst Eric Balchunas also commented on the situation.

Describing it as a “compliance game of chicken,” with each bank waiting for another to act first.

According to Eric, once 1 bank makes a move, the others will follow.

Sounds like the flood gates are about to open. 🌊

Stay tuned. We’ll keep you updated on any major developments.

Love Hacker News but don’t have the time to read it every day? Try TLDR’s free daily newsletter.

TLDR covers the best tech, startup, and coding stories in a quick email that takes 5 minutes to read.

No politics, sports, or weather (we promise).

Subscribe for free now and you'll get their next newsletter tomorrow morning.

IT’S SO SIMPLE 🤑

Don’t try and trade this thing.

Just buy and hold it for the long-term.

That’s the latest message out from Anthony Pompliano.

In his latest interview, Pompliano was asked if Bitcoin can really be considered a store of value.

This was his response.

“When you want a store of value, usually what you’re talking about is not storing value from yesterday to today. You’re trying to store value from today for 5, 10, 15, 20 years… Right now, Bitcoin is the best place you can do that.“

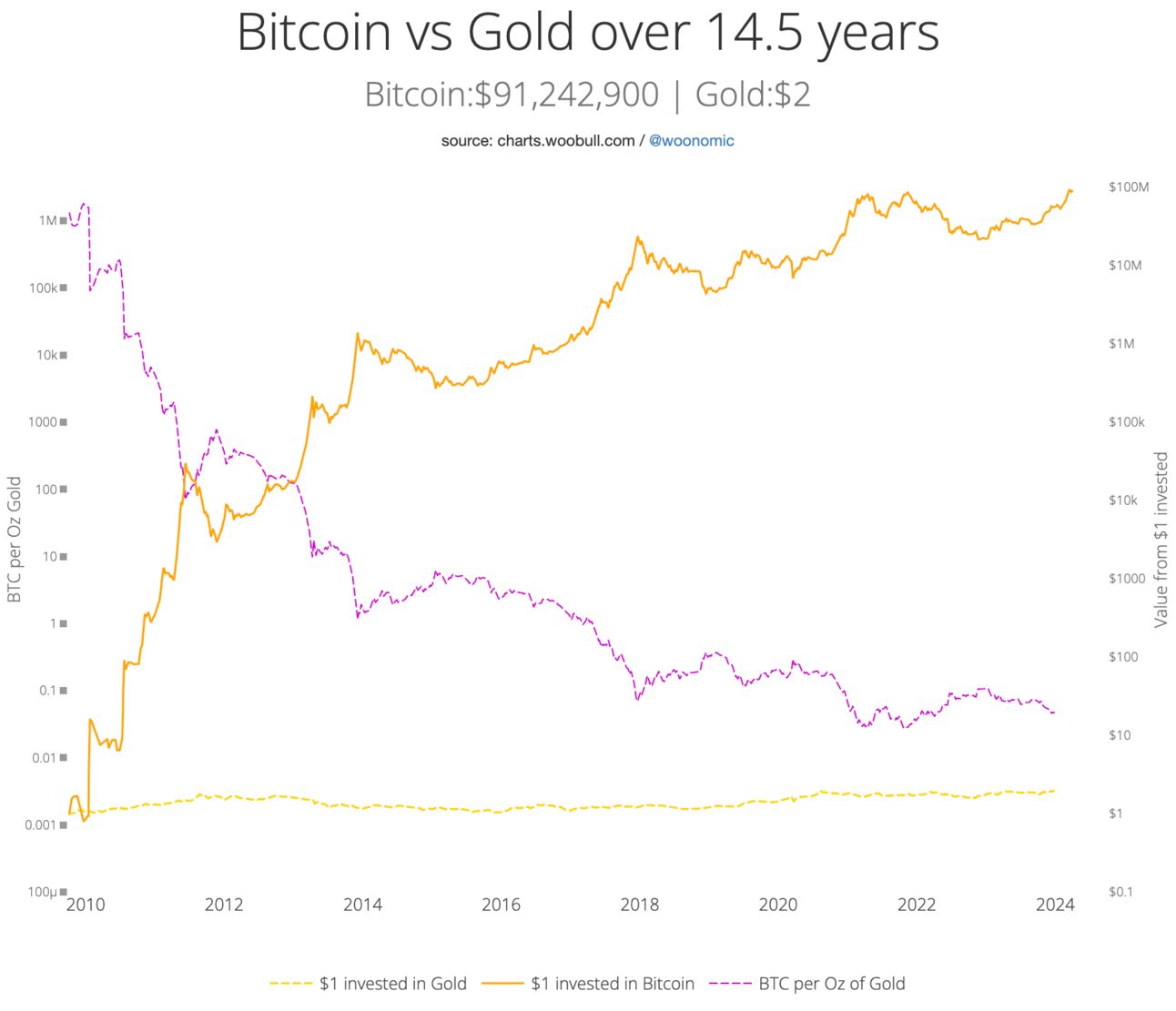

Pomp was asked this question as gold recently hit an all-time high.

Whilst Bitcoin has been consolidating around ~$67,000.

But zoom out a little and you’ll realise that between gold vs Bitcoin, it’s not even close.

And for the US dollar (as a store of value) it’s even worse:

“The dollar is down in purchasing power terms 25% since 2020. Bitcoin during that same time period is up 800%”

Pomp also explained why this time is different…

Wall Street is here.

And people are still underestimating the impact this will have going forward.

“Larry Fink is one of the kings of finance. If Larry Fink says: ‘Hey - I think this has got a shot’, people are going to listen. The messenger really matters. All of a sudden, when it comes from Larry Fink, it has a different weight to it.”

Closing out the interview, Pomp laid out a simple strategy for Bitcoin investors.

“The key thing with Bitcoin is if you think you’re going to speculate, gamble or trade this thing, you probably aren’t going to do so hot. But if you can simply learn to buy an asset, hold it for the long-term, Bitcoin’s been very good to those investors.“

That’s all there is to it.

Just buy it. And hold it. 💎 🙌

BULL MARKET HODLER DYNAMICS 🐂

It’s time to check in on the supply of Bitcoin last active 1+ years ago.

We love this chart. It’s so simple to understand and it’s extremely useful.

It categorises coins based on how long it’s been since they last moved on-chain. (as a percentage of the circulating supply)

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

Taking a look at the chart below you’ll notice significant dips in these metrics when Bitcoin reaches new all-time highs. (especially with the 1+ year age band)

Here’s the breakdown for each cohort (compared to what it was 2 weeks ago):

🔴 Supply last active 1+ years ago: 65.84% (down from 67.44%)

🟠 Supply last active 2+ years ago: 54.52% (down from 55.44%)

🟢 Supply last active 3+ years ago: 44.86% (down from 45.29%)

🔵 Supply last active 5+ years ago: 31.21% (down from 31.47%)

Over the last two weeks, all age bands have experienced a slight decrease.

No need to worry. This is perfectly normal.

As Bitcoin recently set a new all-time high, it’s only natural that some investors decide to lock in profits.

Take a look at the 1yr+ age band 🔴, it always dips as Bitcoin’s price increases throughout the bull run.

However, the 3yr+ and 5yr+ age bands are essentially still at their all-time highs.

With Bitcoin hitting a new all-time high & all the selling out of Grayscale, these numbers are incredible.

This time truly is different.

More & more investors are here for the long haul. Conviction in Bitcoin still extremely high.

CRACKING CRYPTO 🥜

Bitcoin Cash successfully completes halving, price leaps to its highest since 2021. Bitcoin Cash price soars 10% after blockchain halving event, reaches highest level since May 2021.

Binance ends support for Bitcoin Ordinals. Binance is ending support for Bitcoin nonfungible tokens just a few months after introducing it to its marketplace.

Aave DAO’s latest move against MakerDAO spurs fears of ‘walled gardens’ in DeFi. Aave’s DAO has made a flurry of moves aimed to preserve alignment within the organization over the past two months.

Ripple, Developer Behind XRP Ledger, Enters Stablecoin Fray vs. Tether. The token will be "100% backed by U.S. dollar deposits, short-term U.S. government Treasuries and other cash equivalents," according to the company

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Who wrote Ethereum's Yellow Paper, which serves as the formal definition of the Ethereum protocol.

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) Gavin Wood 🥳

The Ethereum Yellow Paper, authored by Dr. Gavin Wood, is the definitive technical document that underpins the Ethereum protocol. Vitalik wrote Ethereum’s white paper in 2013.

GET IN FRONT OF 62,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.