GM to all of you nutcases. It’s Crypto Nutshell #660 turnin’ it up… 🎚️🥜

We're the crypto newsletter that's more terrifying than a vacation gone wrong on a beach that ages you in hours... 🏖️⏳

What we’ve cooked up for you today…

🏦 ETH Season

🧠 An IQ test

📉 Profit taking?

💰 And more…

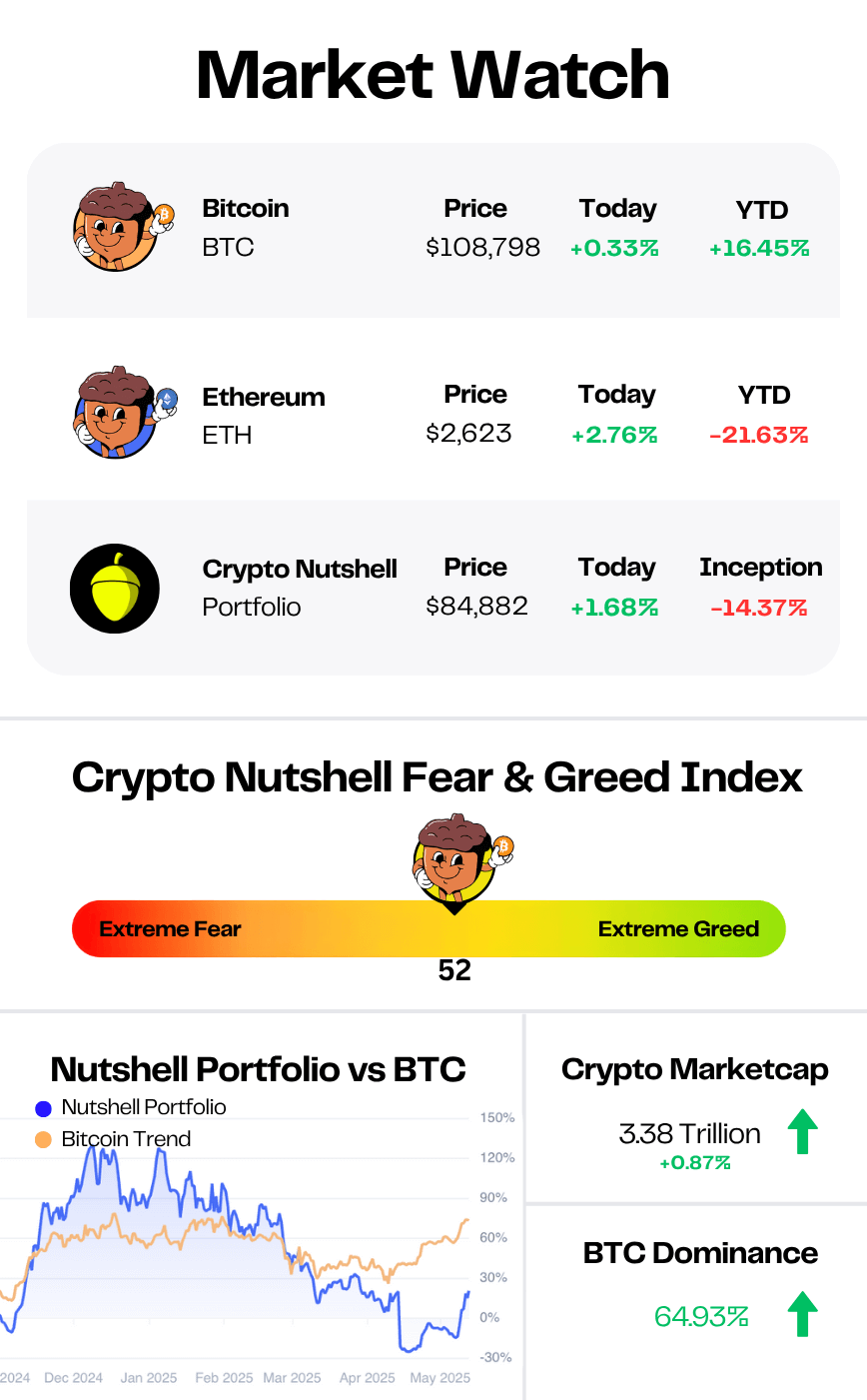

Prices as at 4:35am ET

ETH SEASON 🏦

BREAKING: Ether Treasury Firm BTCS Surges 100% on $100M ETH Buying Plan

Bitcoin has Michael Saylor.

Ethereum?

It’s building a squad.

Four public companies just made major ETH plays - and it’s getting impossible to ignore:

BTCS surged 100% after unveiling a $100M ETH accumulation plan

SharpLink now holds 205,634 ETH, second only to the Ethereum Foundation

GameSquare launched a $100M ETH treasury strategy backed by DeFi powerhouse Dialectic

Bit Digital flipped its entire BTC stack into ETH - buying over 100,000 ETH

This isn’t hype. It’s a coordinated shift.

What’s driving the rotation?

Staking yields and the rise of on-chain income (GameSquare is targeting 8–14%)

Tokenization narrative gaining steam across TradFi

And growing conviction that Ethereum is the financial base layer of the future

SharpLink’s even rolling out new metrics - like ETH Concentration - to give investors a transparent look at per-share crypto exposure.

And with Ethereum co-founder Joe Lubin now leading the board?

Yeah… this isn’t a half-hearted pivot.

Meanwhile, BTCS is blending TradFi and DeFi - raising capital through equity, convertible debt, and Aave - all to stack ETH with minimal dilution.

We’ve seen this before.

MicroStrategy kicked off the Bitcoin treasury wave.

Now Ethereum’s writing its own playbook.

And it’s only just getting started. ⚙️

Most political news lives in the extremes.

It’s either rage bait meant to rile you up, or echo chambers that only reinforce what you already believe. The result? More division, less understanding — and a lot of burnout.

We give you the full story on one major political issue a day, broken down with arguments from the left, right, and center — plus clear, independent analysis. No spin. No shouting. No bias disguised as truth.

In just 10 minutes a day, you’ll actually understand what’s happening — and how all sides see it.

Join 400,000+ readers who are skipping the noise and getting the full picture.

AN IQ TEST… 🧠

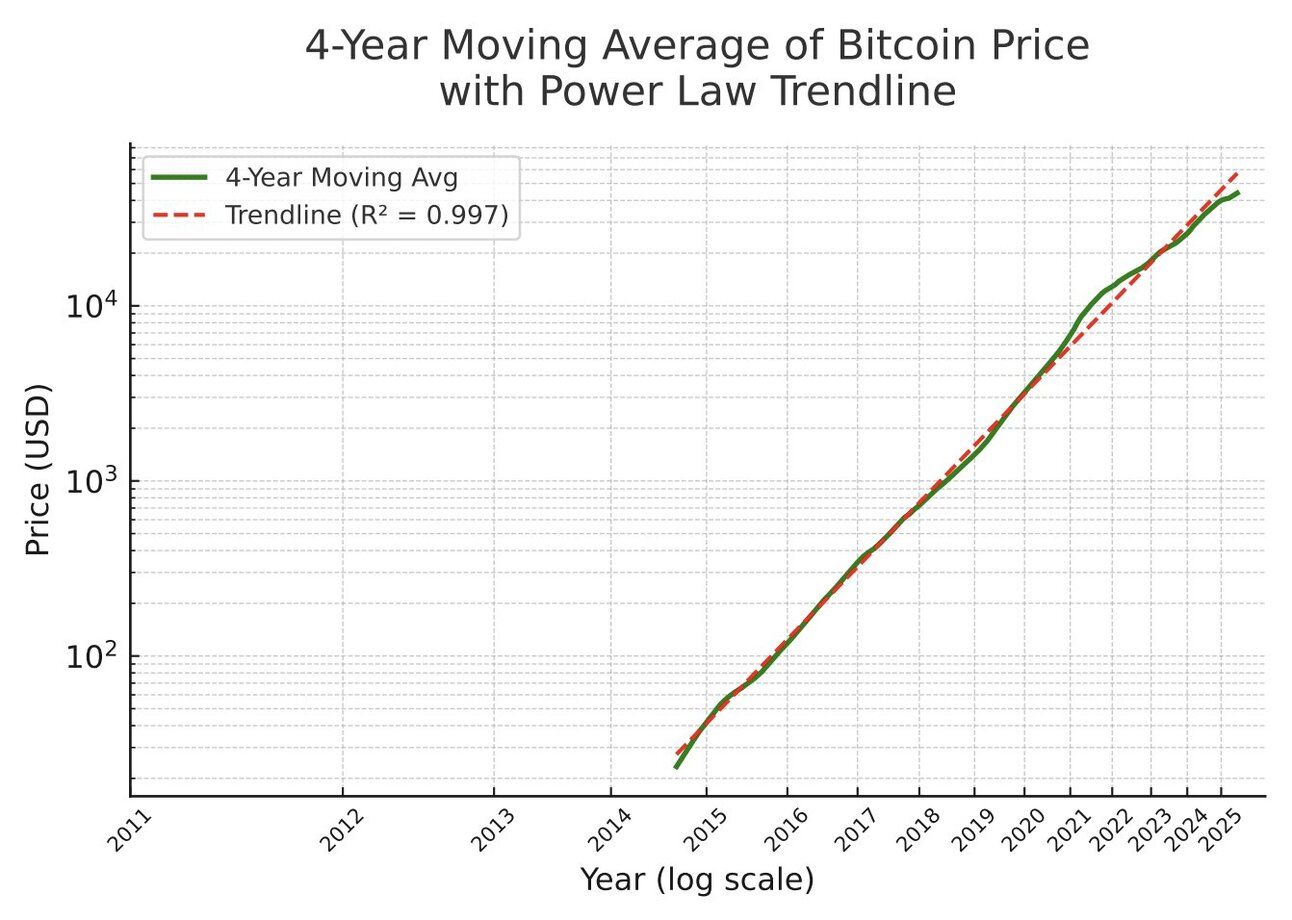

Fred Krueger is a quant, ex-hedge fund guy, and early Bitcoin investor.

And this week, he dropped one of his most brutal takes yet:

“This is an intelligence test. If you don’t invest, you are an idiot.”

What was he talking about?

This chart:

It’s the 4-year moving average of Bitcoin — plotted against the Power Law Trendline on a log scale.

The result?

A near-perfect fit.

The line barely deviates.

The slope keeps rising.

The pattern has held for over a decade.

Fred’s point?

Harsh? Maybe.

But look at the chart.

If you see an asset on a trajectory like this - compounding with brutal consistency - and still choose to sit on the sidelines…

It’s not bad luck. It’s bad thinking. 🧠

PROFIT TAKING? 📉

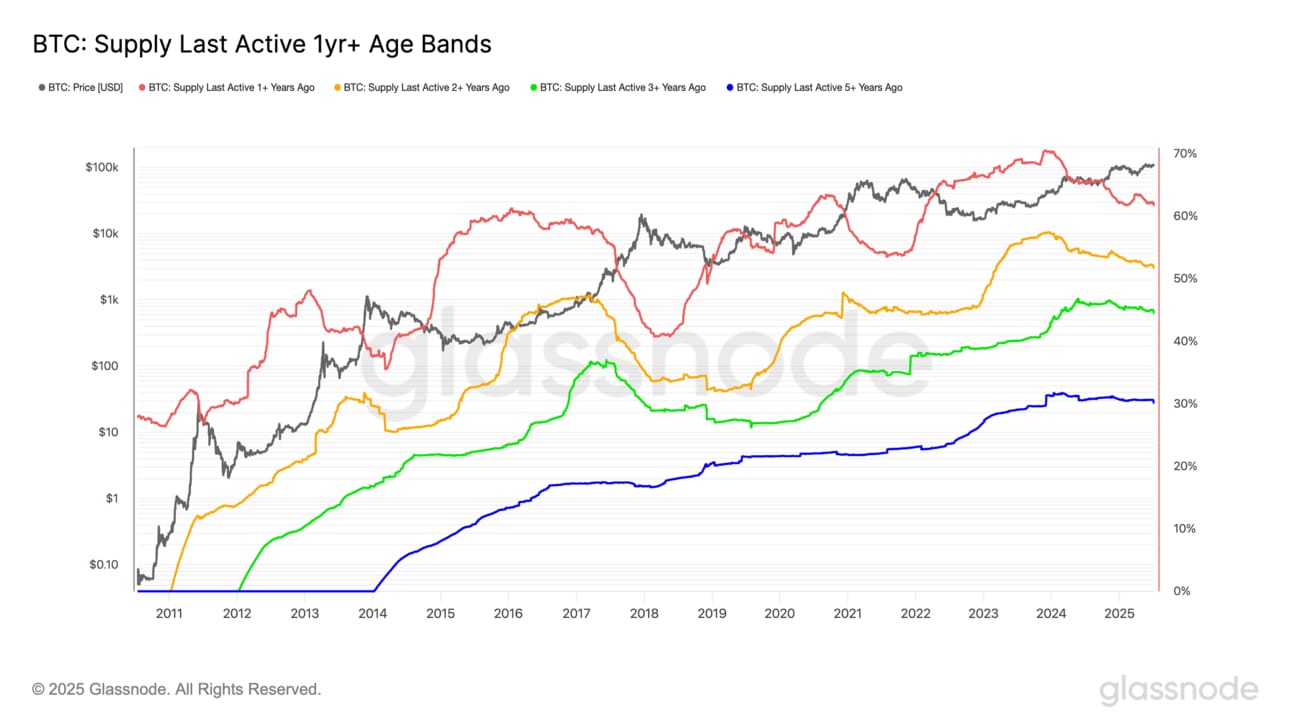

Let’s check in on one of our favourite metrics: Bitcoin’s supply last active 1+ years ago.

It’s a simple but powerful signal - tracking how much BTC has remained untouched as a percentage of total circulating supply.

Here’s the logic:

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

Here’s the latest supply breakdown vs. two weeks ago:

🔴 Supply last active 1+ years ago: 62.01% (down from 62.24%)

🟠 Supply last active 2+ years ago: 51.72% (down from 52.31%)

🟢 Supply last active 3+ years ago: 44.56% (down from 45.02%)

🔵 Supply last active 5+ years ago: 30.18% (down from 30.62%)

That means 62.01% of all Bitcoin still hasn’t moved in over a year.

But as you can see…

Every single cohort has seen a slight decline over the past two weeks.

As Bitcoin approaches all-time highs, it’s almost inevitable that we’ll see some form of profit taking.

Regardless…

Nearly two-thirds of the entire supply remains untouched.

That’s not noise.

That’s conviction. 💎

CRACKING CRYPTO 🥜

SharpLink stock continues surging as treasury tops 200k Ethereum. SharpLink surges on 200,000 ETH milestone as firm embraces aggressive treasury strategy.

Japanese company moves to align CEO with Bitcoin strategy, full salary goes to BTC. Energy company Remixpoint said its recently appointed CEO, Takashi Tashiro, would use his salary in Japanese yen to purchase an equivalent amount of Bitcoin.

Holding at $109K, but Maybe Not for Long. Set for an IPO and with a real business, Silicon Valley darling Figma last week disclosed $70 million exposure to bitcoin, with plans to bring that to $100 million.

Two men charged in $650 million global fraud scheme involving foreign exchange trading and crypto. Prosecutors charged two men for their roles in operating a scheme that led to $650 million being stolen and "vanishing" funds into crypto.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the primary incentive for miners to secure the Bitcoin network?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Earning block rewards and transaction fees 🥳

Miners are rewarded with newly minted BTC and transaction fees for validating blocks — it's what keeps the decentralised network running. ⛏️💰

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.