GM to all of you nutcases. It’s Crypto Nutshell #777 liftin’ from the rubble… 🏗️🥜

We’re the crypto newsletter that’s more relentless than a bounty hunter chasing fugitives across the edge of the galaxy… 🤠🚀

What we’ve cooked up for you today…

🦸 The Super App

🕰️ The Cycle Just Got Longer

🥤 Supply squeeze

💰 And more…

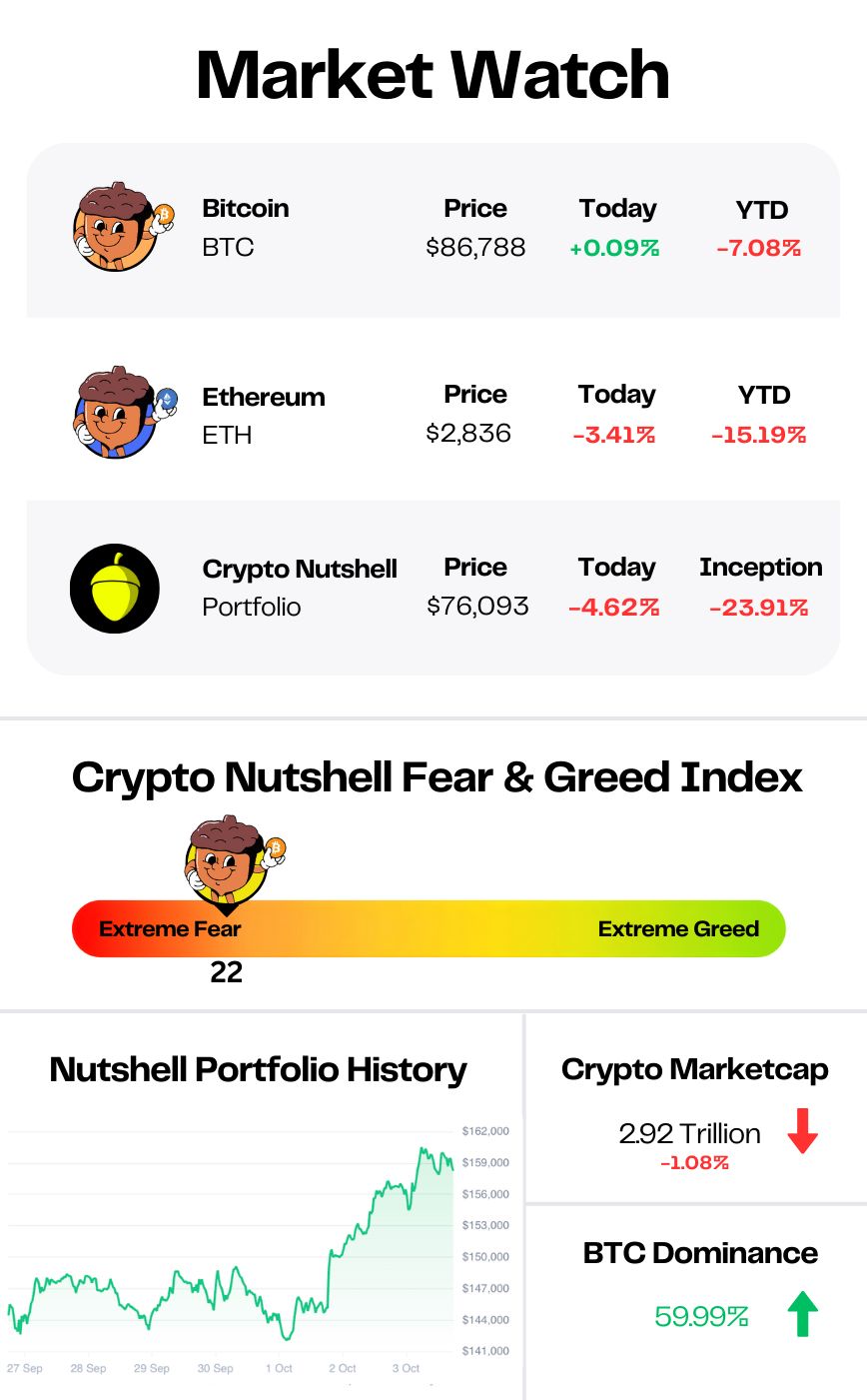

Prices as at 2:30am ET

THE SUPER APP 🦸

BREAKING: Coinbase expands into stocks, prediction markets, Solana DEX trading via Jupiter, and more in 'everything exchange' push

Coinbase just rolled out its most aggressive product expansion in 13 years.

Stock trading, prediction markets, Solana DEX integration, custom stablecoins, and AI tools are rolling out now as the exchange races to keep up with competitors.

Let's break it down.

Stock trading

U.S. users can now trade hundreds of stocks and ETFs alongside crypto. Commission-free, with select stocks available 24/5.

Thousands more stocks coming in the next few months. Stock perpetual futures for international users roll out early 2026.

Coinbase is positioning this as a bridge to tokenized equities, with Coinbase Tokenize launching in 2026 for managing tokenized real-world assets.

Prediction markets

Coinbase launched prediction markets via Kalshi partnership. Users can trade event-based contracts on elections, sports, and economic indicators starting at $1.

Solana DEX trading

Coinbase integrated Jupiter - Solana's largest DEX aggregator - directly into its app, letting users trade Solana tokens without leaving the platform.

Millions of assets across Solana and Base are now accessible.

Custom stablecoins

Companies can issue branded stablecoins backed 1:1 by USDC through Coinbase. Early partners include Flipcash, Solflare, and R2.

This puts Coinbase into direct competition with established stablecoin infrastructure providers like Paxos and Anchorage.

Why this matters

Coinbase is playing catch-up.

Robinhood, Kraken, and Gemini have already launched tokenized equities outside the U.S. Several competitors are exploring prediction markets.

The difference?

Coinbase is bundling everything into one platform and betting that scale wins.

The regulatory shift helped. The SEC greenlit always-on trading of tokenized stocks. The GENIUS Act provided stablecoin clarity. And market structure legislation is expected in 2026.

But the real story is consolidation.

Crypto exchanges are morphing into full financial platforms - stocks, derivatives, predictions, stablecoins, banking services - competing less with each other and more with traditional fintech.

Coinbase isn't the first to do this. But it might be the biggest. 🚀

What Happens When $4.7T in Real Estate Debt Comes Due?

A wave of properties hit the market for up to 40% less than recent values. AARE is buying these income-producing buildings at a discount for its new REIT, which plans to pay at least 90% of its income to investors. And you can be one of them.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

THE CYCLE JUST GOT LONGER 🕰️

This week macroeconomic expert Raoul Pal addressed the question on everyone’s mind:

Is the cycle over… or are we in crypto’s first 5-year cycle?

Raoul Pal at Solana Breakpoint 2025

Speaking at Solana Breakpoint 2025 in Abu Dhabi, he was very direct:

“We had this perfect 4-year cycle and this is where everybody's scratching their heads right now. What the hell's going on? Has the cycle finished?”

According to Raoul, the cycle didn’t break.

It changed.

And as you should know by now, the reason comes down to debt and liquidity.

“In 2022, at the beginning of ’22, rates were still at zero and they extended the debt maturity by a year to five years. So we’ve got an extra year in the equation.”

That single shift matters more than most people realize.

Because debt rollovers drive liquidity.

And liquidity drives crypto.

Raoul explains that the big wave of debt that normally fuels the blow-off phase was pushed back:

“All of the debts that need to get rolled, get rolled in 2026 and not 2025. So that’s why we’ve had less liquidity than we expected at this point.”

In other words:

The “banana zone” arrived… but with less fuel.

That’s why this cycle feels slower, messier, and much more frustrating than past ones.

Raoul only caught this over the summer after re-doing the math:

“I realised, okay, wow, they’ve actually changed the structure of liquidity here.”

When he adjusted the model to account for the longer debt maturity, the conclusion was clear:

“Probabilistically speaking, we’ve got further to go and we’ve got the big liquidity burst to come.”

So no, in his view, this cycle isn’t over.

It’s just longer.

And if he’s right, the peak isn’t behind us…

It’s still all to play for… 🎲

SUPPLY SQUEEZE 🥤

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Only 16.33 million ETH are left on exchanges.

That's just 13.53% of the entire supply. And since January, another 4.42 million ETH has been pulled off exchanges.

Read that again…

This is what a supply squeeze looks like before the market catches on.

ETH has sold off alongside the rest of crypto. Fear's running hot. And yet exchange balances still aren't climbing.

That tells you everything. This isn't panic. It isn't capitulation.

Whales aren't bailing. They're positioning. 🐳

CRACKING CRYPTO 🥜

Bitcoin data proves 60% of top US banks are quietly activating a strategy they publicly denied for years. US banks embrace Bitcoin as it becomes a standard financial offering by 2026, integrating crypto into mainstream wealth workflows.

Bhutan pledges 10K Bitcoin to develop its ‘mindfulness city’. Bhutan has pledged 10,000 Bitcoin from its stash to develop the Gelephu Mindfulness City, using long-term treasury and yield strategies to support sustainable economic growth.

Crypto industry insiders meet with key senators on market structure bill negotiation. Executives and lobbyists attended a meeting today with Senator Tim Scott and others to hash out the ongoing talks over crypto's most important policy effort.

Hut 8 shares surge 25% as bitcoin miner seals AI deal with Anthropic and Fluidstack, signs $7 billion data center lease. The company signed a 15-year lease with Fluidstack at its River Bend campus in Louisiana, with Google providing a financial backstop.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which stablecoin briefly flipped Tether (USDT) to become the largest by market cap in 2023?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: USDC 🥳

USDC briefly overtook USDT in March 2023 during the Silicon Valley Bank crisis, when Tether faced banking concerns. Circle's USDC hit around $44 billion while USDT dropped to $41 billion.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.