Today’s edition is brought to you by RAREMINTS

GM to all of you nutcases. It’s Crypto Nutshell #574 vibin’ out… 🎶 🥜

We're the crypto newsletter that's more exhilarating than a high-stakes race through the neon-lit streets of the future... 🚗💡

What we’ve cooked up for you today…

🥶 Inflation cools

🗺️ FOMO = 7 figure Bitcoin

📈 Always going on

💰 And more…

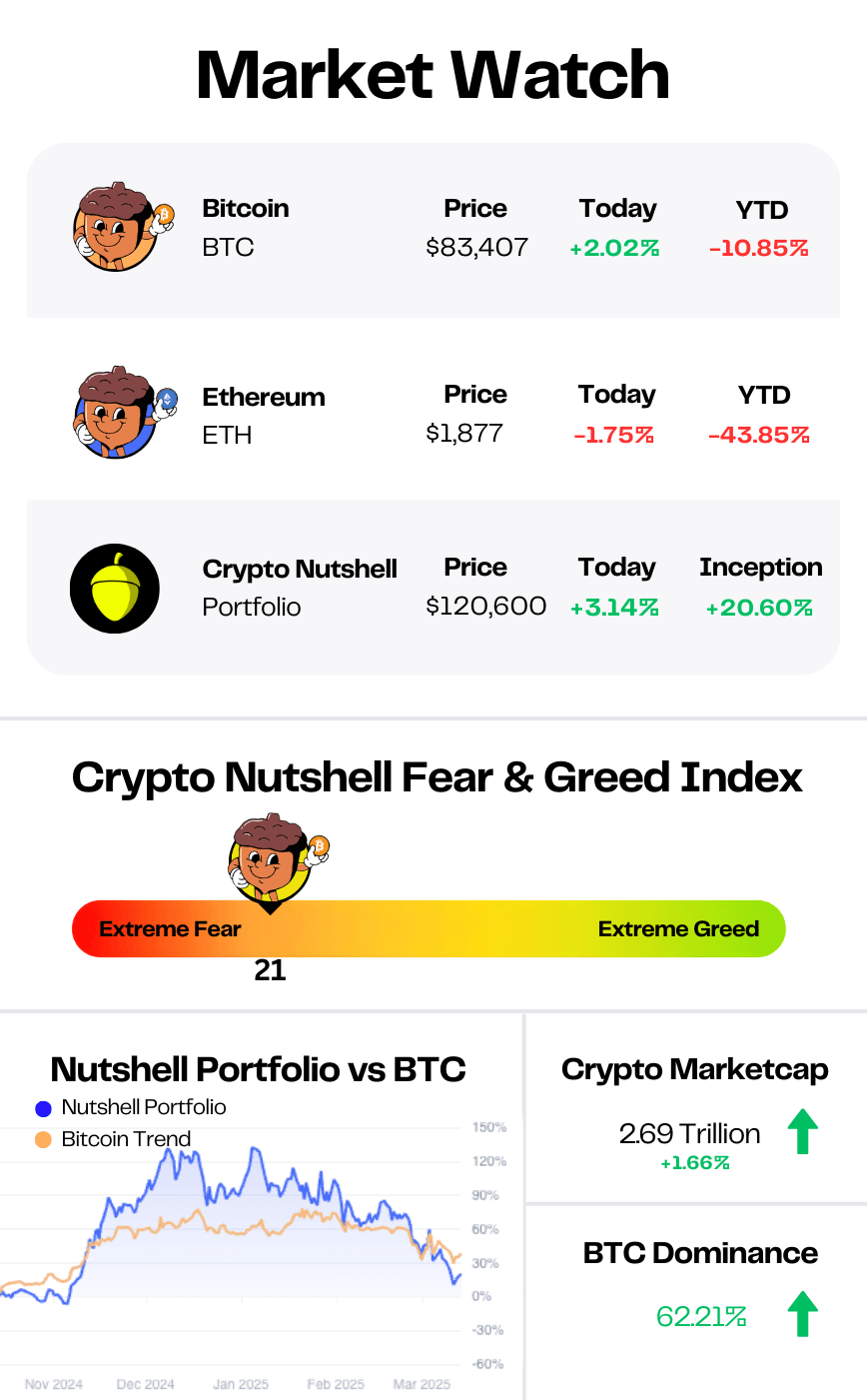

Prices as at 3:30am ET

INFLATION COOLS 🥶

BREAKING: US CPI comes in lower than expected — Are rate cuts coming?

The latest inflation report just dropped…

And it’s better than expected!

CPI rose 2.8% YoY, lower than the forecasted 2.9%

Core CPI came in at 3.1%, marking a decline from January’s 3.3% (and below estimates of 3.2%)

The good news? This softer inflation print has fuelled expectations for rate cuts later this year.

(Which in case you didn’t know is extremely bullish for risk assets such as Bitcoin and crypto)

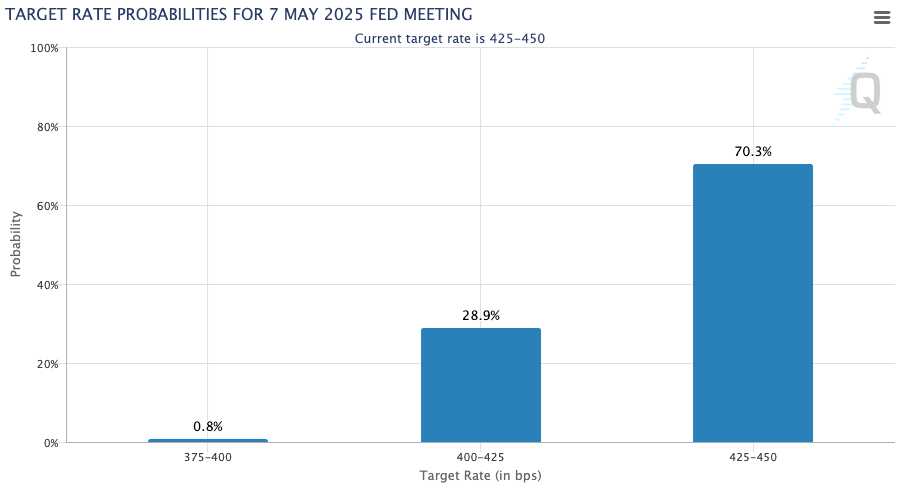

The probability of a May rate cut has surged to 28.9% - over 3x higher than last month.

While expectations for three cuts by year-end have jumped over 5x to 32.5%.

And four cuts have skyrocketed from just 1% all the way up to 21%.

May Rate Cut expectations

So how’d the markets react to this news?

Bitcoin briefly surged to $84,000 before cooling off to ~$83,000

Ethereum is up 0.50% in the last 24 hours however the ETH/BTC has hit its lowest level since April 2020.

Stocks rallied, with the Nasdaq up 1.8%, led by:

Meta (+4%)

Tesla (+8%)

Nvidia (+6%)

But here’s the problem…

Despite the positive CPI report, Bitcoin and crypto failed to sustain their gains.

Why?

Macro uncertainty is still front and centre…

Trump’s Tariff Chaos: The full impact of these tariffs are still not clear, complicating the Fed’s decision

The Fed’s Dilemma: Inflation cooling is good, but Trump’s economic policies could reignite inflation. This puts the Fed in a tough spot - cut rates too soon, and inflation might spike; delay too long, and markets could tank.

Market Fear: While rate cut expectations have increased, the market is still shaky after weeks of risk-off sentiment.

What’s Next?

All eyes are now on the Fed’s March 19 meeting. (Their next rate cut decision) 👀

While a rate cut isn’t expected at this meeting (current odds: 3%), Jerome Powell’s commentary will be critical.

If Powell signals a sooner than expected pivot, we could see the floodgates open for risk assets. 🌊

For now, macro remains in control.

DISCOVER THE NEXT 100X TOKEN 💎

The Harsh Truth About Crypto: Most retail traders lose money.

While those late to the party finally get in, project founders, VCs and early investors sell their bags for millions.

That said, there are still hundreds of tokens with 100X potential, you just need to find the right ones.

Crypto is an alpha-driven industry, where those who are early gain outsized returns, often for FREE via airdrops.

If you want to join RAREMINTS exclusive community where they break down trending crypto news, hand-pick tokens with 100X potential and share ALL of their trades, click on THIS LINK here.

What to expect:

Trending news, price alerts, and exclusive alpha to stay ahead of the curve

New projects and innovations broken down in under 5 minutes

Hand-picked tokens and memecoins with 100X potential, based on historical data and macro narratives

Join for FREE before others do. Your portfolio will thank you.

FOMO = 7 FIGURE BITCOIN 🗺️

The race to secure Bitcoin as a strategic reserve asset is now officially underway.

Nation-state FOMO has now begun and with Bitcoin’s supply locked at 21M, the path to 7 figures could happen sooner than anyone expects.

That’s the latest from VanEck’s Head of Digital Asset Research, Matthew Sigel.

In Sigel’s latest interview he laid out 3 key factors that could push Bitcoin to $1M per coin within 2 years:

The U.S. has legitimized Bitcoin as a strategic asset

March 6: Trump formally classified Bitcoin as a strategic reserve asset.

The U.S. isn’t selling its Bitcoin anymore - it’s holding it.

Other nations now have no choice but to follow

BRICS countries, Gulf nations, and emerging markets are watching.

If the U.S. is stockpiling Bitcoin, can they afford to be at zero?

Bitcoin’s supply is locked at 21 million - demand isn’t

Unlike gold, you can’t mine more Bitcoin when demand rises.

If nation-states start buying, there’s no liquidity left for retail.

How fast could this happen?

Sigel believes that if multiple governments announce purchases, Bitcoin’s illiquid supply would create a supply shock, triggering a rapid price spike.

A $1M Bitcoin within 24 months? It’s aggressive - but not impossible.

3 key questions to ponder:

What happens when central banks compete for Bitcoin in a fixed-supply market?

What if governments start front-running each other, just like we saw with the ETFs?

What if the U.S. eventually does start buying more Bitcoin?

The Strategic Bitcoin Reserve may have just changed the game.

VanEck thinks nation-state FOMO is inevitable - and the price action could be violent.

Are you positioned for what’s coming? 🤨

ALWAYS GOING UP 📈

It’s time for another look at Ethereum’s supply side dynamics.

Today we’ll be focusing on the amount of Ethereum currently being staked.

Quick Note: Ethereum staking involves locking up ETH to support the blockchain’s security. In return, users earn rewards for staking.

If you’d like to learn more about staking, check out this article.

As of today, 58,291,792 ETH is staked.

That’s an increase of 594,706 Ethereum in just the past two weeks. (~$1.13 billion at today’s prices)

And yes, this marks yet another all-time high. (This metric literally sets a new record daily.)

Here’s the crazy part though…

Staked Ethereum accounts for 49.28% of the entire circulating supply.

Nearly half of Ethereum’s supply is in the hands of long-term holders - investors who aren’t looking to sell anytime soon.

Despite weak price action, these holders remain locked in. 💪

With so much ETH taken off the market, supply is tightening fast.

Setting the stage for a potential supply squeeze.

CRACKING CRYPTO 🥜

SEC reportedly preparing to drop Ripple lawsuit, XRP jumps 5%. The delay in the settlement might come from Ripple, who is looking to avoid the $125 million fine ruled in an August court decision.

U.S. Treasury Market Most Volatile in 4 Months May Slow Any Bitcoin Price Recovery After CPI. Increased volatility in the Treasury market often leads to reduced risk taking in financial markets.

EU retaliatory tariffs threaten Bitcoin correction to $75K. “Tariff noise” will likely continue pressuring global and cryptocurrency markets until after April 2, limiting investor risk appetite.

SEC delays ETF filings for Dogecoin, XRP and others as agency awaits Paul Atkins’ confirmation. There are at least 60 spot crypto ETF proposals waiting for review, according to Bloomberg.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is Ethereum's current all-time high?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: $4,721.07 🥳

According to Coinbase, Ethereum’s current all-time high is $4,721.07

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.