Today’s edition is brought to you by Crypto.com - your chance to win an all-inclusive UFC 325 experience.

GM to all of you nutcases. It’s Crypto Nutshell #794 rollin’ the dice… 🎲🥜

We’re the crypto newsletter that’s more chaotic than a mercenary team dropped into a mission with no rules and no backup… 💥🎒

What we’ve cooked up for you today…

🏦 DOJ Investigation into Fed Chair Powell

🐮 You’re not bullish enough

💎 Diamond hands

💰 And more…

Prices as at 2:40am ET

FED CHARGED 🏦

BREAKING: Bitcoin Jumps Amid DOJ Investigation of Fed Chair Jerome Powell

No one saw this coming…

The Department of Justice just opened a criminal investigation into Federal Reserve Chair Jerome Powell.

What happened?

The U.S. attorney for Washington, D.C., opened a criminal probe into Powell over the Fed's $2.5 billion headquarters renovation and whether he misled Congress about the project.

Powell called it a "pretext."

"This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions — or whether instead monetary policy will be directed by political pressure or intimidation,"

Powell directly tied the investigation to his refusal to cut interest rates at Trump's demand.

"The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President."

Trump denied knowledge of the probe but has repeatedly attacked Powell for being "too slow" to cut rates.

The investigation is being overseen by U.S. Attorney Jeanine Pirro, a Trump appointee.

Republican Senator Thom Tillis condemned the move, calling it a clear attempt to undermine Fed independence. He vowed to block all Fed nominations until the matter is resolved.

What this means for crypto

Experts say if the DOJ case succeeds, it would set a "dangerous precedent" - the president could use executive authority to punish a Fed chair for not complying with his preferred monetary policy.

"The challenge to central bank autonomy reinforces Bitcoin's narrative as a 'neutral' asset that operates independently of legal or political disputes."

HashKey Group's Tim Sun said a successful case would "destabilize and erode confidence in the entire dollar and U.S. Treasury system," benefiting decentralized, non-sovereign assets.

Short term: heightened volatility.

Long term: The case for Bitcoin as an institutional hedge if Fed independence is compromised grows.

But for now, crypto markets are looking past the drama. Bitcoin trades near $92,000. Ethereum holds above $3,100.

Powell's term ends in May.

The fight over the Fed and interest rates is heating up. 🚀

Ready to watch UFC 325 from the best seats in the house? 🥊

Crypto.com is giving away an all-inclusive UFC experience - and there are multiple ways to win.

Here's what's up for grabs:

Grand Prize: Pair of UFC 325 tickets + AU$1,500 in travel vouchers + AU$100 BTC 🎟️

Top 50 Challenge: Buy CRO and rank in the top 50 by volume to win up to AU$50 BTC 💸

New User Bonus: First 500 new sign-ups who buy AU$100+ CRO get AU$50 BTC credited to your account 🎁

Entry is simple: Buy at least AU$100 worth of CRO between now and January 19, 2026.

New and existing users are both eligible - just opt in through the campaign section in the Crypto.com app.

Whether you're chasing the grand prize or stacking BTC rewards, there's something for everyone.

YOU’RE NOT BULLISH ENOUGH 🐮

Jesse Eckel is a full-time crypto analyst who publicly built & tracked tracked a million-dollar portfolio by following liquidity.

This week, he gave a warning:

“You are not bullish enough.”

Why?

Because 2026 is not going to look anything like 2025.

In Jesse’s words:

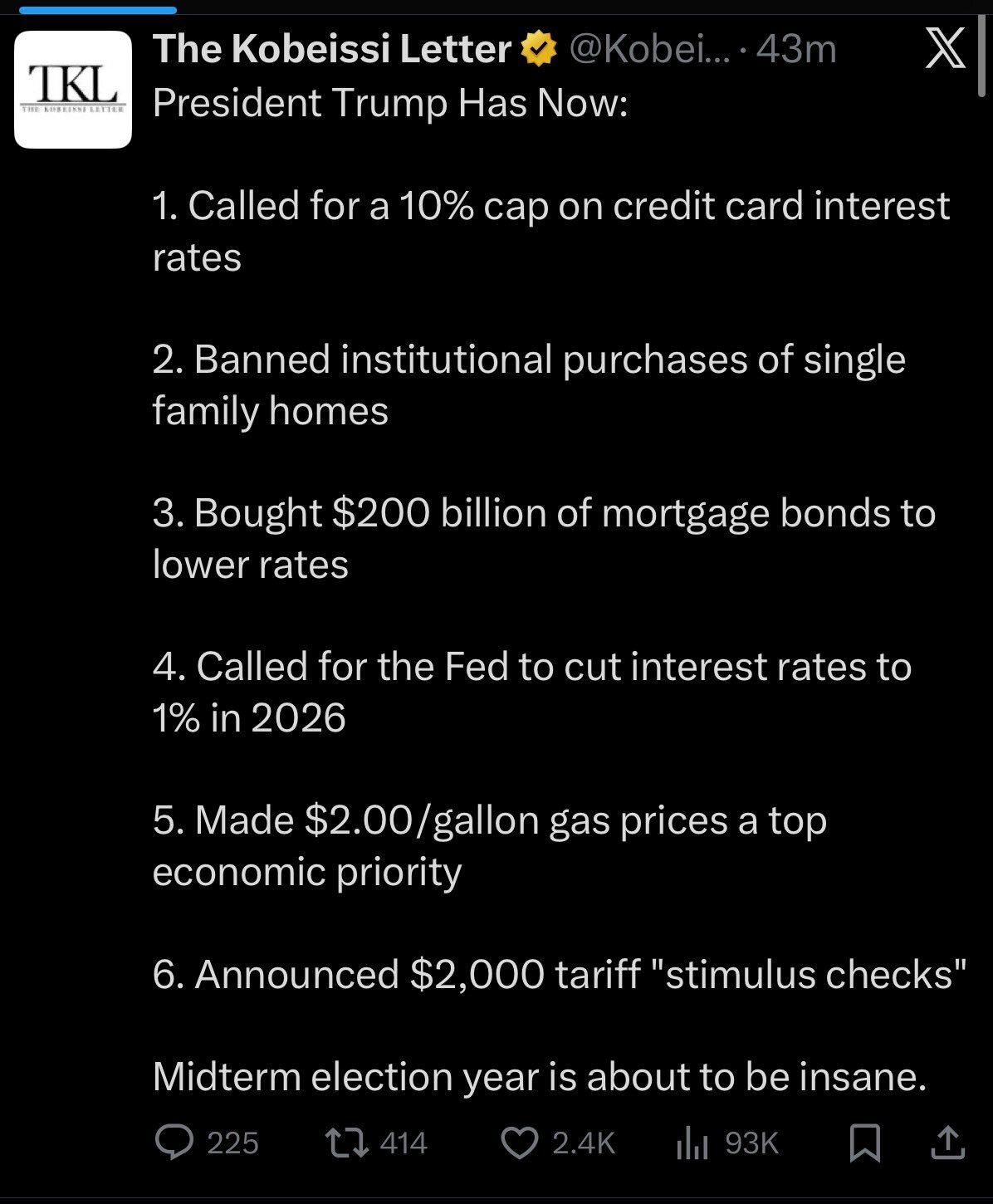

Trump has already made it clear what his 2026 strategy is:

There’s only 1 reason Trump is doing this…

This is about making everyone feel rich.

We’ve been pointing this out since mid-2025. Trump’s entire playbook is to run the economy hot into the midterms. If the Fed won’t stimulate hard enough, he’ll do it himself.

And you already know what that means:

Liquidity up → asset prices up.

Always.

Bitcoin does not care about politics. It cares about money printing.

“2026 is about making everyone feel rich using every means Trump can access.”

You are not bullish enough. 🐂

DIAMOND HANDS 💎

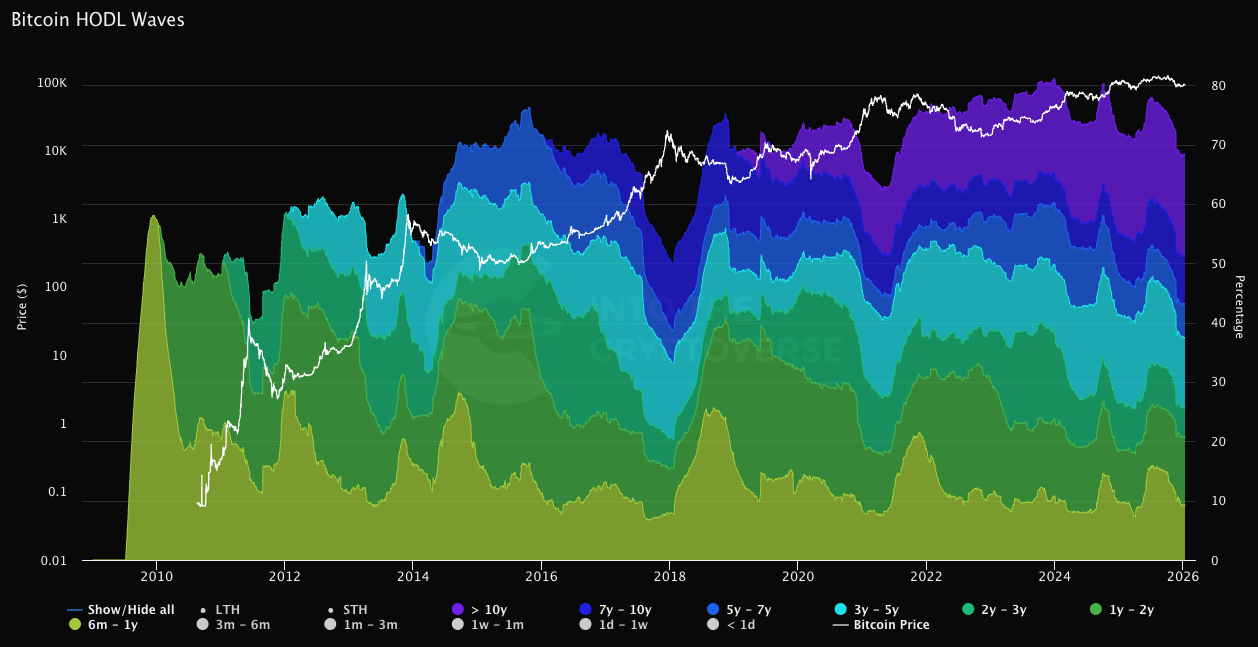

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

Today we’ll be focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 9.35% (up from 9.31%)

1y - 2y: 11.45% (down from 11.57%)

2y - 3y: 4.98% (up from 4.92%)

3y - 5y: 11.76% (down from 11.90%)

5y - 7y: 5.73% (up from 4.55%)

7y - 10y: 8.13% (down from 8.15%)

>10y: 17.02% (up from 17.00%)

TL;DR: 68.42% of all Bitcoin has not moved in over six months. 🔒

That's up from 68.40% two weeks ago. Basically unchanged.

The story here is stability.

The youngest LTH cohort (6-12 months) barely moved. The 1-2 year band dropped slightly as some mid-cycle holders trimmed. The 2-3 year group ticked up as coins aged in.

The 3-5 year band shed a bit of supply, but here's where it gets interesting...

The 5-7 year cohort jumped over a full percentage point. That's coins aging into deep storage.

And the oldest bands? Still rock solid. The 7-10 year group held steady. The 10+ year supply now sits at 17.02%.

This is what conviction looks like.

Coins quietly aging into dormancy whilst the market does its thing.

Bottom line: supply is locked, long-term holders aren't moving, and the base keeps strengthening. 💎

CRACKING CRYPTO 🥜

X Plans ‘Smart Cashtags’ to Link Crypto and Stock Tickers to Live Prices. X is developing a feature that turns ticker symbols in posts into links for real-time pricing and asset-specific information.

Community banks sound Alarm on stablecoins as JPMorgan remains calm. More than 100 bankers urged senators to tighten stablecoin rules, warning yield-like incentives could pull trillions from local lending, though JPMorgan struck a calmer tone.

BitMine's Total Staked ETH Holdings Surpass 1 Million. BitMine, the largest Ethereum treasury company, staked an additional 86,400 ETH, bringing its total staked ETH stash to over 1 million.

Coinbase may reconsider support for US market structure bill. Coinbase may withdraw its support from the market structure bill if it imposes broader limits on stablecoin rewards, Bloomberg reported.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

The Winklevoss twins famously used their Facebook settlement money to buy Bitcoin. Approximately how much BTC did they accumulate?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 120,000 BTC 🥳

Cameron and Tyler Winklevoss reportedly bought around 120,000 BTC between 2012-2013, spending roughly $11 million when Bitcoin traded between $8-120.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.