GM to all of you nutcases. It’s Crypto Nutshell #798 slidin’ on through… 🛼🥜

We’re the crypto newsletter that’s more high-pressure than a newsroom racing to break the story before the market moves… 📰⚡

What we’ve cooked up for you today…

🏦 It fell apart

🇺🇸 USA will buy 1 million Bitcoin

🔍 Shrinking

💰 And more…

Prices as at 2:05am ET

IT FELL APART 🏦

BREAKING: Coinbase Withdraws Support for Crypto Bill on Eve of Key Senate Vote

Coinbase just torpedoed the crypto industry's biggest legislative push…

Hours before a key Senate Banking Committee vote Thursday, CEO Brian Armstrong announced Coinbase was pulling support for the CLARITY Act.

"This version would be materially worse than the current status quo… We'd rather have no bill than a bad bill."

The markup was postponed within hours. No new date set.

What went wrong

Armstrong cited four dealbreakers:

Stablecoin rewards restrictions

Tokenized equities treatment

DeFi provisions

SEC power expansion

The banking lobby had pushed to ban yield on stablecoins, worried that stablecoin rewards would make traditional bank accounts less attractive.

The Monday draft allowed rewards from transactions, remittances, and loyalty programs - but banned direct yield.

Coinbase initially signalled it could live with that language.

Then came 137 proposed amendments. Several aimed to make stablecoin rules even more restrictive. Some were bipartisan, backed by Senators Thom Tillis (R-NC) and Angela Alsobrooks (D-MD).

Armstrong also flagged a new section on illicit finance that appeared for the first time in Monday's 270-page text.

"We developed this concern that if it went into a markup, the only way to edit some of that base text would have been through an amendment, and amendments had already been submitted,"

Armstrong called the potential outcome "catastrophic for the average American consumer."

The banking fight

Armstrong framed this as banks trying to kill competition.

"The high level principle is that you can't really have banks come in and try and kill their competition at the expense of the American consumer."

He noted traditional savings accounts pay roughly 14 basis points while stablecoin rewards can reach 3.8%.

Industry split

The move divided crypto.

Ripple CEO Brad Garlinghouse backed the bill. "I remain optimistic that issues can be resolved through the mark-up process."

Kraken co-CEO Arjun Sethi urged moving forward. "Walking away now would lock in uncertainty and leave American companies operating under ambiguity while the rest of the world moves forward."

The Digital Chamber CEO Cody Carbone was blunt: "Inaction is unacceptable. We cannot afford to walk away from the table at a moment when clarity is within reach."

What happens next

Senate Democrats are holding a call with industry reps Friday to restart negotiations.

Armstrong said he expects a new draft "in a few weeks." Senator Cynthia Lummis posted that lawmakers are "closer than ever."

But TD Cowen was pessimistic…

The objections Armstrong raised "include changes that Democrats secured in advance of the vote," analyst Jaret Seiberg wrote. Fixing those while maintaining the 60-vote bipartisan support needed to pass the Senate won't be easy.

Democrats face little pressure to rush. They expect to retake the House in 2026, giving them more leverage in 2027.

The Senate Agriculture Committee still plans markup January 27. But without Banking Committee alignment, passage becomes significantly harder.

Armstrong said he'd rather see no bill than accept one that could have eliminated three or four Coinbase product lines. 🚀

Fuel your business brain. No caffeine needed.

Consider this your wake-up call.

Morning Brew}} is the free daily newsletter that powers you up with business news you’ll actually enjoy reading. It’s already trusted by over 4 million people who like their news with a bit more personality, pizazz — and a few games thrown in. Some even come for the crosswords and quizzes, but leave knowing more about the business world than they expected.

Quick, witty, and delivered first thing in the morning, Morning Brew takes less time to read than brewing your coffee — and gives your business brain the boost it needs to stay sharp and in the know.

U.S.A WILL BUY 1 MILLION BITCOIN 🇺🇸

Cathie Wood just dropped the most politically charged Bitcoin prediction we’ve heard this year.

She predicts in 2026, the Trump administration will follow through in buying 1 million Bitcoin.

Here’s what she said verbatim, in ARK Invest’s official 2026 outlook:

“2026 is, in the U.S., the midterm elections. And President Trump does not want to be a lame duck. So I have a feeling that he is going to work with his crypto and AI czar… to do a few things.”

Then she got specific:

“There’s been reticence about actually buying Bitcoin for the Strategic Reserve. So far, [the Bitcoin held] it’s confiscated. The original intent was to own a million Bitcoin.”

And her conclusion:

“So I actually think they will start buying, because I think this will help Trump… The midterm elections… the crypto community… his family is all in on Bitcoin… I think he sees crypto as a path to the future.”

That is a veteran macro investor talking about political incentives.

As we’ve been pointing out, Midterm elections are everything. Cathie is right - the sitting President does not want to be a lame duck.

They want momentum, headlines, and a growing economy going into that vote.

And in Cathie’s view, crypto is one of the levers.

If the U.S. government moves from passively holding confiscated Bitcoin to actively buying for a Strategic Reserve, that is not a normal bid.

That is a sovereign bid.

It reframes Bitcoin from a speculative asset into a piece of national financial infrastructure.

Cathie is mapping power, incentives, and timing.

Trump wants 2 productive years.

He wants the crypto community on his side.

He wants a future-facing economic story.

And according to her, Bitcoin sits right in the middle of that. 👀

SHRINKING 🔍

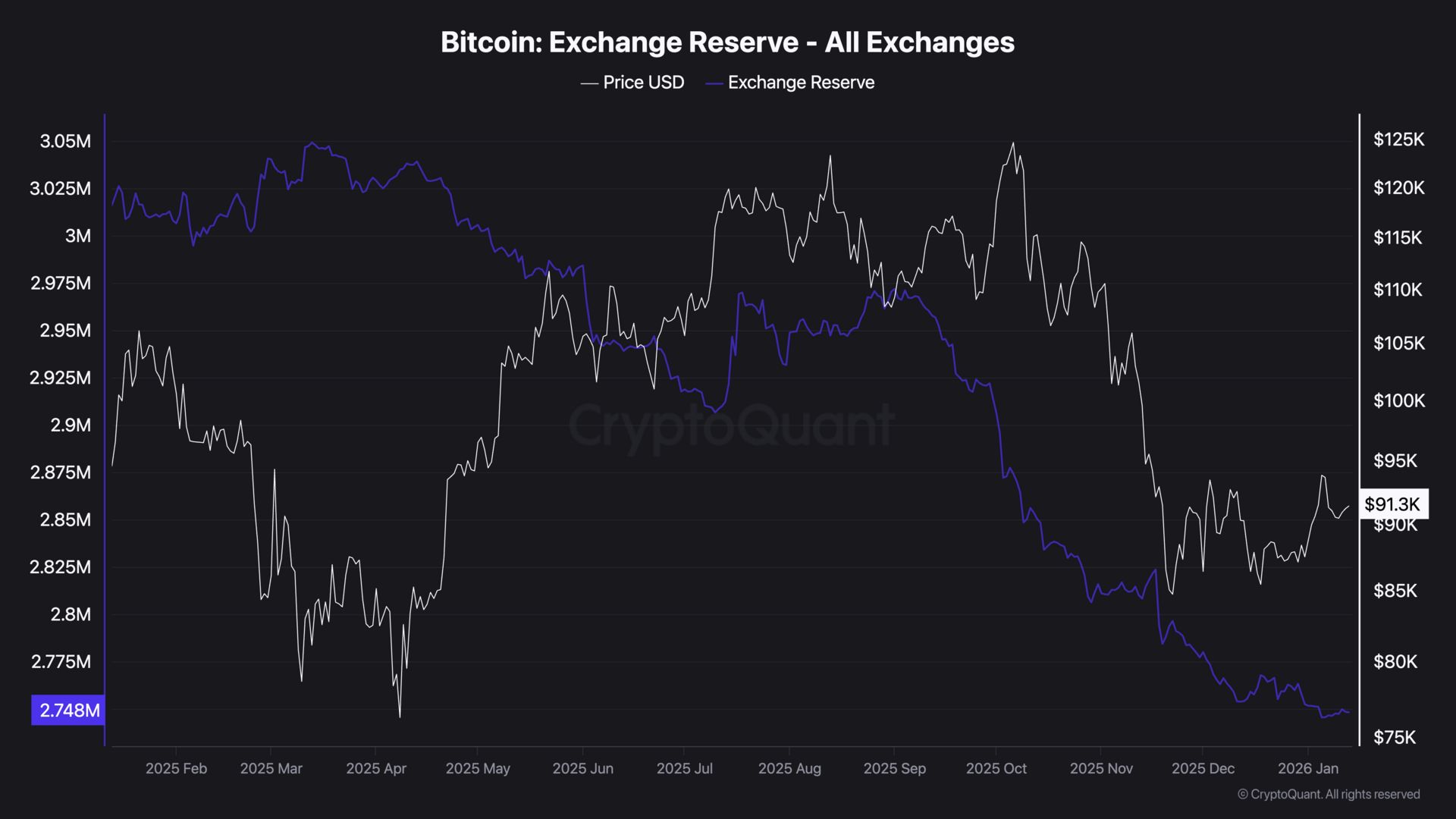

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Just 2.75 million BTC now sit on exchanges - 13.76% of the total supply.

Since January, around 3,480 BTC have been withdrawn - roughly $317 million moved into cold storage, treasuries, and long-term wallets.

Sure, some weak hands are breaking. Short-term holders are capitulating. Fear's running its course.

But step back. The trend hasn't reversed.

Available supply keeps draining. Committed holders keep accumulating. 🧱

CRACKING CRYPTO 🥜

Chainlink, Cardano and Stellar Futures Begin Trading on CME Next Month. CME Group plans to launch Cardano, Chainlink, and Stellar futures on February 9, expanding its regulated crypto derivatives lineup.

BTC Whales Turn Net Positive After Fastest Selloff In Years Ends. Bitcoin whales are rebuying BTC, while steady inflows to the spot ETFs combine to put wind in BTC’s sails.

Goldman Sachs sees crypto, tokenization and prediction markets as growth areas. The firm is exploring how these technologies can fit into its business and has met with prediction market platforms.

Kaito token plummets after X revises API policies to ban InfoFi crypto projects. InfoFi has led to a "tremendous amount of AI slop & reply spam" on the X platform, the firm's product lead said.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Are you ready for this week’s quiz?

5 questions. All from this week’s issues. If you’ve been paying attention, you’ll crush it. If you’ve been skimming, it’ll show.

Tap the button below to start this week’s quiz, then tell us how you scored in the poll at the bottom of this newsletter. 👇️

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.