Today’s edition is brought to you by Topper

Topper makes off-ramping effortless, fast, and accessible. Get started now and convert your crypto to cash, fee-free!

GM to all 84,827 of you. Crypto Nutshell #534 scuttlin’ in… 🦀 🥜

We're the crypto newsletter that's more intense than a high-stakes poker game with your life on the line... ♠️🃏

What we’ve cooked up for you today…

🏦 Another one

🕊️ This megatrend will send us higher

💪 The surge continues

💰 And more…

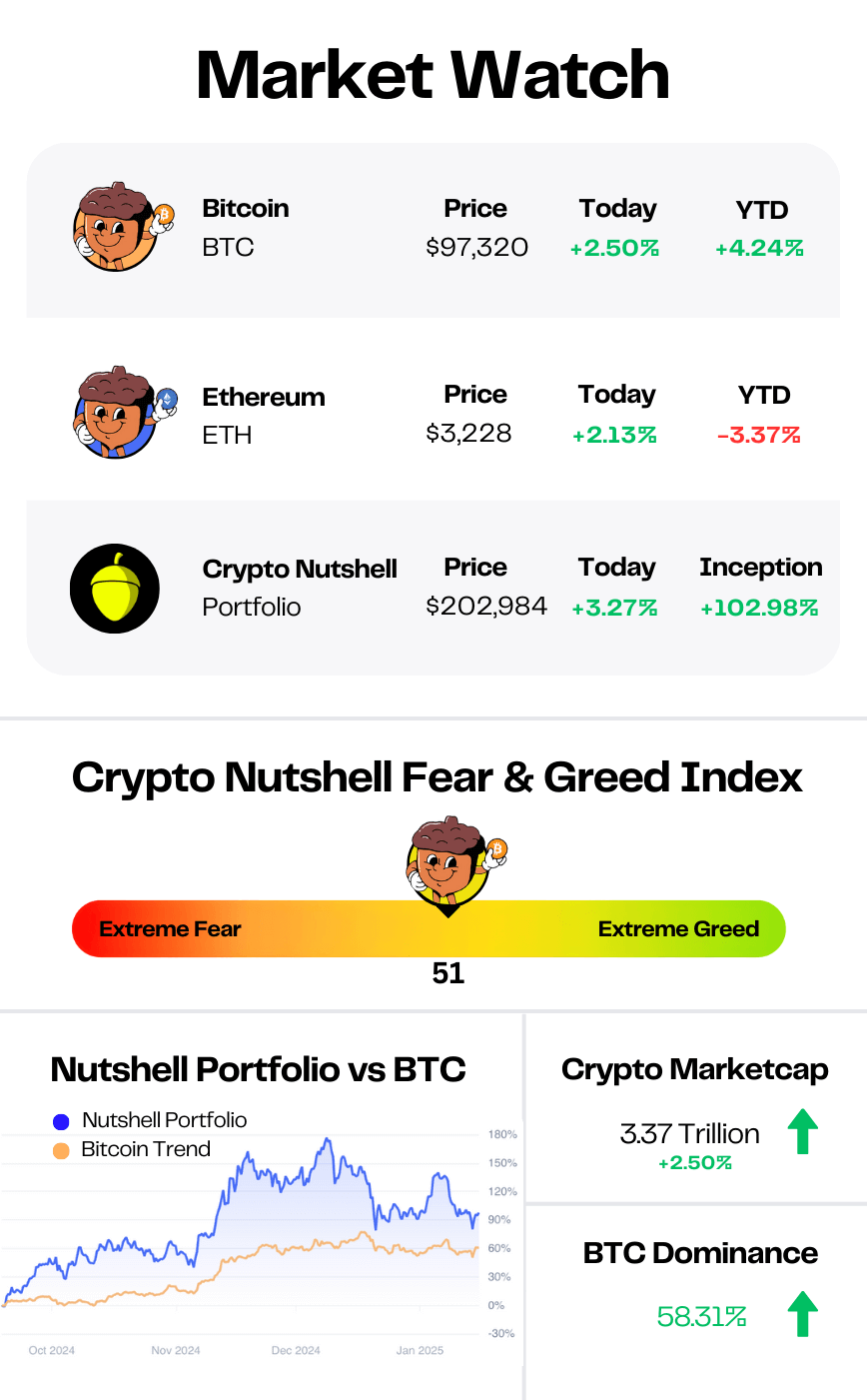

Prices as at 11:30pm ET

ANOTHER ONE 🏦

BREAKING: Meta Shareholder Proposes Bitcoin Adoption For Corporate Treasury

Remember back to a few weeks ago when we had Microsoft considering a Bitcoin investment? (Only 0.55% of shareholders voted in favour of the investment…)

Well, now we’ve potentially got another MAJOR company considering adding Bitcoin to their balance sheet.

This time, Meta shareholders urged the company to allocate a portion of its $72 billion in cash to Bitcoin.

The proposal was filed by Ethan Peck, an employee of The National Center for Public Policy Research.

Peck explained that Meta is losing 28% of its cash assets over time due to inflation:

“Since cash is consistently being debased and bond yields are lower than the true inflation rate, 28% of Meta’s total assets are consistently diminishing shareholder value simply by sitting on the balance sheet.”

Continuing on, Peck also points out that Zuckerberg has a goat named Bitcoin:

“Mark Zuckerberg named his goats 'Bitcoin' and 'Max.' Meta director Marc Andreessen has praised Bitcoin and is also a director at Coinbase. Do Meta shareholders not deserve the same kind of responsible asset allocation for the Company that Meta directors and executives likely implement for themselves?"

But here’s where it gets real interesting…

The National Center for Public Policy Research is the same organisation that submitted similar proposals to Microsoft and Amazon.

We know the Microsoft proposal didn’t quite work out. 🥹

But the Amazon proposal is scheduled to be discussed at the April 2025 annual meeting…

More and more companies are considering using Bitcoin as a treasury asset every single day.

This trend isn’t going away anytime soon.

More on this in the next section…

Off-Ramping Crypto Doesn’t Have to Be Hard 🤑

Converting crypto to fiat can be frustrating—limited asset support, high fees, and long delays. That’s why Topper’s new Off-Ramp is a game-changer.

With Topper Off-Ramp, you can:

✅ Withdraw over 200+ assets: From Bitcoin and Ethereum to emerging tokens, access one of the largest supported asset libraries in the crypto space, giving you the freedom to manage your portfolio your way.

✅ Access your funds instantly: Say goodbye to waiting days for withdrawals. Topper ensures your funds reach your debit card almost immediately, making your crypto as liquid as cash.

✅ Enjoy global coverage: With Visa and Mastercard debit card support in the U.S.and Europe—and Visa Original Credit Transactions worldwide—off-ramp securely, no matter where you are.

Take control of your digital assets today with Topper’s Off-Ramp and experience a faster, smarter way to convert crypto to cash.

THIS MEGATREND WILL SEND US HIGHER 🕊️

Companies buying Bitcoin to put on their balance sheet is so much bigger than just Michael Saylor & MicroStrategy.

This is a genuine megatrend.

A megatrend that’s going to push crypto prices much higher over 2025.

That’s the latest message out from Matt Hougan.

Matt Hougan is the Chief Investment Officer at Bitwise. They have the 5th largest Bitcoin ETF, holding over $3.86 billion in Bitcoin.

This week, in an investment memo, Matt made a big prediction for 2025:

“My prediction: We’ll see hundreds of companies buy Bitcoin for their treasuries over the next 12-18 months, and their purchases will lift the entire Bitcoin market substantially higher.”

Matt then broke down why this megatrend is bigger than you think:

Reason 1: MicroStrategy Alone Is Doing Work

MicroStrategy is not a huge company. It’s currently ranked 220th largest in the world.

A little bit bigger than Chipotle.

Although MicroStrategy may not be huge, their Bitcoin purchases are massive. Over 2024, they alone bought ~257,000 Bitcoin.

To put that into perspective, they purchased more Bitcoin than all the Bitcoin mined in 2024 (218,829).

“Let me say that again: A company the size of Chipotle bought more than 100% of the entire new supply of bitcoin in 2024.”

What happens when larger companies, such as Meta (20x MicroStrategy’s size), follow suit?

Reason 2: The Trend Is Already Bigger Than MicroStrategy

Although MicroStrategy gets the headlines, it’s not alone.

Today, 70 public companies - including Tesla & Block- hold Bitcoin on their balance sheets, owning a combined 141,302 BTC (excluding MicroStrategy).

Private companies, like SpaceX, add another 368,043 BTC to the mix.

“That’s significant. It means that, even today, MicroStrategy is less than 50% of the corporate BTC market. I suspect it’ll be a small fraction of it eventually.”

We’re just at the start of companies adding Bitcoin to their balance sheets…

Reason 3: The Number Of Companies Buying Bitcoin Is About To Explode

The game has changed.

Thanks to 2024, the reputational risks of holding Bitcoin have faded. Crypto has now become much more mainstream with political support.

But the real game-changer? The new FASB accounting rules.

Companies can now mark Bitcoin gains as profits on their books.

With this barrier removed, Matt believes the number of companies buying Bitcoin will skyrocket - from 70 to hundreds or even thousands.

“I believe the number of companies that own Bitcoin on their balance sheets is going to explode.”

Conclusion

Companies will continue buying Bitcoin for the same reasons as individuals: to hedge against inflation, capitalize on potential profits, and future-proof their finances.

As Matt puts it:

“You don’t have to know why every company buys Bitcoin… just look at the numbers and ask yourself: Where is all this demand going? And what will that mean for the market?”

The megatrend is here - make sure you profit from it. 🌊

THE SURGE CONTINUES 💪

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are often used on centralized and decentralized exchanges to purchase other digital assets. And allow the instant transfer of money between borders.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

The last time we checked in on this metric, the stablecoin market cap was ~$188.36 billion. (18th of December)

Today the aggregate stablecoin market cap is ~$188.91 billion. 📈

That’s a minor increase of ~$0.55 billion in the last two weeks.

But here’s the thing…

Over the last 6 months, the stablecoin market cap has been exploding.

It’s increased by over $35.87 billion!

Capital continues to pour back into the crypto industry. (At an accelerating rate)

Here’s the simple takeaway:

This is one of the most important metrics for an altcoin bull run.

Simply put, more liquidity = Larger potential pumps 😎

CRACKING CRYPTO 🥜

Bitcoin adoption is outpacing the internet and mobile phones. BlackRock also advocated Bitcoin exposure through its spot ETF, IBIT, as it deems direct exposure complex for many.

Gary Gensler says the presidential election wasn’t about crypto money. The SEC chair is set to leave office in six days, the same day Donald Trump is scheduled to be inaugurated as president in Washington, DC.

Spot Bitcoin ETFs Exceeded Expectations in 2024, but Just Wait for 2025. Gary Gensler has described crypto as the Wild West and one observer said markets are likely to see just that under new leadership in D.C.

Donald Trump's inauguration may no longer be a sell-the-news event for bitcoin, K33 says. Bitcoin’s price initially surged following Donald Trump’s election victory, buoyed by the prospect of his pro-crypto policies.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Twice weekly Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Memory test! What was the approximate trading volume of the Bitcoin ETFs after 3 days of trading?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) $10 billion 🥳

The approximate trading volume of the Bitcoin ETFs after 3 days of trading was $10 billion.

GET IN FRONT OF 85,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.