GM to all of you nutcases. It’s Crypto Nutshell #693 cleanin’ it up… 🧹🥜

We're the crypto newsletter that's more heart-pounding than surviving a sinking ocean liner in freezing waters... 🚢❄️

What we’ve cooked up for you today…

🏦 Ethereum’s on a roll

🦖 Here come the monsters

🤑 OGs doubling down

💰 And more…

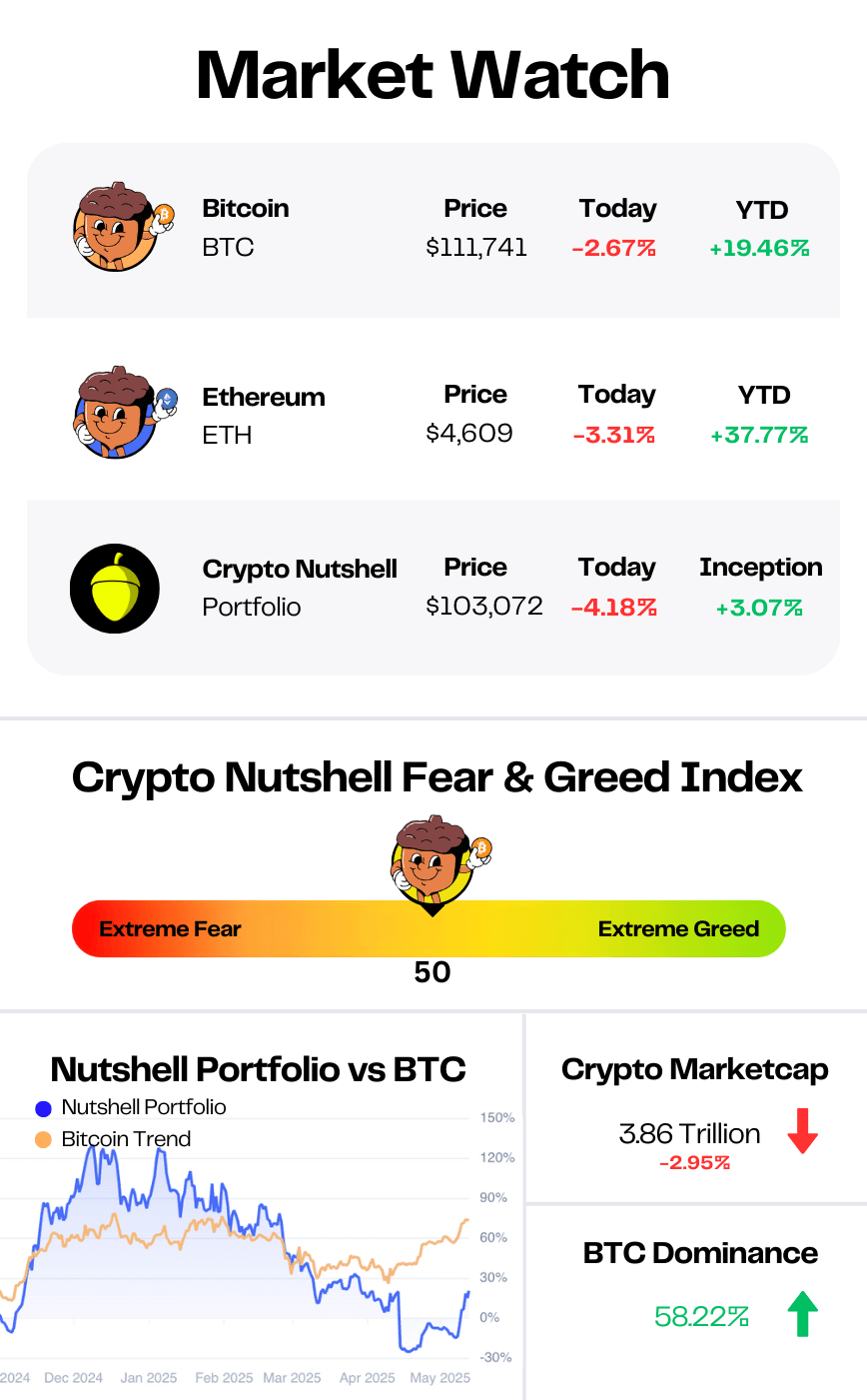

Prices as at 4:20am ET

ETHEREUM’S ON A ROLL 🏦

BREAKING: Ethereum Jumps to New Record Price in Move Towards $5,000

Ethereum has been on fire lately…

Just 48 hours after smashing its 4-year-old record, ETH ripped to a new all-time high of $4,953.

Since then, it’s cooled to around $4,720 - but still up 9.3% in the past week.

The spark?

Jerome Powell’s Jackson Hole pivot.

His dovish tone lit the fuse Friday, sending Ethereum up 15% in a single day and smashing through its 2021 high of $4,878.

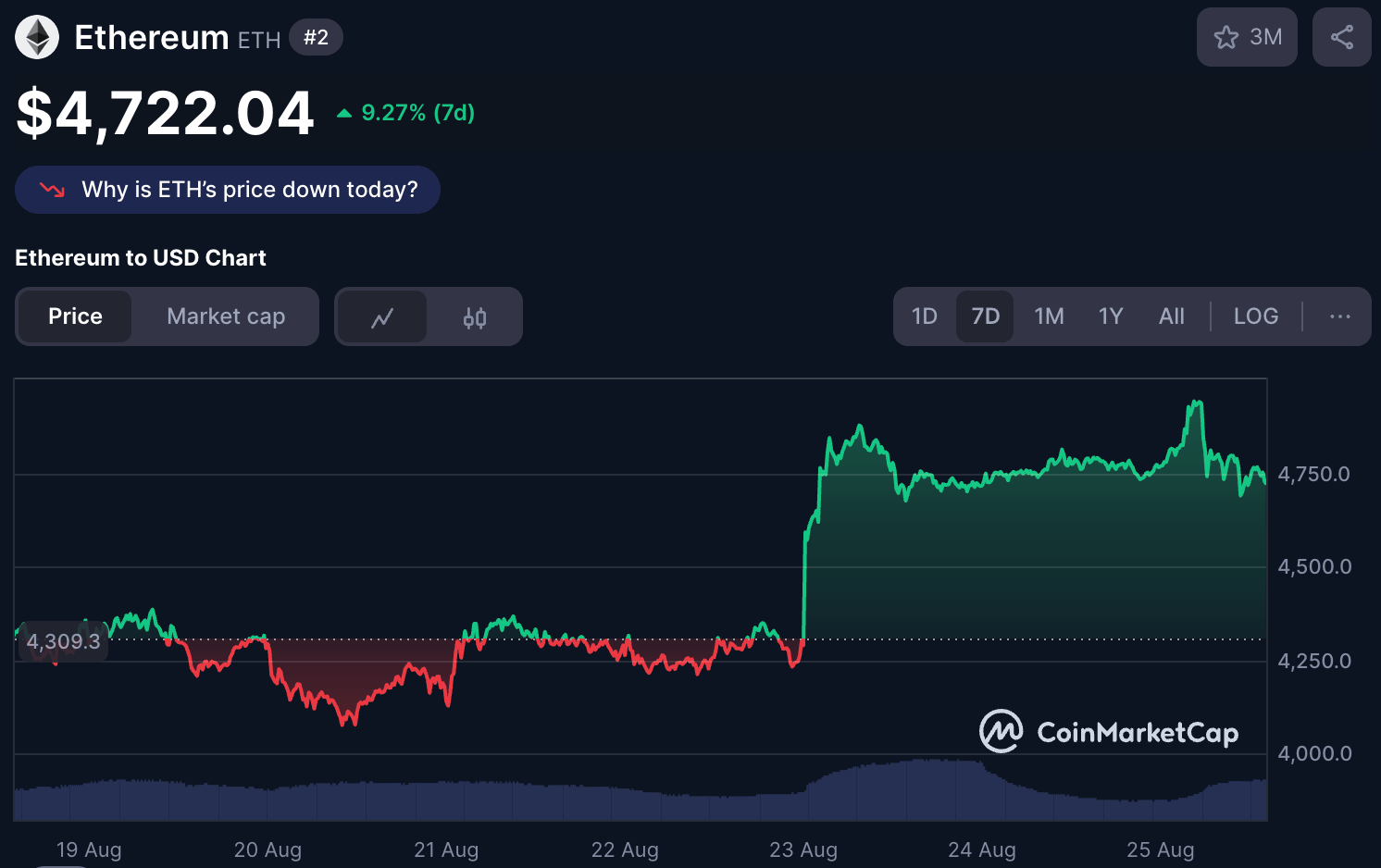

This chart is wild

But this isn’t just a Fed trade…

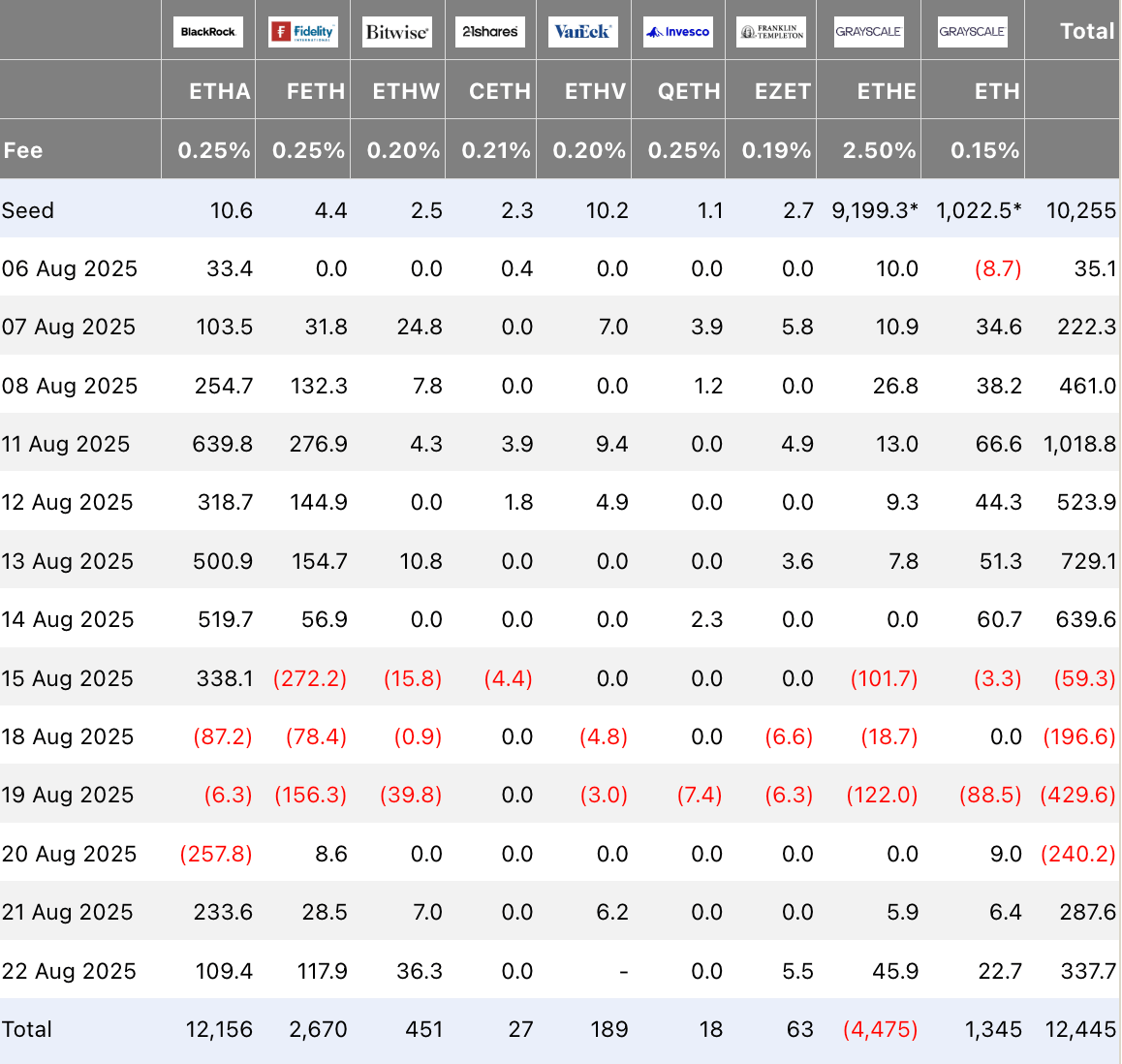

Spot ETH ETFs are pulling in record flows, with over $1 billion in a single day last week.

For the first time since launch, they’re outpacing the Bitcoin ETFs.

Ethereum ETF flows

On top of this, corporates are piling in too. BitMine Immersion now holds $7B+ in ETH and SharpLink Gaming $3.6B+.

That’s Michael Saylor–style treasury adoption, but in Ethereum.

Regulation is also catching up fast.

The SEC’s new staking guidance under Trump unlocked liquid staking rewards.

The GENIUS Act gave stablecoins - almost all of which run on Ethereum - a clear U.S. framework.

Wall Street sees it. Treasuries see it. The flows prove it.

The only question left: when does ETH break $5K?

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

HERE COME THE MONSTERS 🦖

Ethereum just broke into new all-time highs - tapping just under $5,000 today.

And the monsters are circling.

In his latest interview this weekend, Tom Lee didn’t hold back:

“I think there is a very high probability - I’m going to say maybe even 50% - that Ethereum’s network value will flip Bitcoin’s.”

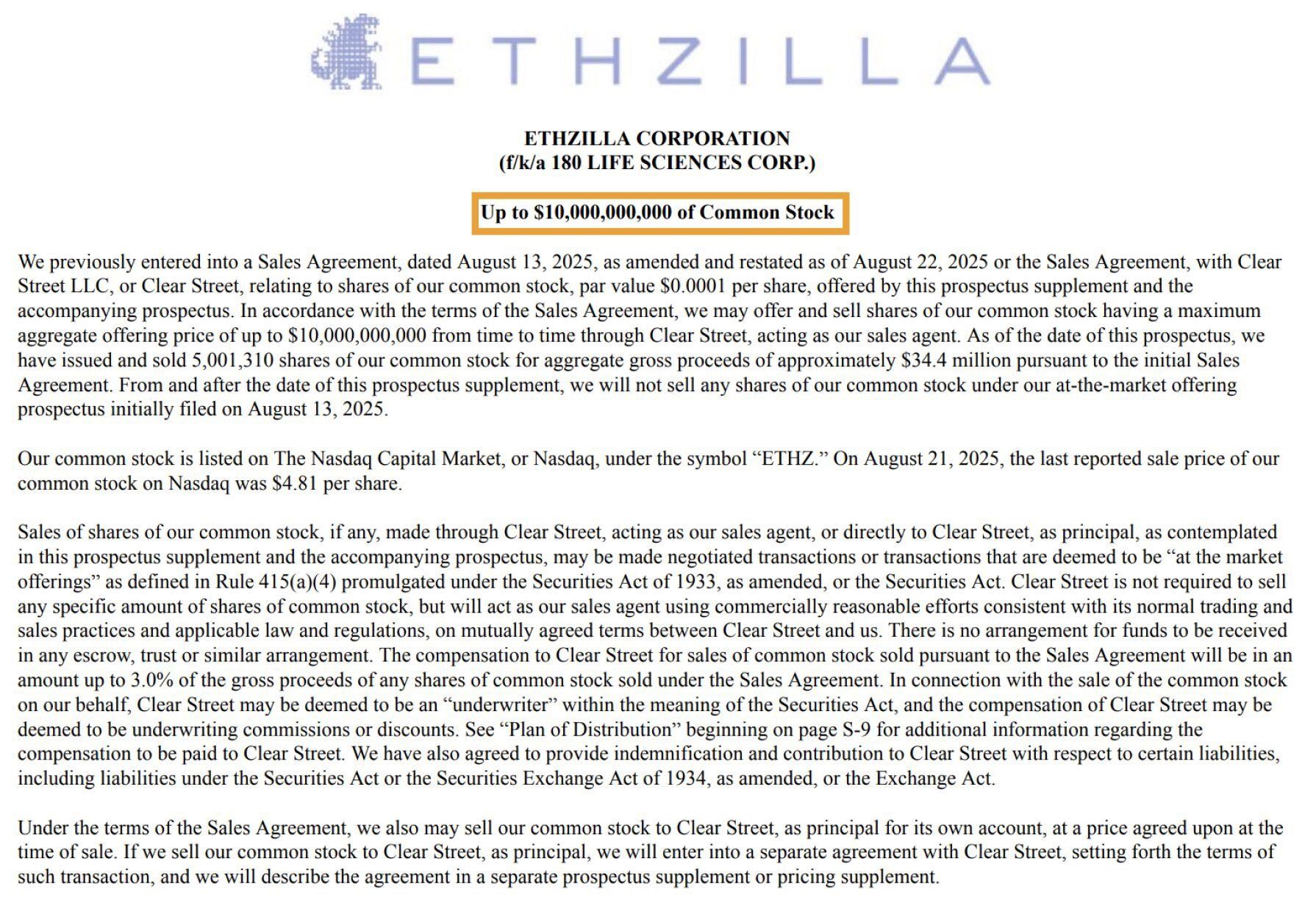

Meanwhile, a newly rebranded Ethereum treasury company - ETHZilla - is now live on the NASDAQ under ticker ETHZ.

They have already bought 94,675 ETH at an average of $3,902

Are backed by Peter Thiel (7.5% stake) - yes, that PayPal mafia billionaire

Today, they announced a $10 billion dollar raise to deploy straight into ETH:

ETHZilla announcement

Add that to Tom Lee’s $20B ETH capital raise last week… and that’s $30 billion in known capital ready to hit Ethereum.

The scale of what’s building here is crystal clear:

The monsters are circling… 🦖

Ethereum’s run is nowhere near over.

OGs DOUBLING DOWN 🤑

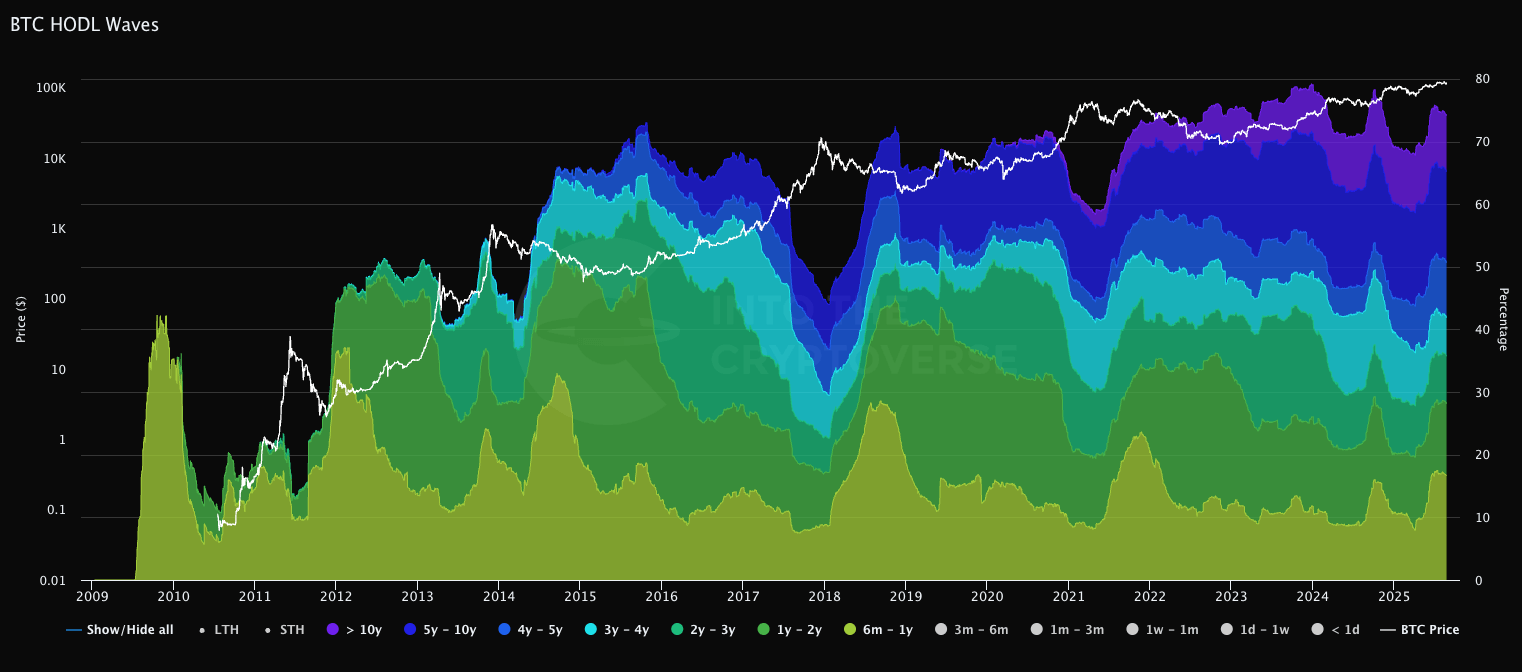

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

As always, we’re focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 16.62% (down from 17.08%)

1y - 2y: 11.58% (up from 11.54%)

2y - 3y: 7.57% (down from 7.65%)

3y - 4y: 6.17% (down from 6.20%)

4y - 5y: 8.77% (down from 8.91%)

5y - 10y: 14.50% (up from 14.54%)

>10y: 8.93% (up from 8.90%)

TL;DR: 74.14% of all Bitcoin hasn’t moved in over six months 🔒

The latest shifts tell a simple story:

Coins are aging into stronger hands.

Yes, the 6–12 month band thinned a bit, but both the 1–2 year and 10+ year cohorts ticked higher.

That’s fresh buyers turning into long-term holders, and OGs doubling down on conviction.

Small pullbacks in the 2–3, 3–4, and 4–5 year ranges?

That’s selective profit-taking, not broad selling pressure. These dips are minor against the sheer weight of supply locked away.

The bigger takeaway: even with Bitcoin hovering near record highs, the base of long-term holders isn’t budging.

Supply is tightening, conviction is firm, and every passing week more BTC vanishes into deep storage. 🚀

CRACKING CRYPTO 🥜

The latest data from Bitcoin Is Dead dropped this week: Bitcoin has 'died' no less than 431 times. The latest data from Bitcoin Is Dead show Bitcoin has ‘died’ 431 times, with gold bug Peter Schiff topping the Bitcoin critic rankings.

Saylor signals third consecutive Strategy Bitcoin buy in August. Strategy co-founder Michael Saylor signaled on social media that the company will make its third Bitcoin acquisition for the month of August.

XRP Price Prediction: $5 Back in Target as Ripple, Solana Price Action Flash Bullish. While whales booking profits created near-term pressure, some analysts argue that structural flows continue to point higher if resistance levels give way.

Japan eyes 20% flat tax for crypto trades, path to ETF offering with tax code revision: report. The shift comes as Japan also plans to approve the first official yen-denominated stablecoin, JPYC, in the fall.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Who received the first-ever Bitcoin transaction from Satoshi Nakamoto in 2009?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Hal Finney 🥳

Satoshi sent 10 BTC to cryptographer Hal Finney — making him the first person to ever receive Bitcoin. 🚀

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.