Today’s edition is brought to you by Crypto.com

Ready to Level Up your crypto journey? Join the Crypto.com Level Up programme today!

GM to all of you nutcases. It’s Crypto Nutshell #764 sweepin’ up rubble… 🧹🥜

We’re the crypto newsletter that’s more adrenaline-filled than a thief drifting through city streets with cops on every corner… 🚗💨

What we’ve cooked up for you today…

😱 Strategy may sell BTC?

🩸 Who buys when it hurts?

💎 Not Flinching - Bitcoin’s long-term holders

💰 And more…

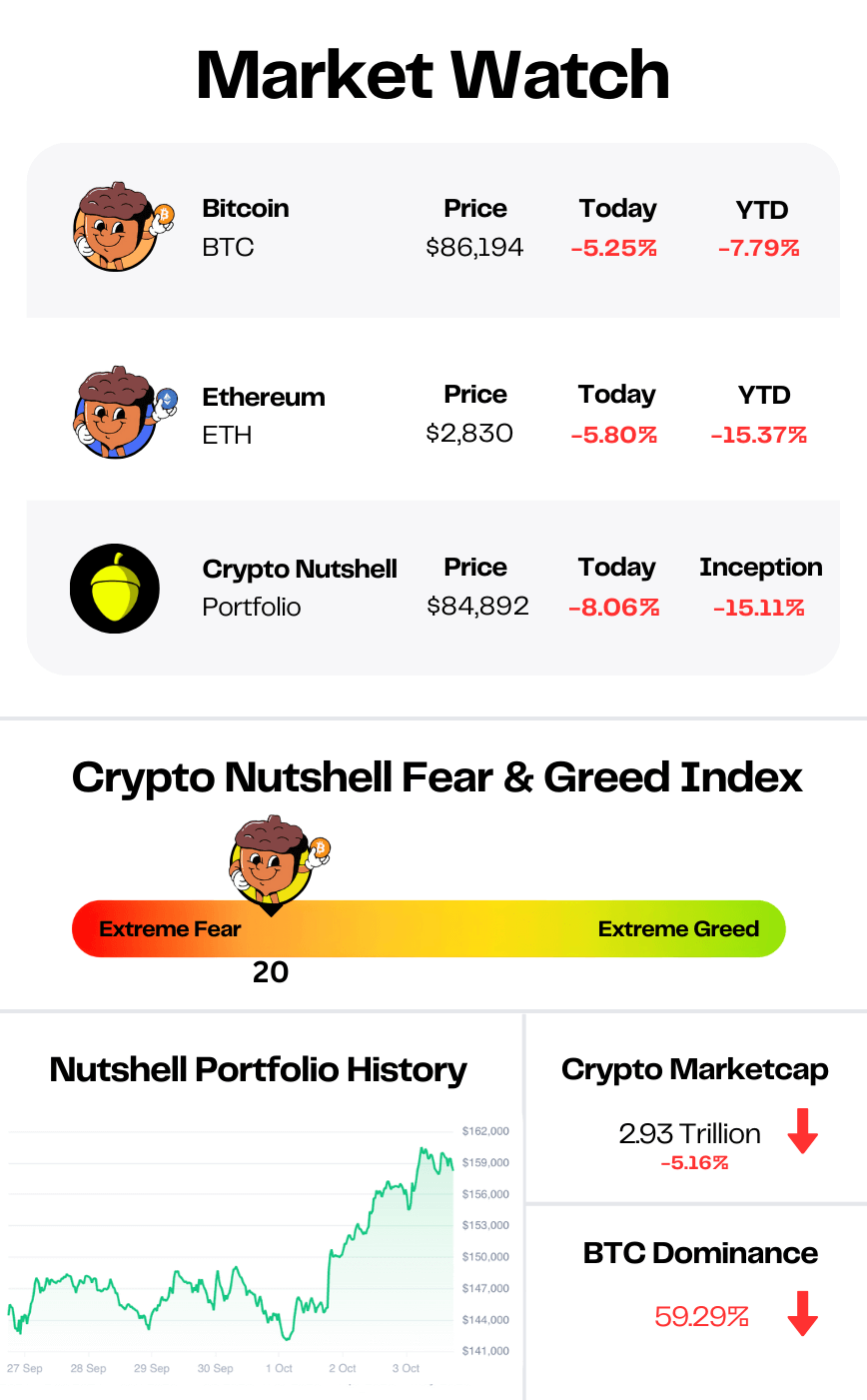

Prices as at 2:30am ET

STRATEGY MAY SELL BTC? 😱

BREAKING: Strategy will sell Bitcoin as ‘last resort’ if mNAV drops, capital is unavailable

The Strategy FUD continues…

After a week of Twitter panic about forced selling, Strategy CEO Phong Le finally laid out the conditions under which they would touch their Bitcoin.

He said they would only consider selling BTC if both of these are true:

MSTR trades below net asset value (mNAV < 1), so issuing new shares destroys value

Access to fresh capital dries up, so they cannot roll or raise funding normally

In that scenario, he called selling some BTC “mathematically” justified to protect Bitcoin yield per share.

In other words, if dilution is worse than selling coins, they reserve the right to sell. But he did call it a last resort.

This matters because Strategy now holds roughly $750 to $800 million a year in dividend obligations on its preferred shares. The plan:

When the stock trades at a premium, raise capital and buy more BTC

Keep paying dividends through good and bad markets to prove the structure is sustainable

To back that up, they launched a BTC Credit dashboard that argues they can meet obligations for decades even if BTC goes sideways and remain solvent at much lower prices.

Then Saylor added a signal of his own.

For a year, his weekend X posts have used orange dots to hint at Monday Bitcoin buys.

This time he teased a switch to green dots, which the market is reading as a possible signal of some kind of shift, even if nobody knows which way yet.

The core takeaway:

Le is openly admitting there is a line where selling BTC becomes a financial decision.

At the same time, Strategy still claims its debt is covered if Bitcoin falls back to $74,000, and remains “manageable” even near $25,000.

So the message is simple:

They are not planning to sell. But they want the market to know they can if they have to.

Ready to take your wealth to the next level?🤑

With Crypto.com, everything you need is in one place.

Trade hundreds of cryptocurrencies directly in AUD, spend with your Crypto.com Visa Card, and track your portfolio - all from one easy-to-use app.

No more juggling multiple platforms or hidden conversion fees.

On top of that, the Crypto.com Level Up programme has been completely upgraded.

Here’s what makes it the best subscription program in the industry:

Zero Trading Fees: Trade freely and keep more of your profits.💸

Bigger Rewards: Earn up to 6% cashback with your Crypto.com Visa Card. 🎁

Smarter Tiers: Choose Plus (AU$6.99/month), Pro (AU$49.99/month), or go Private with CRO staking. 👍

Existing members have already been upgraded automatically - now it’s your turn to experience the new Level Up.

WHO BUYS WHEN IT HURTS? 🩸

Bitcoin just flushed down to ~$85,000.

Alts followed it down.

Fear is back on the timeline.

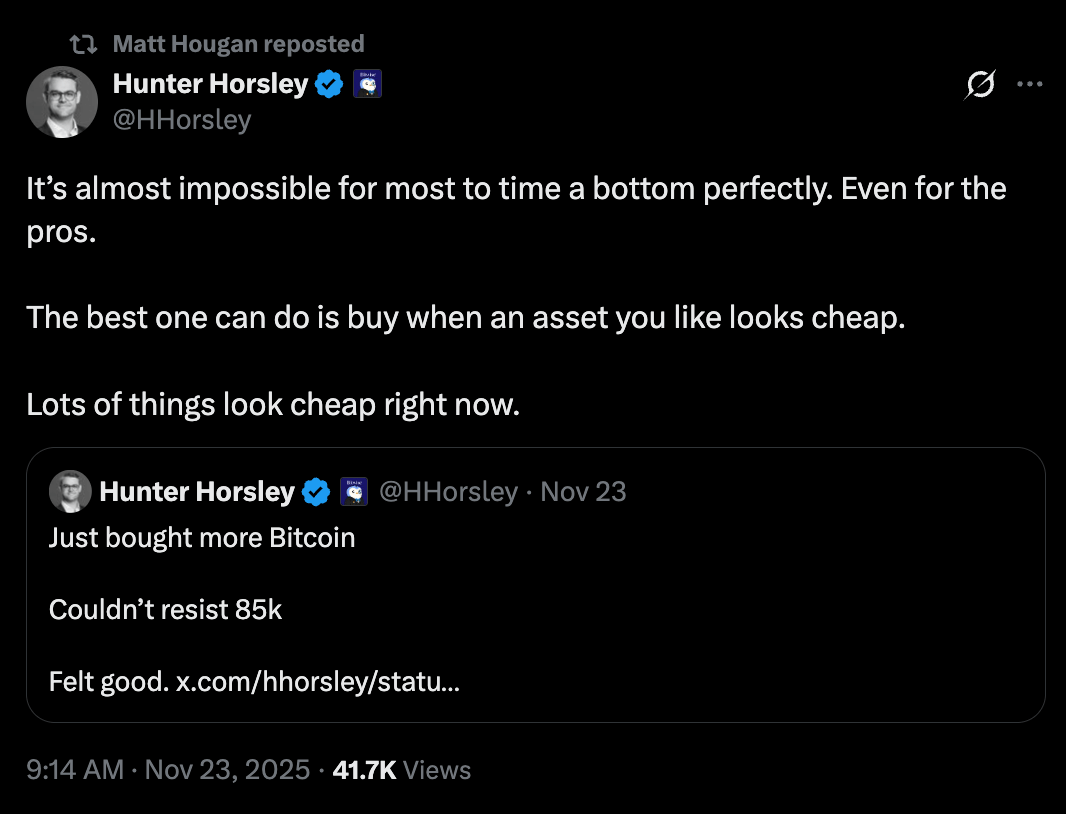

But some people, like Hunter Horsely, are buying.

This is what Hunter Horsley, CEO of Bitwise, posted into the chaos:

It’s a simple message.

You don’t need to nail the exact bottom.

You just need to have conviction when prices are ugly.

Panic is loud.

But quiet accumulation is what wins long term.

NOT FLINCHING 💎

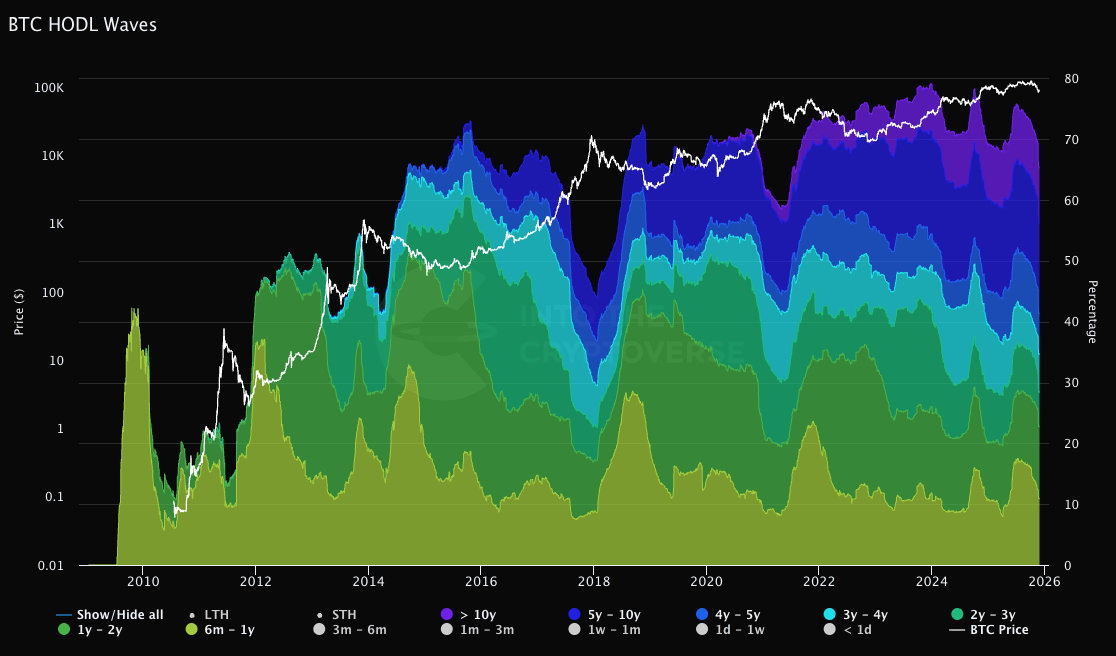

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

As always, we’re focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 10.86% (down from 12.43%)

1y - 2y: 11.91% (down from 13.25%)

2y - 3y: 5.61% (down from 6.41%)

3y - 4y: 6.27% (up from 5.73%)

4y - 5y: 6.70% (down from 7.89%)

5y - 10y: 14.87% (up from 14.86%)

>10y: 9.11% (up from 9.08%)

TL;DR: 65.33% of all Bitcoin has not moved in over six months. 🔒

That is a 4.32% drop from two weeks ago. Not nothing, but still far from a structural breakdown.

The 6–12 month band took the biggest hit as shorter term holders sold into recent price strength. The 1–2 year and 2–3 year groups also thinned out, which tells you mid-cycle traders are taking risk off the table.

On the other side, older supply is still creeping higher. The 3–4 year cohort is growing. The 5–10 year and 10+ year bases continue to edge up as more coins age into deep storage.

This is what rotation looks like. Some coins leave the mid-range bands. More keep flowing into multi-year dormancy instead of back onto exchanges.

Bottom line: the foundation is softer at the edges but still very strong. Supply is tight, conviction is sticky, and each shakeout hands a bit more of the supply to holders who do not flinch. 💎

CRACKING CRYPTO 🥜

Tether's USDT Downgrade Brings Old Arguments Back to the Front. S&P Global last Wednesday slashed its rating on Tether's USDT stablecoin to its weakest score.

China's central bank reaffirms crypto ban, flags stablecoin risks following multi-agency meeting. Beijing has moved in recent months to quell some digital asset activity in Hong Kong, like real-world asset tokenization and stablecoin issuance.

Nasdaq crypto chief pledges to ‘move as fast as we can’ on tokenized stocks. Nasdaq head of digital assets said that the exchange aims to work with the SEC “as quickly as possible” to advance its proposal for tokenized stocks.

Grayscale’s Zcash ETF: Regulated privacy, or privacy in name only? A deep dive into Grayscale's Zcash ETF filing and how regulation has the potential to reshape the meaning of privacy.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What does a spike in Bitcoin realized price usually indicate?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: The average holder’s cost basis is rising 🥳

When realized price climbs, it suggests new buyers are entering at higher prices and older coins are moving. 📊

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.