GM and welcome to The Crypto Nutshell 🥜, the newsletter that captures the electrifying essence of the cryptocurrency world in a bite-sized package, delivering all the latest updates and trends straight to your inbox every single day.

Today we’ll cover:

Two major economic events to lookout for 👀

An experts huge prediction 🔥

Promising On Chain analysis 💰

And more…

Market Watch

Let's kick off this edition of The Crypto Nutshell with a glimpse into the market's pulse. We'll provide updates on the top cryptocurrencies, market trends, and significant price movements.

From Bitcoin's dominance to altcoin rallies, we'll decode the market's mysteries and help you make sense of it all.

The Bitcoin roller coaster continues as it teeters on the edge of the $30,000 mark, leaving investors on the edge of their seats. Will it hold strong as support or will a fierce battle ensue? Recent charts show a brief surge above $30,000 followed by a minor retreat, giving us some insight into the past five days' price movements.

As if the suspense wasn't enough, brace yourself for two major economic events unfolding this week. We have the release of crucial US economic data and eagerly anticipated remarks from Federal Reserve Chair Jerome Powell. Powell will be discussing the economy on June 28-29, while the latest US Personal Consumption Expenditures (PCE) Index figures will be available on June 30. According to CME Group's FedWatch Tool, the probability of a rate hike in July currently stands at over 70%.

Bitcoin finds itself at a pivotal moment, hovering near the $30,000 mark. Support levels and historical patterns hint at a potential breakthrough, but the uncertainty surrounding upcoming economic events adds another layer of intrigue. Brace yourselves, investors, and stay patient while keeping a watchful eye on the ever-changing market landscape.

Expert of the day - Steven Lubka

Today, we turn our attention to the insights of Steven Lubka, the managing director and head of private clients and family offices at Swan Bitcoin, a bitcoin only exchange that allows investors to accumulate and stack BTC.

According to Steven Lubka, wealthy investors and family offices are significantly investing in Bitcoin.

We’ll have $100,000 Bitcoin by the end of 2024

Following the collapse of Silicon Valley Bank, Swan Bitcoin has observed a massive increase in high-net-worth individuals (HNWI are investors who have at least $1 million in liquid financial assets) taking large positions in Bitcoin.

Family offices, which have the most control and the fewest restrictions over their ability to invest in alternative assets, are seen as early adopters. The recent banking crisis has shaken the trust of wealthy investors in traditional finance, leading them to invest in Bitcoin as an asset outside the financial system.

Source - Kitco News

On Chain Data

Turning to on-chain data, we observe a fascinating trend: the quantity of Bitcoin held by on-chain entities owning less than 10 Bitcoin has reached an all-time high and is rapidly increasing. This suggests growing interest and participation from retail investors in the Bitcoin ecosystem. Source.

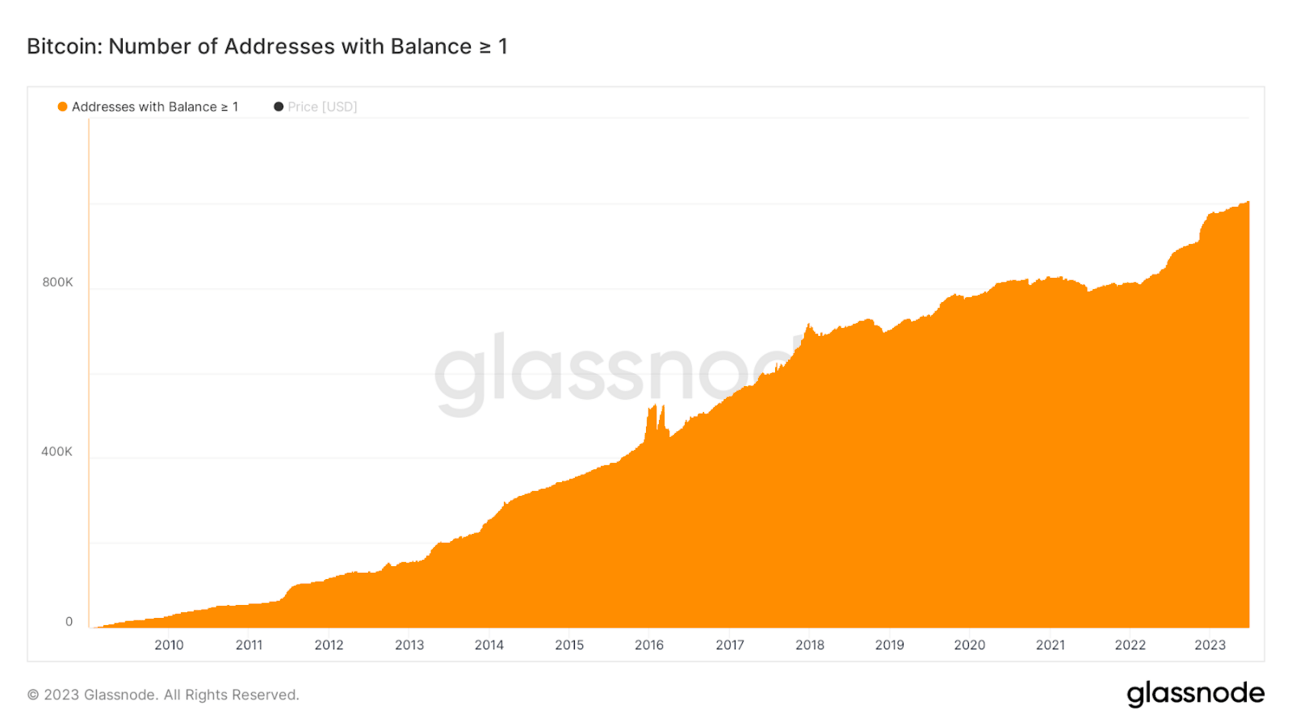

Additionally, the number of addresses holding at least 1 Bitcoin has surpassed 1 million. This milestone showcases the expanding network of Bitcoin owners and highlights the growing adoption and decentralization of the cryptocurrency. Source.

Articles

MicroStrategy's $4 Billion Bitcoin Investment Turns Profitable Amid Renewed Institutional Interest. Michael Saylor’s company has an average purchase price of $29,803 USD.

A recent surge in activity around exchange-traded funds (ETFs) has led to the largest weekly inflow for digital asset investment products since July 2022. Bitcoin also reached a 2023 high of $31,431, setting new all-time records against local currencies in Argentina, Venezuela, and Lebanon.

In a move to promote its blockchain and crypto sector, Japan has exempted cryptocurrency issuers from a 30% corporate tax on unrealized token gains. Japan’s largest bank, MUFG, is exploring issuing stablecoins with global cryptocurrency companies.

Blockchain-based trading card game, Gods Unchained, has announced its partnership with Epic Games Store, bringing the game to over 230 million PC users worldwide. Gods Unchained aims to redefine the TCG (Trading Card Game) genre and solidify its position among popular digital card games such as Hearthstone and Magic: The Gathering.

Meme Corner

Because what would the crypto world be without its share of memes?