GM to all of you nutcases. It’s Crypto Nutshell #625 goin’ live… 📡🥜

We're the crypto newsletter that's more enchanting than a giant peach flying across the ocean with insect friends onboard... 🍑🪰

What we’ve cooked up for you today…

🤑 So close

👔 No Bitcoin left

📈 Sidelined capital

💰 And more…

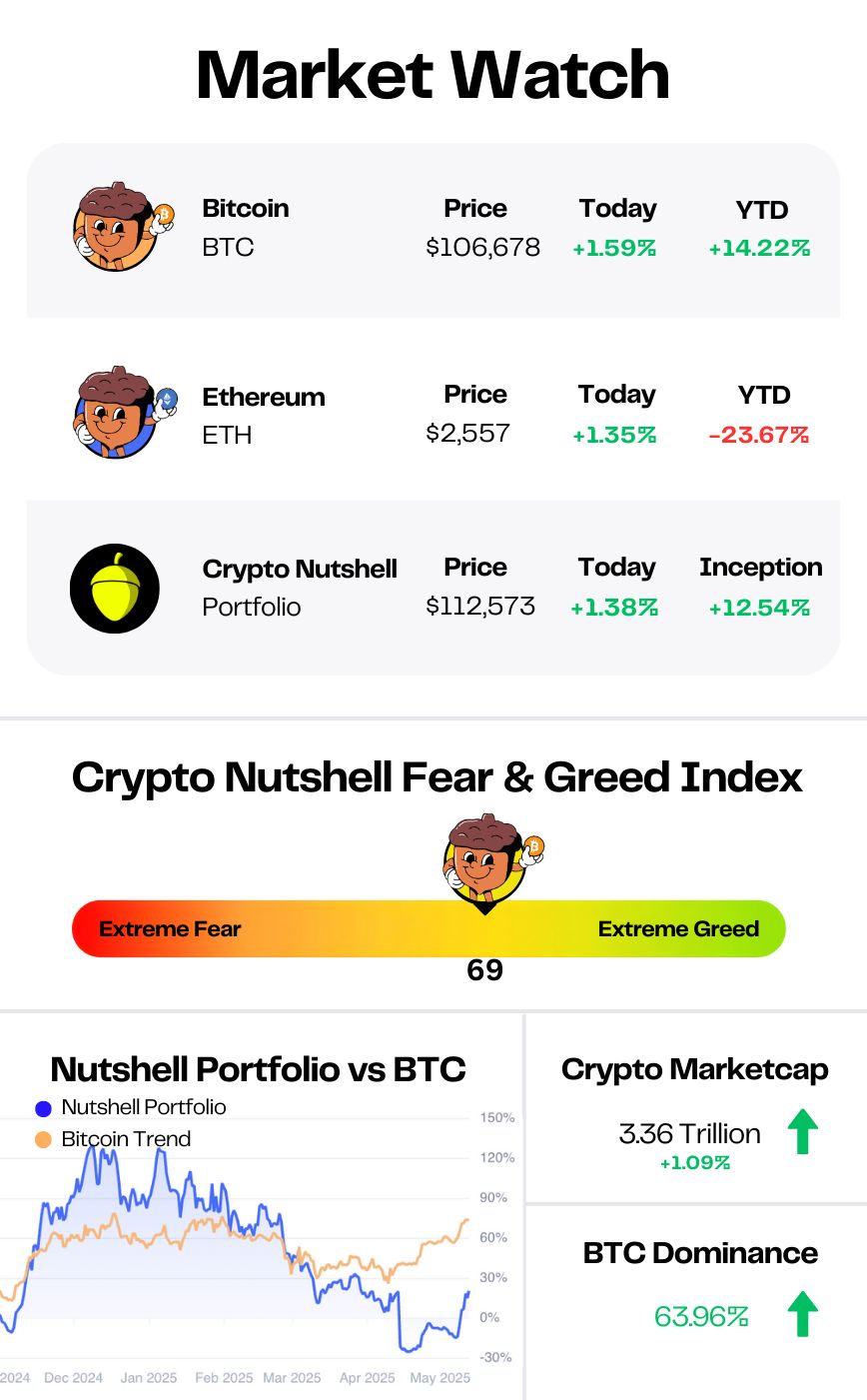

Prices as at 3:50am ET

SO CLOSE 🤑

BREAKING: Bitcoin Price Jumps to $107K With All-Time High Mark in Sight

Can you feel it?

On Tuesday, BTC surged to $107,000, just 2% shy of its all-time high.

But this isn’t just about price action.

It’s the convergence of institutional inflows, favourable macro conditions, and ETF dominance that’s setting the stage for what could be a historic summer.

Traditionally, May marks the start of a market cooldown.

But this year? We might be flipping the script.

Analysts at Wincent are already calling it a “buy in May” scenario, fuelled by relentless ETF demand and an explosion in corporate treasury adoption.

Over $3.3 billion has poured into Bitcoin ETFs this month alone.

And with public companies following Michael Saylor’s playbook at record pace, supply is tightening just as fresh capital floods in.

On the macro front, two major catalysts loom:

The Fed’s next rate decision in June

Trump’s July 9 tariff deadline

Either could spark major volatility - or act as fuel for a breakout.

Meanwhile, BlackRock’s IBIT just hit a major milestone: it’s now the second-largest Bitcoin holder on the planet, surpassing Binance and Strategy.

With over 636,000 BTC in its vault, IBIT holds more Bitcoin than any entity besides Satoshi Nakamoto.

At current pace, analysts believe IBIT could overtake Satoshi’s 1.12 million BTC stash by next summer - especially if Bitcoin approaches $150K and institutional allocations accelerate.

Elsewhere in the market, the ripple effects are being felt across altcoins:

Ethereum has surged 58% over the past 30 days

Dogecoin is up 43%

Solana has climbed 22%

XRP has added 12%

This isn’t just another rally.

It’s the start of something bigger - a structural shift in capital flows, legitimacy, and momentum.

With spot ETFs hitting escape velocity and Bitcoin inching toward price discovery, Summer 2025 could be when everything clicks.

The breakout is close. And this time, it feels different. 🚀

Find out why 1M+ professionals read Superhuman AI daily.

AI won't take over the world. People who know how to use AI will.

Here's how to stay ahead with AI:

Sign up for Superhuman AI. The AI newsletter read by 1M+ pros.

Master AI tools, tutorials, and news in just 3 minutes a day.

Become 10X more productive using AI.

NO BITCOIN LEFT 👔

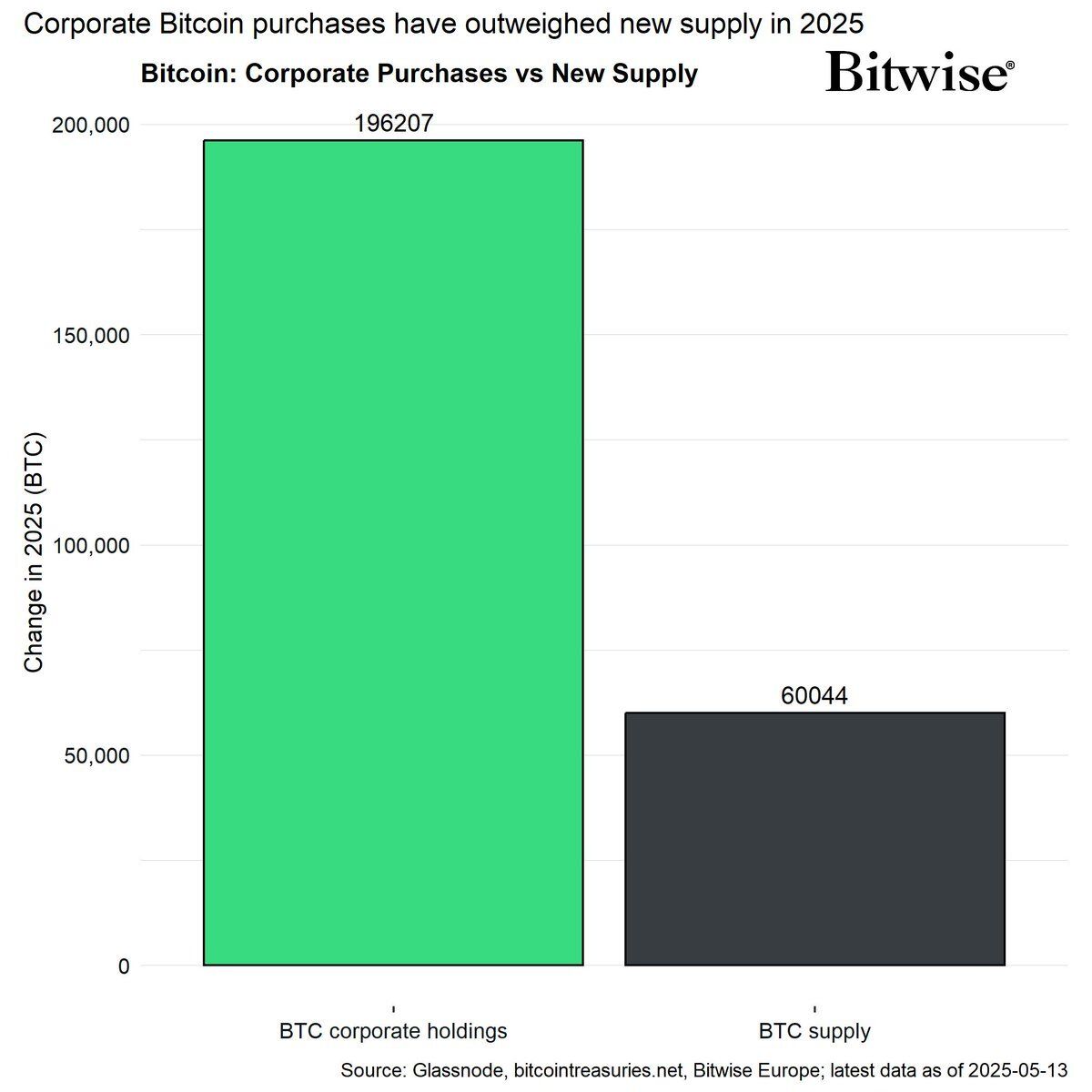

We just got a major update from Bitwise.

And the signal couldn’t be louder:

Corporations are buying waaaay more Bitcoin than what’s being created.

Institutions are buying all the Bitcoin 👀

The Numbers

New BTC supply in 2025: 60,044 BTC

Corporate BTC purchases in 2025: 196,207 BTC

That’s 3.3x more demand than supply — from just corporate buyers.

And we’re only in May.

Why It Matters

This is a textbook supply shock.

Bitcoin’s issuance was cut in half last year.

Meanwhile, corporations are accelerating their accumulation.

So now we’re in a position where:

New supply is shrinking 🧊

Corporate demand is exploding 💥

Retail hasn’t even properly joined the party yet 🎉

The result?

Upward pressure that gets harder to ignore by the week.

Takeaway

If you're still wondering why Bitcoin keeps grinding higher...

This is why.

Supply can't keep up.

And demand isn't slowing down.

The squeeze is real. 🍋

SIDELINED CAPITAL 📈

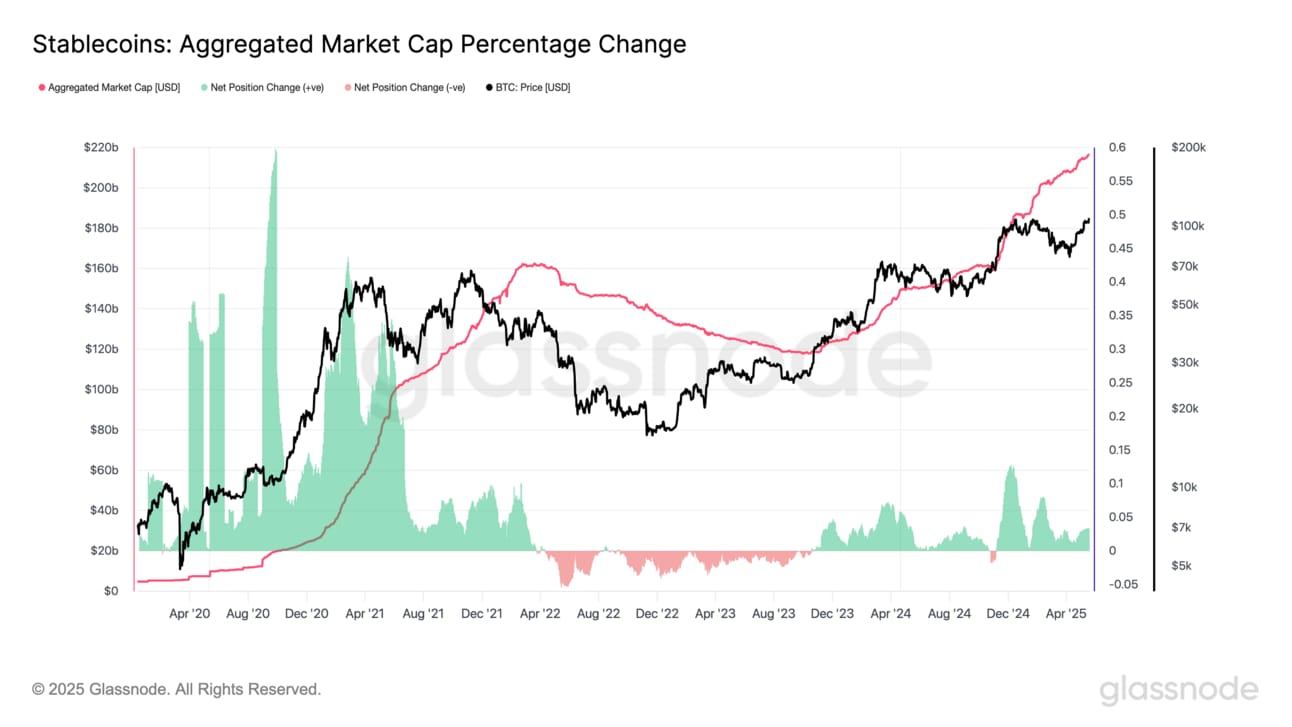

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

On May 9, total stablecoin supply was sitting around $214.98B.

Today?

We’re at $216.18B - a $1.20 billion jump in just two weeks.

But it gets better…

Earlier this week, stablecoin supply hit a fresh all-time high of $216.35B.

Year-to-date, that’s a $31.13B surge and the chart’s still climbing. 📈

So why does this matter?

Because stablecoin supply = dry powder.

More stablecoins on-chain means more sidelined capital ready to deploy - and historically, this kind of setup has front-run major altcoin rallies.

TL;DR:

Liquidity is rising.

Capital is flowing in.

And the fuel for the next move is stacking fast💥

CRACKING CRYPTO 🥜

CME XRP futures debut hits $15M in daily volume, fueling hope for ETF approval. Nate Geraci said "spot XRP ETFs are only a matter of time," based on the history of regulated futures market boosting odds of approval.

German gov’t missed out on $2.3B profit after selling Bitcoin at $57K. The German government missed out on $2.3 billion worth of profit on its Bitcoin holdings, which were sold at an average of $57,000 per Bitcoin during the summer of 2024.

Crypto Advisory Council Coming to New York City. "We want to use technology of tomorrow to better serve New Yorkers today," said the mayor at a summit on Tuesday.

SEC delays decisions on XRP and Dogecoin ETF proposals, asks for public input. The SEC pushed back deadlines for a few proposals on whether to approve exchange-traded funds tracking XRP and Dogecoin.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which of the following blockchains uses Proof of Stake (PoS) as its consensus mechanism?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Ethereum 🥳

After The Merge in 2022, Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS) — reducing energy usage by over 99%. ♻️⚙️

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.