GM to all of you nutcases. It’s Crypto Nutshell #758 feelin’ the heat… 🌡️🥜

We’re the crypto newsletter that’s more inspirational than a math genius breaking codes the world said were unbreakable… 🧠🔐

What we’ve cooked up for you today…

📉 This is brutal

🎓 Harvard buys the dip

😱 Panic selling

💰 And more…

Prices as at 2:40am ET

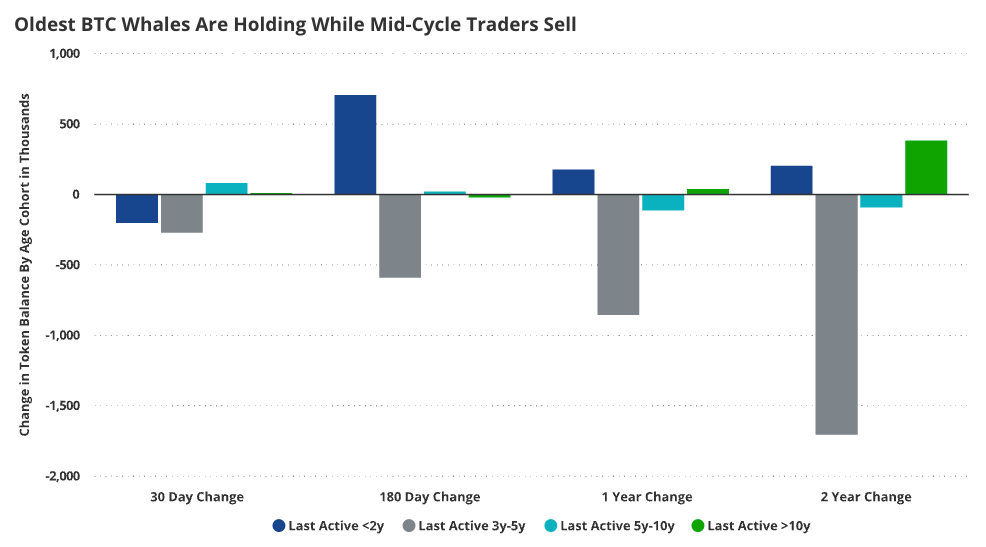

WHO IS SELLING? 📉

BREAKING: Bitcoin Sell-Off Led by Mid-Cycle Wallets While Long-Term Whales Hold Firm

Everyone is pointing at the whales again.

But VanEck’s latest ChainCheck report says the real sellers are not the OGs.

It’s the mid-cycle holders…

Bitcoin is now near multi month lows in the high $80Ks, about 30% below the October peak.

On the surface, it looks like classic top of cycle distribution.

But under the surface, it looks more like rotation.

Who is actually selling?

VanEck splits holders by how long it has been since their coins last moved.

The heavy selling is concentrated in coins that last moved within the past 5 years.

The 3 to 5 year band has been shrinking for two years, down about 32% as those coins change hands.

That is your classic “cycle tourist” cohort. People who bought in the last cycle or during the chop.

They are the ones hitting the bid now. And ETF data tells the same story.

Over the last 30 days, Bitcoin ETFs have bled around 49,000 BTC.

Roughly 2% of total AUM as late buyers near the top capitulate. That is painful. But it is not a structural rug pull.

Who is holding the line?

Coins that have not moved in over 5 years keep climbing.

VanEck notes the 5+ year cohort has grown by roughly 278,000 BTC in the last two years.

That is coins aging into the oldest band, not new money coming in.

Translation: The longest term holders are sitting tight through this entire drawdown.

At the same time, “smaller whales” are stacking.

Wallets with 100 to 1,000 BTC have increased their balances 9% over 6 months and 23% over 12 months.

So while the very largest whales trimmed over the last year, mid sized players absorbed that supply.

This is not one way exit liquidity. It is redistribution.

What this really looks like

Put it all together and the story changes:

Mid-cycle holders and top buyers are doing most of the selling.

The oldest whales are stable and still growing as a cohort.

Smaller whales are accumulating.

Prices are ugly. Sentiment is even worse.

But on chain, this looks less like long term conviction breaking and more like the market handing coins from impatient hands to patient ones.

Not a collapse. A reset.

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

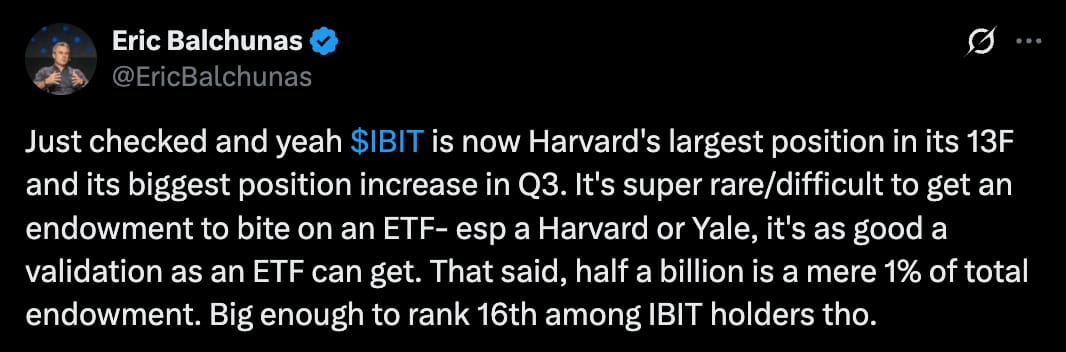

HARVARD BOUGHT THE DIP 🎓

While everyone was doomscrolling this past week…

Bitcoin nukes below $90K.

Sentiment in the gutter.

Retail panicking.

But behind the scenes?

Harvard - yes, that Harvard - quietly increased their Bitcoin exposure by 237%.

Their latest filing shows:

$442.8 million worth of Bitcoin ETFs.

And this wasn’t rumor or speculation - it was confirmed by Eric Balchunas, Bloomberg’s senior ETF analyst and the most trusted voice in ETF flow data.

Here’s what he said:

Let that sink in.

Harvard - the most prestigious endowment on the planet - made IBIT their #1 position last quarter.

And they did it during one of the most violent selloffs of the cycle.

But here’s the real kicker:

Harvard putting nearly half a billion dollars into Bitcoin ETFs is still only ~1% of their endowment.

Translation:

They’re dipping their toe. This could just be the beginning.

The takeaway?

While traders were panic-selling…

While Crypto Twitter convinced themselves “the top is in”…

The smartest capital in the world was buying:

Harvard.

BlackRock.

Michael Saylor.

Abu Dhabi

Institutions with unlimited time horizons.

They’re not trading candles.

They’re positioning for the next decade.

Remember that the next time fear kicks in. 👀

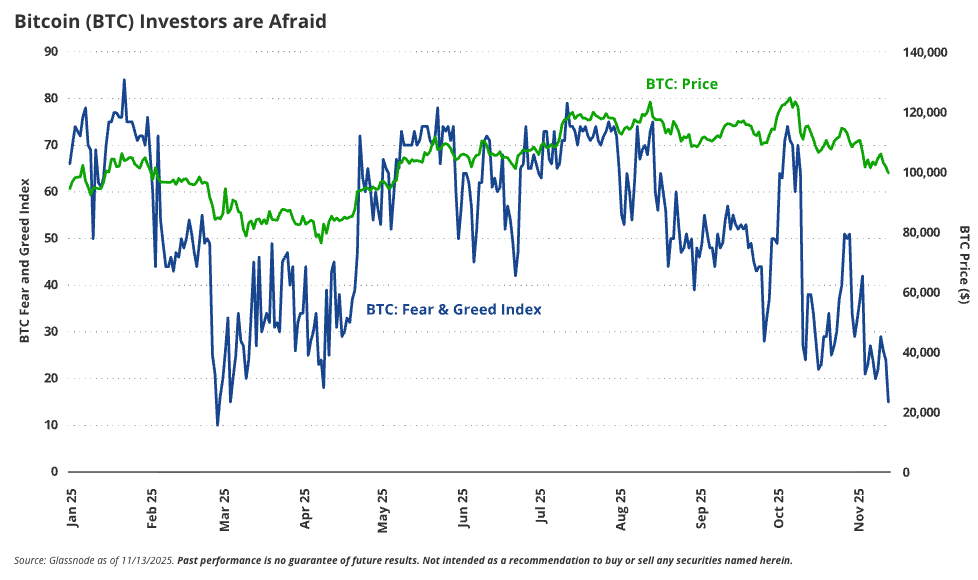

PANIC SELLING 😱

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Just 2,875,827 BTC now sit on exchanges - 14.42% of the total supply.

Since January, 203,228 BTC have been withdrawn - roughly $19.3 billion taken off the open market.

But here’s the twist…

Unlike ETH, where balances keep draining even during the drop, Bitcoin exchange balances rose by 6,813 BTC this week - about $647 million.

A sign that some panic selling has started to happen…

But the scale is still tiny compared to the yearly outflow…

Some people are breaking.

Long-term conviction isn’t.

CRACKING CRYPTO 🥜

El Salvador buys the dip defying IMF demands: Over $100M in BTC added as price wobbles. What the timing says about sovereign adoption, and whether it props up spot liquidity.

SEC enforcement actions dropped 30% under Paul Atkins. Cornerstone Research cited the US SEC's dismissal of a case against Coinbase as ”consistent” with the agency’s priorities under Chair Paul Atkins.

Bridgewater Founder Ray Dalio Says He Holds About 1% of Wealth in BTC. The hedge fund manager from Bridgewater continues to hold bitcoin but expressed preference for gold, while also warning a bubble looms over the U.S. economy.

JPMorgan says Strategy could face billions in outflows if MSCI and other major indices remove it. Strategy could see about $2.8B in outflows if MSCI removes it from its indices, and another $8.8B if other index providers follow.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

We’re got something extra special for you today.

Instead of a single trivia question, you’re getting a 5 question weekly quiz pulled straight from this week’s Crypto Nutshell issues.

If you’ve been paying attention, you’ll crush it.

If you’ve been skimming, it will show.

Tap the button below to start this week’s quiz, then tell us how you scored in the poll at the bottom of this newsletter. 👇️

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.