GM to all 11,661 of you. Crypto Nutshell droppin’ in. 🥜 🪂

We’re the crypto newsletter that's more heroic than a billionaire vigilante protecting his city... 🦇🌃

Today, we’ll be going over:

🤑 Why a Spot Bitcoin ETF is such a big deal…

🌊 How to out-return Bitcoin (seriously)

🤔 Bitcoin Halving check-in

💰 And more…

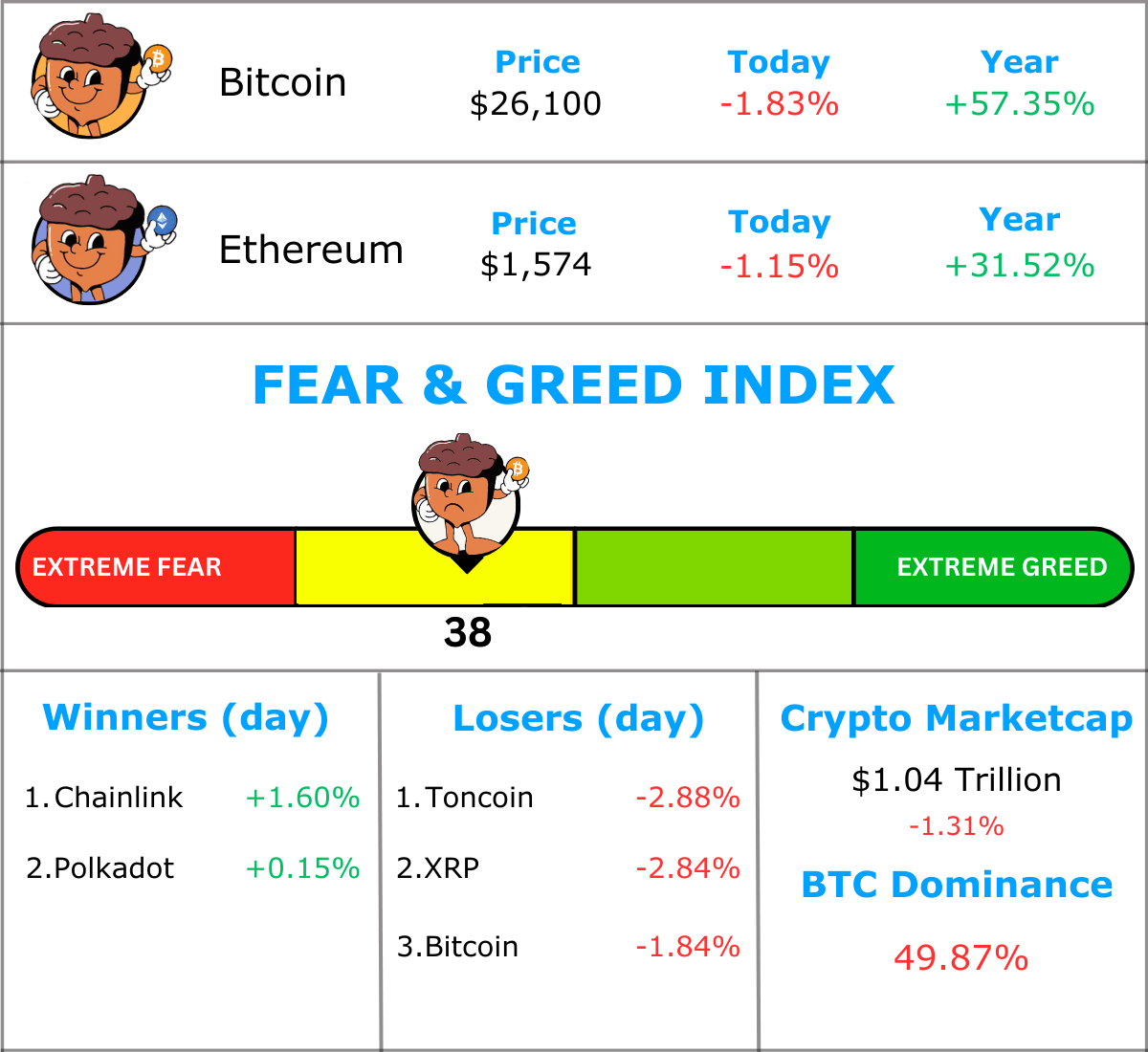

MARKET WATCH ⚖️

Prices as at 7:00am ET

Only the top 20 coins measured by market cap feature in this section

WHY A SPOT ETF IS A BIG DEAL 🤯

The Bitcoin ETFs are set to unleash a wave of capital onto the Bitcoin market.

The next deadline dates for the SEC’s decision on the spot Bitcoin ETFs is fast approaching. The key date to lookout for?

17th October 2023.

This is the second deadline day for BlackRock’s ETF approval (the biggest of them all).

Most people don’t understand just how big these company’s are and the HUGE amount of cash they are about to bring into the market. The most notable being BlackRock with $10 Trillion in assets under management. 😱

Not sure why everyone is getting so hyped up about these ETFs?

Check out this insane chart. The Gold ETF literally made the price go parabolic. 📈

TOGETHER WITH CROWDSCALE 🤑

What do these three companies have in common?

Apple 🍏

Google📱

Microsoft 💻:

They all started in someone’s garage…

Wouldn’t it be nice to get in on these companies early?

You hear about it all the time, the top 1% investors always get in on companies like Apple, Google and Microsoft before they go public. But how can YOU find out about these companies?

That’s where CROWDSCALE comes in. They’re a quick, 5-min weekly read that sends you:

A deep dive into a promising startup 🤑

Whether this startup is worth investment 🤔

All with some humour sprinkled in for an entertaining read 😂

As always, they’re completely FREE.

Destroy that subscribe button below and it’ll automatically add you to their list.

Future you will thank you. ❤️

Sponsored

CROWDSCALE

Startup investing for the masses. Read by 4,600+ people looking to discover & invest in the world's next big idea.

HOW TO OUT RETURN BITCOIN 😱

Do you want to out-return Bitcoin?

It sounds crazy, but there’s a straight-forward way to do it. (and no, it’s not a scam)

It all comes down to the genius of Michael Saylor.

Yesterday, loyal reader of the Crypto Nutshell, Ron, wrote to us. He intends to sell his Bitcoin and buy MicroStrategy stock.

Why? To out-return Bitcoin. 😲

But does this work? 🤷

Lucky for us, the man himself, Michael Saylor, recently broke down, exactly this.

Saylor has not only used all the cash at MicroStrategy to buy Bitcoin, but he also sweeps all cash flows into buying more Bitcoin.

He doesn’t stop there. He’s used the unique position of MicroStrategy to take out over $2 billion in debt at a 1.5% interest rate and used that to buy even more Bitcoin.

The result? MicroStrategy stock now out-performs Bitcoin.

“What we've done is, we've levered the balance sheet with debt that cost us about 1.5% interest. So MicroStrategy takes advantage of its position as an operating company to do something that an ETF can't do.”

Here’s what’s at play: shareholders aren’t only making a return on the Bitcoin, but also the return on the debt that Saylor has issued at 1.5%.

If you assume Bitcoin will increase at over 1.5% per year into the future… MicroStrategy stock will continue to out-return Bitcoin. 🤯

Here's the beauty of what Saylor's done. He’s used MicroStrategy’s unique position of being a publicly traded, high cash flow business to secure debt at an incredibly low interest rate.

(Good luck convincing a bank to give you a 1.5% interest rate)

Saylor has created a leveraged long play on BTC. Played out in the real world, here’s what happens:

2023:

Bitcoin: Up 57.%

MicroStrategy: Up 122.6%

However, you also out-return to the downside:

2022:

Bitcoin: Down 64%

MicroStrategy: Down 74%

Bottom line: Should you do this yourself? Answer these questions:

Do you think Bitcoin out-returns 1.5% into the future?

Do you have easy, low-fee access to U.S equities?

Do you not care that you can’t custody your own BTC?

Do you trust Michael Saylor & the management team at MicroStrategy?

Are you immune to volatility and seeing large swings in your investments?

If you answered yes to everything, it may be a good decision to swap your BTC for MicroStrategy stock.

Us personally?

We are Australian born and live international. The regulatory loopholes we need to jump through to buy U.S equities is too much.

We also value holding BTC ourselves. So we're fine with holding plain old Bitcoin. 😉

Let us know what you think of this strategy at the bottom of today’s newsletter. 👇

BITCOIN HALVING CHECK IN 🤔

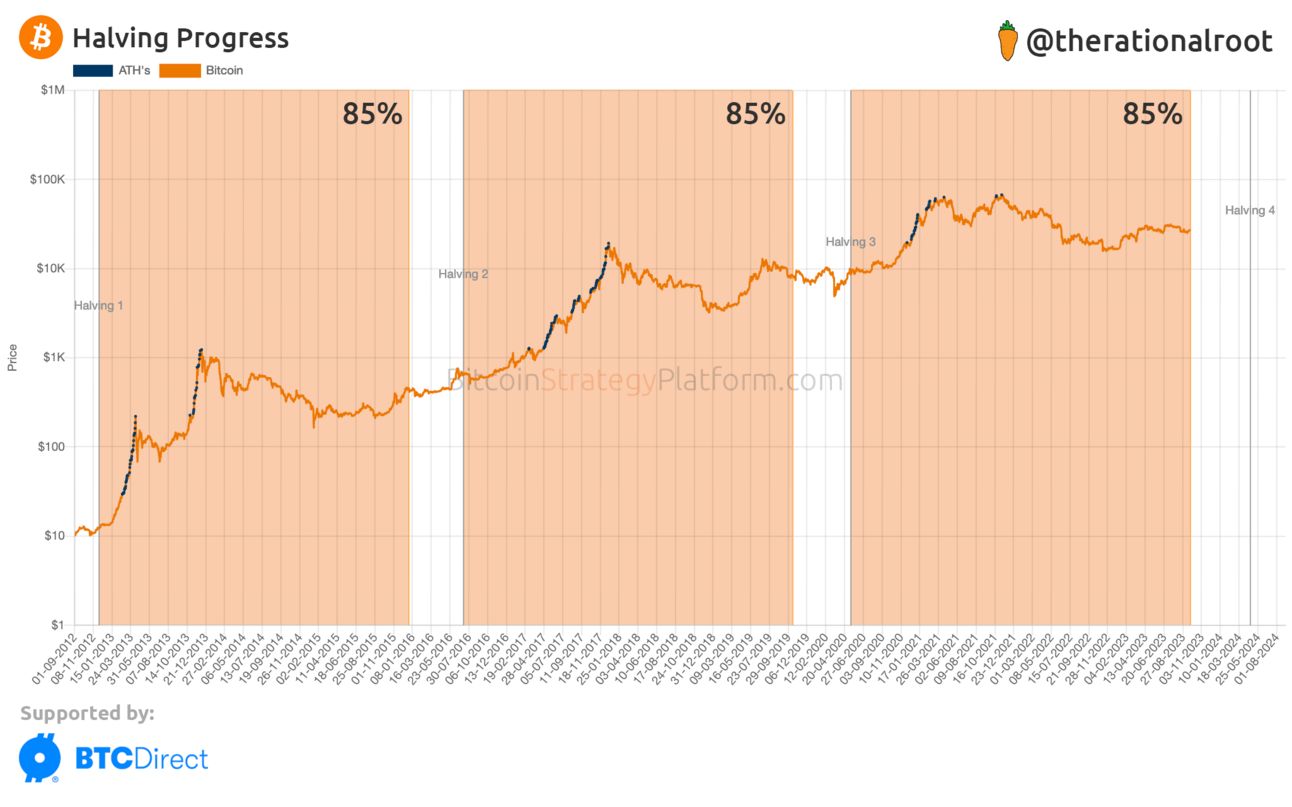

Twitter analyst @therationalroot recently published a chart showing Bitcoin’s Halving percentage progress.

The Bitcoin Halving is a major event for Bitcoin and occurs roughly every 4 years. If you’re new to Bitcoin or still unsure what the Halving actually is, checkout this short video.

Historically the Halving has been the catalyst for explosive price action, for the last 3 cycles Bitcoin has set new all time highs ~1 year after the Halving (navy blue dots on the chart below).

So now we’re 85% of the way to the next Halving.

The remaining 15% of the cycle has historically seen Bitcoin’s price continue to trade sideways. Taking a look at 2016 & 2020, Bitcoin’s price largely remained the same.

If history were to repeat itself, we’re in for an extended period of sideways price action. The price only really begins to explode upwards around 1 year after the Halving occurs.

So don’t be disappointed if the price doesn’t instantly rocket to new all time highs as soon the Halving occurs (we wish that’s how it worked…).

BUT… Don’t forget that this time WILL be different.

With the Bitcoin ETFs likely to be approved before the Halving who knows how much an impact they will have on Bitcoin’s price. We’re in for a wild ride. 🚀

CRACKING CRYPTO 🥜

WHAT WE’RE READING? ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Mindstream

The hottest AI newsletter around. News, opinions, polls and so much more. Join us for free!

Sponsored

Lettuce Trail

Packed with inspiring success stories, expert tips, and valuable recommendations that will empower you to unlock your full potential and achieve remarkable results.

Sponsored

CROWDSCALE

Startup investing for the masses. Read by 4,600+ people looking to discover & invest in the world's next big idea.

CAN YOU CRACK THIS NUT? ✍️

What is proof of work?

A) The way miners secure and scale Bitcoin’s blockchain

B) A way to verify transactions on a blockchain

C) The predecessor to proof of stake

D) All of the above

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) All of the above 🥳

Proof of work is also called mining, in reference to receiving a reward for work done. To learn more checkout this article.

GET IN FRONT OF 11,600+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.