Today’s edition is brought to you by DeleteMe

Take back control of your data. Learn more and get 20% off your plan at joindeleteme.com/CRYPTONUTSHELL

GM to all of you nutcases. It’s Crypto Nutshell #773 levelin’ it up… 🍄🥜

We’re the crypto newsletter that’s more relentless than a cyborg assassin tracking its target through time, no matter the cost… 🤖⏳

What we’ve cooked up for you today…

😱 The treasury model collapse

🌊 Follow the liquidity

📈 Only up

💰 And more…

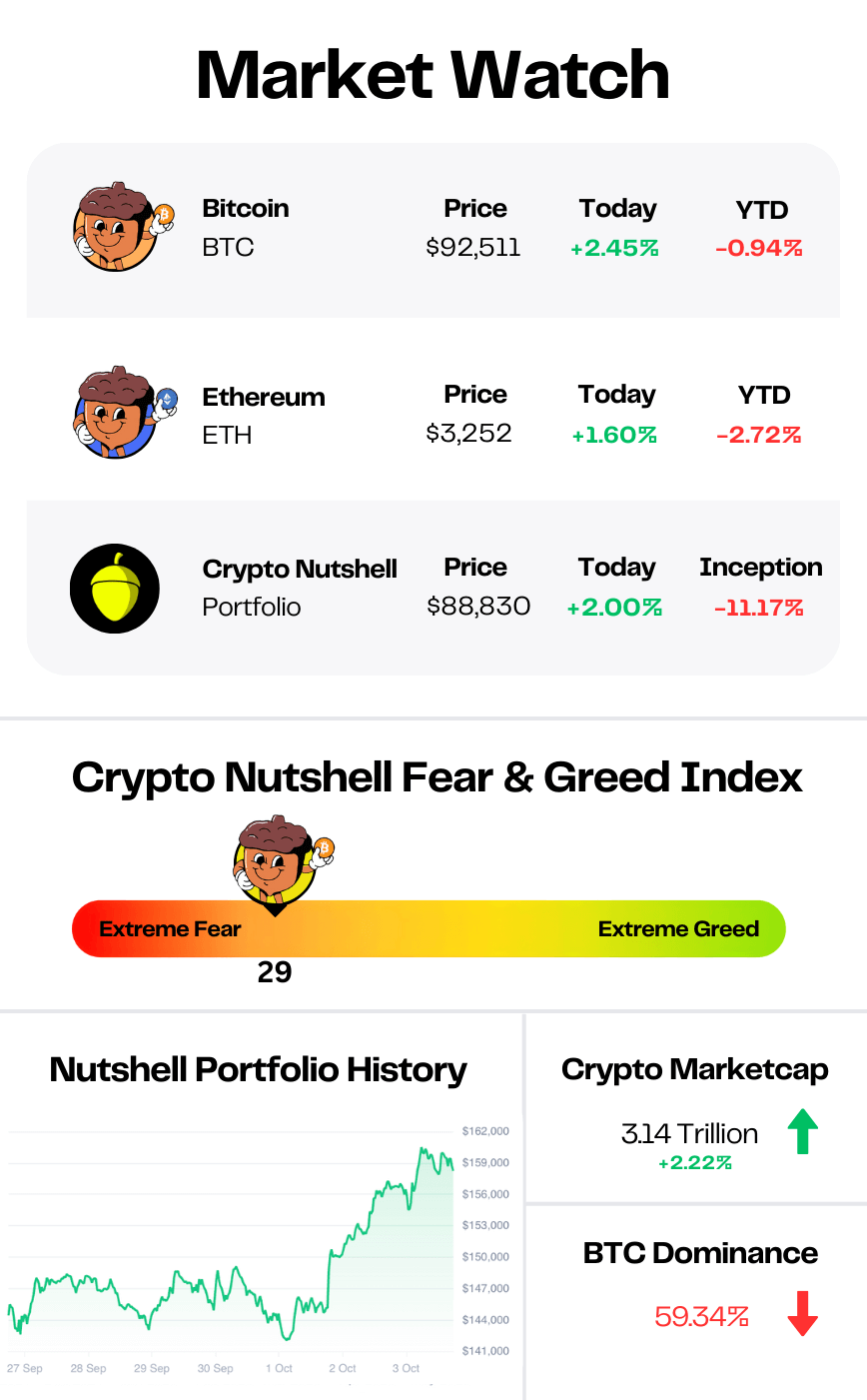

Prices as at 2:05am ET

THE TREASURY MODEL COLLAPSE 😱

BREAKING: Some Bitcoin Buying Firms Are Selling as Losses Pile Up on Paper

Most corporate Bitcoin treasuries are now sitting on losses…

A new report from BitcoinTreasuries.net found that 65% of the 100 companies tracked bought Bitcoin above $90,000 - leaving the majority underwater as BTC hovers in the low-$90Ks.

This is the first real stress test of the corporate treasury playbook since it went mainstream earlier this year.

And the cracks are starting to show.

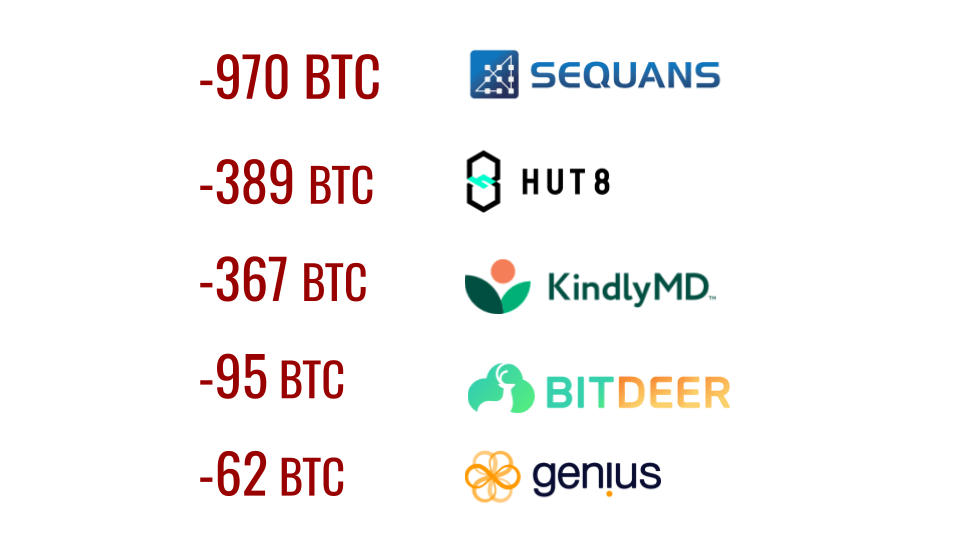

Five companies sold Bitcoin in November, including miner Hut 8 and treasury firm Sequans, which dumped roughly one-third of its holdings.

Combined, they offloaded 1,900 BTC as prices collapsed toward $81,000.

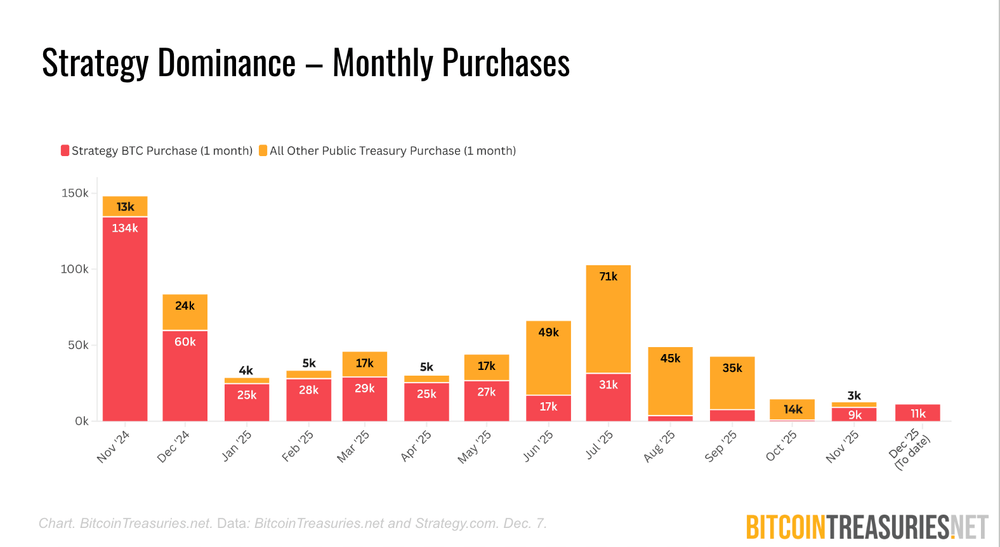

On a net basis, corporates still added 10,750 BTC last month.

But here's the problem: 72% of that came from Strategy alone.

Michael Saylor bought another 9,000 BTC in November while nearly everyone else either paused or sold.

Only 28 companies disclosed a Bitcoin purchase in November, down from 164 that have bought since January.

That includes around 60 first-time buyers who announced a purchase earlier this year but have gone silent since.

Meanwhile, the balance sheets tell a brutal story…

Companies like Trump Media and Figma bought Bitcoin around $120,000. Tesla and Block, by contrast, have cost bases below $30,000.

The gap between early movers and late entrants has never been wider.

And with "substantial mark-to-market pressure" hitting boards and risk committees, the report warns that strained balance sheets could force a rethink for many treasury firms.

This doesn't point to widespread distress yet. But it does expose the downside of chasing elevated prices and banking on long-term upside to validate those decisions.

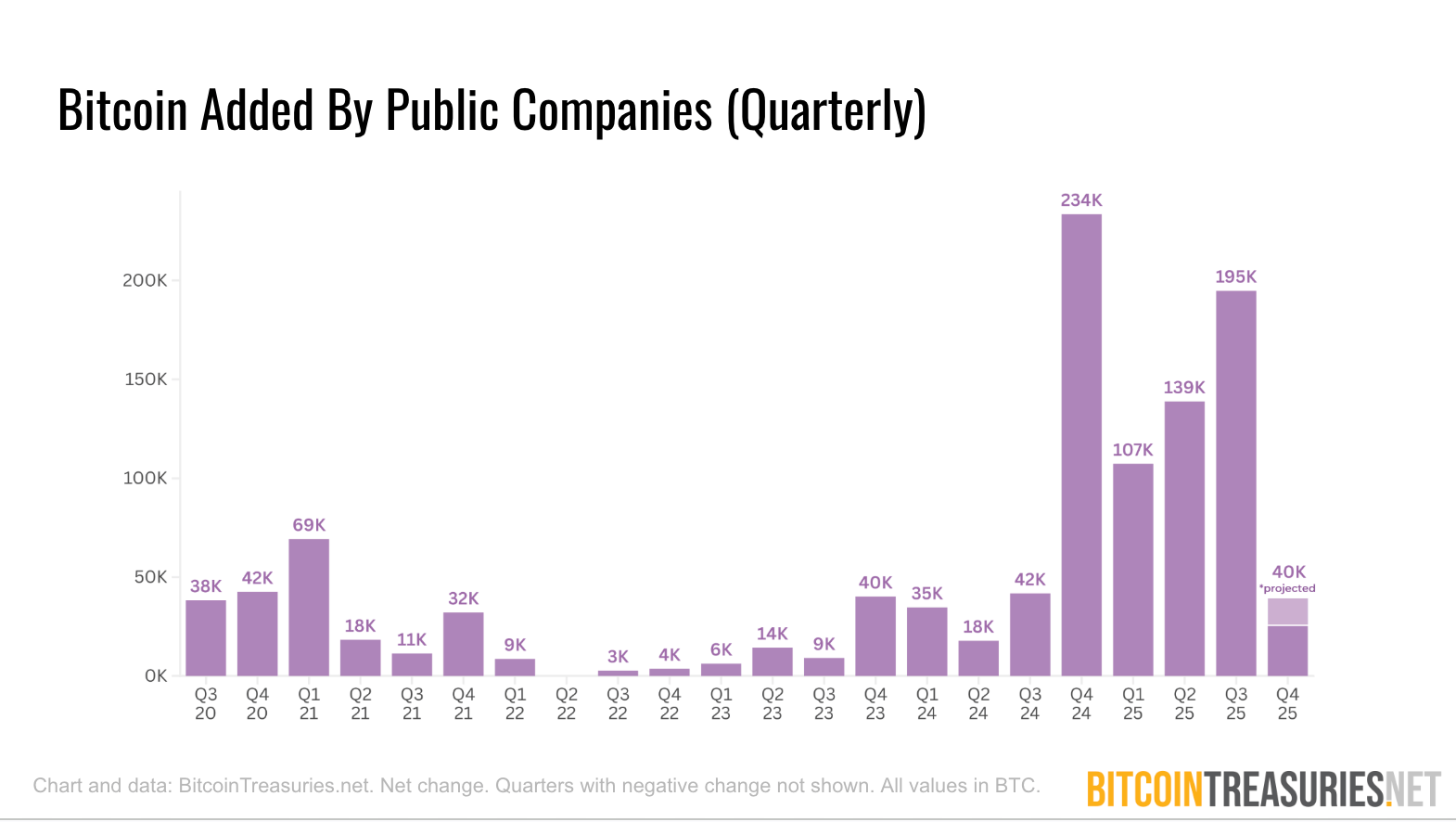

The fourth quarter is on pace to add roughly 40,000 BTC to corporate balance sheets - the weakest quarter since Q3 2024 and well below the "summer buying frenzy" that defined the first half of this year.

The hype around corporate Bitcoin adoption has clearly cooled alongside the buying activity.

Risk committees are confronting what happens when conviction meets a 30% drawdown.

And for most of them, the answer isn't "buy more."

It's wait and see. 🚀

Speaking of waiting...

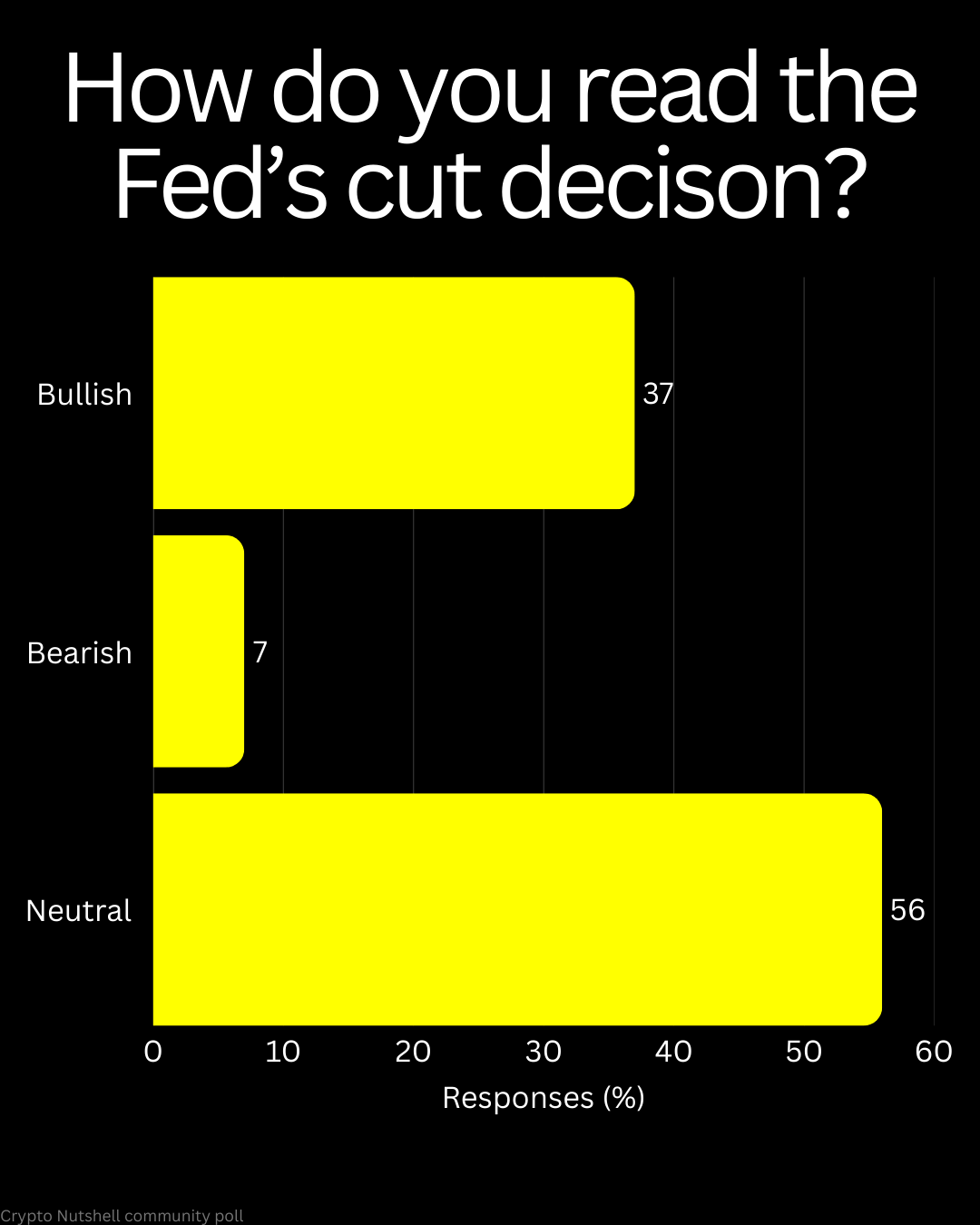

Most of you aren't buying the Fed's mixed signals either.

In yesterday's poll, 56% said the real shift happens when Hassett replaces Powell in May - not from Wednesday's rate cut or Treasury purchases.

Only 37% saw the $40B in liquidity as bullish, while just 7% thought Powell's caution signals a stalling easing cycle.

The message is clear: The Crypto Nutshell community is looking past the noise and positioning for the bigger regime change ahead.

YOU PROTECT YOUR CRYPTO. BUT WHAT ABOUT YOUR PERSONAL DATA? 🔐

If you believe in self-custody for your assets, you should care about who controls your personal information.

Right now, data brokers are trading your digital identity including: your name, address, phone, work details, income, and family info, all without your consent.

Just like leaving crypto on a sketchy exchange, exposed personal data puts you at risk of:

Phishing scams targeting your wallets 🎣

Doxxing that links your identity to crypto activity 🕵️

Targeted attacks based on wealth signals or online presence 💻

Data leaks compromising your family's security 🧑🤝🧑

That's why the Crypto Nutshell team uses DeleteMe.

Think of it as self-custody for your personal information. DeleteMe scans hundreds of data broker sites and removes your info automatically, all year round.

When we signed up, they found and deleted 100+ listings we never knew existed.

You wouldn't trust a sketchy exchange with your keys. Don't trust data brokers with your identity.

FOLLOW THE LIQUIDITY 🌊

Arthur Hayes is a crypto OG and the co-founder of BitMEX.

He is one of the few people who deeply understands the "plumbing" of the global financial system.

And in his latest interview with David Lin, he argued that the 4-year cycle is now officially dead.

His reasoning?

Bitcoin doesn't pump just because the mining supply gets cut in half.

It pumps when the world floods the system with cash.

Arthur argues that previous bear-markets weren't caused by a magical time limit - they happened because central banks tightened monetary policy.

But right now, as we know, the opposite is happening:

The Fed is cutting rates. 📉

Trump is pushing for stimulus. 💸

China and Japan are easing. 🌏

Translation:

Global liquidity is expanding, not contracting.

We aren't facing a bear market driven by a calendar date; we are entering an era of cheap money.

The supply of Bitcoin is fixed. But the supply of fiat currency is about to explode.

Don't watch the clock…

Watch the printer. 🖨️

ONLY UP 📈

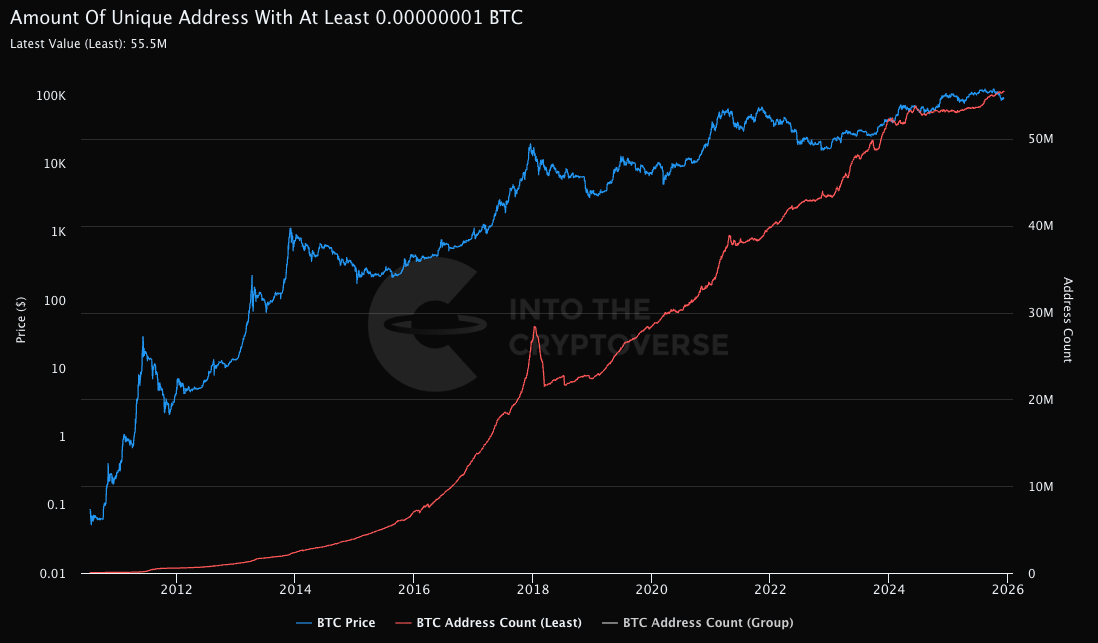

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

There are now 55.48 million wallets holding Bitcoin.

That’s ~190k more wallets than two weeks ago.

And if we zoom out…

In 2025 alone, this number is up by 2.36 million.

The message is clear: adoption isn’t slowing - it’s accelerating.

More holders. More conviction. More resilience through every swing.

Price moves around. The network keeps getting stronger. 💪

CRACKING CRYPTO 🥜

XRP ETFs absorbed nearly $1 billion in 18 days, yet the price is flashing a major warning signal. XRP ETFs create a buffer against volatility, as passive inflows absorb supply that might otherwise drive prices lower.

Bitcoin treasuries stall in Q4, but largest holders keep stacking sats. Bitcoin treasury adoption slowed down in the fourth quarter of 2025, but the largest players continue to accumulate the BTC supply steadily.

U.S. Financial-Risk Watchdog, FSOC, Erased Digital Assets as a Potential Hazard. From Donald Trump's crypto-friendly regulators, the yearly report that once flagged financial-stability risks is no longer issuing "vulnerability" warnings.

Terraform Labs founder Do Kwon sentenced to 15 years over $40 billion Terra-Luna collapse: Inner City Press. Terraform Labs founder Do Kwon was sentenced for his role in the collapse of the Terra and Luna tokens on Thursday.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Are you ready for this week’s quiz?

5 questions. All from this week’s issues. If you’ve been paying attention, you’ll crush it. If you’ve been skimming, it’ll show.

Tap the button below to start this week’s quiz, then tell us how you scored in the poll at the bottom of this newsletter. 👇️

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.