GM. Crypto Nutshell comin’ in hot! 🫶 🥜

We’re the crypto newsletter that won't disappear like people in a small town plagued by supernatural occurrences... 🌌👻

Today, we’ll discuss:

Mark Cuban hacked 👾

Will the FED will crash markets? 🤔

Short-term holders down bad 🍑

And more…

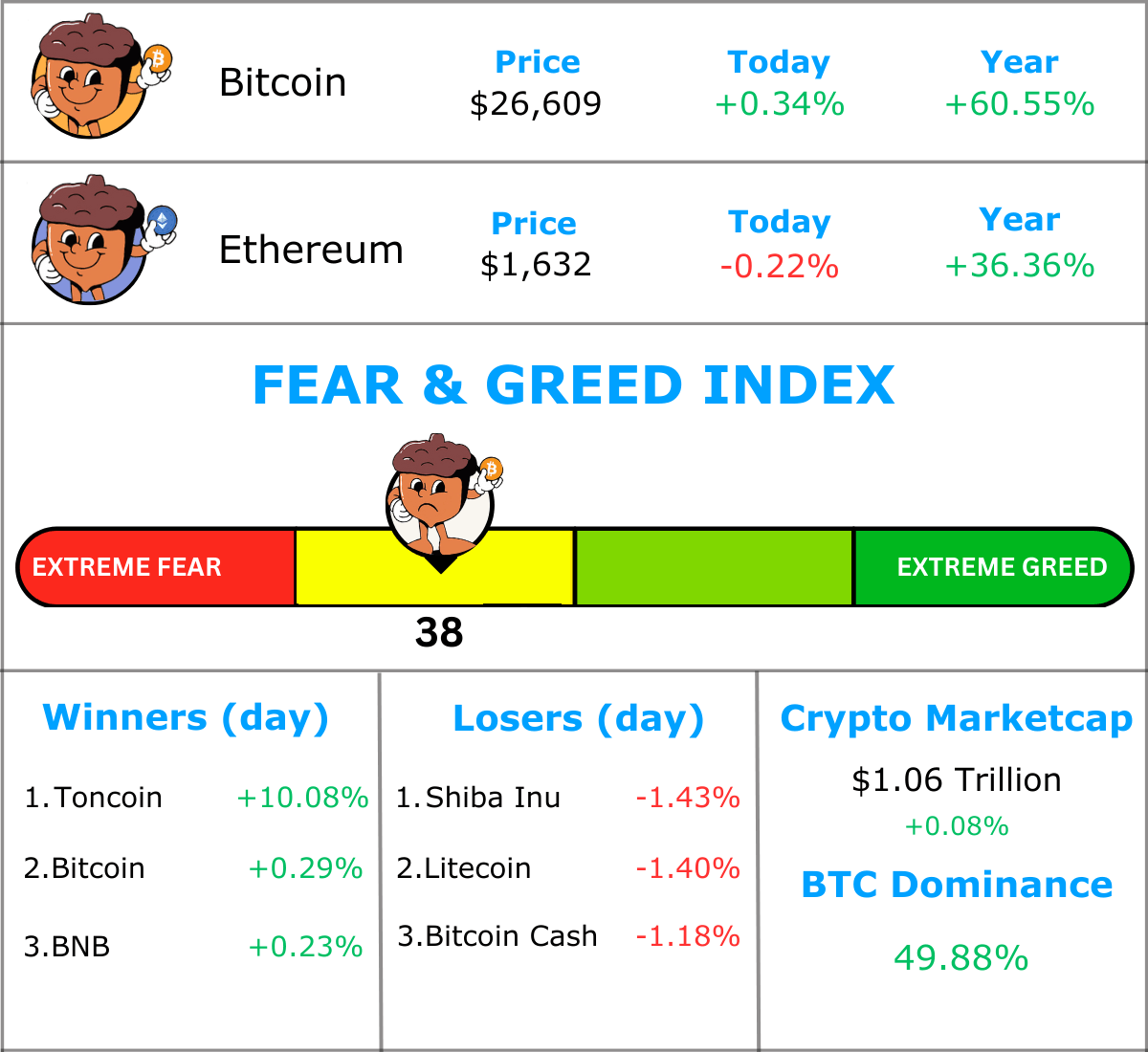

MARKET WATCH ⚖️

Prices as at 7:45am ET

Only the top 20 coins measured by market cap feature in this section

MARK CUBAN HACKED 😲

JUST IN: Billionaire investor Mark Cuban loses $870K in crypto in MetaMask wallet hack

Billionaire investor Mark Cuban, whose net worth is over $5 billion, is the latest to fall victim to a wallet hack. Cuban’s wallet was drained of $870,000 worth of crypto assets including Ethereum, USDC, Polygon and Lido Staked ETH to name a few.

Before going any further let’s put this in perspective. With Mark Cuban’s net worth of $5 billion this would be like the average person losing $590.

Enough to sting a bit but not the end of the world.

“I went on MetaMask for the first time in months. They must have been watching”

Crypto investigator Wazz was the first to pick up on this hack highlighting suspicious behaviour with Cuban’s Metamask wallet that had been inactive for 6 months.

Luckily for Cuban, he was able to transfer out ~$2 million in USDC to Coinbase Custody before the hacker could take any more.

A couple of lessons to be learned here:

Never leave a significant amount of assets in your Metamask hot wallet (this guy had ~$3 million just sitting there)

Always be careful of links you click when dealing with crypto wallets

Never sign any transaction with your Metamask wallet that you aren’t 100% sure is safe

TOGETHER WITH THE PHENOM UPDATE ⛫

Crypto is like the wild west of investing.

It’s not uncommon to see 10x, 50x or even 100x plus returns in a bull market.

As much as we love Bitcoin & Ethereum, unfortunately they’re most likely not going to pull a 100x next bull run. They’ve gotten too big.

The next 100x gem is probably going to come from a coin you’ve never heard of.

The problem? There are literally thousands upon thousands of coins.

That’s why we read The Phenom Update.

They share the best kept secrets on the latest DeFi & crypto trends. 🤫

The best part?

Just like us, they’re completely free.

Click that beautiful subscribe button and it’ll automatically add you to their list.

If you’re not a fan, you can always unsub. Nothin’ to lose. 🎉

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

WILL THE CRASH MARKETS? 🤔

There’s a lot of debate at the moment over wether or not we are going to see a crash in traditional markets.

With the FED raising interest rates at the fastest rate in history, something has to break. Right? 🤔

We saw some things break earlier this year with the regional banking crisis.

Many thought this would be the end of the interest rate hikes, yet since then, we've seen 3 more rate hikes.

This is bad for crypto prices.

With such an aggressive FED, economists such as David Rosenberg believe it's inevitable we'll see a 2001/2008 level crash.

Macroeconomist, Raoul Pal, disagrees.

He believes that 2022 was the result of the rate hikes and now everything's priced in. Crypto & equity markets are forward looking, so now look to the future when the FED pauses or cuts.

Raoul also argues that the FED will likely pause or cut rates in Q4 this year.

If he’s right, that would be a major catalyst for crypto.

“Last year was a terrible year. It was the worst year in the history of the 60/40 portfolio. Everybody's wealth went down at every level. Liquidity massively tightened. The equity markets all went down, but people didn't get their ‘justice warrior’ 50% crash. I said from the beginning of this this is going to look more like 1990 than it will to 2008. But everybody wanted their 2008 crash or their 2001 crash and what they got was a 1990 recession. Which was: the market goes down 20%, 25% and then moves on its way.”

Bottom line: Who’s right? No one can say for sure. 🔮

We tend to agree with Raoul, in that 2022 was the bottom at least for crypto. It’s hard to top the combination of rate hikes & FTX.

SHORT TERM HOLDERS DOWN BAD 💵

Today we’ll be taking a look at two investing cohorts, short-term and long-term holders. The Percent Supply in Profit metric works by comparing the price when coins were last moved to the current market price. If the price when a coin last moved is below the market price, then that coin is considered to be in profit.

Short-term holder (STH): coins held for less than 155 days

Long-term holder (LTH): coins held for more than 155 days

As of today, only 16.3% of the STH supply is in profit, meaning the other 83.7% are holding an unrealised loss. The recent price dip has severely impacted these STHs. 😱

Before this dip, Bitcoin had been trading around the $28,000 - $30,000 mark for quite some time (short-term holders would have purchased within this range). So any upwards price movement back to this range would explode the majority of short-term holders back into profit. 🤑

While the STHs are deep underwater, the long-term holders have only seen their supply in profitability increase from the cycle bottom.

As of today, 73.3% of the LTH supply is in profit, meaning that only 26.7% are holding an unrealised loss. 😎

Takeaway: At first glance it might seem that short-term holders are f*cked. But that isn’t actually the case.

With some upwards price action we would see a large amount of these short-term holders flip back into profit. But if the price dips again we could be in for some trouble as selling pressure increases…

We’ll keep you updated.

CRACKING CRYPTO 🥜

CAN YOU CRACK THIS NUT? ✍️

Yesterday we did a deep dive into Ethereum and how the merge impacted the network.

Approximately, what percentage of the Ethereum supply is currently being staked?

A) ~24.83%

B) ~25.48%

C) ~37.43%

D) ~14.79%

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) ~24.83% 🥳

Yep that’s right, pretty much 1 quarter of the Ethereum supply is locked up for staking. Make sure you check out yesterday’s edition for our Ethereum deep dive.

GET IN FRONT OF 10,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.