GM to all of you nutcases. It’s Crypto Nutshell #800 revvin’ up… 🚗🥜

We’re the crypto newsletter that’s more unhinged than a city spiraling into chaos one bad decision at a time… 🌆🔥

What we’ve cooked up for you today…

🏦 Tokenised stocks are stocks

📐 A mathematical certainty

🤯 Back with a bang

💰 And more…

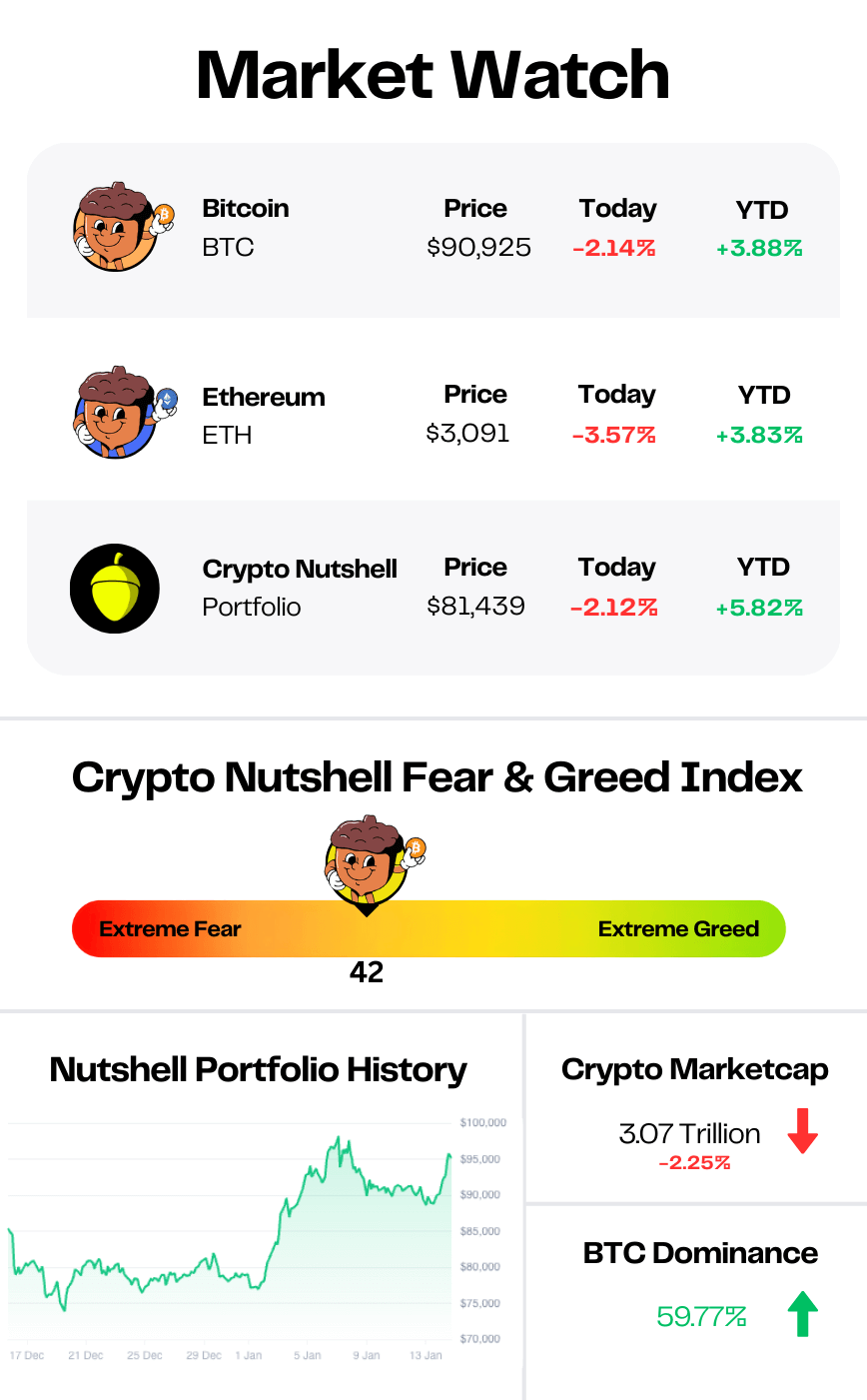

Prices as at 4:50am ET

TOKENISED STOCKS ARE COMING 🏦

BREAKING: NYSE develops tokenized securities platform to support 24/7 trading

The New York Stock Exchange just made its biggest move into crypto.

On Monday, NYSE said it's building a blockchain platform for tokenized stocks.

The platform would run 24/7. Trades would settle instantly. And funding would happen through stablecoins.

If approved, it would be the first time America's oldest exchange runs fully on-chain.

What's being built

The platform links NYSE's trading system to blockchain settlement. It supports multiple chains. Trades settle in real time using stablecoins - not the usual one-day wait.

It would handle both tokenized versions of normal stocks and ETFs, plus new digital-native securities. Shareholders keep the same voting rights and dividends as before.

ICE, NYSE's parent company, is already working with BNY and Citi.

The goal: let members move money outside normal banking hours and across time zones.

Why it matters

This isn't a just a test run. It's not a vague press release about "exploring blockchain."

It's the world's largest stock exchange building real infrastructure to settle trades on-chain, around the clock, with stablecoins.

"For more than two centuries, the NYSE has transformed the way markets operate… We are leading the industry toward fully on-chain solutions, grounded in the unmatched protections and high regulatory standards that position us to marry trust with state-of-the-art technology."

The timing isn't random.

Robinhood has already launched tokenized stocks for European users.

Coinbase plans to add them this quarter.

Nasdaq is pushing for near 24-hour trading. The race is heating up.

BlackRock's Larry Fink called tokenization "the next major evolution in market infrastructure."

NYSE just showed it agrees.

But…

The platform still needs regulatory approval. The launch is targeted for later this year.

And at the time of writing, no specific blockchains have been named. 🚀

Trusted by millions. Actually enjoyed by them too.

Morning Brew makes business news something you’ll actually look forward to — which is why over 4 million people read it every day.

Sure, the Brew’s take on the news is witty and sharp. But the games? Addictive. You might come for the crosswords and quizzes, but you’ll leave knowing the stories shaping your career and life.

Try Morning Brew’s newsletter for free — and join millions who keep up with the news because they want to, not because they have to.

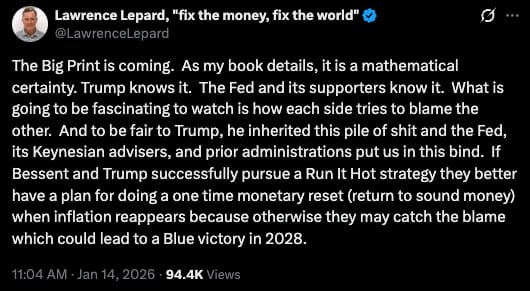

A MATHEMATICAL CERTAINTY 📐

Larry Lepard put it bluntly this week: the Big Print is coming.

Not because politicians want it. Not because the Fed is reckless.

But because the math leaves no other option.

And that is very good for crypto prices…

If you don’t know who Larry Lepard is, he’s a longtime macro investor who laid all of this out years ago.

In his book, he explains the Big Print as the unavoidable moment when governments are forced to print massive amounts of money instead of defaulting on their debts.

This week, he explained why it’s coming sooner than people expect and why it can’t be avoided:

Here’s why he says it’s mathematical certainty:

The government has way too much debt.

They can’t realistically pay it back the normal way.

So when things get tight, they are forced to print boat loads of money.

That’s the “Big Print.”

And when a lot of new money gets created, prices tend to rise, and your dollars buy less & less.

Bitcoin was literally made for that kind of world.

There will only ever be 21 million BTC.

No one can print more.

So as the masses start realizing their money is being diluted, they look for things that can’t be diluted.

That’s why the Big Print is good for Bitcoin & crypto.

Stack accordingly. 🥞

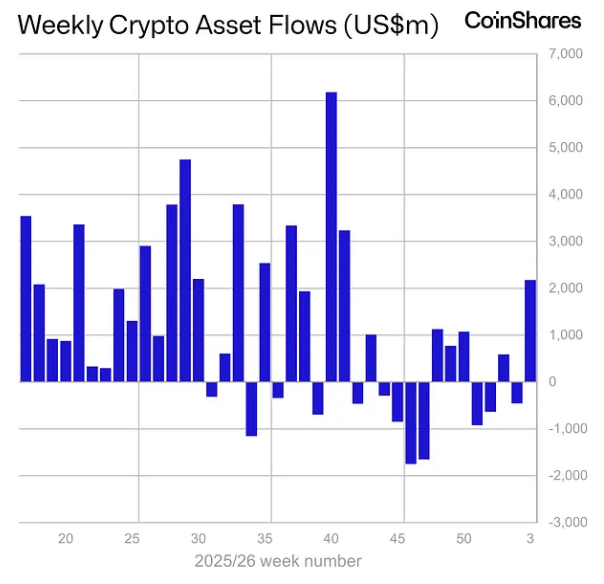

BACK WITH A BANG 🤯

And we’re back…

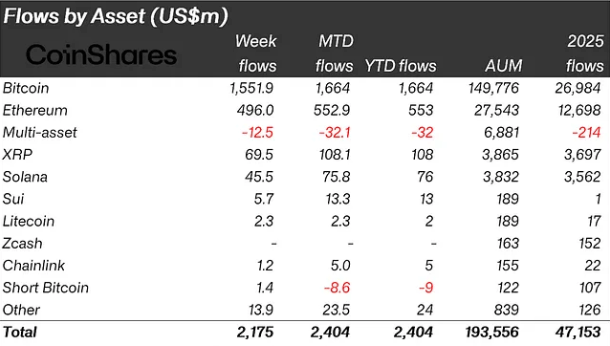

Last week, digital asset funds saw inflows of $2.17 billion.

That’s the largest weekly total since October 10th, 2025. (Just before the market crash)

Let’s break it down.

The inflows were concentrated on Bitcoin last week which saw $1.55 billion.

Ethereum followed with $496 million in inflows.

Whilst XRP and Solana saw inflows of $69.5 and $45.5 million.

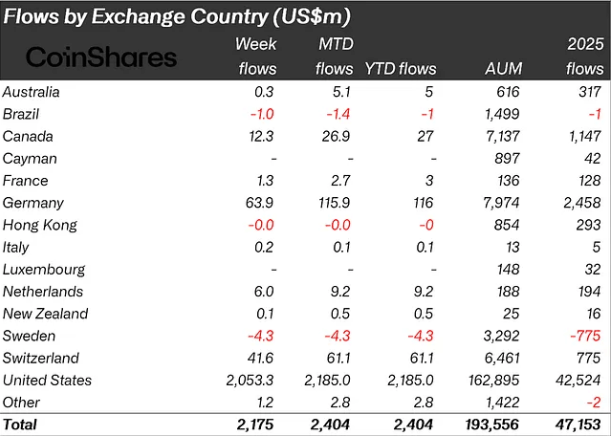

From a regional perspective, the US dominated with $2.05 billion.

Germany, Switzerland and Canada followed with inflows of $63.9m, $41.6m and $12.3m respectively.

CoinShares points out that inflows were strong early in the week, then sentiment flipped on Friday with $378 million in outflows.

This was likely due to two macro economic factors:

Diplomatic escalation over Greenland and renewed tariff threats

Kevin Hassett, a leading contender for Fed Chair, is now likely staying in his current role

The money's coming back in, but it's still a little skittish.

One headline and the flows start to reverse. That's not conviction yet.

But it's a start. 🚀

CRACKING CRYPTO 🥜

Bermuda Plots 'Fully On-Chain National Economy' With Help From Coinbase and Circle. Bermuda wants to take its entire economy on-chain and will lean on Coinbase and Circle for support in the process.

India’s RBI Proposes BRICS CBDC Link for Cross-Border Payments. The proposal would place CBDC interoperability on the BRICS agenda, though talks remain early and depend on consensus over technology and governance.

Traders slash odds of $100,000 bitcoin by end of January as Greenland tensions rattle markets. Odds of bitcoin rising to $100,000 by the end of January plunged on the Polymarket.

Vitalik Buterin calls for 'different and better' DAOs beyond token-holder voting. Buterin said new DAO models should address issues of privacy and decision fatigue, for which he suggested the use of ZK and AI technology.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Ethereum launched in 2015, but which of these Layer 1 blockchains went live before it?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Ripple (XRP) 🥳

The XRP Ledger launched in 2012, three years before Ethereum. Solana came in 2020, Polkadot in 2020, and Cardano in 2017. XRP is one of the oldest cryptocurrencies still actively traded.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.