GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter more empowering than being chosen by a sword in a stone to rule a kingdom... 🗡️👑

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Why the USD is going to ZERO 📉

Bitcoin’s Hash Rate hits an all time high 📈

And more…

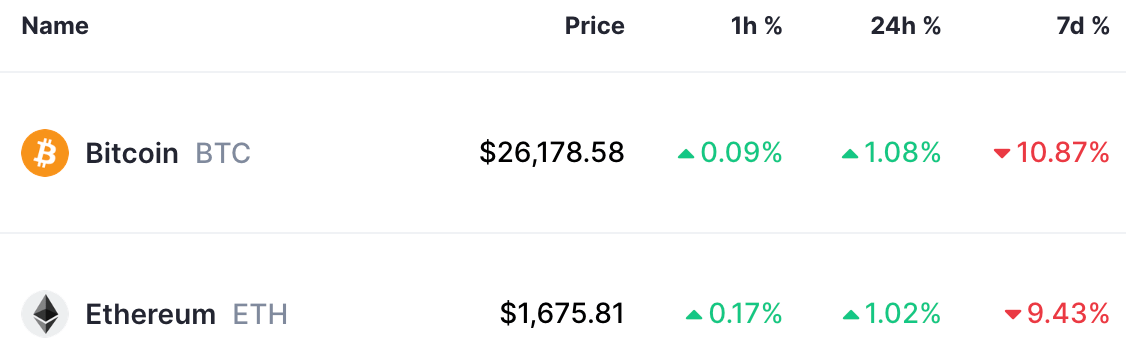

MARKET WATCH ⚖️

BTC Dominance is currently at 49.02% and the current crypto market cap is $1.06T ▲1.19%

Biggest Winners of The Day 🤑

XRP (XRP) ▲8.25%

Toncoin (TON) ▲5.42%

Litecoin (LTC) ▲1.74%

Biggest Losers of The Day 😭

Shiba Inu (LCH) ▼0.70%

UNUS SED LEO (LEO) ▼0.58%

Only the top 20 coins measured by market cap feature in this section

All price data as of 8:55am ET

PUBLIC COMPANIES THAT OWN BTC 📈

Here’s an interesting chart for you to start your day. Let’s take a look at the leaderboard of Public companies that own Bitcoin. 🤑

Michael Saylor’s MicroStrategy is well ahead of the competition, holding more than 10x the amount of Bitcoin of second placed Marathon Digital.

Taking a look at how much Bitcoin all of these companies hold, isn’t it insane that MicroStrategy holds more than everyone else on this list combined? 🤯

Also note how MicroStrategy, Tesla and Block are the only companies in this list that aren’t directly involved in the Crypto Industry. The rest of the companies are either Bitcoin miners, crypto exchanges, or are involved with BlockChain technologies.

Who will be the next non-crypto company to purchase Bitcoin? 🤷♂️

Let us know what you think in the poll at the bottom of this newsletter. 👇

EXPERT OF THE DAY 💰

Michael Saylor is the undisputed King of Bitcoin. Not only does his public company, Microstrategy, own 152,800 Bitcoin but Saylor himself owns 17,732 Bitcoin.

Combined, this is worth a whopping $4.47 billion dollars. 💰

He’s truly gone, all in.

In his latest interview, he made a guarantee.

The US dollar will collapse. 📉

This seems like an insane prediction coming from someone who literally studied rocket science at MIT, but Saylor argues if you look at history and the stats of fiat currency, the pattern is clear.

Throughout history, every currency ever created goes to zero on a long enough timeline.

“There have been 10,000 currency collapses. From the Lydians to the Athenians to the Spartans to the Romans to the Venetians to the Brits to the Carthaginians to the Persians. You could just go on and on and on and on and history is full of examples.”

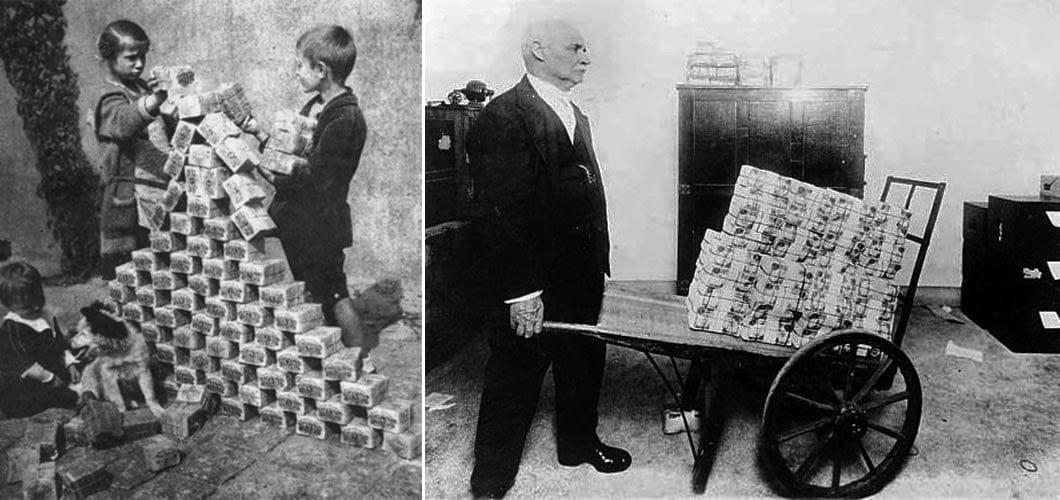

There are thousands of examples of this. Here are 3 of perhaps the most noteworthy:

Ancient Rome: The denarius, Rome's silver coin, was steadily debased over time, leading to inflation and eventually contributing to the economic decline of the empire.

Revolutionary France: The rapid printing of the "assignat" during the French Revolution led to hyperinflation and the collapse of the currency.

Germany after World War I: The Weimar Republic experienced hyperinflation in the early 1920s, famously resulting in wheelbarrows of money needed to buy basic goods.

Throughout history, there are 3 common factors that contribute to the collapse of a currency. These are:

Excessive money printing

High national debt

Economic mismanagement

Once you look at the facts throughout history, Saylors prediction doesn’t seem insane at all. It looks logical. It’s not a matter of if the US dollar is going to collapse, but when.

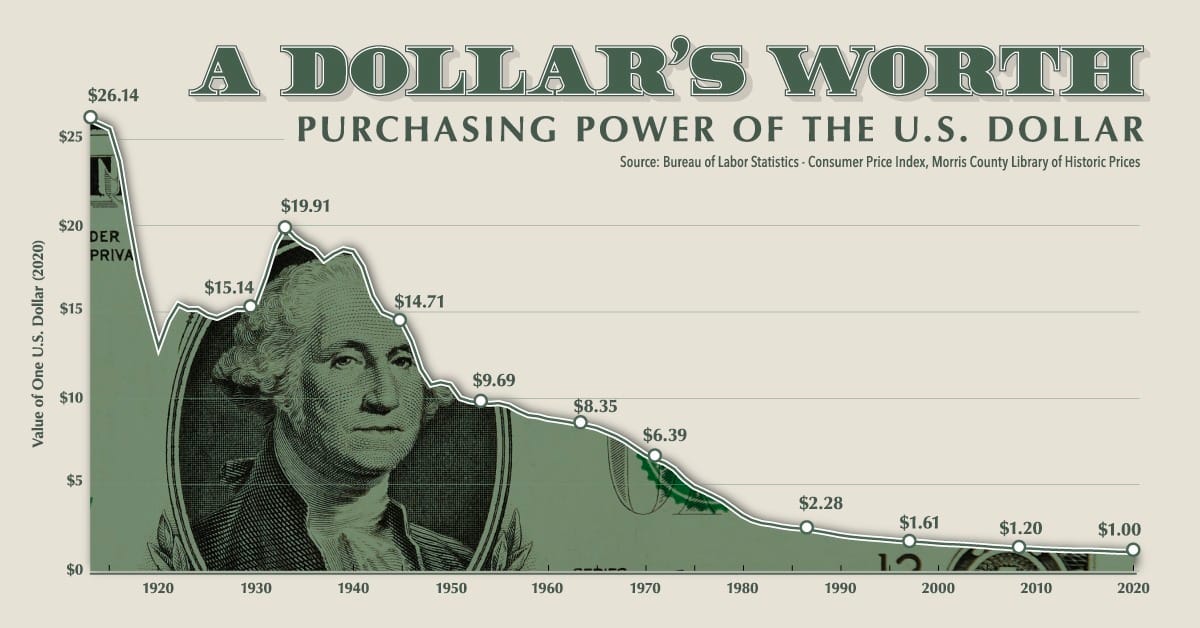

Check out this chart which illustrates this point.

Luckily, there’s now a way to opt out of the devaluation of your currency.

Bitcoin. 👑

Nutty’s takeaway: Take a look at the 3 common factors that contribute to the collapse of a currency again.

Excessive Money Printing. High National Debt. Economic Mismanagement.

Does that remind you of anywhere? 🇺🇸

ON CHAIN DATA DIVE 📊

How about some good news?

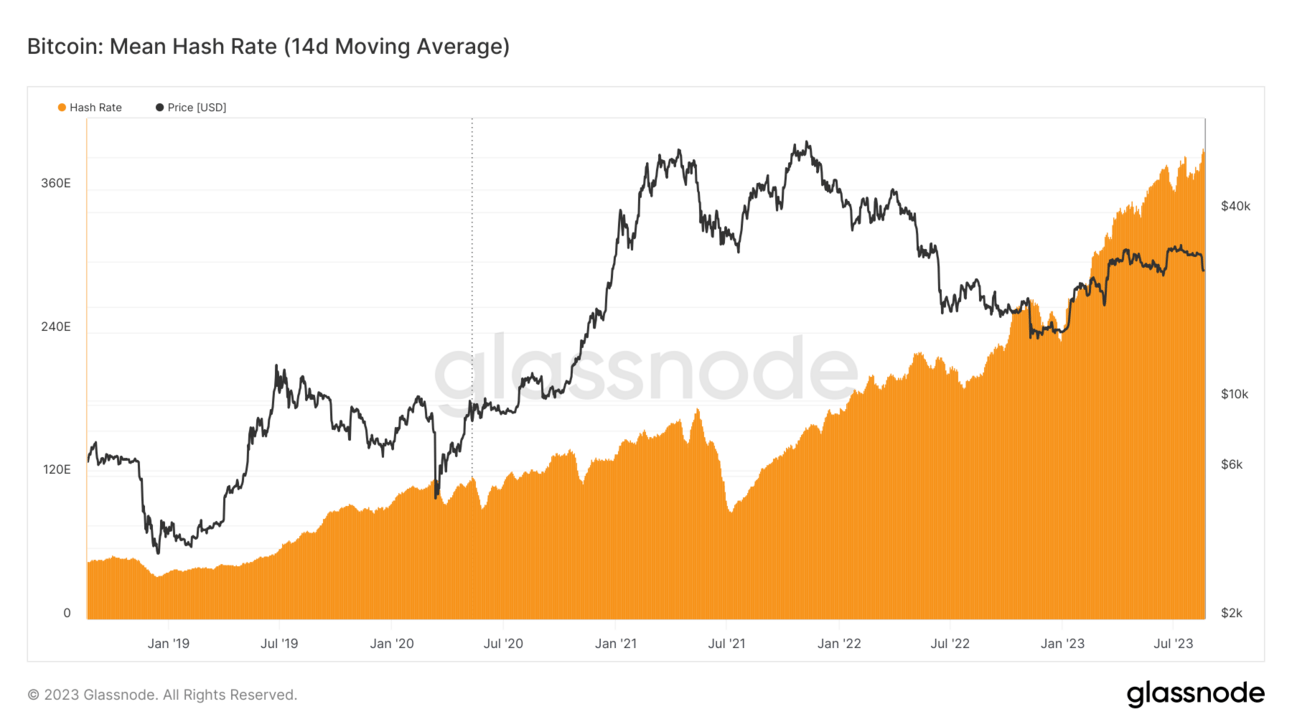

Bitcoin’s hash rate just reached an all time high of 400 trillion hashes per second (Th/s).

The hash rate is basically the total amount of processing and computing power of the Bitcoin network. It’s a crucial indicator of Bitcoins network strength and security.

Hash rate increase: the networks total computational power is rising and the becoming more secure

Hash rate decrease: the network is more at risk of cyber attacks and is becoming less decentralised.

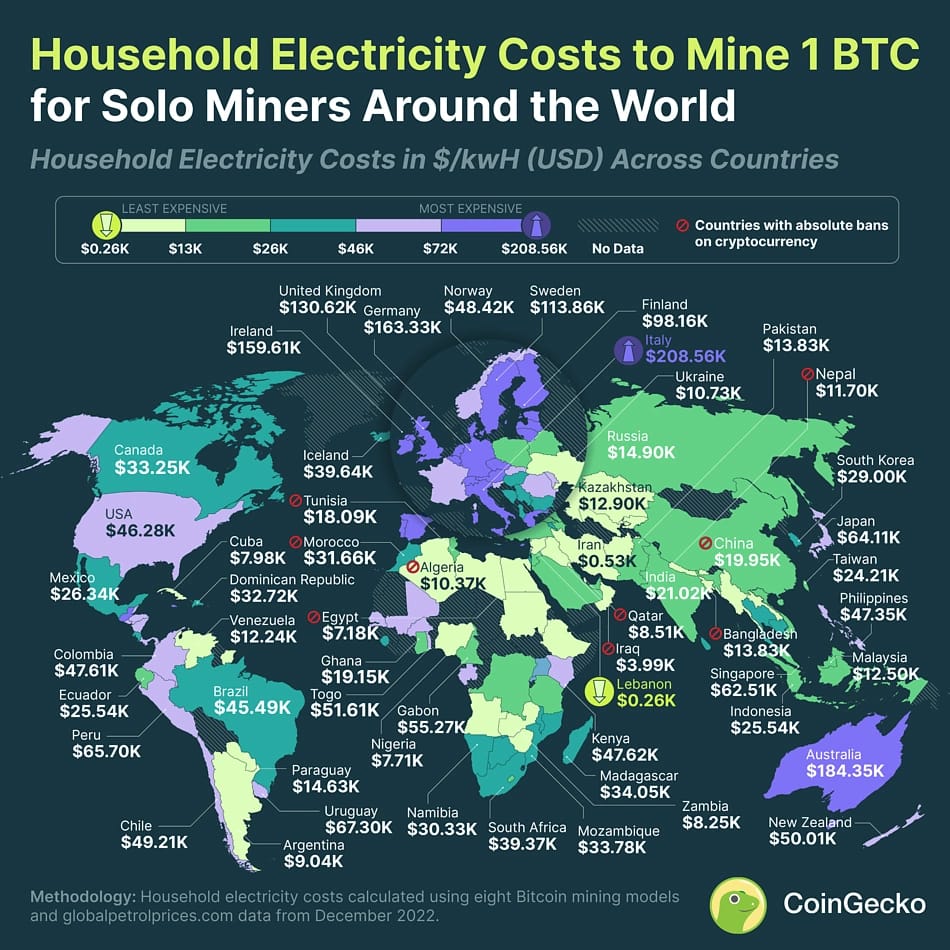

Have you ever wondered how much it would cost to mine 1 Bitcoin at home?

Yes? Well you better have a spare $46,291.24 lying around. That’s how much it would cost the average household in electricity to mine 1 Bitcoin, according to a report by CoinGecko.

CoinGecko revealed that only 65 countries are profitable for solo Bitcoin miners. 34 of these countries are in Asia, while Europe only has five.

Italy tops the charts as the most expensive with electricity costs per coin coming in at $208,560. 😱

You could buy roughly 8 Bitcoin for that amount…

Lebanon comes in as the cheapest with the electricity cost per coin only at $266. How so cheap? 🤯

Most profitable countries to mine 1 Bitcoin:

Lebanon - $266.02 🇱🇧

Iran - $532.04 🇮🇷

Syria - $1,330.1 🇸🇾

Ethiopia - $1,596.12 🇪🇹

Sudan - $2,128.17 🇸🇩

Libya - $2,660.21 🇱🇾

Kyrgyzstan - $2,660.21 🇰🇬

Angola - $3,724.29 🇦🇴

Zimbabwe - $3,990.31 🇿🇼

Bhutan - $4,256.33 🇧🇹

Least profitable countries to mine 1 Bitcoin:

Italy - $208,560.33 🇮🇹

Australia - $184,352.44 🇦🇺

Belgium - $172,381.50 🇧🇪

Denmark - $166,795.06 🇩🇰

Germany - $163,336.79 🇩🇪

Ireland - $159,612.50 🇮🇪

Lithuania - $152,163.92 🇱🇹

Netherlands - $137,798.79 🇳🇱

United Kingdom - $130,616.23 🇬🇧

Cayman Islands - $128,222.04 🇰🇾

Nutty’s Takeaway: If Bitcoin is so cheap to mine in Lebanon then why isn’t everyone doing it? At first glance this looks like a money making glitch doesn’t it?

It’s important to keep in mind that this report was only based on average electricity costs and didn’t consider the feasibility and other logistics.

Also most of these countries are facing electricity shortages and periodically turn off all electricity, making mining Bitcoin a little difficult.

However there definitely seems to be some potential here… (trip to Lebanon anyone?) 🇱🇧

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

The data in a blockchain gets stored in ________ .

A) Buckets

B) Blocks

C) Cubes

D) Bricks

Find out the answer at the bottom of this newsletter 😀

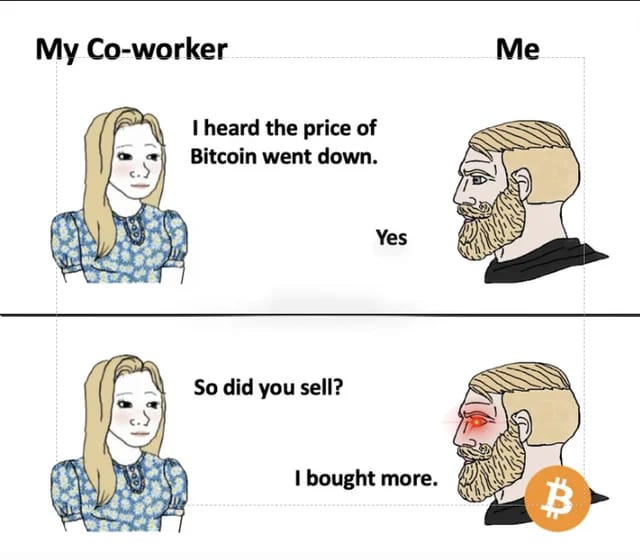

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) Blocks 🎉

The data in a blockchain gets stored in “blocks".

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.