Today’s edition is brought to you by RAREMINTS

GM to all 64,612 of you. Crypto Nutshell #312 keepin’ it calm... 🧘 🥜

We’re the crypto newsletter that’s more intriguing than a billionaire vigilante protecting Gotham City from crime... 🦇🌃

What we’ve cooked up for you today…

👨⚖️ CZ sentenced

🏦 How an ETF works

🤔 Is Bitcoin still profitable?

💰 And more…

MARKET WATCH ⚖️

Prices as at 7:05am

Only the top 20 coins measured by market cap feature in this section

CZ SENTENCED 👨⚖️

BREAKING: Ex-Binance CEO Changpeng Zhao sentenced to 4 months in prison

The former CEO of cryptocurrency exchange Binance has been sentenced to 4 months in prison.

Back in November, Changpeng Zhao (CZ) pleaded guilty to one count of failing to take required anti-money-laundering (AML) measures.

As a result, CZ stepped down as Binance CEO and Binance agreed to pay $4.3 billion to settle related allegations.

Funds are SAFU

Prosecutors were seeking a three-year prison sentence - more than twice the guideline range for the crime.

Before being sentenced, CZ apologised for his actions:

“I failed here… I deeply regret my failure, and I am sorry.”

The prosecution added:

“Incarceration is necessary to reflect the seriousness of the offense… A probationary sentence here will incentivize others to break the law and to do it in the largest scale possible.”

If you’ve ever done the rounds on Crypto Twitter, you’ve definitely seen this pic of CZ posted before…

Binance receives a $4 billion fine.

And CZ gets sentenced to 4 months in prison.

You can’t make this stuff up….

TOGETHER WITH RAREMINTS 💎

There’s a reason we all love crypto… the returns.😍

In a bull market? No other asset can compete.

And with the Bitcoin Halving approaching, now's the perfect time to get in!

The problem? There’s literally tens of thousands of coins.

That’s why we read RAREMINTS.

Keeps you up to date with daily insights and news ✅

Gives you access to exclusive airdrops for FREE 🪂

Breaks down Crypto developments in a quick 5 min read 📨

Click here to join 30,000+ investors / builders from Coinbase, Binance, KuCoin and more discovering their next 10x crypto opportunity today. 🤑

Future you will thank you.❤️

SOME PERSPECTIVE 🏦

Bitcoin & the wider crypto market has been ugly over the last month.

Many are pointing the blame at the Bitcoin ETFs, which after a rocket ship-like start, have begun having zero flow days.

Are the ETFs over?

In his latest interview, James Seyffart addressed these common criticisms surrounding the Bitcoin ETFs as of late.

But first, he reiterated just how successful they’ve already been.

Speaking about BlackRock, this is what he had to say:

“A 72 day inflow streak is one of the top 10 streaks we’ve ever seen for an ETF. And it is the record for a launch, we’ve never seen an ETF launch and then continually take in money every single day.”

But then James was asked:

Whats up with these zero flow days?

Well as it turns out, zero flow days are completely normal for an ETF.

“Most ETFs don’t see a flow every day in or out. For the most part it’s going to be zero… It’s standard normal procedure for an ETF just not to have flows on a given day. There is going to be days and weeks where these things see meaningful outflows.”

James explains that the way ETFs work are actually quite complex.

But put simply:

If demand outstrips the current supply of shares, new shares will be created (net inflows).

And If demand is lower than the current supply of shares, then shares will be destroyed (net outflows).

BlackRock has now had 5 zero flow days in a row

Over the long-run, these ETFs will continue to grind higher and higher.

Then James was asked about the upcoming approval/denial of the Ethereum ETFs in May.

And according to James it’s not happening this year:

“It’s not happening, we’re not seeing any movement, it’s very unlikely to happen. Our official stats are at 25%, we’re going to have to lower that in the near future because we aren’t seeing any movement whatsoever.”

Make no mistake, Seyffart still expects them to be approved eventually.

“I think 2025 is more likely, but we need to see what the SEC denies it on”

The current consensus is that the SEC will approve the Ethereum ETFs eventually.

But it’s not looking like it’ll happen this year…

Although harsh dips in the crypto market aren’t nice, always zoom out & remember the fundamentals.

Crypto has far too many macro tailwinds to not be ridiculously bullish in the long-term.

IS BITCOIN STILL PROFITABLE? 🤔

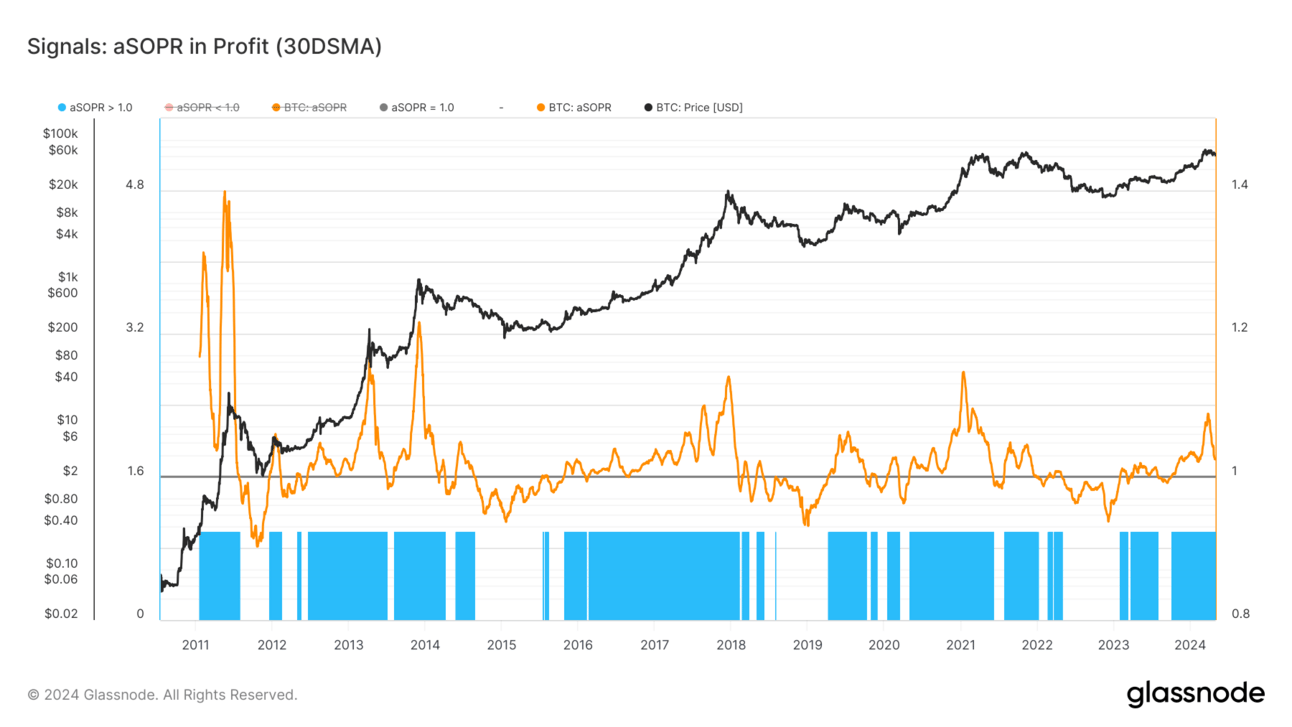

Today we’ll be taking a look at the Adjusted Spent Output Profit Ratio (aSOPR).

Although this metric may sound a little confusing, really it’s quite simple.

It tracks the sale of every coin and determines whether it was in profit or not.

This is done by comparing the fiat value of a coin when it is first purchased to the fiat value when it is sold.

aSOPR >1: on average, coins are being sold at a profit 🐂

aSOPR < 1: on average, coins are being sold at a loss 🐻

aSOPR = 1: on average, coins are being sold at breakeven 😐

But the neat thing about aSOPR is that coin volume is not considered in the calculation.

This means that whales can’t heavily skew this data by locking in huge profits or losses. Think coins being sold from 2013, etc.

All we’re looking at here is if the transaction was in profit or loss. A simple yes or no.

Today, aSOPR is at 1.024 (It has fallen recently due to Bitcoin recent price action.)

But what does this number mean? 🤷♀️

Well, it indicates that on average, Bitcoiners are still realising profits.

aSOPR above 1.0 is a tell tale indicator of a bull market. (this metric flashes blue when aSOPR is above 1.0)

Profits are being realised on chain and demand is sufficient in absorbing these sales.

And although short-term sentiment has turned bearish.

As long as this metric remains above 1.0…

We’re all good. 🤞

CRACKING CRYPTO 🥜

Hong Kong's Bitcoin and Ethereum ETFs launch with lower than expected trading volumes. ChinaAMC leads as Hong Kong's first spot Bitcoin and Ethereum exchange-traded funds (ETFs) see lukewarm start.

Patrick McHenry accuses Gary Gensler of misleading US lawmakers over Ether. Patrick McHenry claimed SEC Chair Gary Gensler intentionally misled Congress in a 2023 hearing.

BlackRock's BUIDL Becomes Largest Tokenized Treasury Fund Hitting $375M. BlackRock's first tokenized offering, created with Securitize, has captured almost 30% of the $1.3 billion tokenized Treasury market in just six weeks.

What could drive BTC price with halving complete, ETF demand stalled. Upcoming macroeconomic clarity, or a lack thereof, is likely to be a key contributor to bitcoin’s next price movement.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) XRP 🥳

XRP launched in June 2012

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.