Today’s edition is brought to you by Heatbit - the world’s only heater-purifier that makes $15 / month while on

Get your Heatbit Mini and join the Bitcoin network today!

GM to all 14,829 of you. Crypto Nutshell #115 spookin’ through. 🛸 🥜

We’re the crypto newsletter that's more heart-warming than an alien trying to phone home...🌌👽

Today, we’ll be going over:

🤪 Cointelegraph f*cks up

🌎 Worlds most powerful man wants Bitcoin

🧐 Pricing signal reached

🤑 And more…

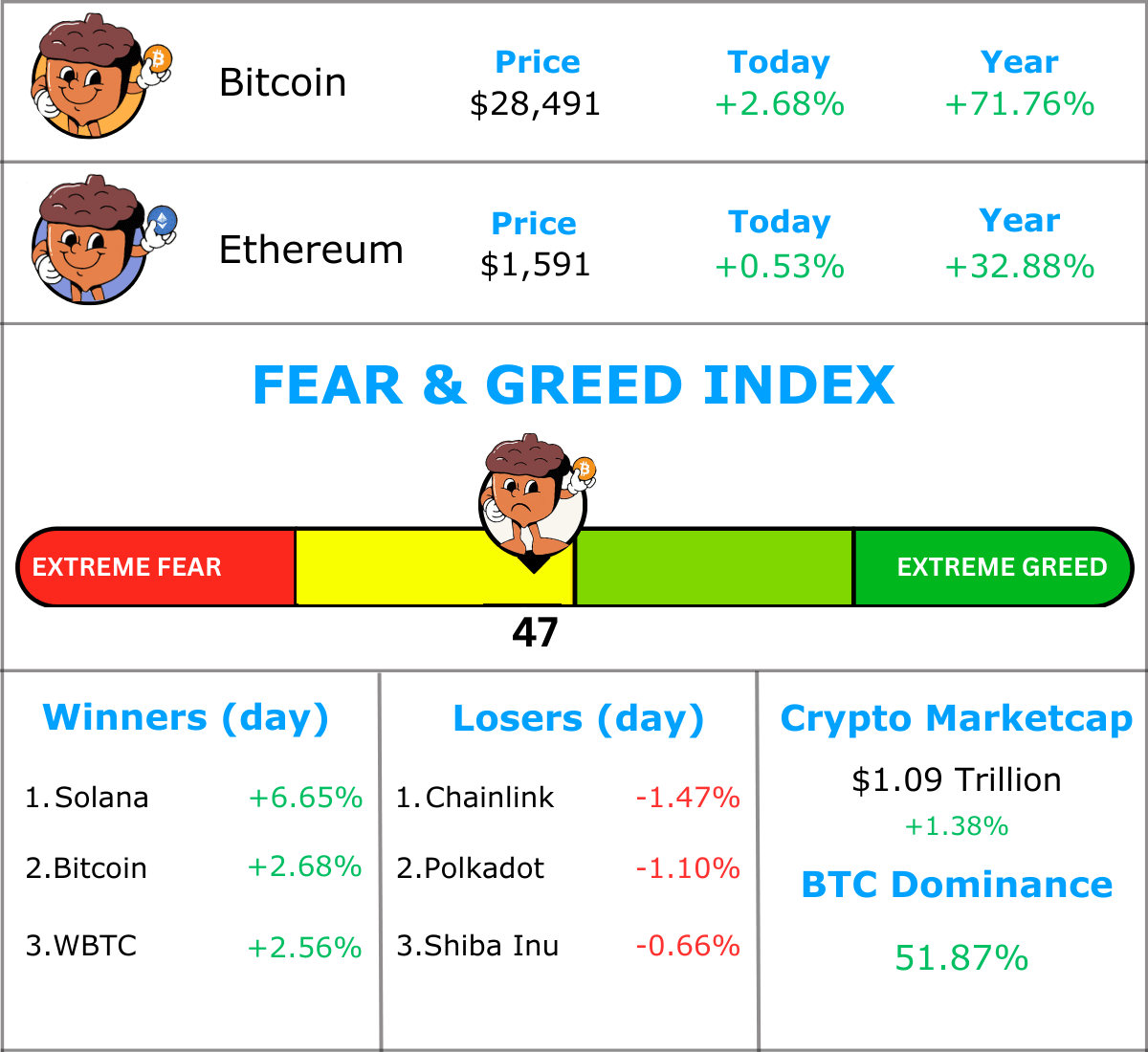

MARKET WATCH ⚖️

Prices as at 6:20am ET

Only the top 20 coins measured by market cap feature in this section

COINTELEGRAPH F*CKS UP 🤪

BREAKING: Bitcoin spikes 10% on false report of BlackRock ETF approval

Yesterday morning, we all woke up to the news we’ve all been waiting for…

The BlackRock ETF had finally been approved. 😱 🎉

According to a tweet from Cointelegraph… with absolutely no source…

This tweet immediately went viral. Everyone was celebrating. It had finally happened.

Bitcoin’s price reacted by instantly rocketing up to $29,483.

But then ETF experts soon picked up on this tweet. No one could identify any sources claiming this to be true. And eventually it was confirmed to be fake news… 😢

Bitcoin’s price immediately crashed on this confirmation. However it is still trading above $28,000 at the time of writing.

It’s insane the impact one tweet can have.

In fact, the past 24 hours alone saw $136.5 million in positions be liquidated. All off a single tweet.

Cointelegraph’s Editor-in-Chief definitely had an interesting take. Apparently it’s our fault as the readers for putting too much pressure on them to get news out ASAP… 😂

The SEC’s response…

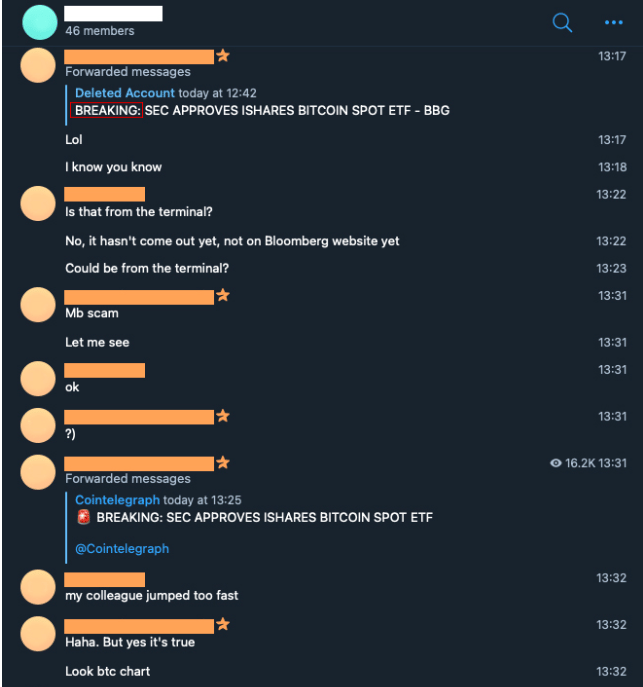

Cointelegraph has since revealed the full timeline of how this unfolded (props to them for being this transparent and owning up to their mistake).

In the article they reveal where they initially picked up on this news.

A telegram account (now deleted) posted it in a channel they use to scout breaking news…

So although the ETF approval turned out to be fake - there was a positive to takeaway. There’s a huge amount of money on the sidelines just waiting for approval. 🌊

P.S. Top ETF analysts have approval odds at 90% by January 2024…

TOGETHER WITH HEATBIT 🔥

If you read the Crypto Nutshell - you’re probably a fan of Bitcoin... 🤔

But unless you know what you’re doing, joining the network & mining Bitcoin is pretty complex and difficult…

Well now, thanks to Heatbit - there’s an easy way. Heatbit Mini is the world’s first and only heater-purifier that mines Bitcoin and puts $15 in your pocket monthly.

Powered by last generation silicon chips - same as iPhones and Macs to mine at 10 TH/s ⛏️

Maintains energy consumption on par with traditional appliances and operates silently 😴

Connects seamlessly to your phone to manage the heater and your mined Bitcoin 📲

Heatbit has partnered with us to offer all Crypto Nutshell readers 5% off any of their purchases. Just use the discount code: TREE

Click here to grab a heater that warms you up, purifies the air and generates you a monthly income through Bitcoin. 🚀

WORLDS MOST POWERFUL MAN WANTS BITCOIN 🌎

Following the Cointelegraph false alarm on the Bitcoin spot ETF, Larry Fink appeared on Fox Business.

When Larry Fink speaks, everyone listens. That’s because:

He’s the CEO of BlackRock, the largest asset manager in the world 🌎

Has over $8.5 Trillion under management 💰

Arguably the most powerful & influential figure in investing 👑

Larry Fink has a unique perspective as BlackRock are one of the front-runners in the Bitcoin ETF-race.

Here’s what he had to say on the Cointelegraph report and Bitcoin.

First off, he had only just heard about it before the interview:

“I was busy all day, I only heard it an hour ago.”

He also believed the rally in Bitcoin extended beyond the false report:

“This rally is way beyond this (ETF) rumour…. It’s an example of the pent up interest in crypto… We’re hearing from clients around the world about the need for crypto.”

Fink concluded that “the rally today is about a ‘flight to quality’ with all the issues surrounding the Israeli war.”

When the CEO of the largest asset manager in the world is calling a rally in crypto a ‘flight to quality’…

How could you NOT be bullish? 🐂 😉

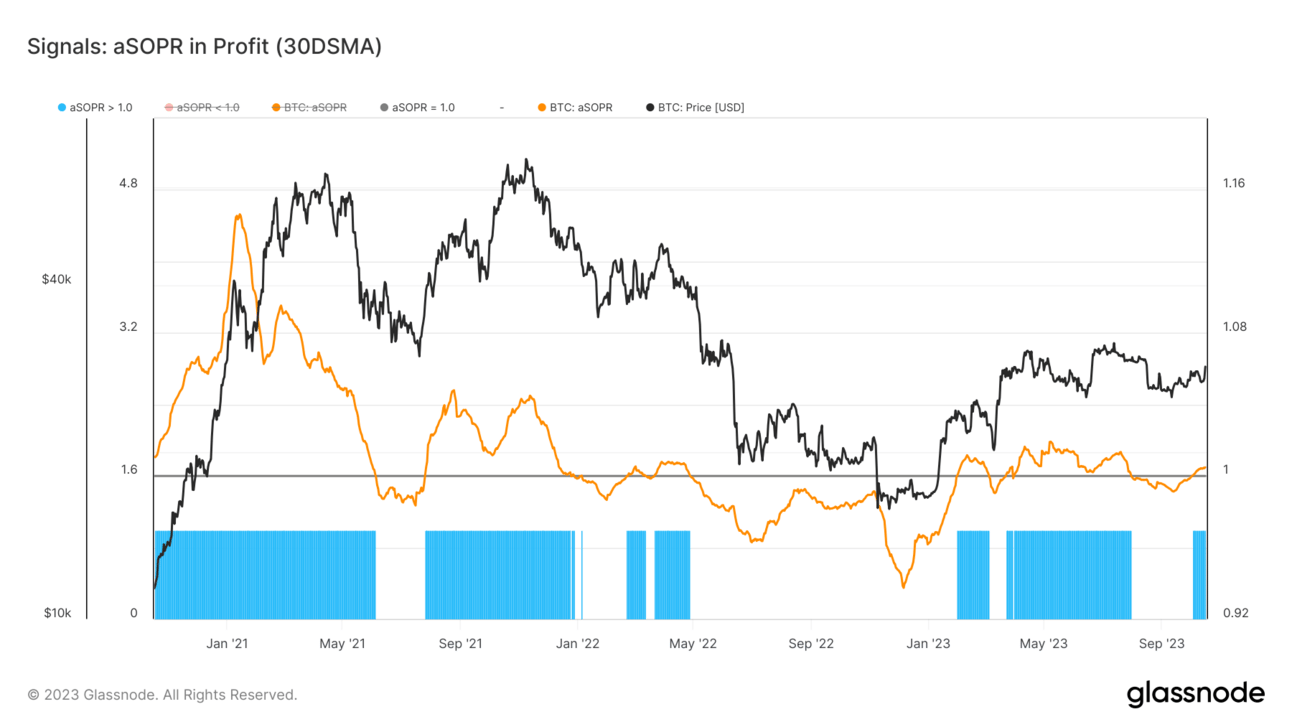

PRICING SIGNAL REACHED 🧐

With Bitcoin’s recent price rally above $28,000, a key pricing signal has once again been reached.

Lets jump in.

The adjusted Spent Output Profit Ratio is an easy way to understand profitability of the whole Bitcoin network. It’s calculated by price sold / price paid for every transaction.

The “adjusted” part means that we exclude coins with a lifespan younger than 1 hour. This allows us to more accurately track real sale and purchase transactions.

Values greater than 1: coins moved are on average selling at profit

Values less than 1: coins moved are on average selling at a loss

Values equal to 1: coins moved are on average selling at breakeven

The cool thing about aSOPR is that coin volume isn’t considered in the calculation. This means that whales can’t heavily skew this data by locking in huge profits. Think coins being sold from 2013 etc. All we’re looking at here is if the transaction was in profit or loss.

When aSOPR is > 1 a blue bar will appear (this is what we want).

Recently, aSOPR has broken above 1. This signifies that the market is now on average locking in profits.

From Glassnodes data, this indicates an increase in demand and a more positive sentiment surrounding the asset.

The key here is if Bitcoin can sustain itself above an aSOPR of 1. If it can, Bitcoins price could be in for an explosive rally.

Just take a look at how quickly the aSOPR increased in 2021…

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

Sponsored

Lettuce Trail

Packed with inspiring success stories, expert tips, and valuable recommendations that will empower you to unlock your full potential and achieve remarkable results.

CAN YOU CRACK THIS NUT? ✍️

Which of the following is not a “privacy coin“?

A) Monero

B) Zcash

C) Oasis Network

D) Bitcoin

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Bitcoin 🥳

Bitcoin is in fact NOT a “privacy coin“. Bitcoin’s blockchain is public meaning you can view all transactions ever made by anyone.

GET IN FRONT OF 14,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.