GM to all of you nutcases. It’s Crypto Nutshell #638 lightin’ it up… 💡🥜

We're the crypto newsletter that's more suspenseful than catching a serial killer who’s always one step ahead... 🕵️♂️📁

What we’ve cooked up for you today…

🏦 Crypto’s killer app

👑 The real breakout is coming

💪 Locking in

💰 And more…

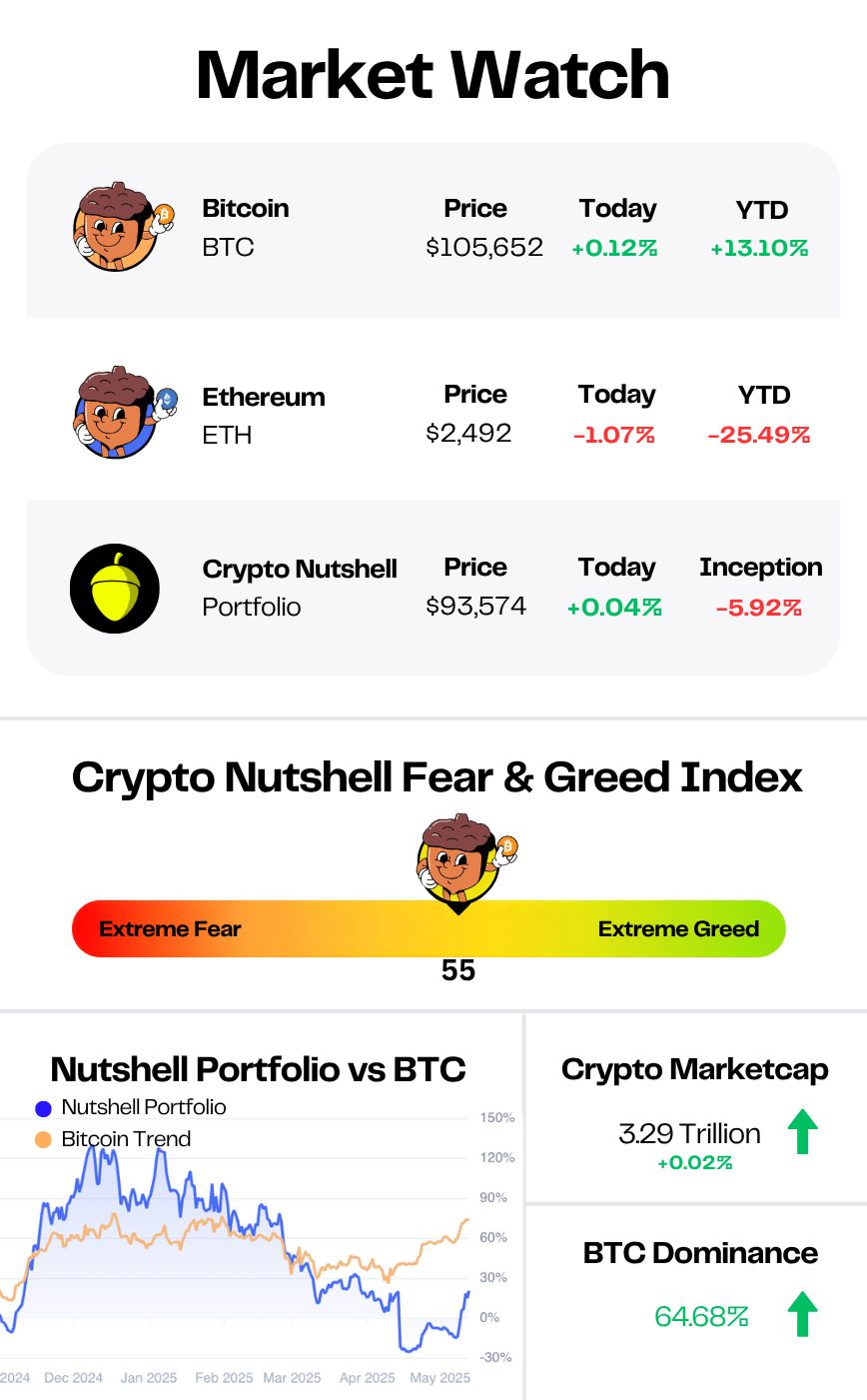

Prices as at 4:15am ET

CRYPTO’S “KILLER APP” 🏦

BREAKING: Why Circle's ‘Super Positive’ IPO Could be Bullish for Ethereum

At Crypto Nutshell, we talk a lot about institutional adoption of Bitcoin…

But the real institutional adoption story right now?

Stablecoins - and Ethereum is at the centre of it.

After years of delays, Circle (issuer of USDC) finally went public on the NYSE.

Shares exploded 167% on Day 1 and kept running, up another 38% the next day.

But this isn’t just a win for Circle…

It’s a massive validation for Ethereum - which hosts over $36.7 billion of USDC, more than half the total supply.

And that’s just scratching the surface:

Stablecoin volume hit $27.6T in 2024, surpassing Visa and Mastercard

Big Tech is moving in - Apple, Google, Airbnb, and X are all in early talks to integrate stablecoin payments

Circle’s IPO is shining a spotlight on the infrastructure behind stablecoins - which means ETH is now front and centre for curious investors

Bitwise strategist Juan Leon summed it up perfectly:

“As USDC usage proliferates, it translates into more liquidity for DeFi and excitement for developers to build on Ethereum.”

The momentum doesn’t stop there…

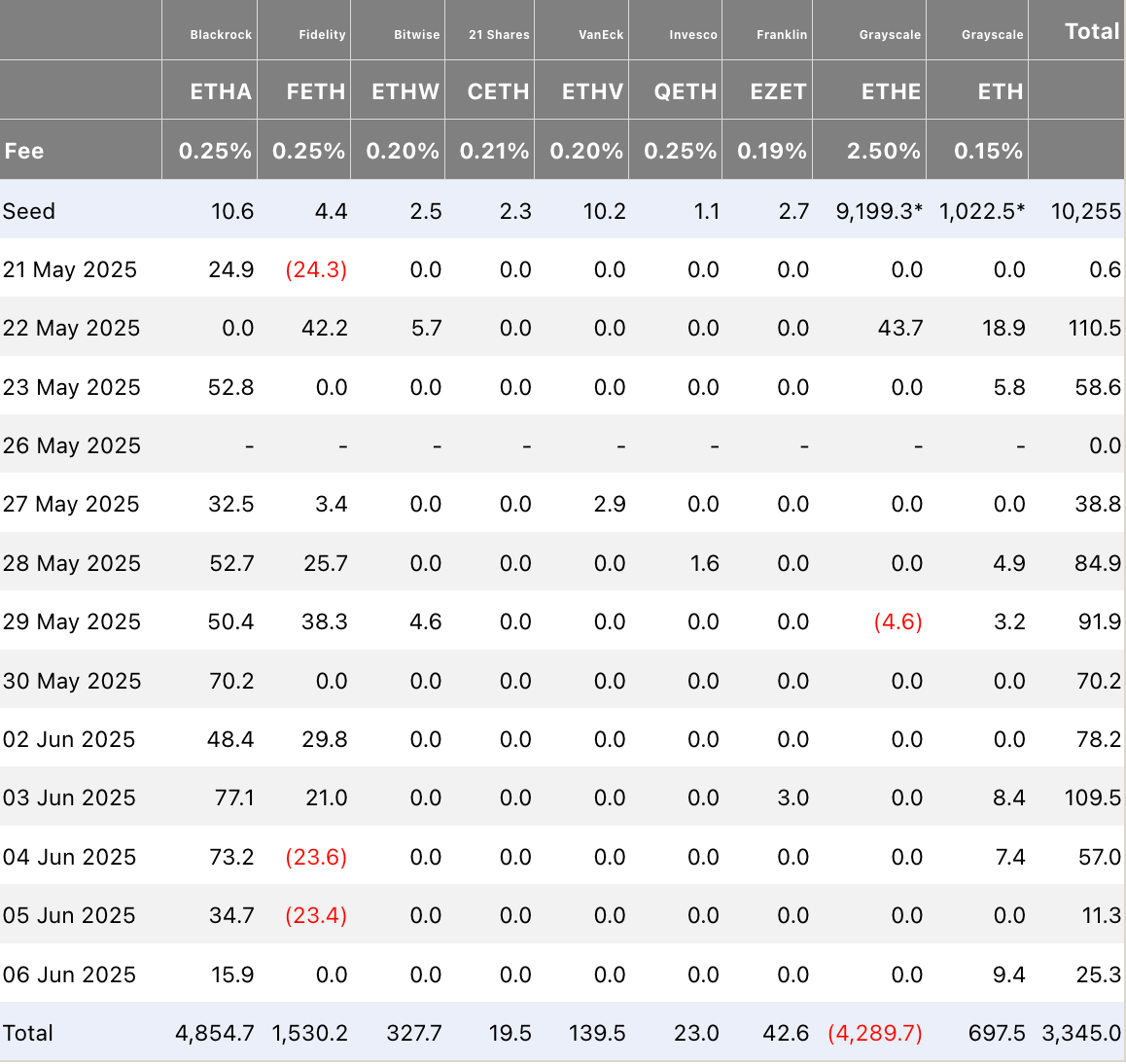

Spot ETH ETFs have now seen 15 straight days of inflows, hitting a record high of $3.35 billion in cumulative inflows since launch.

Ethereum ETF Flows

The Takeaway?

Stablecoins are going mainstream.

Wall Street, Big Tech, and crypto’s biggest players are all making moves - and Ethereum is quietly becoming the financial rails of it all.

This isn’t hype.

It’s the next phase of real-world crypto integration.

And ETH might be the biggest winner. 🚀

Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

THE REAL BREAKOUT IS COMING 👑

Everyone’s watching Bitcoin vs the US dollar…

But according to one of the sharpest macro minds in the game - that’s not the breakout that matters.

Pentoshi just shared what he believes is the chart to watch.

Bitcoin vs Gold.

And when it breaks out?

It won’t look back.

Who is Pentoshi?

One of the most respected pseudonymous macro traders on Twitter.

Known for his:

🧠 Accurate macro calls

📈 Tactical technical analysis

🐧 Penguin avatar and razor-sharp takes

In his latest post, Pentoshi laid it out simply:

The fastest-growing ETF in history is a Bitcoin ETF, not a gold one

Younger generations don’t care about gold - they’re already choosing Bitcoin

Gold supply can still grow

Bitcoin’s supply never will: 21 million. That’s it.

And unlike gold?

Bitcoin is easy to store, easy to send, and easy to verify.

The BTC vs USD breakout will get headlines.

The BTC vs gold breakout will trigger the real shift.

When it happens, you’ll know we’re in a new era. 🏛️

LOCKING IN 💪

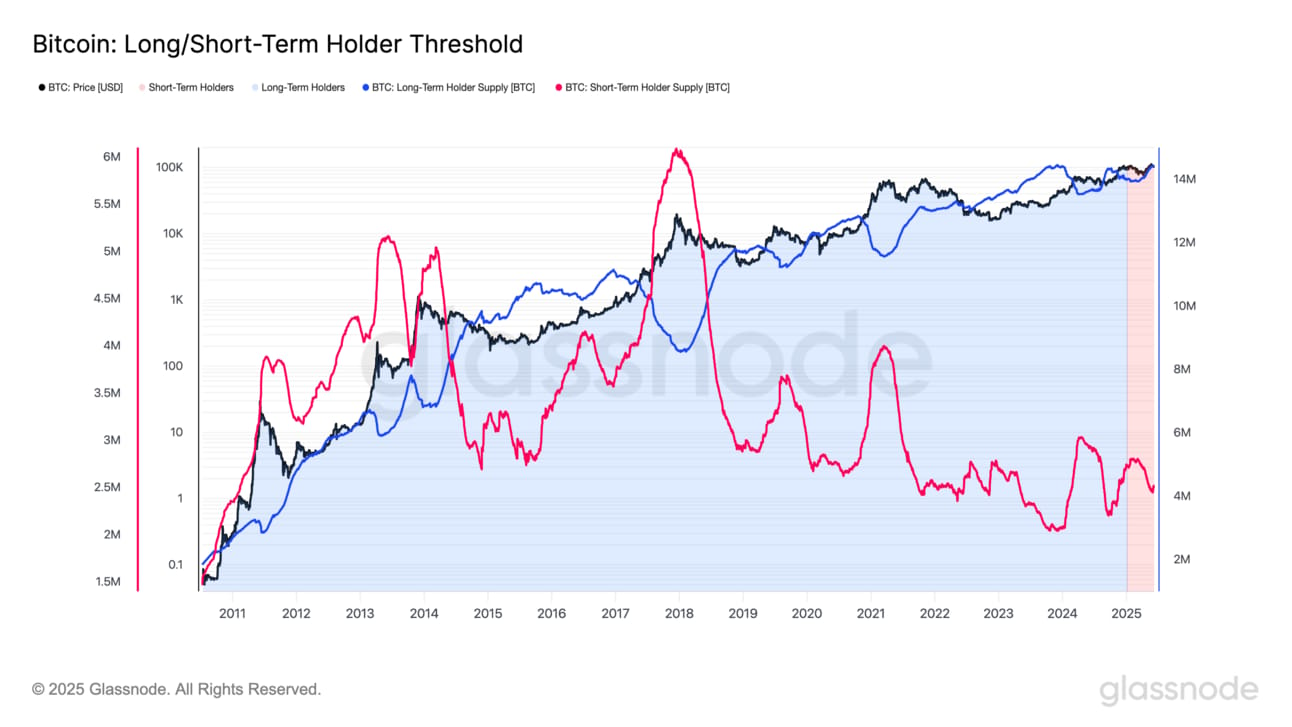

Time for a check-in on the Long/Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): Coins held for less than 155 days

🔵 Long-Term Holders (LTHs): Coins held for more than 155 days

🟥 Short-Term Holder Cost Basis: All coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: All coins purchased in this price range are LTHs

This metric is powerful because it shows exactly what price range long and short term holders bought their Bitcoin at. 🔍

Right now, the key threshold date is January 5th, 2025 - when Bitcoin was trading around $105,000.

All coins purchased before this date are classified as LTHs.

All coins purchased after this date are classified as STHs.

As of today, LTHs hold 14,447,278 BTC - a massive 72.69% of the circulating supply.

STHs?

Just 2,511,764 BTC, or 12.64%.

And the gap?

Widening fast.

In the past 90 days alone, 520,027 BTC has migrated into long-term hands - a clear sign that conviction is rising.

Historically, when this kind of shift happens, it leads to one outcome:

Shrinking supply. Fading sell pressure. And explosive upside.

Bottom line?

The strongest hands in the game are locking in - and they’re not budging. 💪

CRACKING CRYPTO 🥜

Bigger than Coca-Cola? If Tether went public, it could reach a $515B valuation. With a valuation of $515 billion, a Tether IPO would outpace Coca-Cola and Costco, making it the 19th most valuable company in the world.

Apple, X, Google, Airbnb Among Those Looking Into Stablecoins. According to Fortune, the tech giants are in early talks with crypto firms to add stablecoin payments to reduce fees.

Bitcoin network transaction activity reaches lowest level since Oct. 2023. 31 Bitcoin Core developers recently released an open letter arguing against relayers filtering out non-standard transactions as a decentralization risk.

Michael Saylor teases fresh Bitcoin buy after $1B stock offering. Michael Saylor hints at another Bitcoin purchase with a cryptic post after Strategy raises $1 billion through a preferred stock offering to fuel its BTC accumulation.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Who first proposed the idea of smart contracts, long before blockchains existed?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Nick Szabo 🥳

Nick Szabo coined the term “smart contracts” back in the 1990s — envisioning self-executing code long before Ethereum brought the concept to life. 🧠📜

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.