GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter that won't be on a break, unlike some people we know... ☕💔

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Massive week for Bitcoin ahead 🤑

How do Bitcoin Miners make money?💰

And more…

MARKET WATCH ⚖️

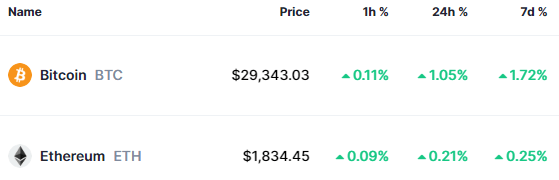

BTC Dominance is currently at 50.15% and the current crypto market cap is $1.17T ▲0.71%

Biggest Winners of The Day 🤑

Chainlink (LINK) ▲2.70%

Toncoin (TON) ▲1.55%

Bitcoin (BTC) ▲1.13%

Biggest Losers of The Day 😭

Shiba Inu (SHIB) ▼1.40%

Avalanche (AVAX) ▼1.27%

Dogecoin (DOGE) ▼0.78%

Only the top 20 coins measured by market cap feature in this section

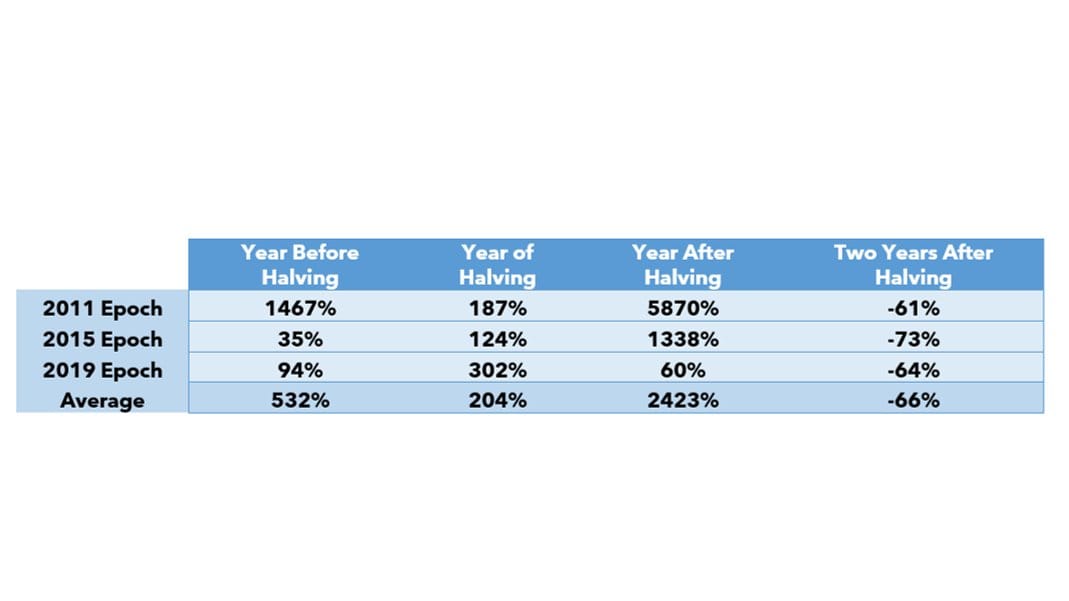

Take a look at this table posted by Will Clemente. Bitcoin’s down years have all come in the second year after the halving; 2014, 2018, 2022.

2024 and 2025 are looking good… 🤑🤑

All price data as of 8:10am ET

EXPERT OF THE DAY 💰

This expert believes that this week is going to be a big week for Bitcoin & Crypto markets.

Cathie Wood and her firm ARK Invest was the first public asset manager to gain exposure to Bitcoin back in 2015.

In her interview today with Bloomberg, she spoke on why this week could shape up to be a huge week in the history of Bitcoin.

What date should you be looking out for?

August 13th.

That’s the date that the SEC has to come to a decision on the ARK Invest Spot Bitcoin ETF. 😮

Although the most likely outcome is that the SEC is going to delay a decision and push back the date, there is a chance.

ARK Invest is first in line. 🥇

Cathie however did concede that she believes the first Bitcoin ETF to be approved will be BlackRocks.

Another major point Cathie made?

The wonder of Bitcoin is that it plays the role of two hedges. The first is a hedge against inflation and the outright confiscation of wealth. The second is a hedge against counter-party risk.

This was brought to the forefront of investors minds at the beginning of the year with the regional banking crisis. With the collapse of SVB, Signature Bank and First Republic Bank, the value proposition of Bitcoin was clear.

I think the SEC, if it's going to approve a Bitcoin ETF, will approve more than one at once.

Even with cash in the bank, you’re not safe. You don’t have actual ownership over your wealth. Bitcoin solves this.

Nutty’s takeaway: Although this week could be a watershed moment for Bitcoin & the wider crypto market if the ARK Invest Bitcoin ETF is approved - we wouldn’t get too excited.

ARK Invest has been pushed back before by the SEC and we’d wager this time won’t be any different. They aren’t part of the ‘in’ crowd like BlackRock or Fidelity.

We’d put it at a 95% chance the SEC delays their decision date...

But, there’s a chance.

Regardless, even if it does get delayed, that’s just more time to stack sats. The BlackRock decision date will be here in no time at all. BlackRocks Bitcoin ETF final decision date?

16th of March, 2024.

Coincidentally ~1 month before the Bitcoin halving. 🤔

First slowly, then all at once. 🥂 🫡

ON CHAIN DATA DIVE 📊

Continuing on from yesterday’s edition on Mining fundamentals, today we’ll be taking a look at how Miners make their money.

Bitcoin Miners are paid the Total Block Reward by the network with the revenue coming from two sources:

The Block Subsidy: Newly minted coins up to the cap of 21 million (impacted by the halving)

Transaction Fees: People pay fees to move coins around the network, miners get these fees

During Bull markets transaction fees will be higher. More people will be interacting with the network and wanting to move coins around, which leads to congestion as only a limited amount of transactions can be confirmed with each block.

So why were the spikes in 2017 so large?

The 2017 hype was crazy. Block congestion was through the roof. More people were trying to get their transactions confirmed than the system could handle. To get your transaction confirmed ASAP you would have to pay a higher priority fee than anyone else, this drove transaction fee’s way up.

However, transaction efficiencies have saved us from the ridiculous fees of 2017… Thank God 🙏

In 2020 exchanges started utilising transaction batching which groups together a large amount of individual transactions and processes them all in one go. Way more time efficient and cost effective.

The above chart shows us The Total Block Reward which is the sum of the Block Subsidy and transaction fees. You’ll notice that this chart trades at a stable level and then suddenly decreases over and over again. This is the effect of the Bitcoin halving, the drop is block rewards being cut in half.

The Mining Difficulty algorithm discussed in yesterday’s edition keeps the issuance of new Bitcoin through Block Rewards at a constant rate, this is why the Total Block Rewards are stable and predictable.

Now even though Miners earn rewards in Bitcoin, it’s important to take a look at their revenue in USD value. This is crucial for comparison as all of their costs are in fiat currency (hardware, electricity, staff).

So Bitcoin denominated revenue is always declining, but taking a look at the chart above we can see that USD denominated revenue has been increasing over time with the bull and bear market cycles.

Nutty’s Takeaway: So with the Bitcoin halving cutting block rewards in half every 4 years, Miners are heavily reliant on the price of Bitcoin also significantly increasing to keep them profitable.

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

The blockchain holds _________ transactions.

A) Unconfirmed

B) Deleted

C) Confirmed

D) Fresh

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) Confirmed 🎉

The blockchain is the source of truth and stores all confirmed transactions.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.