Merry Christmas, legends!

Thanks for ridin’ with us through every pump, dump, and reindeer-fueled rally this year. 🦌

We’re grateful for each of you. Stay warm, stay weird, and maybe take a break from the charts (or don’t)🎄🥜

What we’ve cooked up for you today…

🏦 Will it pass?

🔮 Tom’s latest prediction

🔒 Locked away

💰 And more…

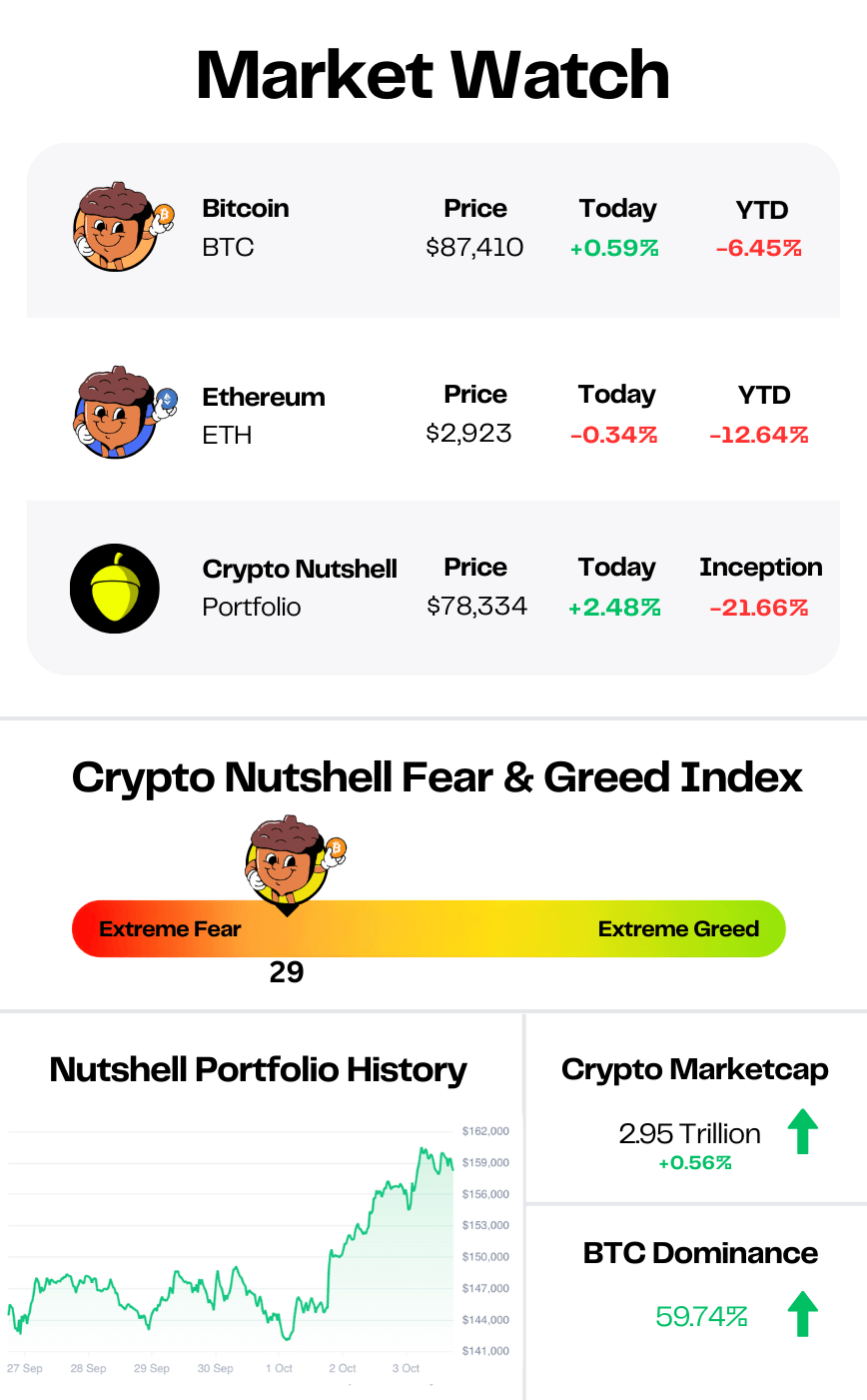

Prices as at 3:30am ET

WILL IT PASS? 🏦

BREAKING: Midterms, shutdown risks and negotiations: Can Congress pass a sweeping crypto bill in 2026?

The all-encompassing crypto market structure bill faces a critical test in 2026.

Crypto advocacy sources give it a 50-60% chance of becoming law before the midterms.

That's basically a coin flip…

The Senate Banking Committee planned to hold a markup before year-end.

That didn't happen.

Now they're targeting early 2026, with a spokesperson confirming "strong progress with Democratic counterparts."

But several major issues still need resolution.

The sticking points

Yield-bearing stablecoins are a flashpoint.

Banks argue that the GENIUS Act left loopholes that could turn stablecoins into savings vehicles, distorting market incentives.

Crypto advocates say offering yield is just fair competition.

DeFi regulation is another battle.

The debate centers on AML requirements and whether the SEC or CFTC should have jurisdiction. Industry sources worry giving the SEC first decision-making power looks "a lot like going down the Gary Gensler route."

Trump's crypto conflicts are also in play.

Bloomberg estimated in July the president has profited $620 million from family crypto ventures, including World Liberty Financial, American Bitcoin mining stake, and the TRUMP and MELANIA memecoins launched before he took office.

And the CFTC is down to one Republican commissioner after four departures this year. Democrats don't want to hand sweeping crypto authority to an understaffed agency.

The timeline crunch

If Senate markups don't happen in January, industry insiders get worried.

"They just need to show progress right out of the gate… If we don't have those things in January, I'm feeling very pessimistic."

The window is tight.

Lawmakers have roughly the first two quarters of 2026 before midterm campaigns take over. There might be a small post-election window around the holidays, but that's optimistic.

And Congress faces another government funding deadline on January 30. If they can't agree, another shutdown pauses everything.

The closer midterms get, the more Trump's conflicts get amplified in Democratic messaging around affordability and privilege.

Bottom line: January will tell us everything. 🚀

Pelosi Made 178% While Your 401(k) Crashed

Nancy Pelosi: Up 178% on TEM options

Marjorie Taylor Greene: Up 134% on PLTR

Cleo Fields: Up 138% on IREN

Meanwhile, retail investors got crushed on CNBC's "expert" picks.

The uncomfortable truth: Politicians don't just make laws. They make fortunes.

AltIndex reports every single Congress filing without fail and updates their data constantly.

Then their AI factors those Congress trades into the AI stock ratings on the AltIndex app.

We’ve partnered with AltIndex to get our readers free access to their app for a limited time.

Congress filed 7,810 new stock buys this year as of July.

Don’t miss out on direct access to their playbooks!

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

TOM’S LATEST PREDICTION 🔮

Earlier this week, we wrote about Wall Street Veteran Tom Lee’s core belief:

“Pessimists get to be right. Optimists get to be rich.”

Now he’s doubling down with his January 2026 predictions…

Tom Lee

In his latest interview, Lee said this, verbatim:

“I think crypto prices are beginning to actually recover. That’s why I think Bitcoin can double from here by the end of January.”

And then he went straight for the sacred cow:

“Many people don’t expect it because of the four-year cycle… If Bitcoin breaks $125k in January, there is no four-year cycle.”

That’s the tell.

This isn’t about a cute price target.

It’s about invalidating the framework most people are still trading off.

Lee’s been consistent on this all year:

Liquidity matters more than halvings

Structure matters more than sentiment

And big moves happen when expectations are low, not high

Which brings it full circle to his other point this week.

No one gets rich being a bear.

They get rich by staying optimistic through the part of the cycle that feels uncomfortable, boring, or “wrong.”

If Bitcoin does what Lee thinks it can do by the end of January…

It won’t just surprise the market. It breaks everyones model entirely. 🧨

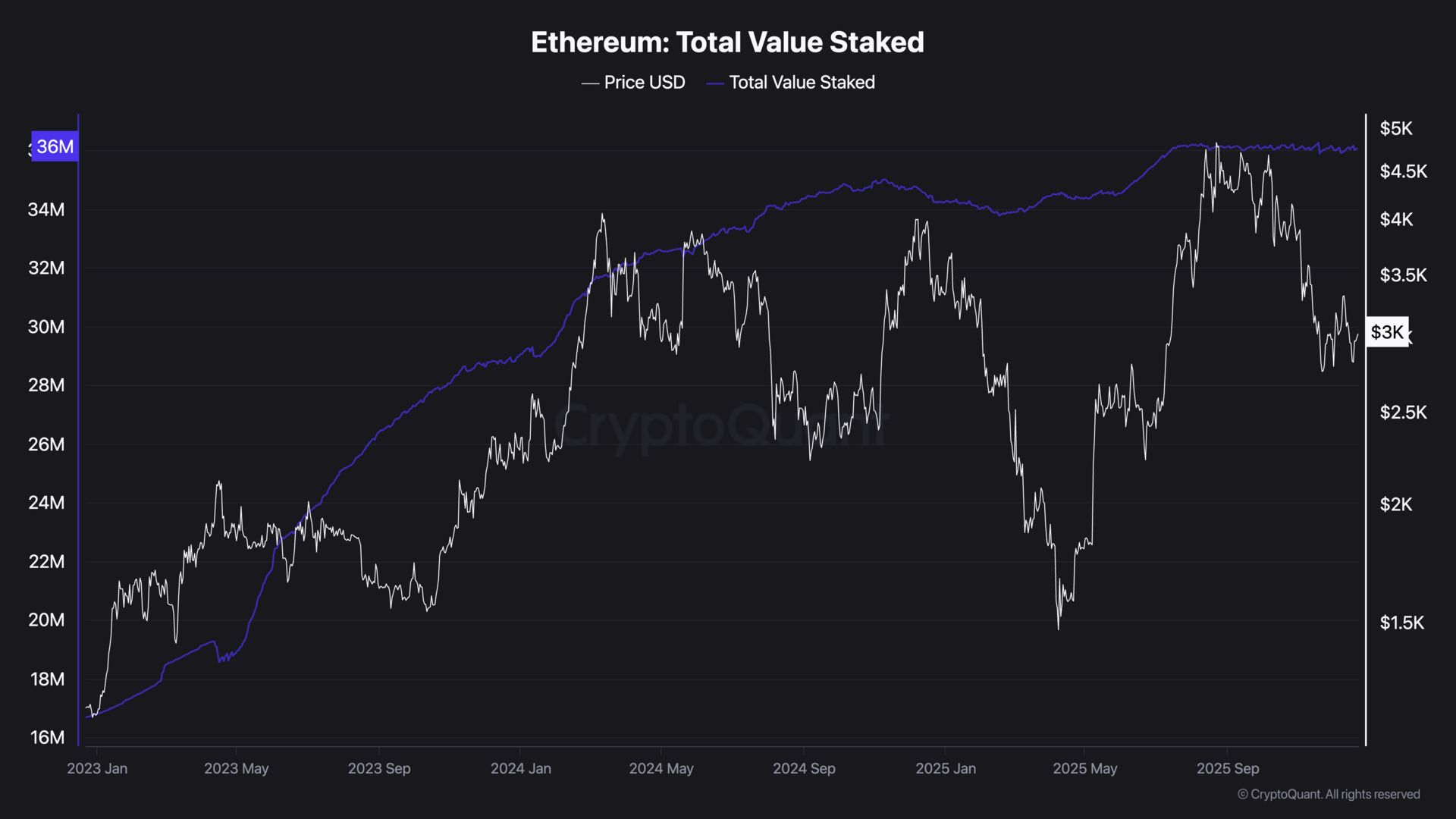

LOCKED AWAY 🔒

Time for check in on Ethereum’s supply side dynamics.

To do that we’ll be focusing on the amount of Ethereum currently being staked.

Quick Note: Ethereum staking involves locking up ETH to support the blockchain’s security. In return, users earn rewards for staking.

If you’d like to learn more about staking, check out this article.

36.07 million ETH is now locked in staking, up 1.80 million this year alone.

That's 29.89% of the entire supply - nearly one third of Ethereum pulled off the liquid market.

Week after week, more ETH gets staked and stays there. Exchange balances sit at multi-year lows. Long-term holders aren't budging.

And now almost 30% of the supply is locked, earning yield, with no intention of moving.

The liquid float keeps shrinking whilst staking participation keeps climbing.

When real demand finally collides with that kind of scarcity, ETH doesn't grind higher.

It re-prices violently. 🚀

CRACKING CRYPTO 🥜

How Pudgy Penguins Landed the Las Vegas Sphere—After Dogwifhat Couldn't. The Las Vegas Sphere is currently adorned with the cartoon creatures of crypto-native brand Pudgy Penguins. Here's how it happened.

Trend Research Buys 46,379 ETH While Some Public Treasuries Sell Ether. Trend Research is preparing another $1 billion to buy more Ether, after Bitmine's pushed its holdings past 4 million ETH as peers sell to pay down debt and buy back stock.

Ripple-linked XRP's price holds steady even as new income opportunities appear. XRP's price action aligns with broader market trends, but, contrarily, negative social sentiment may signal a potential rebound.

Spot bitcoin, ether ETFs see outflows amid Christmas holiday derisking. US spot bitcoin ETFs posted $188.6 million in net outflows on Tuesday, marking their fourth straight day of negative flows.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

When the FBI seized Silk Road's Bitcoin in 2013, approximately how much BTC did they confiscate?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 174,000 BTC 🥳

The US government seized approximately 174,000 BTC from Silk Road operator Ross Ulbricht and the marketplace itself, worth around $34 million at the time.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.