GM to all of you nutcases. It’s Crypto Nutshell #694 campin’ out… ⛺🥜

We're the crypto newsletter that's more hilarious than two stepbrothers turning their rivalry into brotherhood... 😂🥁

What we’ve cooked up for you today…

🏦 Is it over?

🧃 Juicy institutional predictions

📉 Outflows are back

💰 And more…

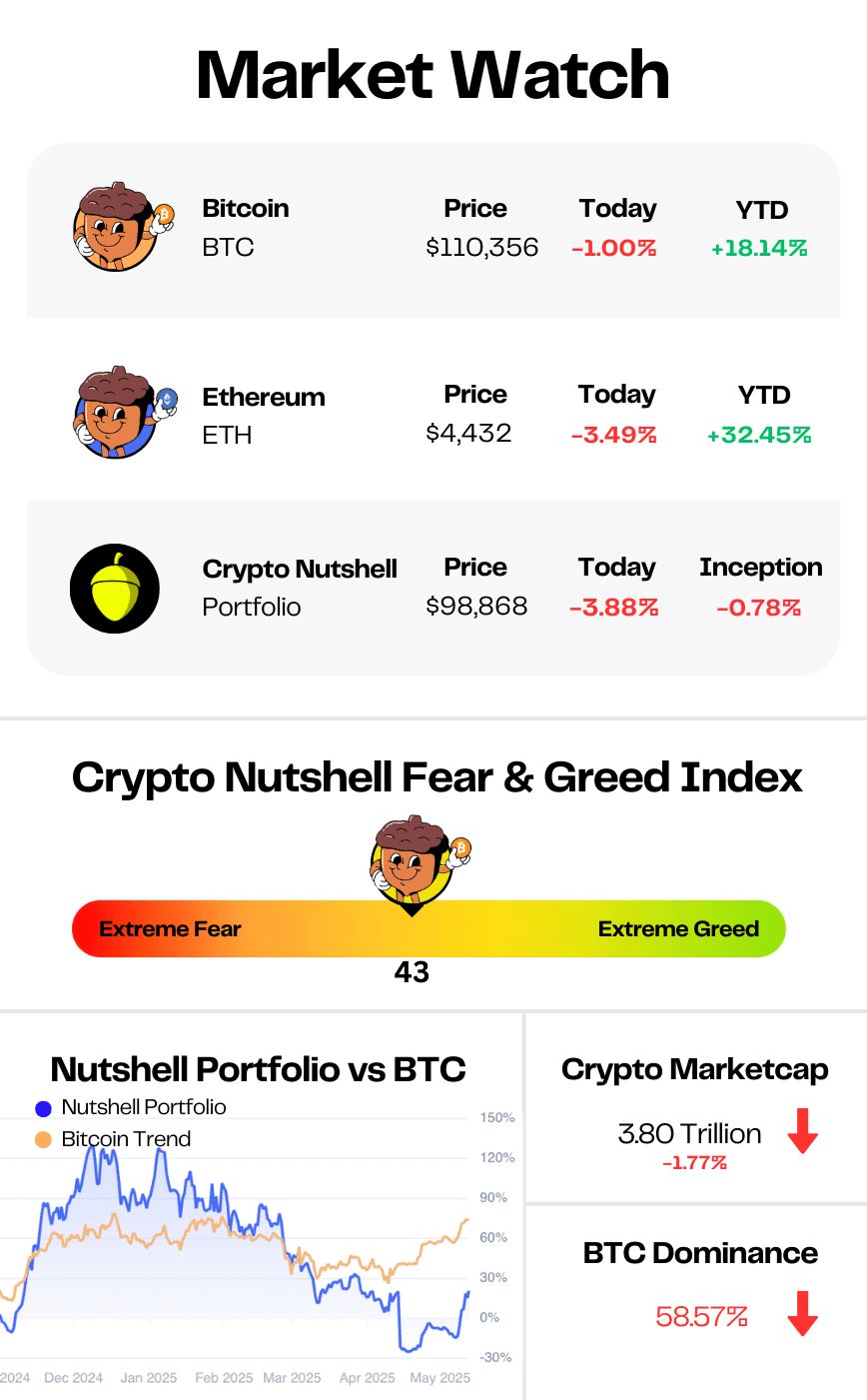

Prices as at 4:00am ET

IS IT OVER? 🏦

BREAKING: Bitcoin slides below $110,000 as capital rotation shifts to risk-off mode

After a brief post–Jackson Hole rally, Bitcoin has plunged back under $110,000.

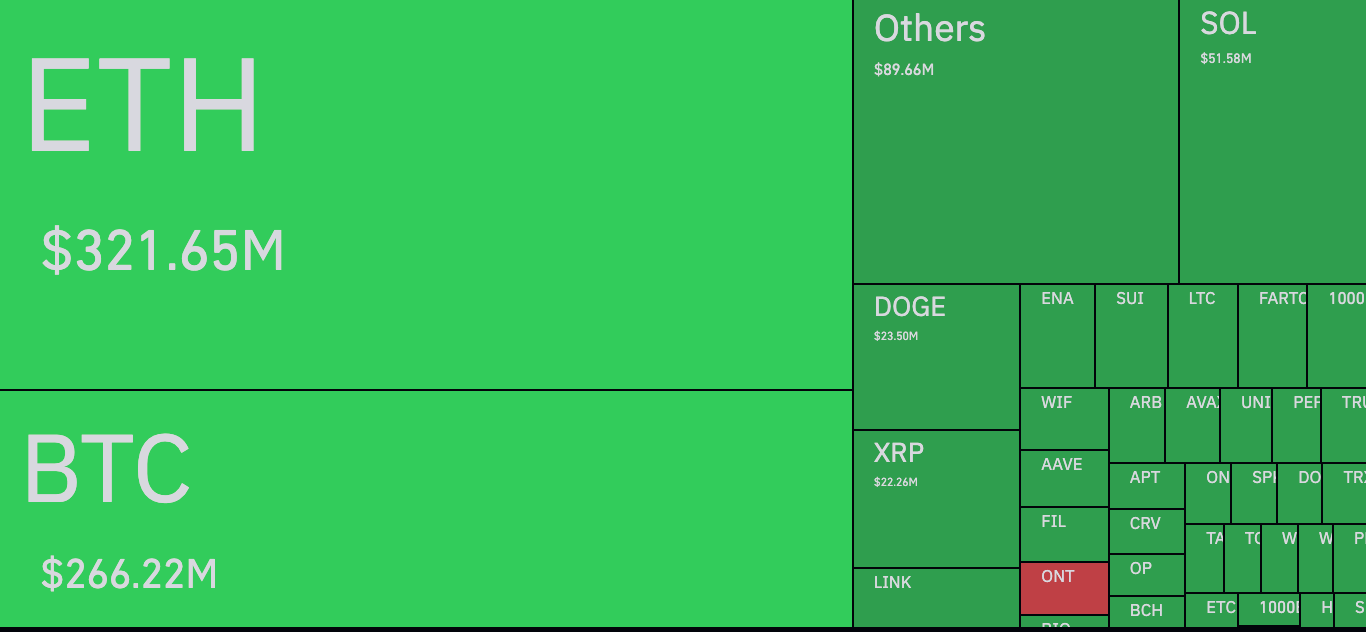

Completely wiping out all of last week’s gains and triggering nearly $900M in liquidations across crypto…

BTC hit a seven-week low near $109,000, down more than 11% from its all-time high less than two weeks ago.

Ethereum was hit even harder, tumbling 7.4% to $4,371 after trading above $4,900 earlier in the day.

XRP fell 4.8%, Solana plunged nearly 10%, and BNB dropped 4.2%.

“Selling pressure intensified as a large holder offloaded 24,000 BTC, triggering a wave of liquidations.”

Over 200,000 traders were wiped out in 24 hours - most of them late longs.

Total crypto liquidations by asset

According to Presto’s Rick Maeda, this isn’t rotation anymore - it’s risk off:

“Alts sold off faster than majors and stablecoin inflows stayed flat, signalling risk-off across crypto rather than capital shifting within the sector.”

The pain isn’t just in spot markets.

Crypto ETFs bled $1.43B in outflows last week - the largest since March. (More on this later)

And with September historically crypto’s weakest month (–3.77% average losses for BTC, –6.42% for ETH), seasonality might make it worse…

The bottom line: the market has flipped risk-off. Bitcoin is bleeding, Ethereum’s rally just reversed, and altcoins are selling off harder.

But history is clear: these flushes reset leverage, clear weak hands, and set the stage for the next leg higher.

Short-term pain. Long-term story unchanged. 🚀

Hear from leaders at Anthropic, Rocket Money, and more at Pioneer

Pioneer is a summit for the brightest minds in AI customer service to connect, learn, and inspire one another, exploring the latest opportunities and challenges transforming service with AI Agents.

Hear directly from leaders at Anthropic, [solidcore], Rocket Money, and more about how their teams customize, test, and continuously improve Fin across every channel. You’ll take away proven best practices and practical playbooks you can put into action immediately.

See how today’s service leaders are cultivating smarter support systems, and why the future of customer service will never be the same.

JUICY INSTITUTIONAL PREDICTIONS 🧃

Matt Hougan - CIO at Bitwise - just released their first ever 10-year forecast for Bitcoin.

The most juicy part?

They are projecting Bitcoin will compound at 28.3% annually for the next decade.

Let’s run the math:

Today: ~$120K

10 years of 28.3% CAGR = ~$1.2M per Bitcoin by 2035

This isn’t some wild prediction from a crypto influencer. This is coming straight out of Bitwise - the guys running one of the biggest Bitcoin ETFs on the planet.

It’s conservative, it’s institutional, and that’s exactly why it matters.

Wall Street doesn’t see Bitcoin as a “speculative play” anymore.

They’re modelling it as the best-performing major asset of the next decade.

If that’s true?

Owning even fractions today could mean millionaire status in the future. 🥂

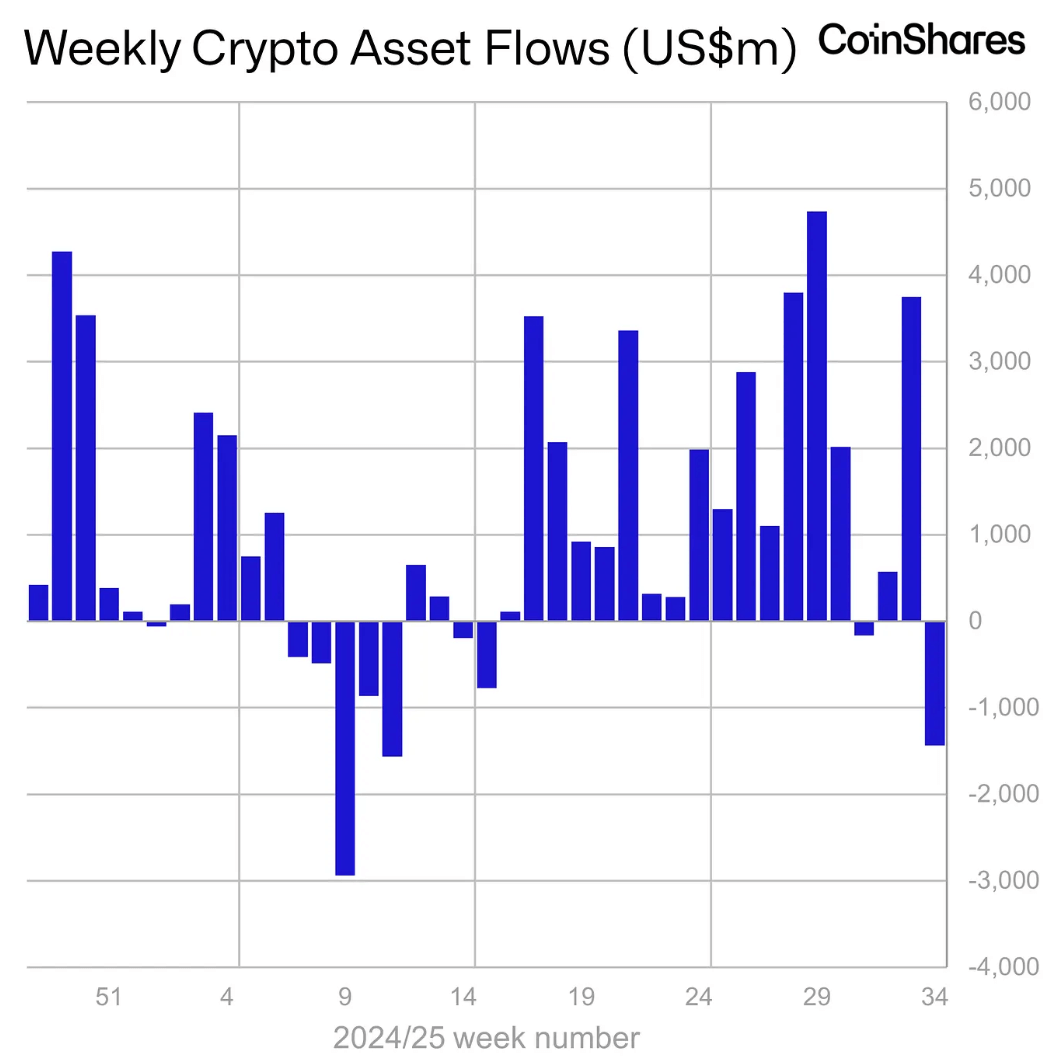

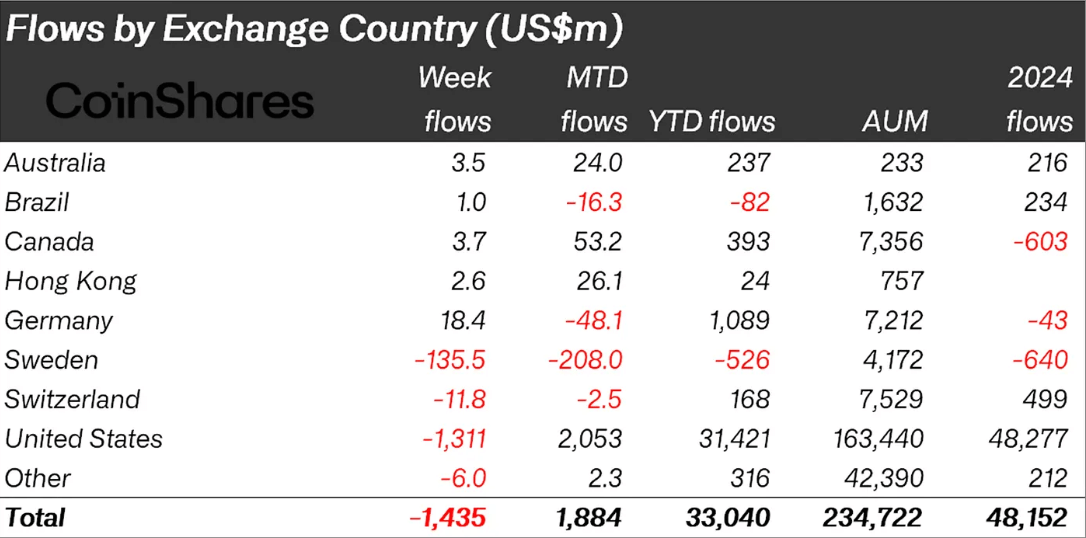

OUTFLOWS ARE BACK 📉

The streak is over…

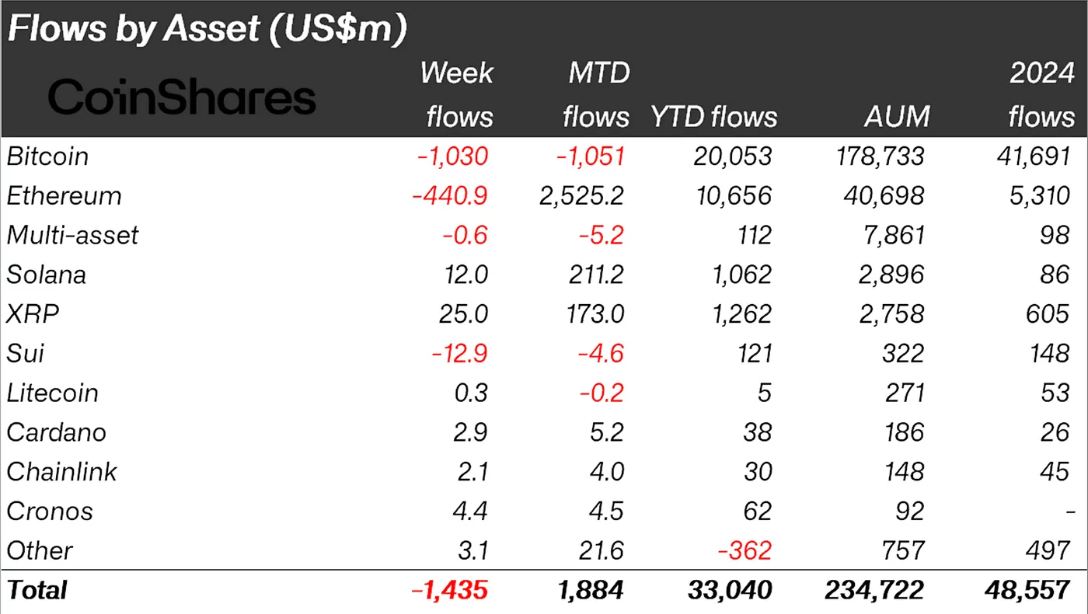

Digital asset funds just logged their first big outflow in weeks - a massive $1.43 billion, the largest since March.

Let’s break it down.

The bulk of last weeks outflows came from Bitcoin, which bled $1.03B.

Ethereum wasn’t spared either, dropping $441M.

While XRP and Solana continued their hot streaks with inflows of $25.0M and $12.0M respectively.

Regionally, the U.S. led the exodus with $1.31B in outflows.

Sweden followed with -$135.5M and Switzerland with -$11.8M.

While Germany, Canada and Australia saw inflows of $18.4M, $3.7M and $3.5M respectively.

So what happened?

CoinShares says pessimism around the Fed drove $2B in outflows earlier in the week.

But sentiment flipped after Jerome Powell’s dovish Jackson Hole remarks, pulling $594M of inflows back in by week’s end.

Ethereum saw the strongest recovery. Mid-week inflows helped limit its losses to $441M - far less than Bitcoin’s $1B drain.

The message is clear: Fed fear triggered the sell wave, Powell’s pivot cushioned the blow, and ETH showed the stickier bid.

CRACKING CRYPTO 🥜

Wall Street giants plot $1 billion Solana treasury set to close in weeks shaking market. Galaxy, Jump and Multicoin line up Cantor Fitzgerald to quietly amass SOL.

ETHZilla Authorizes $250M Buyback, Expands Ether (ETH) Treasury to $489M. The company now holds 102,237 ether worth about $489 million.

US SEC opens comment period on proposed staked Injective ETF from Canary. The SEC is seeking public input on whether to approve a staked INJ ETF, setting the stage for its next steps on the proposal.

Strategy buys $357M in Bitcoin as price drops to $112K. Michael Saylor’s Strategy, acquired 3,081 Bitcoin for $356.9 million last week, according to a SEC filing on Monday.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the minimum amount of ETH required to run a validator node on Ethereum?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 32 ETH 🥳

Ethereum requires 32 ETH to run a validator, ensuring skin in the game for securing the network. 🛡️

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.