GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter that won't sink your investments like a supposedly unsinkable ship hitting an iceberg...🚢❄️

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Bitcoin’s true value 🤑

Checking in on the DeFi market💰

And more…

MARKET WATCH ⚖️

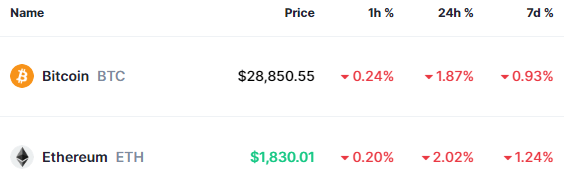

BTC Dominance is currently at 49.81% and the current crypto market cap is $1.17T ▼1.54%

BTC Dominance YTD

Biggest Winners of The Day 🤑

BNB (BNB) ▲0.56%

TRON (TRX) ▲0.02%

Biggest Losers of The Day 😭

Solana (SOL) ▼4.58%

Bitcoin Cash (BCH) ▼4.04%

Shiba Inu (SHIB) ▼3.85%

Only the top 20 coins measured by market cap feature in this section

JUST IN: FTX Plans to Restart Crypto Exchange for International Customers 😱

We’ve heard rumours of FTX rebooting, but now it’s pretty much confirmed that this is a real possibility.

The bankruptcy administrators have filed a proposed plan that would see a possible restart of FTX.com

This re-booted exchange would only be available to offshore customers

FTT token holders would get nothing

For the full story click here.

All price data as of 7:45am ET

EXPERT OF THE DAY 💰

This expert argues that Bitcoin is going to at LEAST $2 Million dollars per coin over the upcoming years.

Today’s expert is Greg Foss, for those who haven’t heard of him, here’s his impressive credentials:

Former hedge fund founder

Quantitative analyst

Decades of experience in finance and financial modelling

In his latest interview, Foss dropped some bombshells.

He broke down two of his vital models for predicting Bitcoin’s price. The first model was a valuation for Bitcoin’s current value. What did that model put Bitcoin’s current value at?

$250,000 🤑

His second model?

It suggests Bitcoin will go on to be worth $2.1 Million dollars.

Here’s, in a nutshell, how Foss looks at valuating Bitcoin.

First - he looks at the total addressable market of financial assets in the entire world.

This equals $900 Trillion dollars.

I think it's highly unlikely that bitcoin price is not substantially higher within the next decade than it is now.

Foss then applies a probability that Bitcoin will get a 5% market share of that $900 Trillion.

A 5% market share of $900 Trillion = $45 Trillion dollars. 💰

Then we just divide by the total amount of Bitcoin there will ever be = 21 Million.

$45 Trillion Dollars / 21 Million Bitcoin = ~$2.14 Million per Bitcoin 🤓

Of course, the calculation is a lot more complex than this with many more moving parts, but simplified down you can understand the gist of the model that Greg Foss is using.

Nutty’s takeaway: Although the current valuation and future target predictions are impressive and interesting, something else Foss mentioned in his interview is worth paying attention to. Foss made sure to point out that this would be the value in today’s dollars, not in 100 years time with inflated dollars.

If inflation keeps running as hot as it has been in the last few years, in a 100 years, everything is going to have crazy price valuations because the underlying currency has been inflated into essentially nothing.

Do you understand? 😉

ON CHAIN DATA DIVE 📊

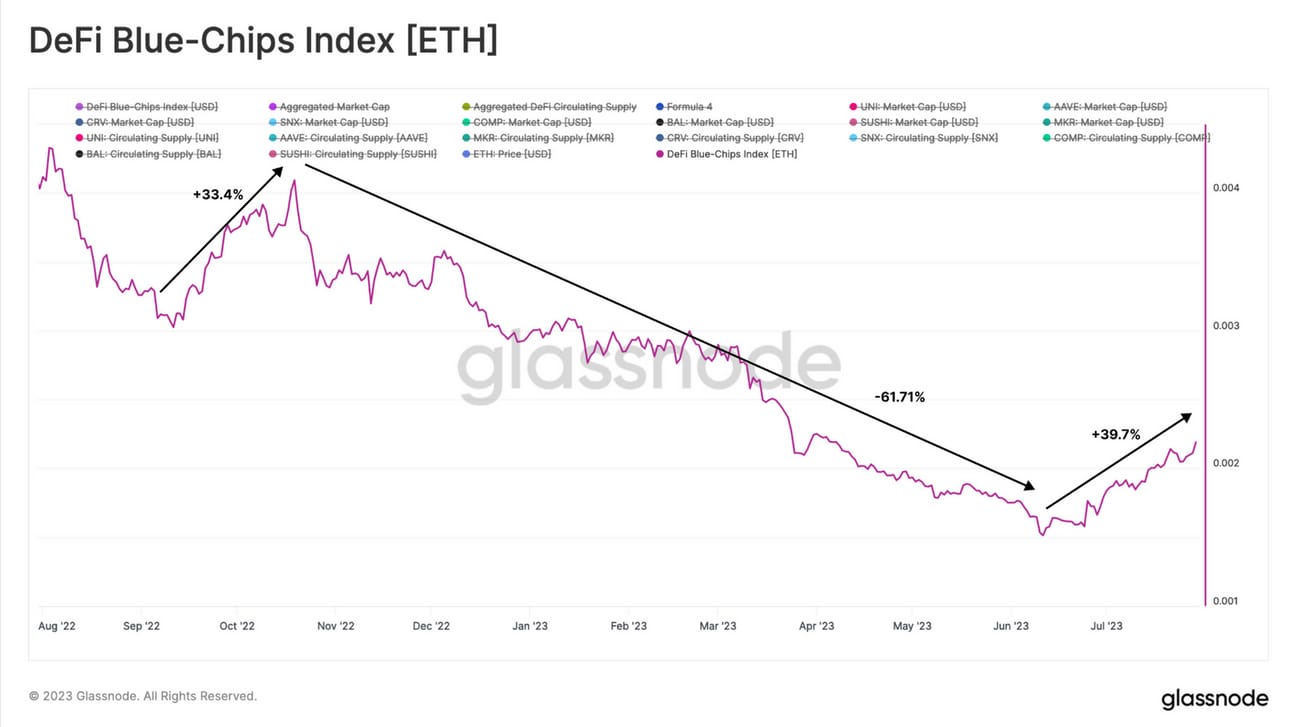

Let’s take a look at how the altcoin markets have been performing recently. Normally we focus on just Bitcoin and Ethereum but we thought this was pretty interesting and worth sharing with you.

Over the last couple of months, altcoins have had a pretty wild time. There’s been positive news and negative news.

The SEC labelled 68 cryptocurrencies as unregistered securities, resulting in decreased market interest. The full list can be found here

The Bitcoin ETF filings sparked a lot of interest not just for Bitcoin but the digital asset market as a whole

The Ripple Labs vs SEC court case where XRP was ruled not a security was another massive catalyst for increased altcoin interest

Glassnode’s Defi index shows the average price of the Blue-Chip DeFi tokens weighted by their circulating supply relative to ETH. It can be used to highlight the general price movement’s of the DeFi market.

This index is made up of the following tokens:

CRV - Curve DAO Token

UNI - Uniswap

BAL - Balancer

SNX - Synthetix

AAVE - AAVE

SUSHI - SushiSwap

COMP - Compound

MKR - Maker

You’ll notice that this index has been increasing since June 2023, a rise of 39.7%. It’s nice to see the DeFi market have a 2 month stretch of positive gains relative to ETH.

Interestingly, this hasn’t been seen since September 2022 where the index gained 33.4%. 🤔

Nutty’s Takeaway: It looks like DeFi tokens have begun to recover from the end of the last bull run. DeFi products are interesting and serve an important piece in the crypto market as a whole. We’ll be keeping an eye on these tokens and seeing if this positive trend can continue.

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

How much Bitcoin is currently available for purchase on exchanges?

A) 1.35 million

B) 2.13 million

C) 1.48 million

D) 1.88 million

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) 1.88 million 🎉

Currently there are 1.88 million Bitcoins available for purchase on exchanges. Check the source here.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.