Today’s edition is brought to you by Animus Technologies.

To leverage A.I and start out-returning Bitcoin, book a call with them today!

GM to all 17,073 of you. Crypto Nutshell #136 slidin’ thru.🕺 🥜

We’re the crypto newsletter that's less mysterious than solving crimes with your unique deductive reasoning in Victorian London... 🔍🎩

Today, we’ll be going over:

🤔 What if the ETFs are denied?

🌕 Bitcoin is going to $350,000

🤑 We’re back in the green

💰 And more…

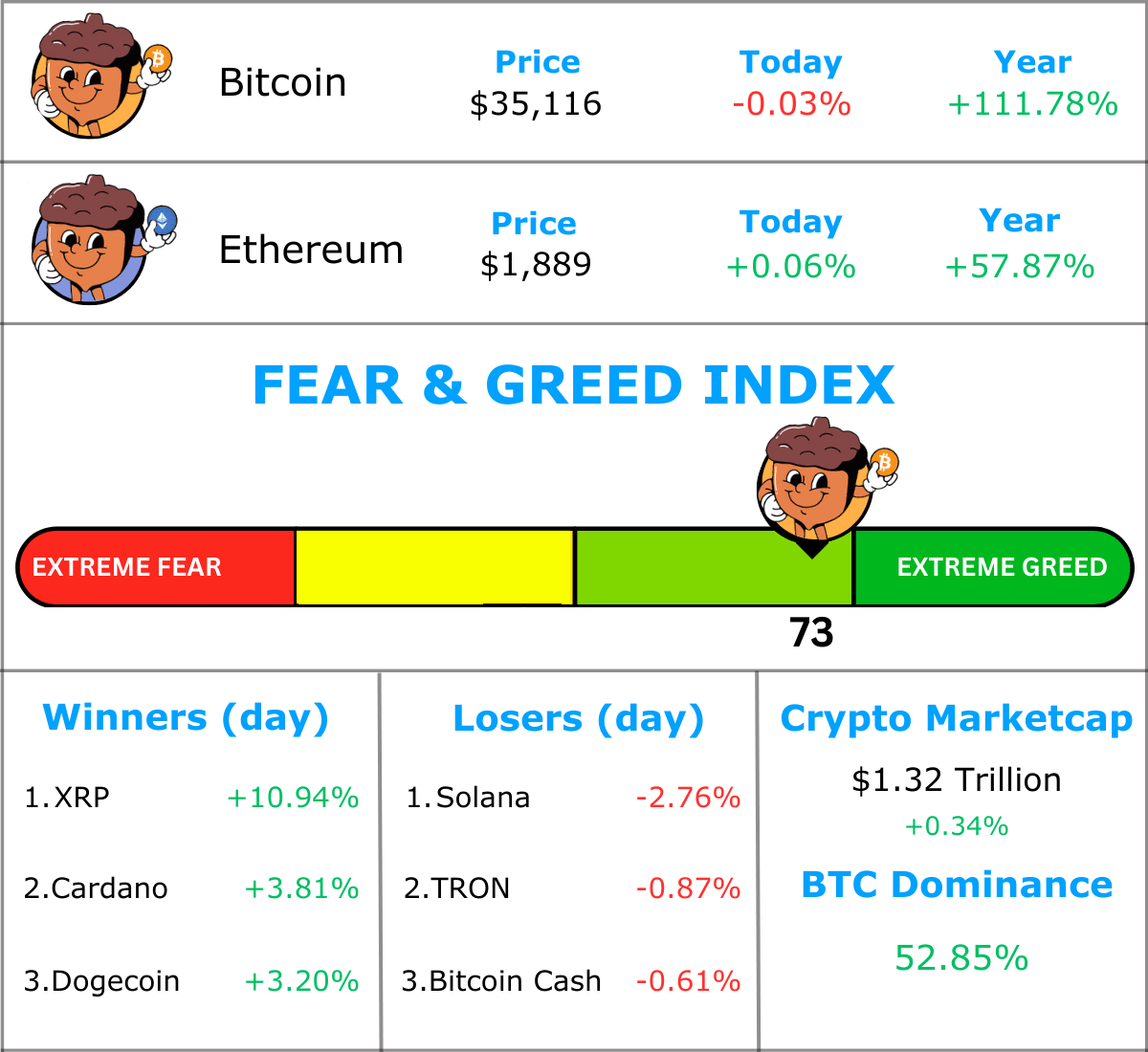

MARKET WATCH ⚖️

Prices as at 4:45am ET

Only the top 20 coins measured by market cap feature in this section

WHAT IF THE ETF’S ARE DENIED? 🤔

We’ve spoken about the spot Bitcoin ETF’s a lot here over the last few weeks.

Bitcoin’s recent price rally has largely been due to the optimism surrounding their approval.

However have you ever considered what would happen if they were never approved?

The obvious answer is there would be some negative short-term price action. But, let’s take a look at what some analysts think would happen in this situation.

Laurent Kssis, a crypto trading adviser at CEC Capital had this to say:

“We could see a move downward and the target could be below $30,000… A cluster at $25,000 is highly unlikely unless the SEC is categorical, but I sense it will be a back-to-the-drawing-board situation and hope will still be in the back of everyone's mind.”

Hashdex CIO, Samir Kerbage, had this to say:

“In the case that a spot ETF isn’t approved soon, we believe Bitcoin’s 2024 investment case remains very strong… More investors are beginning to appreciate the benefits of bitcoin as a store-of-value asset or type of digital gold…. If history once again rhymes, the price of BTC will react positively to this scheduled reduction in supply."

The common theme here is that analysts believe that Bitcoin’s future price isn’t necessarily tied to the approval of an ETF.

There’s a little something called the halving just around the corner…

The approval of the ETFs is just added fuel to the fire. 🔥

Some analysts noted that the rejection of the ETFs by the SEC would likely result in a bunch of lawsuits being filed against them. Just like the Grayscale case. Surely the SEC doesn’t want that right?

So to answer the question, what would happen if the ETFs were denied?

Well, we would certainly see negative short-term price action. But as the halving approaches, Bitcoin would recover and the bull run would kick in.

That’s what the analysts are saying. 😎

TOGETHER WITH ANIMUS 👾

Let’s be real.

There’s probably one main reason you love crypto.

The returns.

Bitcoin is the best-performing benchmark of the decade.

But what if you could do better.

Recently Bitcoin Magazine launched a ‘Bitcoin Alpha Competition’, a campaign to find the most promising approach for generating alpha.

The winners? Animus Technologies.

Animus Technologies is an AI-platform designed to develop data-driven trading strategies for cryptocurrencies.

Their mission: Provide clients with sustainable success in crypto markets through curated investment strategies.

Developed over 6+ years, their results are nuts:

Launching in 2020, Animus Technologies has returned 192.98% vs Bitcoin 40.95% 📈

Uses cutting-edge artificial intelligence and sentiment analysis to out-return Bitcoin on an outright & risk adjusted basis ✅

Won Bitcoin Magazines ‘Bitcoin Alpha Competition’, receiving $1 million in seed capital 🌱

Animus Technologies is looking at taking on a limited number of new clients.

If you are looking to leverage A.I and out-return Bitcoin, you can click here to book a call with their team today to see if they’re right for you.

P.S Check out Bitcoin Magazine’s ‘Bitcoin Alpha Competition’ here!

BITCOIN IS HEADING TO $350,000🌕

Michael Saylor would have to have one of the highest convictions in the entire space.

You don’t invest close to $5 billion into Bitcoin unless you do.

MicroStrategy now holds 158,400 Bitcoin, bought at an average price of $29,586.

Which MicroStrategy have made ~$870 million in profit from their Bitcoin strategy. 🤯

But how high does Saylor think Bitcoin will go?

Although rarely giving predictions, in his latest interview he revealed his thoughts:

“Bitcoin is an asset without an issuer. It is the one, universally recognised protocol that’s a commodity in the space… I think the industry moves to the next level and we 10x from here.”

Although he didn’t give a timeline, Michael Saylor thinks Bitcoin is going to 10x from here.

Which would put Bitcoin at $350,000 a coin. 😳

This begs the question, if Saylor is correct, how much profit would MicroStrategy make on their BTC?

If Bitcoin hit $350,000 per coin, MicroStrategy's 158,400 Bitcoin, acquired at an average price of $29,586 each, would yield a profit of ~$50.75 billion.

Insane. 🤯

Michael Saylor’s Bitcoin trade will either go down as one of the greatest investments of all time, or a huge mistake.

What do you think? 🔮

What do you think of Saylor's Bitcoin trade?

WE’RE BACK IN THE GREEN 🤑

Today we’ll be taking a look at an interesting metric from Glassnode.

Their ‘Cointime Economics’ framework provides a much more accurate cost basis model.

It’s essentially an update to the Realized Price. Which is the average purchase price of the Bitcoin supply.

This model only focuses on active investors and excludes:

Lost coins

Satoshi's coins

Early Miner coins

These coins have an extremely low Realized Price as they last transacted when Bitcoin was less than $1 (skewing the data).

For the full breakdown of how this model is calculated click here.

As of today, the true market mean price is $30,296.

In comparison, the traditional Realized Price is currently at $20,692.

Quite the difference… $9,619 to be exact.

In October Bitcoin’s price convincingly broke through the true market mean price. 📈

Back in March and July, Bitcoin was looking like it would break through.

However it didn’t quite have enough steam to hold above.

So what does this data tell us?

Well, the average Bitcoin holder is now firmly back in profit. 🥳

Bottom Line: Glassnode’s True Market Mean Price model provides a much more accurate view of the cost basis for the Bitcoin supply.

Using this model, the average Bitcoin holder is now back in the green. This can result in a significant shift in investor sentiment (particularly short-term holders).

Holding above the True Market Mean Price is also a classic bull run indicator (take a look at 2021).

The bull run is just beginning… 🐂

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

Sponsored

The Intrinsic Value Newsletter

The weekly newsletter devoted to breaking down business and estimating their intrinsic value, in just a few minutes to read — Join 35,562 readers

Sponsored

Fast Food Club

The Official Fast Food Club. Get access to the world's largest group for fast food secrets, news, tips, menu hacks, and secret recipes. Once you subscribe you'll become a member.

CAN YOU CRACK THIS NUT? ✍️

What type of network is the Bitcoin network?

A) client-server network

B) local area network

C) wide area network

D) peer-to-peer network

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) peer-to-peer network 🥳

Bitcoin is a peer-to-peer network

GET IN FRONT OF 17,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research