GM to all of you nutcases. It’s Crypto Nutshell #819 coolin’ it down… 🧯🥜

We’re the crypto newsletter that’s more high-stakes than a billionaire building rockets to escape a collapsing world… 🚀🌍

What we’ve cooked up for you today…

💻 Addressing the quantum threat

🩸 Never been this bad

✂ Surviving the chop

💰 And more…

Prices as at 2:05am ET

ADDRESSING THE QUANTUM THREAT 💻

BREAKING: Bitcoin Developers Take First Step Toward Quantum-Proofing - But Experts Disagree on How Soon It's Needed

Bitcoin just took its first real step toward defending against quantum computers.

Developers merged BIP 360 into Bitcoin's official improvement repository this week. It's a proposal designed to fix a vulnerability that future quantum machines could exploit to steal funds.

The change isn't active yet - it still needs to go through formal review and win broad consensus.

But it's a clear signal that the threat is being taken seriously.

What's the risk?

Today's quantum computers aren't powerful enough to crack Bitcoin.

But that will likely change in the future…

The concern centres on something called Shor's algorithm. In simple terms, a powerful enough quantum computer could use it to reverse-engineer private keys from public keys and drain wallets.

A 2021 upgrade called Taproot made Bitcoin more efficient, but it also exposed public keys when coins are spent.

BIP 360 removes that vulnerability while keeping the door open for future quantum-resistant upgrades.

When does this become a real threat?

This is where the experts disagree.

Caltech president Thomas Rosenbaum believes fault-tolerant quantum systems could arrive in five to seven years.Recent breakthroughs support that view.

Caltech researchers recently kept over 6,000 qubits stable with 99.98% accuracy. IBM created a 120-qubit entangled state - the largest of its kind. (That’s a big deal in the quantum world)

But others say we're decades away.

Jameson Lopp, co-founder of Bitcoin wallet firm Casa, told Decrypt we're "several orders of magnitude away" from a cryptographically relevant quantum computer.

The bigger concern?

Some developers worry that Bitcoin's real vulnerability isn't quantum computers - it's the network's growing resistance to change.

"It's the nature of network protocols to ossify over time" Lopp said. Reaching consensus across miners, node operators, and users gets harder as Bitcoin matures.

The quantum threat may be uncertain.

But preparing for it? That's already underway. 🚀

Meet America’s Newest $1B Unicorn

It just surpassed a $1B valuation, joining private US companies like SpaceX and OpenAI. Unlike those companies, you can invest in EnergyX today. Industry giants like General Motors and POSCO already have. Why? EnergyX’s tech can recover 3X more lithium than traditional methods. Now, they’re preparing 100,000+ acres of lithium-rich Chilean land for commercial production. Buy private EnergyX shares alongside 40k+ people at $11/share through 2/26.

This is a paid advertisement for EnergyX Regulation A offering. Please read the offering circular at invest.energyx.com. Under Regulation A, a company may change its share price by up to 20% without requalifying the offering with the Securities and Exchange Commission.

IT’S NEVER BEEN THIS BAD🩸

Raoul Pal just posted the Crypto Fear & Greed Index with 3 words:

"Presented without comment."

He didn't need to say more. The chart says it all:

Crypto Fear & Greed Index

The index just hit 5 out of 100. That's not just fear. That's extreme fear.

Historic, generational-levels of fear.

To put that in perspective, the index tracks sentiment across volatility, volume, social media, dominance, and trends. A reading of 5 means the market is more terrified right now than almost any point in the last 2 years.

Look at the chart. The last time sentiment was anywhere close to this level was late 2023, right before crypto ripped into one of its strongest rallies in years.

That's not a coincidence. Markets don't bottom on good news. They bottom when everyone is too scared to buy.

And right now? Everyone is scared.

But if you've been around markets long enough, you know this feeling. It's the same pit in your stomach that shows up right before the biggest moves.

Warren Buffett said it best:

"Be fearful when others are greedy, and greedy when others are fearful."

At 5/100, the "others" have never been more fearful.

The question is: what are you going to do about it? 🧠

SURVIVING THE CHOP ✂

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The warmer the colour, the younger the coins - with red showing Bitcoin that has been held for less than one day.

Today, we’re focusing on short-term holders (STHs) - defined as coins held for less than six months.

Here’s how the Bitcoin supply breakdown looks today:

<1 day: 0.73% (down from 0.89%)

1d - 1w: 2.25% (up from 1.60%)

1w - 1m: 5.70% (down from 6.14%)

1m - 3m: 12.72% (down from 12.88%)

3m -6m: 9.45% (up from 9.30%)

TL;DR: 30.85% of all Bitcoin is in the hands of short-term holders. 🔒

That's up slightly from 30.81% two weeks ago.

The youngest cohort (<1 day) dropped as fresh buying slowed. The 1 day to 1 week band expanded as those coins aged out.

The 1 week to 1 month band shed supply, which moved into the 1-3 month range. Meanwhile, the 3-6 month cohort ticked up as coins matured from below.

Translation: coins are aging, not selling.

Short-term holders remain reactive - quick to panic, prone to flush on volatility.

But the overall share isn't expanding.

If these coins survive the chop and age into the 6+ month bands, this will look like what it always does: weak hands rotating to patient ones. 💎

CRACKING CRYPTO 🥜

Clarity Act Passage Would 'Comfort' Markets Amid Bitcoin Volatility: Treasury Secretary Bessent. U.S. Treasury Secretary Scott Bessent suggested that the crypto market would be calmed by the passage of the Clarity Act.

Saylor Signals Week 12 of Consecutive Bitcoin Buys From Strategy. The co-founder of Strategy, the largest Bitcoin treasury company in the world, signaled that the company will purchase more Bitcoin on Monday.

Wall Street remains bullish on bitcoin (BTC) price while offshore traders retreat. The difference in futures basis between CME and Deribit reflects varying risk appetite across regions.

Kevin O'Leary wins $2.8 million defamation judgment against crypto influencer Ben 'BitBoy' Armstrong. The ruling stems from posts Armstrong made in March 2025 falsely accusing O'Leary of murder in connection with a 2019 boating accident.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What was Bitcoin's initial block reward when the network launched in 2009?

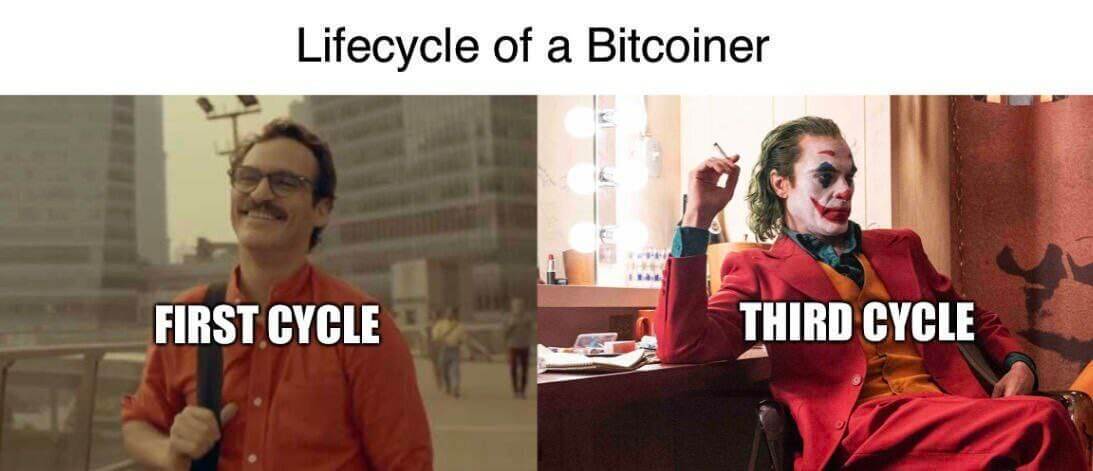

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 50 BTC 🥳

Bitcoin started with a 50 BTC block reward in 2009. After the first halving in 2012, it dropped to 25 BTC, then 12.5 BTC in 2016, 6.25 BTC in 2020, and 3.125 BTC after the 2024 halving.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.