Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all of you nutcases. It’s Crypto Nutshell #578 stayin’ hungry… 🥩🥜

We're the crypto newsletter that's more heart-pounding than running from creatures that hunt by sound in a world gone silent... 🤫🔪

What we’ve cooked up for you today…

🤔 Saylor’s smallest buy yet

🎬 It’s over

📉 When will it stop?

💰 And more…

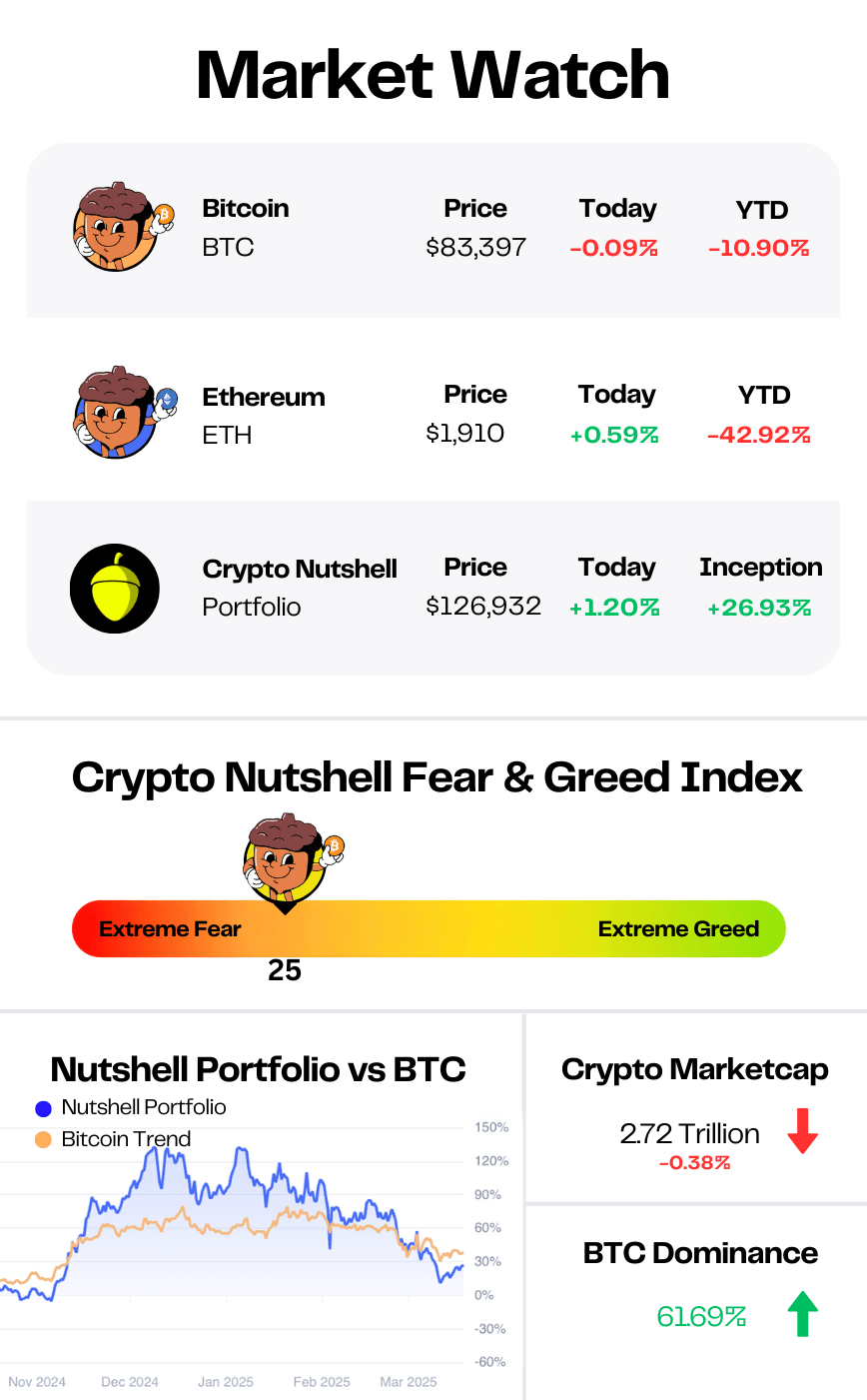

Prices as at 4:35am ET

SAYLOR’S SMALLEST BUY YET 🤔

BREAKING: Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Surprise, surprise…

Michael Saylor’s Strategy (formerly MicroStrategy) is still stacking Bitcoin.

But this times a little different…

This time Strategy announced it’s smallest acquisition since it first began accumulating Bitcoin in 2020.

According to an X post from Saylor, the firm added 130 Bitcoin for $10.7 million at an average price of $82,981 per BTC.

Here’s a quick snapshot of Strategy’s total holdings:

Current BTC Holdings: 499,226 BTC (~2.4% of Bitcoin’s total supply)

Total Cost Basis: $33.1 billion

Average Purchase Price: $66,360 per BTC

Only 774 BTC away from hitting the mind-blowing 500,000 Bitcoin milestone. (Absolutely ridiculous that they’re even that close)

But compared to February’s massive 20,365 BTC purchase for $1.99 billion, this latest buy is a drop in the bucket.

So, what’s going on? Is Saylor running out of money?

Not even close.

This acquisition was funded through Strategy’s new $21 billion "STRK ATM" program, which allows the company to gradually sell shares and raise capital for more BTC purchases. (They’ve only just started selling the shares)

So why the slowdown?

Unfortunately we don’t have the answer to that…

But our best guess is that Strategy is either pacing itself or prioritising larger capital raises before going all-in (again).

One thing is clear: Saylor isn’t done buying Bitcoin. 🚀

MAKE EVERY TRANSACTION COUNT 💳

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.*

IT’S OVER 🎬

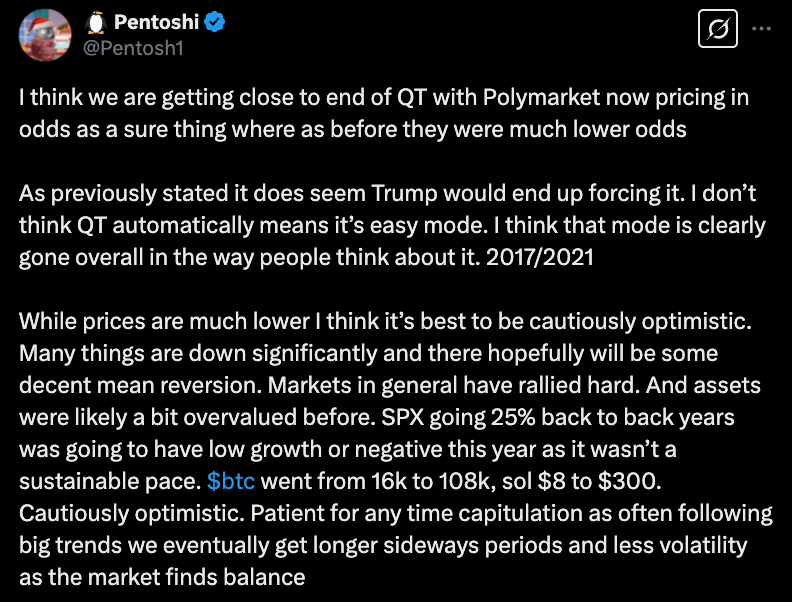

Prediction markets are now pricing in 100% odds that Quantitative Tightening (QT) ends before May.

It’s finally over.

Now is the time to start getting cautiously optimistic.

That’s the latest out of macroeconomic analyst, Pentoshi.

If you’re not familiar with Pentoshi, he’s a technical analyst who regularly posts his charts, trades, and macro predictions on X.

He’s one of our favourite analysts for 2 reasons:

His impressive technical analysis 📈

His stunningly accurate macro calls ✅

To maintain his anonymity, he writes under the pseudonym "Pentosh1" and uses a cartoon penguin as his avatar. 🐧

This week, he pointed out that Polymarket is now pricing in 100% odds we see QT end before May:

100% odds QT ends before May

Why is this happening?

In simple terms, Trump is forcing the hand of the Fed. By starting trade wars and imposing tariffs, he's intentionally crashing the economy.

All with one goal: pressure the Fed into cutting interest rates and stopping quantitative tightening.

Right now, it looks like it’s working.

Why this matters:

When QT ends, 2 things happen:

Lower interest rates

More money printing = more liquidity

And when liquidity increases? Money flows further out the risk curve.

That means money moves into Bitcoin, crypto, and other high-growth assets.

Now, does this mean we shouldn’t expect any positive price action until May?

Of course not.

Markets are forward-looking. They don’t price in what’s happening now – they price in what’s coming.

That means, the time to start being cautiously optimistic is now. 🌤️

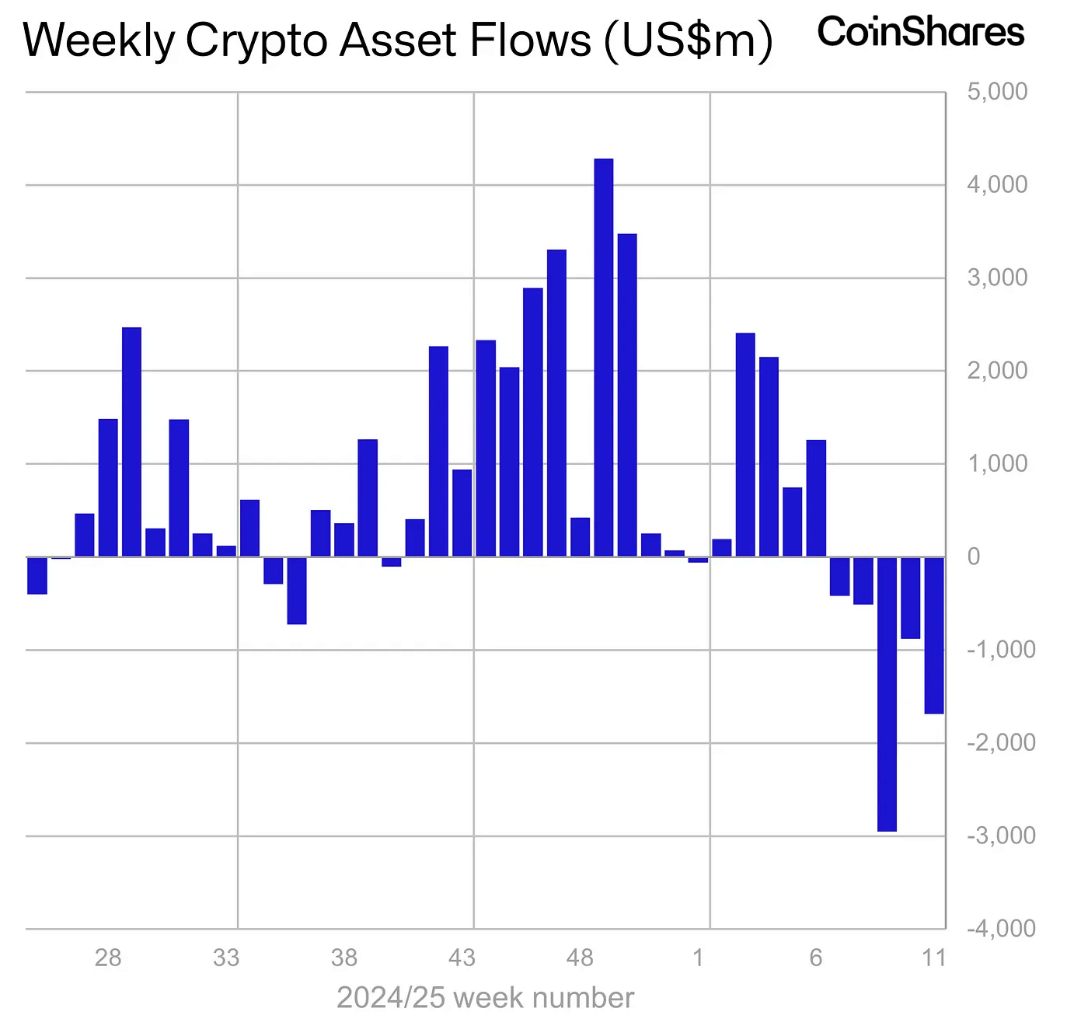

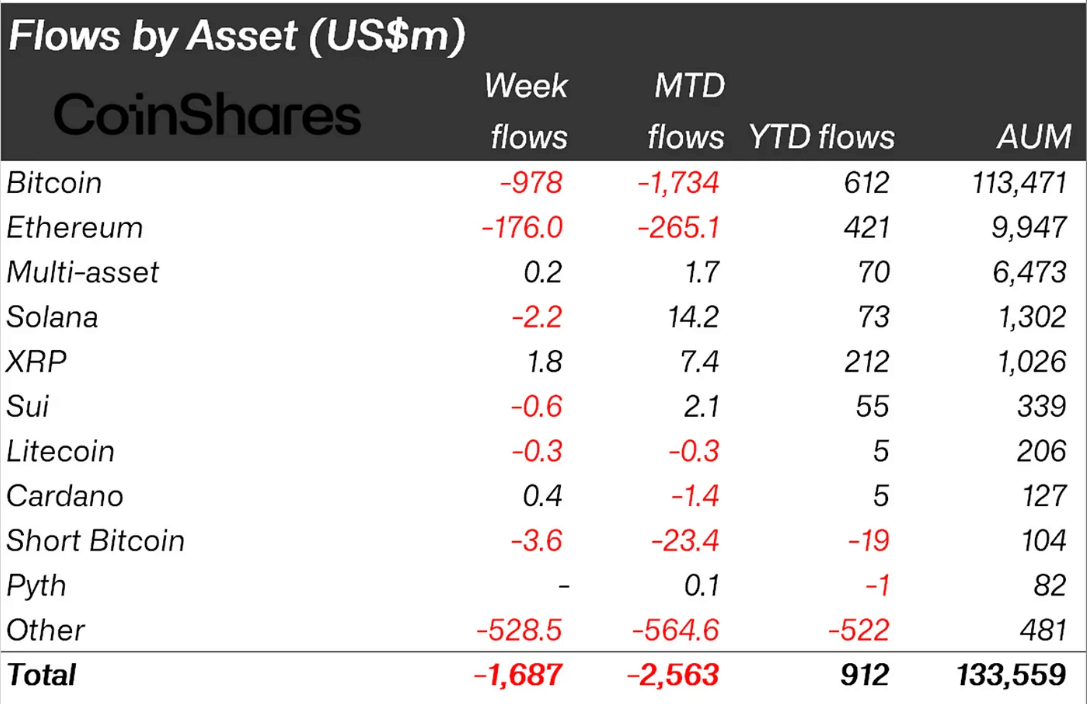

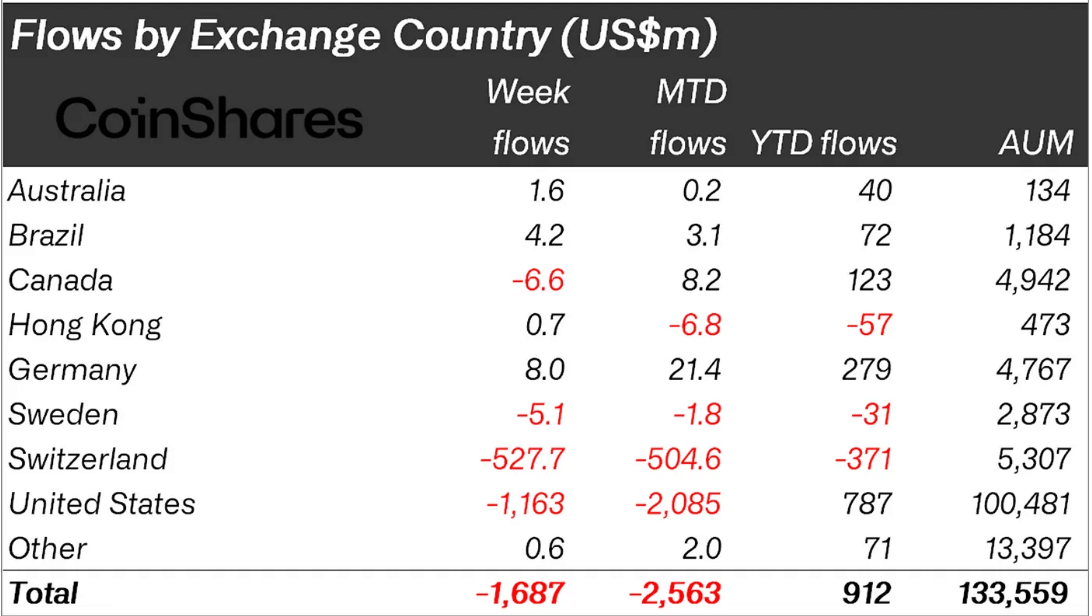

WHEN WILL IT STOP? 📉

The outflow streak continues…

For the fifth straight week, Digital asset funds saw net outflows, with $1.7 billion exiting.

This also marks the 17th straight day of outflows, the longest negative streak we’ve ever seen.

Let’s break it down.

Bitcoin once again saw the majority of outflows, with $978 million exiting.

Total BTC outflows over the last five weeks now stand at $5.4 billion.

Ethereum also wasn’t spared, seeing $176 million in outflows.

However, XRP continued to buck the trend, attracting $1.8 million in inflows.

Regionally, the U.S led outflows with $1.16 billion leaving digital asset funds.

Switzerland followed with a surprising $527.7 million in outflows, which CoinShares attributes to a large seed investor exiting their position.

Whilst Germany, Brazil and Australia all saw minor inflows of $8.0m, $4.2m & $1.6m respectively.

Despite the ongoing outflows, year-to-date inflows remain positive at $912 million.

But here’s the catch:

If this bearish trend continues into the week, YTD inflows could flip negative for the first time this year.

However, as we pointed out earlier, markets are now anticipating the end of quantitative tightening (QT).

If that happens, sentiment could flip bullish fast. 🚀

CRACKING CRYPTO 🥜

Bitcoin whale stirs market with $450M short position on Hyperliquid. The trading community watches closely as the whale's moves challenge both Bitcoin's price and Hyperliquid's strategies.

Hashdex Seeks to Expand U.S. Crypto ETF to Include Litecoin, XRP and Other Altcoins. The proposed amendment would include various cryptocurrencies in the Hashdex Nasdaq Crypto Index US ETF.

Standard Chartered drops 2025 ETH price estimate by 60% to $4K. Standard Chartered downgrades its ETH price expectations, while one analyst compares trading Ethereum to “catching a falling knife.”

Canary Capital files with SEC for what could be the first Sui ETF. We have seen a massive move of developers into the SUI ecosystem," Canary Capital CEO Steven McClurg told The Block in an email.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: HODL 🥳

VanEck’s Bitcoin ETF trades with the ticker $HODL ( ▲ 0.06% )

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.