Today’s edition is brought to you by Coinbase - the easiest way to purchase crypto.

GM to all of you nutcases. It’s Crypto Nutshell #647 keepin’ clean… 😶🌫️🥜

We're the crypto newsletter that's more unsettling than a dinner party where nothing—and no one—is what they seem... 🍷🕵️♂️

What we’ve cooked up for you today…

🏦 Something big is brewing

🧠 Gamestop is all in on Bitcoin

📉 Falling off a cliff

💰 And more…

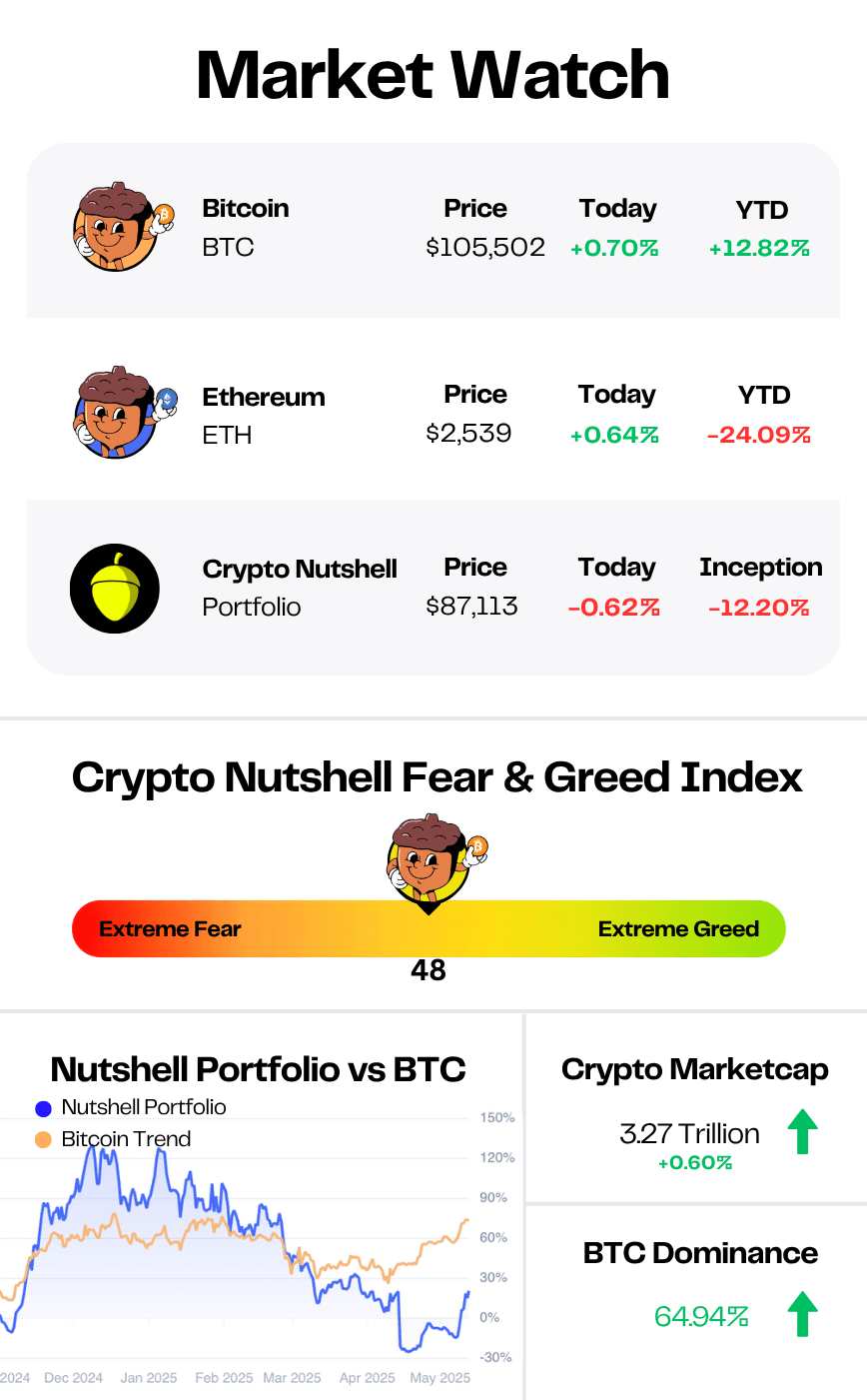

Prices as at 3:50am ET

SOMETHING BIG IS BREWING 🏦

BREAKING: CryptoQuant Warns of $92K BTC Drop as Analyst Views Diverge

At the time of writing, Bitcoin is hovering around $104,000.

Flat. Frozen. Stuck in place.

But under the surface?

The split in opinion couldn’t be sharper.

Some see quiet strength.

Others see a market one step away from cracking.

So… where are we heading next?

Here’s what the top analysts are saying:

CryptoQuant Fires A Warning

Bitcoin might look steady - but CryptoQuant says the foundation is weakening fast.

Spot demand is fading.

ETF flows have collapsed 60% since April.

Whale accumulation? Cut in half.

And short-term holders have offloaded over 800,000 BTC since late May.

Their key “demand momentum” indicator just plunged to -2 million BTC - the lowest reading ever recorded.

If the trend continues, they’re bracing for a retest of $92K. Maybe even $81K.

Glassnode sees the same data

But draws a very different conclusion…

Glassnode agrees the Bitcoin network is quiet:

Low fees, fewer transactions, subdued miner revenue.

But they argue it’s a shift in structure - not a sign of weakness.

On-chain activity is now dominated by large-value transfers.

Meanwhile, the real action has moved to derivatives, where futures and options volumes are 7–16x larger than spot.

Their read?

The market is maturing.

Less retail noise. More institutional precision.

Flowdesk lands somewhere in the middle

Flowdesk also acknowledged the low activity, thin altcoin flows, and flat market-making volume.

But they describe the market as “coiled” - not crumbling.

Stablecoin usage is climbing.

Tokenized gold is surging (up 56% in volume).

Real-world assets are gaining serious traction.

In their view, the lull could be a setup for a major move - and it doesn’t have to be down.

The Bottom Line:

Everyone agrees on one thing:

Volatility is coming.

But where Bitcoin goes next?

That’s anyone’s guess.

The quiet won’t last. Buckle up.

BUYING CRYPTO MADE SIMPLE 🤑

Buying crypto can be easy.

Knowing which exchange to trust? That’s where it gets complicated.

That’s why over 100 million users have started their journey with Coinbase - the most recognised crypto exchange in the U.S.

Here’s what makes Coinbase stand out:

A beginner-friendly platform with a clean interface, helpful tips, and easy access to 250+ cryptocurrencies 💰

Coinbase Advanced for pro-level trading tools - no separate account needed 📈

Staking made simple: earn rewards on ETH, SOL, ADA, and more, all without leaving the app 🥩

You’ll also get access to learning rewards (yes, free crypto), recurring buys, and a sleek mobile app - all backed by a publicly traded company with transparent financials and industry-leading security.

Whether you’re stacking Bitcoin weekly or diving into deep altcoin research…

GAMESTOP IS ALL IN ON BITCOIN 🧠

GameStop just made its boldest move since the meme stock mania - and the man behind it?

Ryan Cohen.

In his latest interview, Cohen confirmed it:

“We have. We currently own 4,710 Bitcoins.”

GameStop now holds over $300 million in Bitcoin - and they're not doing it for the memes.

Here’s why Cohen says they made the move:

Currency debasement is real 💸

Bitcoin and gold are hedges against global monetary risk.Bitcoin is more portable than gold 🌍

You can send it across the planet instantly - no armored trucks needed.It’s easier to verify ✅

Blockchain = built-in authenticity. No assay required.It’s easier to store 🔐

No vaults. No insurance headaches. Just a wallet.It’s got asymmetric upside 📈

Gold is a $20T market. Bitcoin is barely $2T. If Bitcoin wins - the upside is 10x.

And if you’re wondering if GameStop is trying to copy MicroStrategy?

Cohen made it clear:

“We’re not following anyone else’s strategy. We’re following GameStop strategy.”

But they are doubling down.

GameStop just filed to raise up to $2.25 billion through convertible notes - and according to filings, part of that capital could go toward buying even more Bitcoin.

Bitcoin isn’t just for hedge funds and nation-states anymore.

Now meme stocks are going full laser eyes.

GameStop’s not the first - and they won’t be the last.

Strap in. 🚀

FALLING OFF A CLIFF 📉

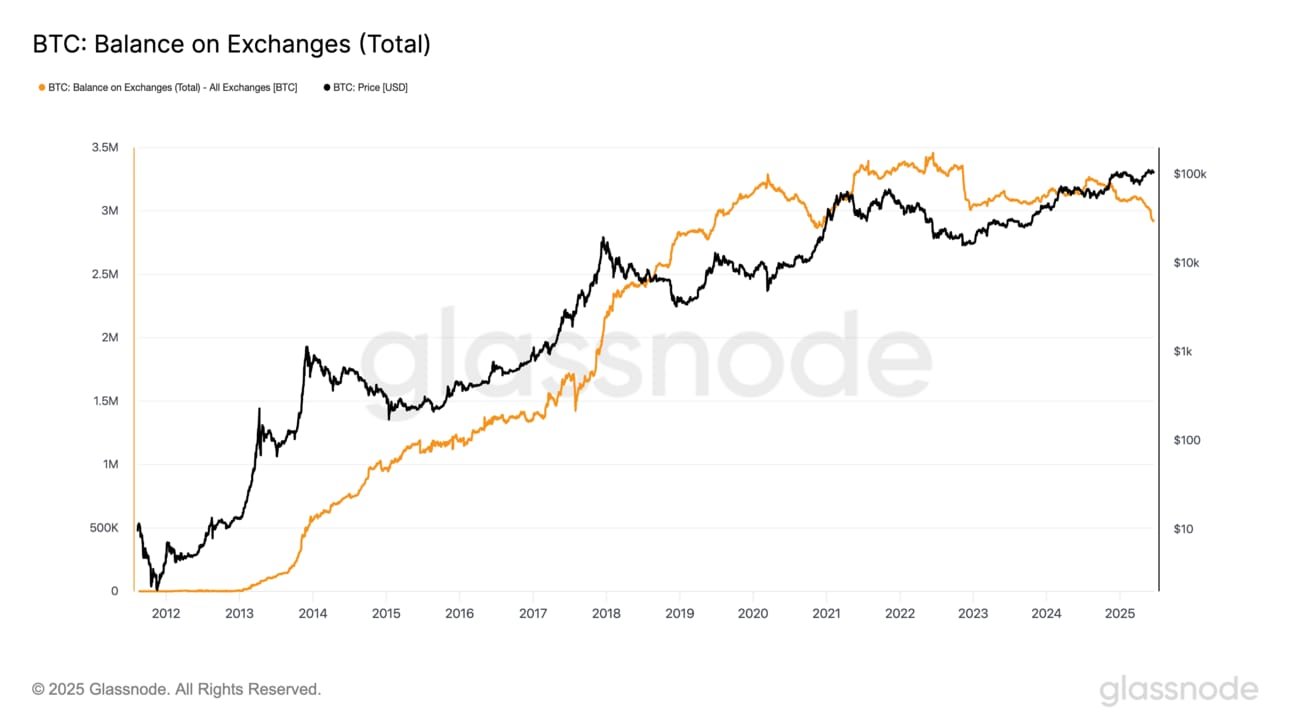

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Only 2,916,961 BTC now sits on exchanges - just 14.67% of total supply.

Translation?

There’s barely any Bitcoin left for sale…

In just the past three months, 161,581 BTC - nearly $17 billion - has vanished from exchange wallets.

The supply is drying up.

And the demand isn’t slowing down.

The playbook is playing out in real time:

Smart money is stacking

Exchange reserves are evaporating

And when supply disappears... price doesn’t stay still

This isn’t a setup on the horizon.

It’s unfolding now.

CRACKING CRYPTO 🥜

Ford explores decentralized legal data storage on Cardano blockchain. Cardano blockchain powers Ford and Iagon's initiative to enhance legal data handling and enterprise security.

South Korea to investigate fees of local crypto exchanges. South Korea’s Financial Services Commission reportedly plans to investigate transaction fees imposed by local trading platforms to check for the need for reductions.

Circle (CRCL) Jumps 34% as Stablecoin Bill Clears Senate, Extending Post-IPO 500% Rally. Wednesday’s rally reflects investor confidence that Circle will be the chief beneficiary if the U.S. formally embraces stablecoins as digital cash equivalents.

Semler Scientific hires crypto industry veteran, plans to double bitcoin holdings by end of year. As of June 4, Semler Scientific (SMLR) holds 4,449 BTC worth approximately $462 million at current prices.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the main purpose of Wrapped Bitcoin (WBTC) on Ethereum?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: To use Bitcoin in Ethereum-based DeFi protocols 🥳

WBTC lets users bring Bitcoin onto Ethereum, enabling them to lend, borrow, or trade BTC in DeFi apps like Aave and Uniswap — all while staying on-chain. 🔗🪙

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.