Today’s edition is brought to you by Ledger - Grab your Ledger Nano today and lock down your crypto the smart way!

GM to all of you nutcases. It’s Crypto Nutshell #812 gettin’ the juice… 🥥🥜

We’re the crypto newsletter that’s more surreal than a family tearing itself apart inside a luxury prison… 🏝️💣

What we’ve cooked up for you today…

🏦 More pain

💣 It’s about to break

📉 Supply shortage

💰 And more…

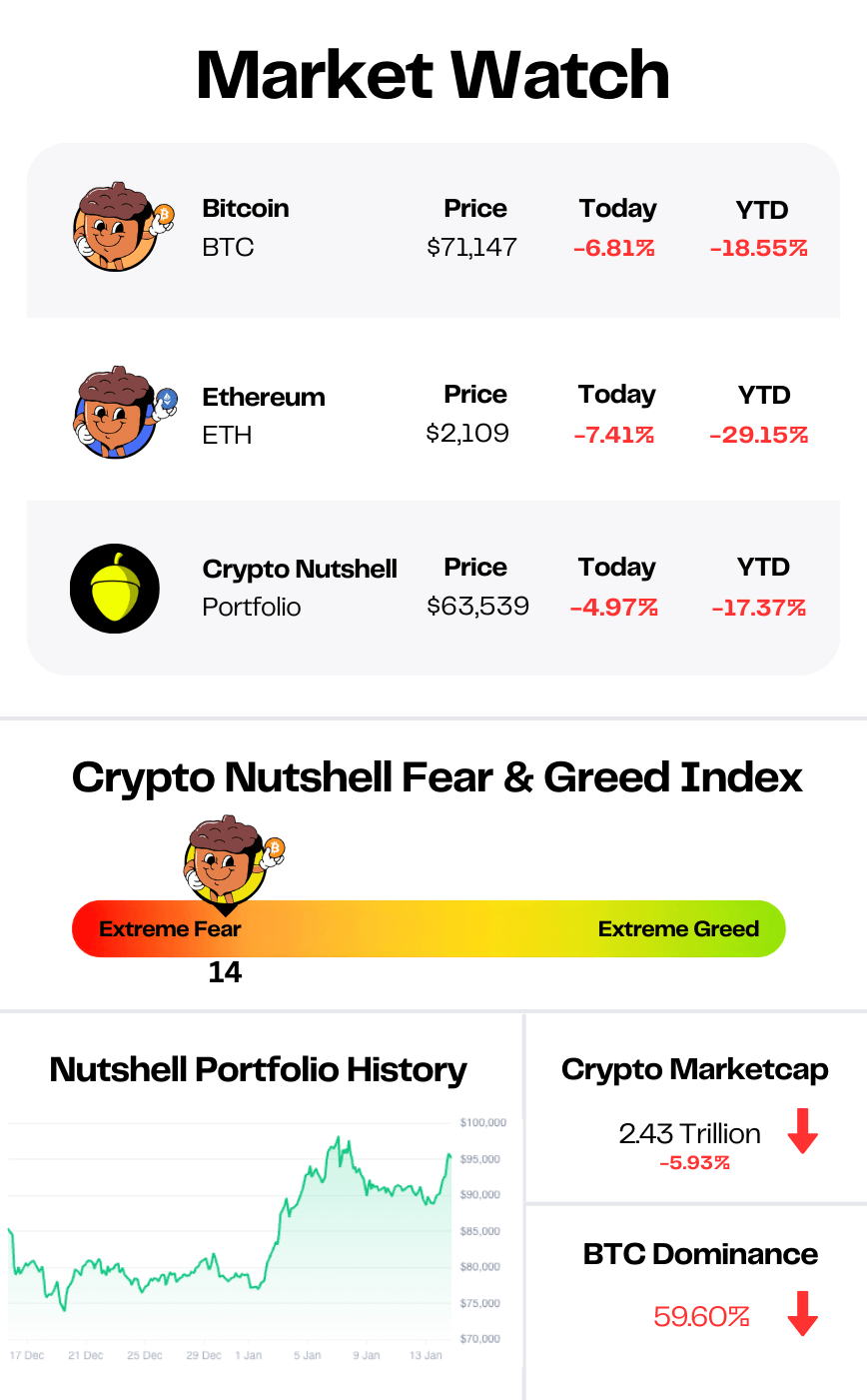

Prices as at 2:40am ET

MORE PAIN 🏦

BREAKING: Bitcoin price sets new 15-month low under $73K as crypto liquidates $800M

Bitcoin just set another 15-month low - and the selling isn't slowing down.

BTC dropped to a low of ~$70,091 on Wednesday, its lowest price since November 2024.

It now trades around ~$71,000, down over 7% in 24 hours and nearly 20% on the week.

The $74,000 support level that analysts flagged as critical? Gone.

$800 million liquidated

The carnage continues.

Over $800 million in crypto positions were liquidated in the past 24 hours. Long traders took the brunt of it once again.

"Notice how volume is high every time price moves down," said trader Roman. "That tells us when volume comes in - it's selling. Bear market price action."

Tech stocks are bleeding too

As we explained yesterday, this isn't just a crypto sell-off.

U.S. technology stocks are getting crushed too.

AMD dropped 17% after its 2026 outlook missed expectations.

Palantir fell 14%. Micron lost 12%. Nvidia, Tesla, and Intel all dropped 5% or more.

The Nasdaq 100 is now down 2.2% on the day.

Crypto miners tied to AI infrastructure got hit even harder. Cipher Mining fell 20%. Hut 8 dropped 14%. MARA and Riot both lost over 10%.

Miner profitability has now hit a 14-month low, according to CryptoQuant.

Where's the bottom?

K33 Research Head Vetle Lunde says current price action shows "unsettling similarities" to the 2018 and 2022 bear markets.

But he argues "this time is different."

Institutional adoption, regulated products, and no forced deleveraging events like FTX or Luna make a full 80% collapse unlikely, in his view.

"We do not expect a repeat of 2018 or 2022," Lunde said. "We view current prices as attractive entry levels for any investor with a long-term approach."

Still, if $74,000 doesn't reclaim as support, the next stops could be $69,000 - Bitcoin's November 2021 peak - or $58,000, its 200-week moving average.

Galaxy's Alex Thorn warned earlier this week that $58,000 is a real possibility if selling persists.

And the Crypto Nutshell Community seems to agree…

In yesterday's poll, only 16% thought Bitcoin has already bottomed.

The majority (67%) expect BTC to fall further, with 34% targeting $58K-$65K and 33% expecting $65K-$70K.

What's next

Stocks keep sliding. Crypto remains volatile.

The government shutdown is over, but Homeland Security funding only extends until February 13 - keeping another deadline risk in play.

For now, bears remain in control. 🚀

NOT YOUR KEYS, NOT YOUR COINS 🔒

It’s not just a saying - it’s the golden rule of crypto.

That’s why we use Ledger.

Ledger is the smartest way to secure your crypto - trusted by over 6 million users worldwide. And for good reason 👇

Ledger Live makes it easy to buy, send, receive, and manage your crypto - all in one secure app

Supports over 5,500 coins and tokens, including Bitcoin, Ethereum, XRP, and all your favourite altcoins

Your private keys stay offline - where hackers and shady exchanges can’t touch them

No KYC, no third-party risk, just full control over your assets

It’s peace of mind in your pocket. 🧘♂️

Don’t wait for an exchange hack or “temporary withdrawal pause” to learn this lesson the hard way.

IT’S ABOUT TO BREAK 💣

The entire system is about to break.

That’s basically Larry Lepard’s message right now.

If you’re new to him: Lepard is a long-time macro investor and one of the loudest “sound money” guys in markets.

He’s been pounding the table on inflation, debasement, and Bitcoin + gold for years.

In his latest interview, he went straight at the Fed:

“Powell is bluffing… He cannot get inflation down.”

His point is that the market still believes the Fed can thread the needle.

But when something finally snaps, Powell will pivot before inflation ever gets back to 2%.

And that’s when the real move starts:

“When things start to break… you’re going to see just an enormous movement of capital from other things into our things.”

What are “our things”?

Stuff that can’t be printed.

Bitcoin. Gold. Silver.

Then he framed the size of the trade:

“There’s $450 trillion dollars of fiat… Bonds, cash, and stocks… Call it $6 or $7 trillion of sound money.”

You don’t need all of that money to rotate.

Even a small percentage does damage:

“Even if only 10 percent of it comes in, that’s $45 trillion dollars chasing $7.”

And that’s the bet.

Not that Bitcoin wins overnight.

But that eventually enough people realise the same thing:

“They can never stop printing… with every bone of my body, I believe that.”

If he’s right, it’s not a slow grind.

It’s a stampede. 🐃

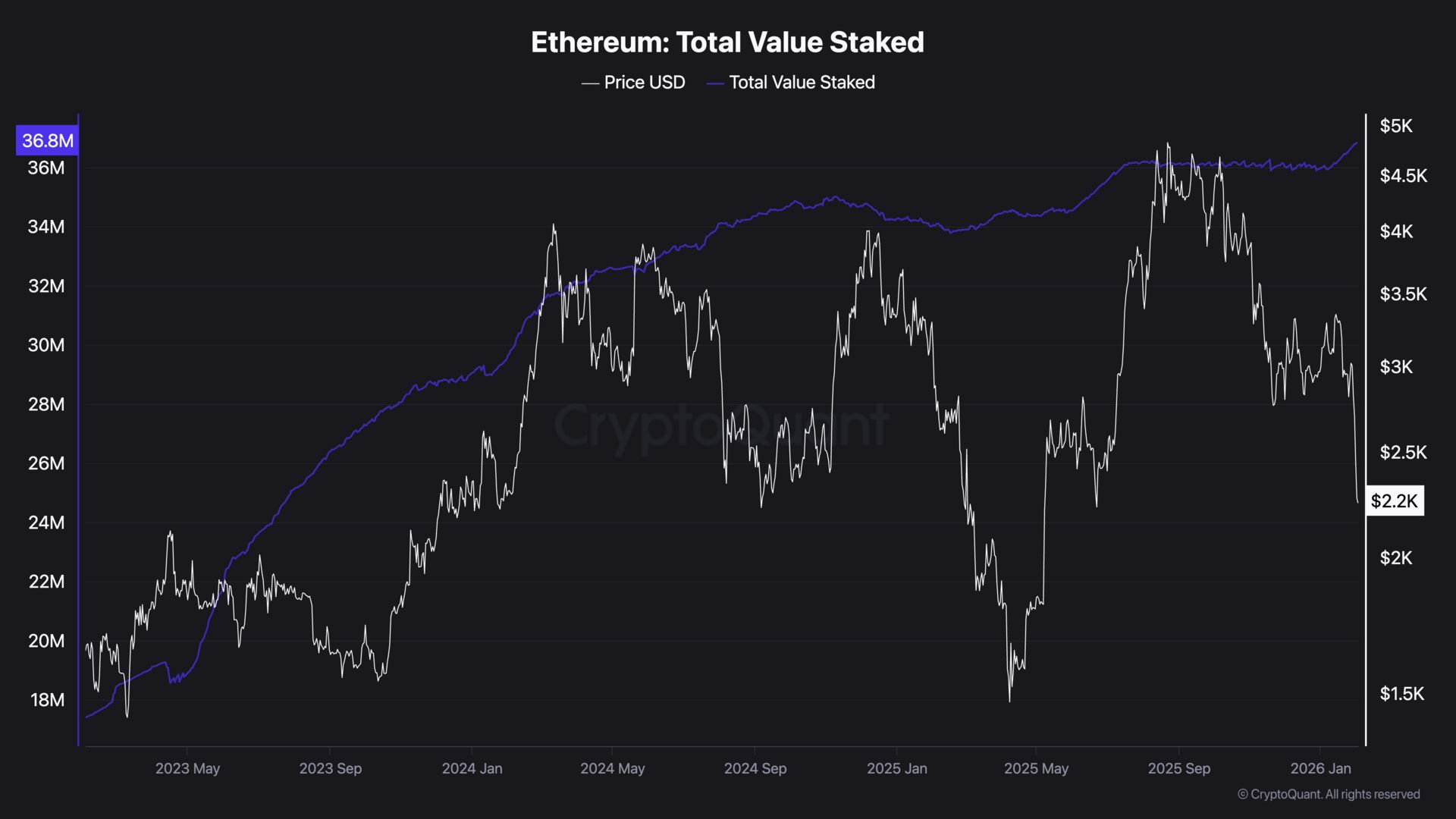

SUPPLY SHORTAGE? 📉

Time for check in on Ethereum’s supply side dynamics.

To do that we’ll be focusing on the amount of Ethereum currently being staked.

Quick Note: Ethereum staking involves locking up ETH to support the blockchain’s security. In return, users earn rewards for staking.

If you’d like to learn more about staking, check out this article.

36.85 million ETH is now locked in staking, up 854,337 so far in 2026.

That's 30.53% of the entire supply.

Nearly one-third of Ethereum is off the market, earning yield, not coming back.

Exchange balances keep falling. Staking keeps rising. Long-term holders aren't moving.

The available supply is tighter than it's ever been.

And when real demand finally shows up against that kind of scarcity?

ETH doesn't grind higher. It gaps. 🚀

CRACKING CRYPTO 🥜

Galaxy Digital selloff misses bigger catalysts in AI, regulatory shift as Benchmark still sees 170% upside. Analysts see Galaxy’s lending and infrastructure businesses holding up better than trading activity during the recent crypto market slowdown.

Wall Street giant CME Group is eyeing its own 'CME Coin,' CEO says. The initiative is part of CME's push into tokenized collateral, and the firm is collaborating with Google on a “tokenized cash” solution set to launch later this year.

$2.9B Bitcoin ETF Outflow, Bearish Futures Data Project More BTC Downside. Data points to additional downside for Bitcoin price as soaring BTC ETF outflows, and bearish repositioning in futures markets highlight traders’ choice to avoid risk assets.

Can the Government 'Bail Out' Bitcoin? Congressman Prompts Bizarre Exchange With Treasury Secretary. Treasury Secretary Scott Bessent got into a yelling match with another congressman over the Trump family’s crypto company.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 90,000 🥳

Decentraland consists of exactly 90,601 individual LAND parcels arranged in a grid, with each parcel representing 16x16 meters of virtual space. These NFT parcels were sold in waves starting in 2017, with some premium locations selling for hundreds of thousands of dollars during the 2021-2022 metaverse hype.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.